Debt Collection Involving For Small Business

Description

How to fill out Letter Informing Debt Collector Of Harassment Or Abuse In Collection Activities Involving Threats To Use Violence Or Other Criminal Means To Harm The Physical Person, Reputation, And/or Property Of The Debtor?

Whether for business purposes or for personal matters, everyone has to manage legal situations at some point in their life. Filling out legal documents demands careful attention, starting with picking the right form sample. For example, when you select a wrong version of the Debt Collection Involving For Small Business, it will be turned down once you submit it. It is therefore crucial to have a dependable source of legal documents like US Legal Forms.

If you need to obtain a Debt Collection Involving For Small Business sample, follow these easy steps:

- Get the template you need using the search field or catalog navigation.

- Examine the form’s description to make sure it fits your case, state, and county.

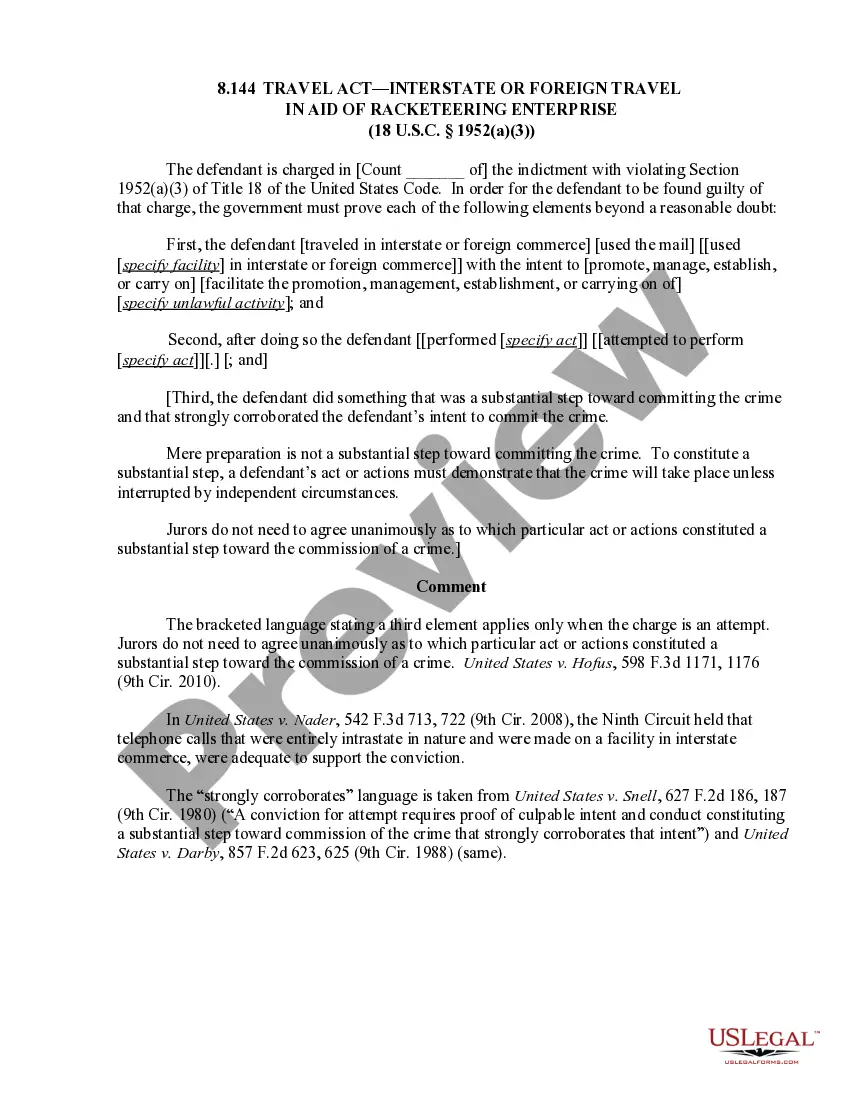

- Click on the form’s preview to view it.

- If it is the incorrect document, go back to the search function to find the Debt Collection Involving For Small Business sample you require.

- Get the file if it matches your needs.

- If you have a US Legal Forms profile, just click Log in to gain access to previously saved files in My Forms.

- In the event you don’t have an account yet, you can download the form by clicking Buy now.

- Choose the correct pricing option.

- Finish the profile registration form.

- Pick your payment method: use a credit card or PayPal account.

- Choose the document format you want and download the Debt Collection Involving For Small Business.

- Once it is saved, you are able to fill out the form with the help of editing applications or print it and finish it manually.

With a large US Legal Forms catalog at hand, you never have to spend time looking for the appropriate template across the internet. Utilize the library’s easy navigation to get the right template for any situation.

Form popularity

FAQ

My name is John, and I am a debt collector with XYZ Company. Your bill payment is past the due date. Based on our records, the total outstanding balance of $10,000 is overdue. We have tried contacting you seven times during the last two weeks.

The Process of Debt Collection for Small Businesses Explained in 8 Simple Steps Sending the invoice. Contacting the debtor by yourself. Negotiate. Issuing dunning letters. Discontinuing the services. Going to small claims court. Hiring a debt collection agency. Filing a lawsuit.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

Small business debt collectors ensure that past due accounts are collected quickly and efficiently. They can help you minimize the risk of bad debt and maximize your chances of successfully recovering money owed to you. Debt collection agencies mainly make attempts to contact the debtor and negotiate payment plans.

On the other hand, here's what you shouldn't do. Don't give a collector any personal financial information, make a "good faith" payment, make promises to pay, or admit the debt is valid.