Information Sheet For Cpp Death Benefit

Description

How to fill out Construction Project Information Sheet?

Regardless of whether for commercial intentions or personal concerns, every individual eventually must handle legal circumstances at some point in their existence. Completing legal paperwork demands meticulous care, starting with the choice of the correct form template.

For example, if you opt for an incorrect version of an Information Sheet For Cpp Death Benefit, it will be rejected upon submission. Thus, it's crucial to possess a trustworthy source of legal documents such as US Legal Forms.

With an extensive selection of US Legal Forms available, you’ll never have to waste time searching for the correct template on the web. Utilize the library’s easy navigation to find the suitable form for any scenario.

- Locate the template you require by using the search bar or browsing the catalog.

- Review the form’s description to ensure it aligns with your situation, jurisdiction, and county.

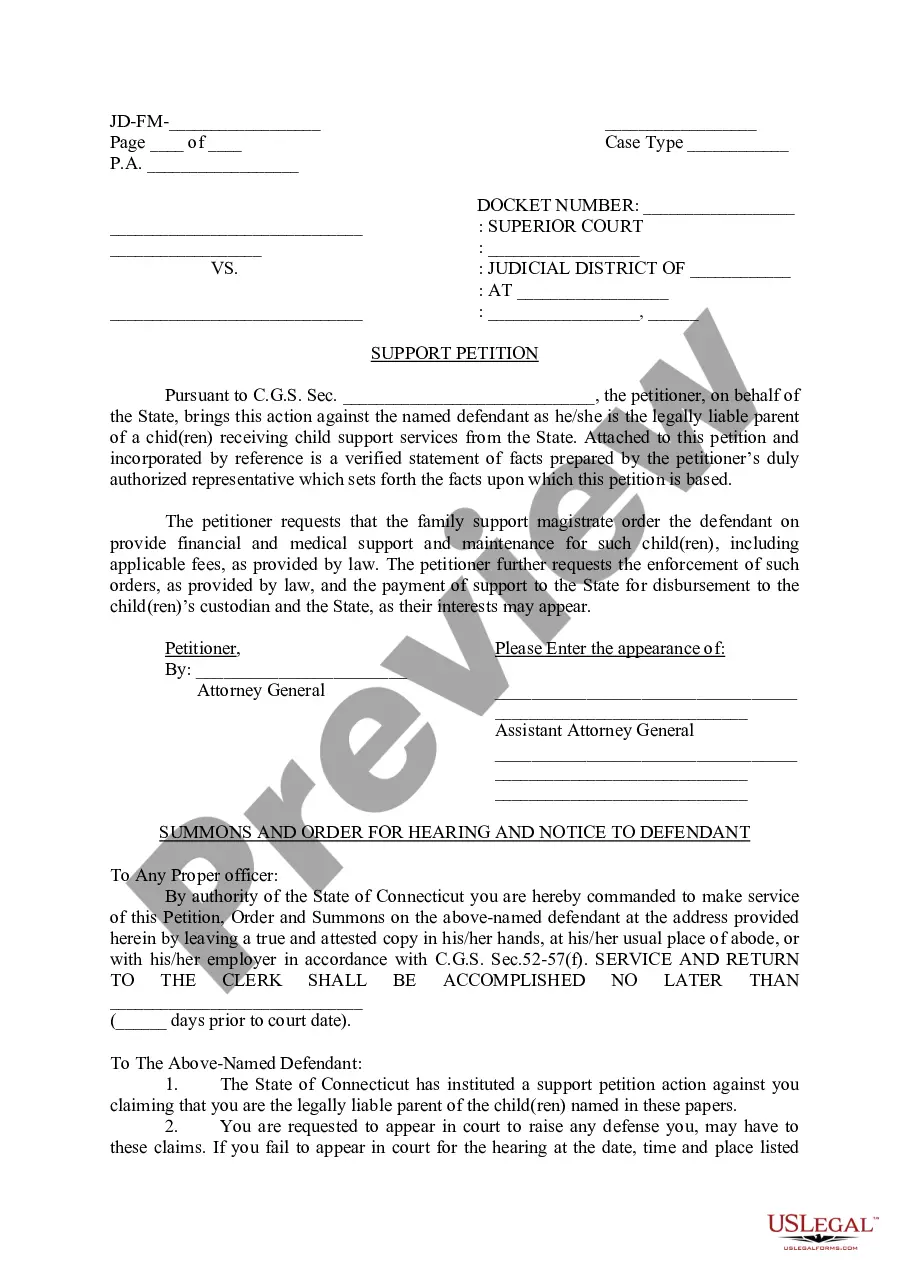

- Click the form’s preview to examine it.

- If it is not the right form, go back to the search feature to find the Information Sheet For Cpp Death Benefit model you need.

- Acquire the template once it meets your requirements.

- If you have a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- If you haven't set up an account yet, you can download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: either a credit card or PayPal account.

- Choose the file format you prefer and download the Information Sheet For Cpp Death Benefit.

- After downloading, you can fill out the form using editing software or print it to complete manually.

Form popularity

FAQ

To obtain your CPP tax slip online, log into your My Service Canada Account. This account will give you access to all your tax slips, including your CPP statement. For ease of understanding the tax implications, consider reviewing the Information sheet for cpp death benefit, which can help clarify any complexities regarding tax slips.

Yes, you can acquire your pension statement online through the Service Canada website, provided you have set up a My Service Canada Account. This convenient option allows for easy access to your pension details from home. Refer to the Information sheet for cpp death benefit for a detailed guide on accessing this service.

To obtain a statement of your pension benefits, you should apply through Service Canada, either online or in person. Providing your personal information is necessary for verification. You can find relevant details in the Information sheet for cpp death benefit, making the process clearer and more efficient.

You can request a CPP statement through the Service Canada website or by visiting a local Service Canada office. Make sure to have your personal information ready for verification. To streamline your understanding of benefits, consult the Information sheet for cpp death benefit, which guides you through the request process.

Receiving a CPP death benefit typically takes a few weeks after the application has been submitted. Processing times can vary based on individual circumstances, but the Information sheet for cpp death benefit assists applicants by outlining the necessary steps and documentation required for timely processing.

To obtain a copy of your CPP statement, you can request it directly from Service Canada. You may need to provide personal identification details to verify your identity. For a comprehensive view of your contributions and benefits, refer to the Information sheet for cpp death benefit, as it contains essential instructions for this process.

When a person passes away, the Canada Pension Plan (CPP) benefits can transfer to survivors or dependents. These beneficiaries may be eligible for a one-time death benefit, which is part of the Information sheet for cpp death benefit. It is important to notify Service Canada promptly to ensure that the correct benefits are distributed.

Filling out a death claim can be straightforward if you have the correct documentation. Start by gathering necessary paperwork, such as the deceased’s Social Security number and proof of death. For guidance through the entire process, reference the information sheet for cpp death benefit to simplify your claim submission.

The $2500 death benefit is not available to everyone; it depends on specific eligibility requirements. Only certain individuals, like those who have made sufficient contributions to Social Security, may be entitled to this benefit. For more clarity, the information sheet for cpp death benefit can provide detailed eligibility criteria.

The $2500 death benefit is typically claimed by the surviving spouse or a dependent of the deceased. However, if no direct survivors exist, other family members may claim it. For a complete guide to eligibility, refer to the information sheet for cpp death benefit to ensure the correct parties know their rights.