Debt Collector Threats For Debt

Description

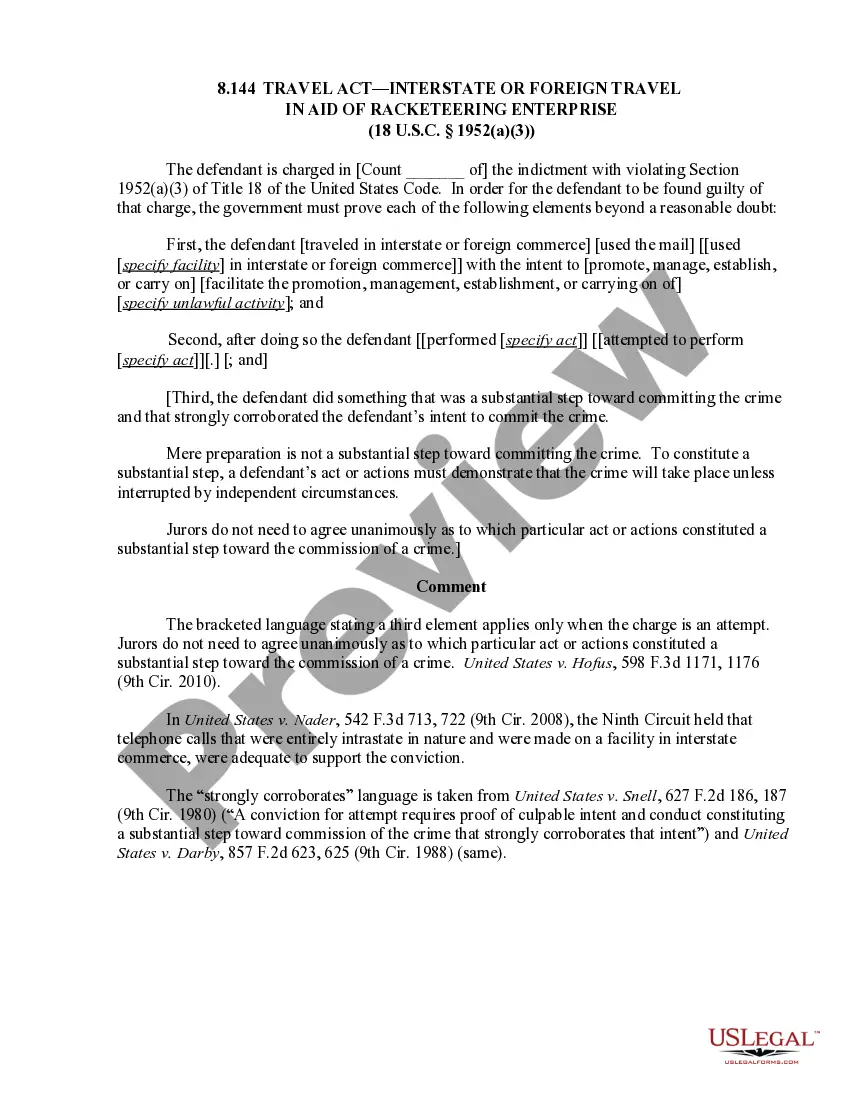

How to fill out Letter Informing Debt Collector Of Harassment Or Abuse In Collection Activities Involving Threats To Use Violence Or Other Criminal Means To Harm The Physical Person, Reputation, And/or Property Of The Debtor?

Creating legal documents from the beginning can frequently feel a bit daunting.

Certain situations may require extensive research and considerable amounts of money spent.

If you’re looking for a simpler and more budget-friendly method for preparing Debt Collector Threats For Debt or any other documents without enduring unnecessary obstacles, US Legal Forms is always accessible to you.

Our online repository of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal matters.

However, before you proceed to download Debt Collector Threats For Debt, consider these recommendations: Review the form preview and descriptions to ensure you have identified the correct form. Verify that the selected form adheres to the laws and regulations of your state and county. Choose the appropriate subscription plan to acquire the Debt Collector Threats For Debt. Download the file, then fill it out, sign it, and print it. US Legal Forms enjoys a strong reputation and boasts more than 25 years of expertise. Join us today and make document completion a straightforward and efficient process!

- With just a few clicks, you can quickly access state- and county-specific templates meticulously crafted by our legal experts.

- Utilize our service whenever you require a dependable platform to rapidly locate and download the Debt Collector Threats For Debt.

- If you’re familiar with our services and have previously registered an account with us, simply Log In to your account, find the form and download it, or re-download it anytime in the My documents section.

- Don’t have an account? No issue. It takes very little time to create one and explore the library.

Form popularity

FAQ

Examples of harassment by a debt collector A debt collector is also not allowed to harass, oppress, or abuse you or anyone else they contact. This includes repetitious phone calls with the intent to harass, use of obscene or profane language, and threats of violence or harm.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

This is where we get our "7-in-7" concept. You can attempt to contact a consumer about 1 debt 7 times in 7 days. And it's the "1 debt" that's key here. Phone numbers do not matter; how many debts your agency has for the consumer does.

You can also file a complaint with the Consumer Financial Protection Bureau (CFPB). This is a government agency that makes sure banks, lenders, and other financial institutions treat you fairly. You can sue a debt collector that has violated FDCPA.