Security Self Employed For Universal Credit

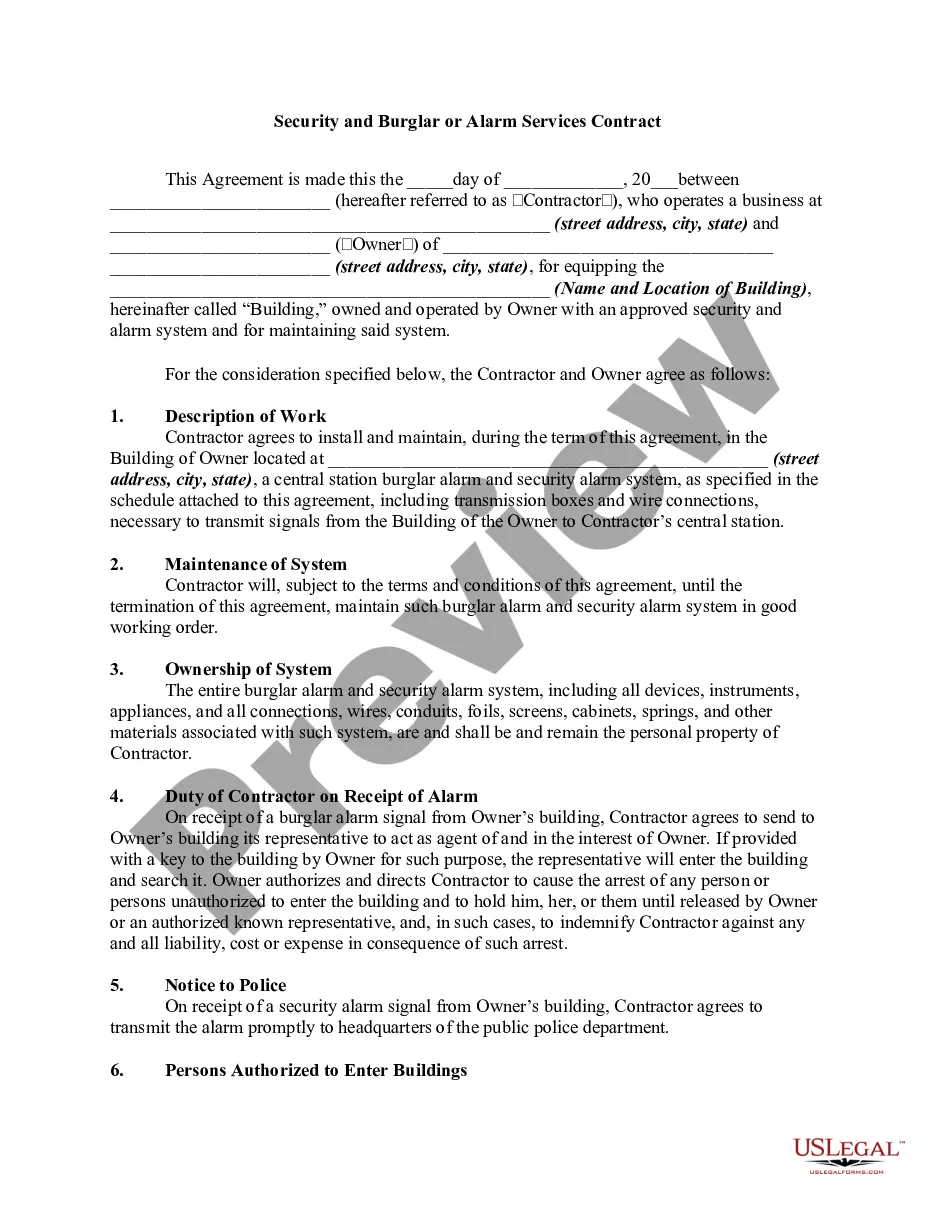

Description

How to fill out Security And Alarm Services Contract - Self-Employed?

Creating legal documents from the ground up can frequently be overwhelming.

Specific situations may require extensive research and significant expenses.

If you’re looking for a simpler and more cost-effective method to generate Security Self Employed For Universal Credit or any other papers without encountering obstacles, US Legal Forms is consistently available.

Our online library of over 85,000 current legal forms encompasses nearly every facet of your financial, legal, and personal affairs.

Examine the form preview and descriptions to confirm that you have the document you desire. Ensure the form you select aligns with the regulations and laws applicable to your state and county. Choose the most appropriate subscription plan to purchase the Security Self Employed For Universal Credit. Download the document, and then complete, sign, and print it out. US Legal Forms enjoys an impeccable reputation and boasts over 25 years of expertise. Join us today and simplify and streamline the form execution process!

- With just a few clicks, you can effortlessly acquire state- and county-compliant forms carefully prepared for you by our legal professionals.

- Utilize our service whenever you require dependable and trustworthy solutions to easily locate and obtain the Security Self Employed For Universal Credit.

- If you’re already familiar with our site and have set up an account previously, simply Log In, select the form, and download it or re-download it at any time from the My documents section.

- No account yet? Not a problem. Setting it up and navigating the library takes just a few minutes.

- However, before diving directly into downloading Security Self Employed For Universal Credit, please adhere to the following suggestions.

Form popularity

FAQ

We may need to see proof of all capital and savings. This includes details of all bank accounts, building society accounts, National Savings Certificates, shares, property land or any other capital you may have. Bank statements and building society books must show the last two months transactions.

To summarise, the answer to the question, can Universal Credit check my bank account? is yes. If the DWP suspects benefit fraud, they have the legal right to gather information from your bank. This underscores the importance of honesty when dealing with Universal Credit claims to avoid potential fraud investigations.

Answer: Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more.

The DWP has legal authority to access bank information to verify the accuracy of claims. When applying for Universal Credit, you must provide accurate financial information, including income, savings, and assets. Misleading or false information can be considered fraud and can have legal consequences.

The net income you earn from your own trade or business. For example, any net income (profit) you earn from goods you sell or services you provide to others counts as self-employment income. Self-employment income could also come from a distributive share from a partnership.