Independent Contractor With W2

Description

How to fill out Self-Employed Independent Contractor Construction Worker Contract?

Creating legal documents from the ground up can frequently feel somewhat daunting.

Certain situations may require extensive research and significant financial investment.

If you're looking for an easier and more affordable method of generating Independent Contractor With W2 or any other documentation without unnecessary complications, US Legal Forms is always available to assist you.

Our online library of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can swiftly obtain state- and county-compliant templates carefully prepared for you by our legal experts.

Ensure the template you select meets the standards of your state and county. Choose the most appropriate subscription plan to purchase the Independent Contractor With W2. Download the form, then complete, validate, and print it out. US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us today and make document preparation a straightforward and efficient process!

- Utilize our website whenever you seek a trustworthy and dependable service through which you can easily locate and download the Independent Contractor With W2.

- If you're already familiar with our services and have previously registered with us, simply Log In to your account, find the form, and download it or re-download it at any time in the My documents section.

- Not registered yet? No worries. It requires minimal time to sign up and browse the catalog.

- However, before proceeding to download the Independent Contractor With W2, consider these recommendations.

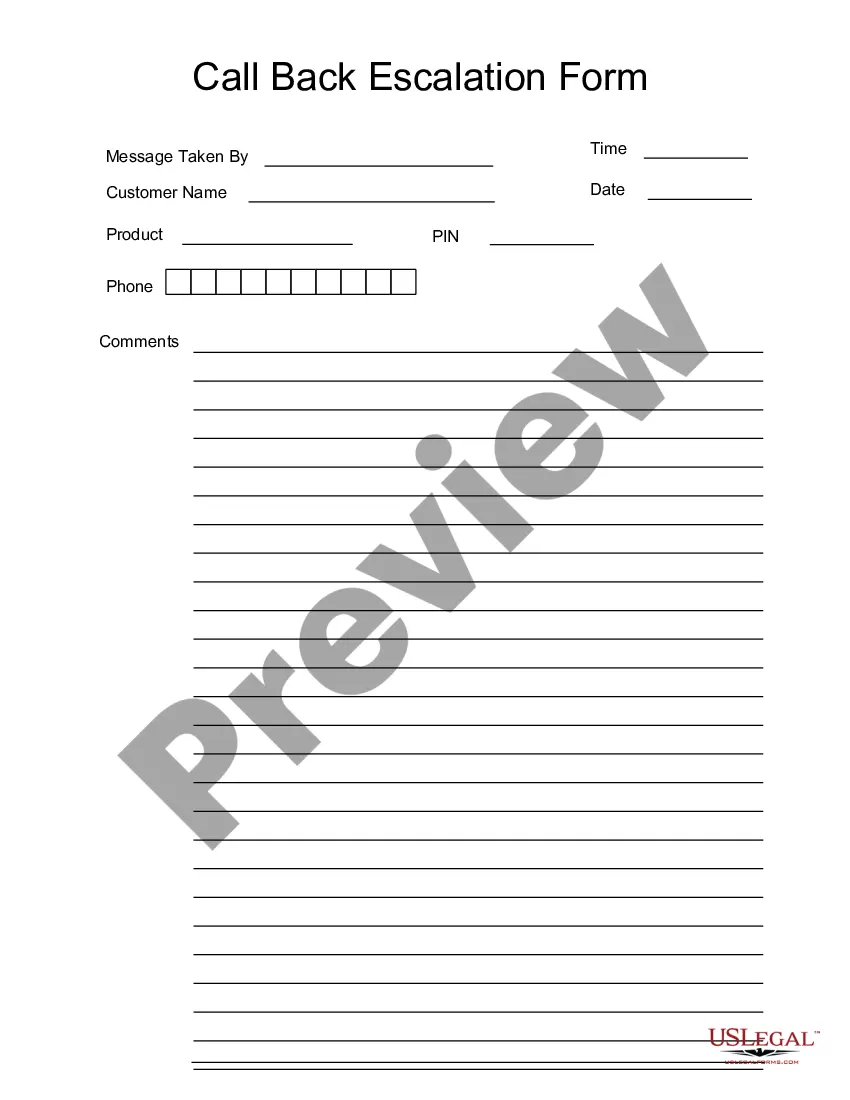

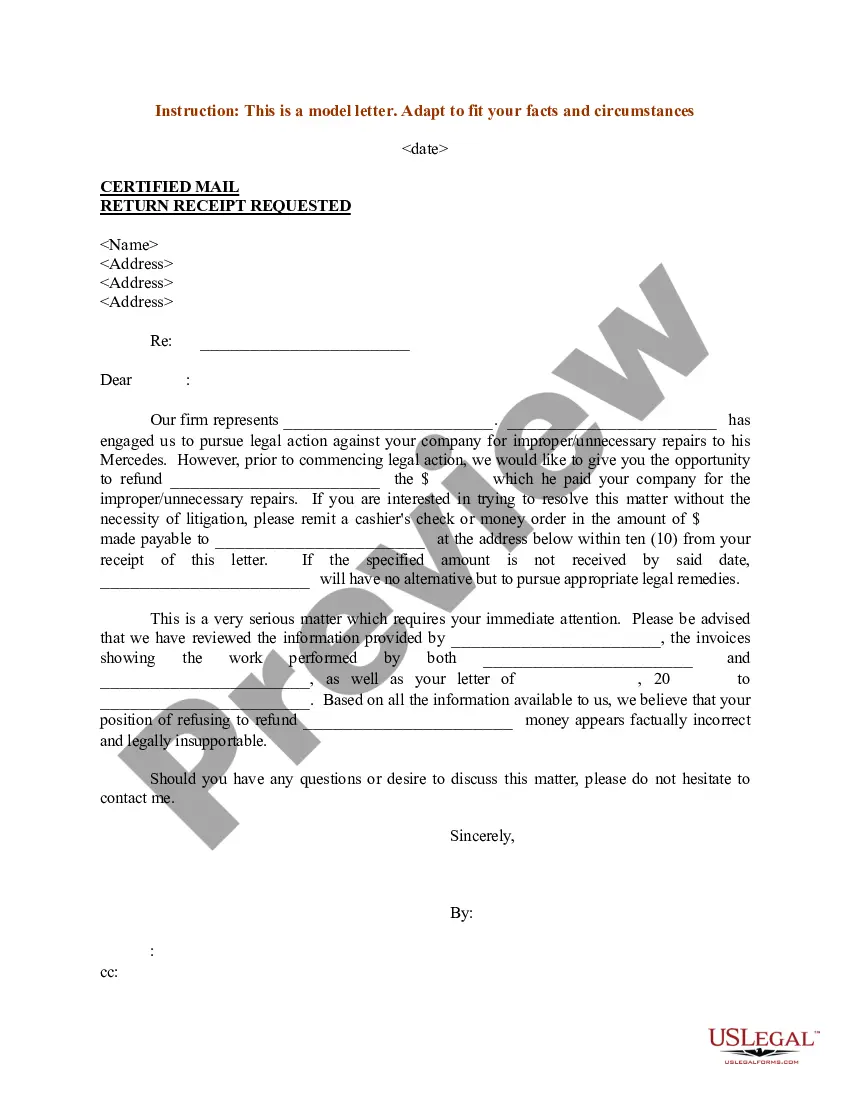

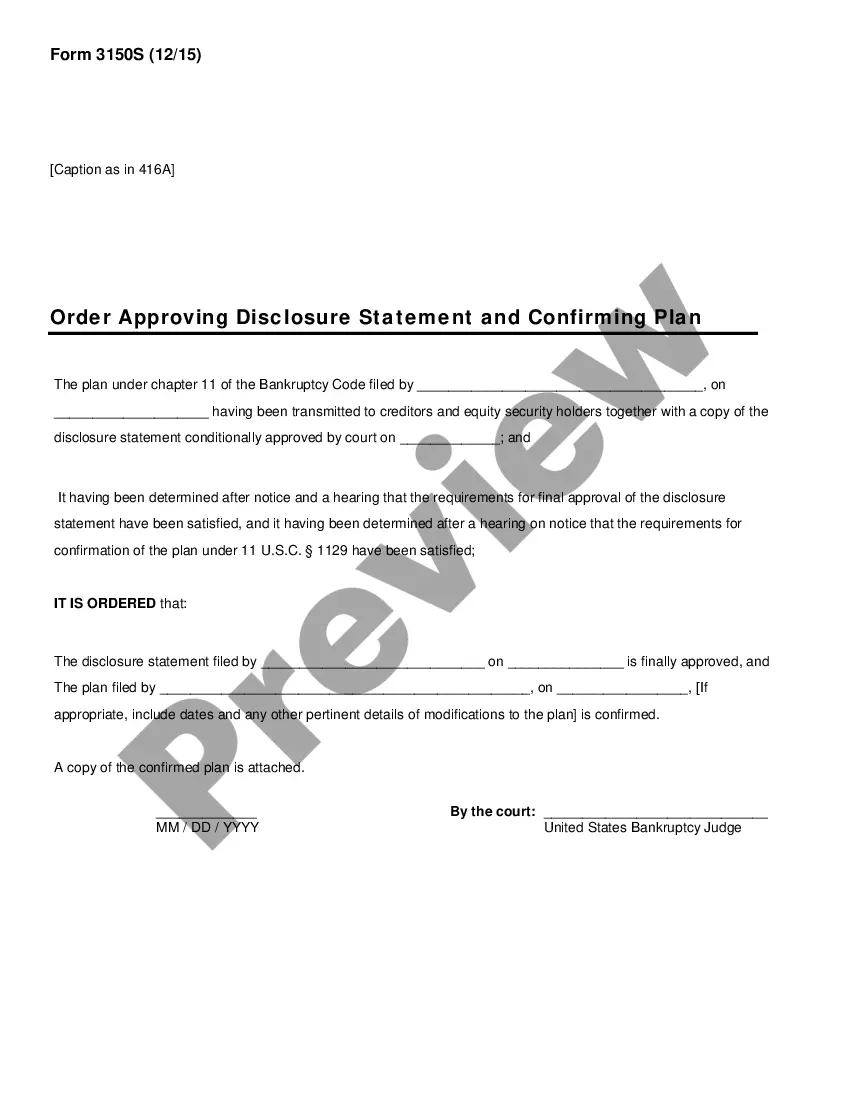

- Check the form preview and descriptions to ensure you are on the correct form you need.

Form popularity

FAQ

Yes, it is possible to be an independent contractor and receive a W-2 from a different employer. This dual status occurs when you work on a contractual basis for one client while being employed by another firm. Be aware that managing taxes from both income streams can be complex. USLegalForms provides tools to help you track your earnings and obligations efficiently.

To prove you are an independent contractor, you should maintain clear documentation of your business activities. This includes invoices, contracts, and records of payments received. Additionally, demonstrating that you control how and when you perform your work can support your position as an independent contractor with W-2 status. USLegalForms offers templates and resources to help you create necessary documentation.

Yes, you can be self-employed while receiving a W-2. This situation typically occurs when you work as an independent contractor with a primary client, while also having other income sources. However, it's essential to understand how taxes will apply to both your W-2 income and self-employment income. Platforms like USLegalForms can help you navigate your responsibilities and keep your records organized.

Form 1099-NEC is provided to freelance workers who are paid $600 or more in non-employment income during the tax year. Can you give employees both forms in the same year? Yes, but this situation could warrant attention from the IRS.

Tax Relief Current payroll taxes include the social security tax of 12.4% and the Medicare tax of 2.9%, both of which are split 50-50 between W2 employers and employees. In contrast, independent contractors are responsible for 100% of their payroll taxes.

? What To Know About Reporting Income In California ? A Quick Legal Guide. In California, workers who report their income on a Form 1099 are independent contractors, while those who report it on a W-2 form are employees.

Yes, an employee can receive a W2 and a 1099, but it should be avoided whenever possible. That's because this type of situation is a red flag and frequently results in a response from the IRS seeking further information.

The answer is that you'll need to report both 1099 and W2 income on your 1040, which is the tax form that every American who receives an income uses to file their taxes.