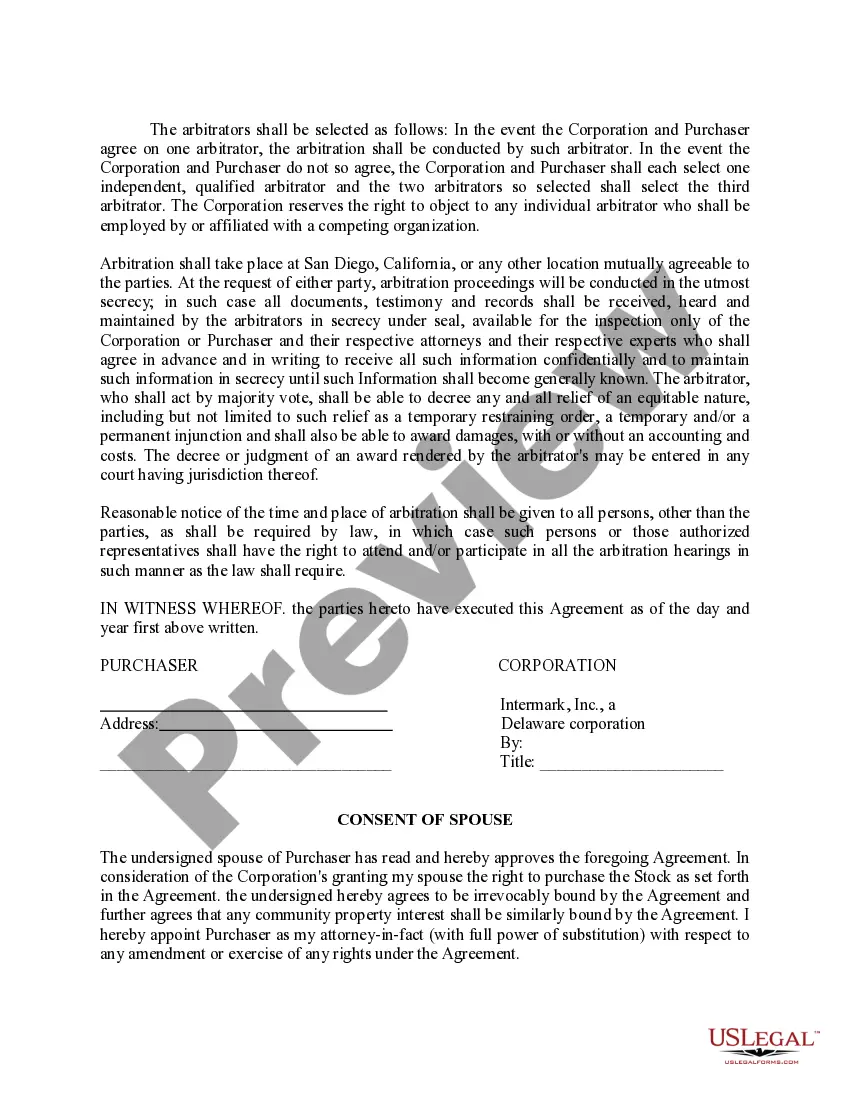

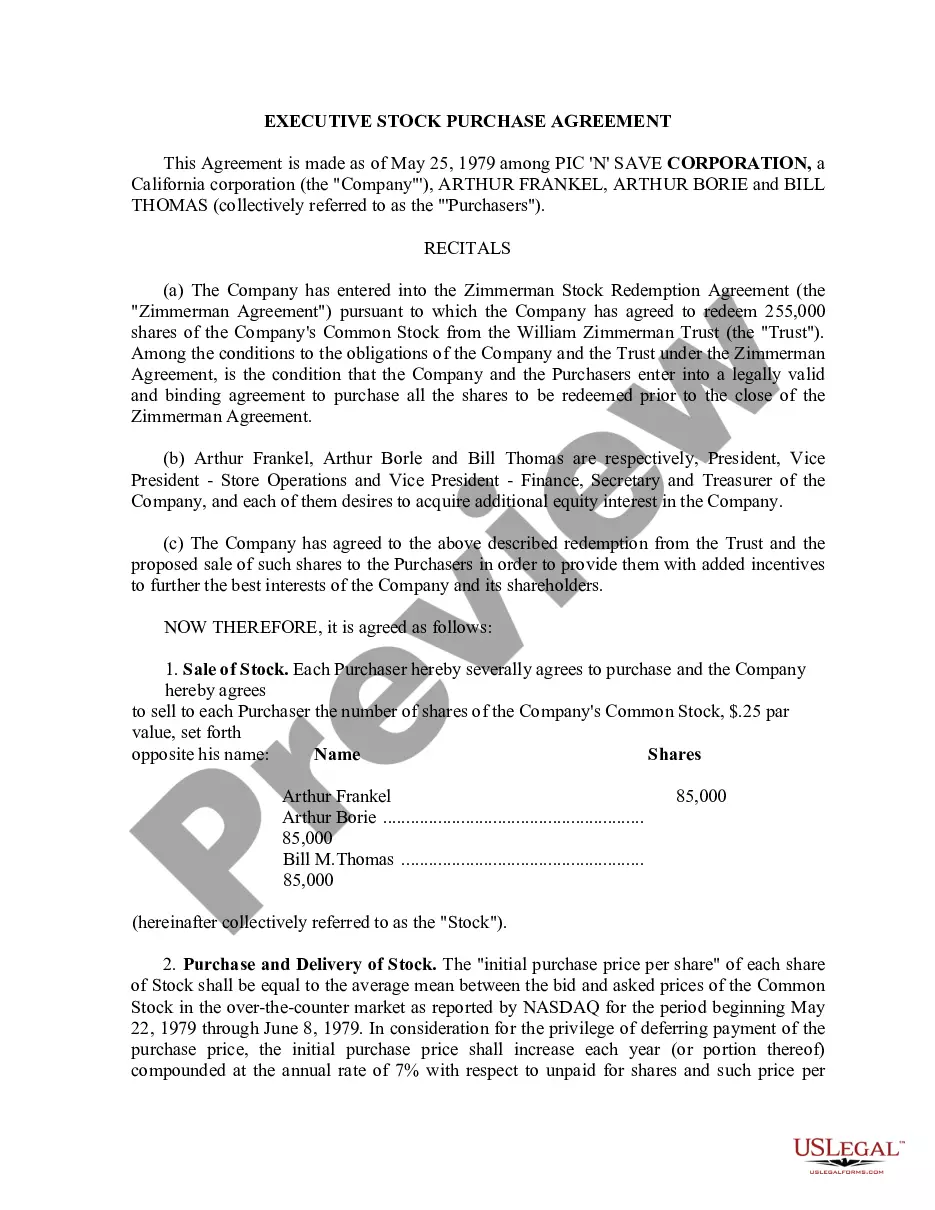

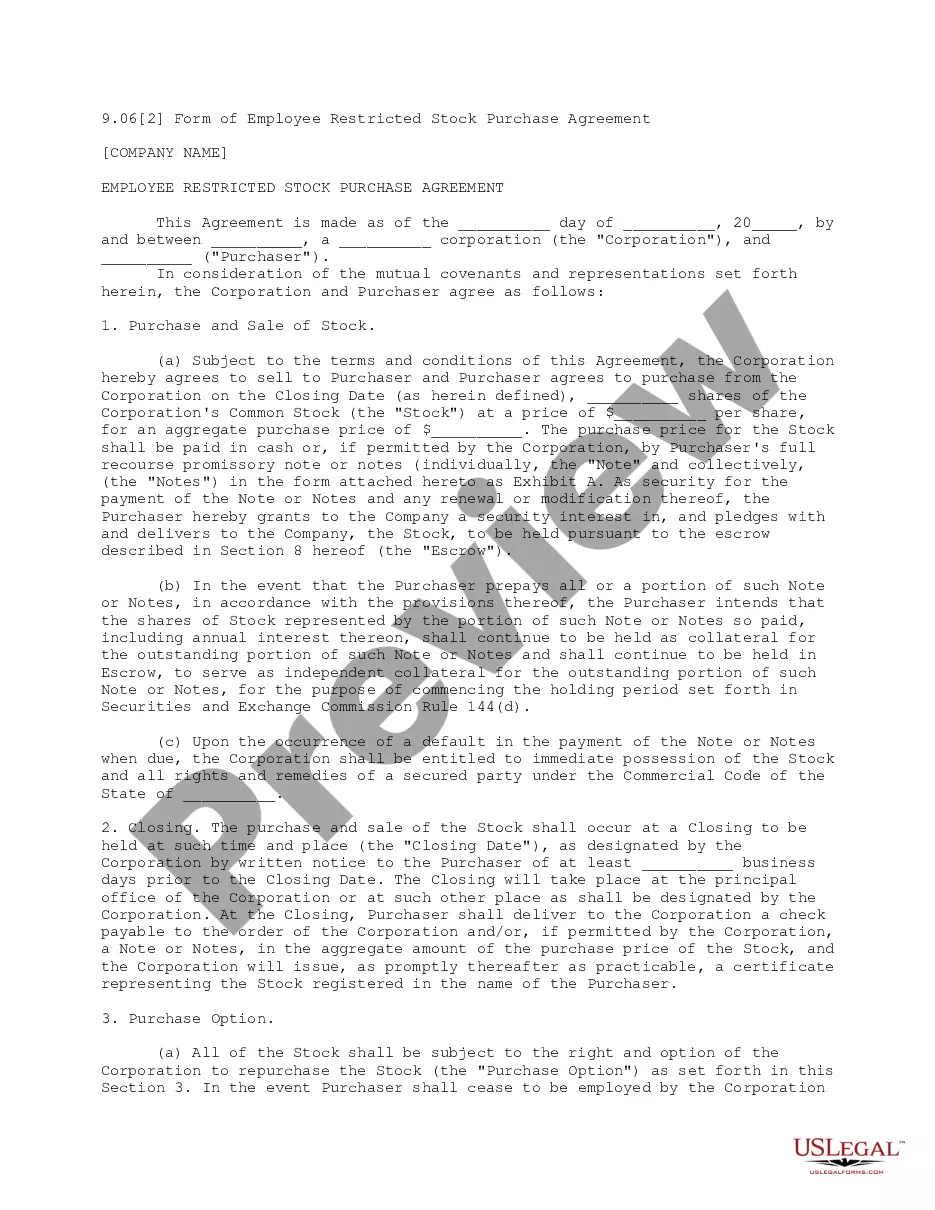

Restricted Stock Between For Profit

Description

How to fill out Sample Restricted Stock Purchase Agreement Between Intermark, Inc. And Purchasers?

Acquiring legal forms that comply with federal and state regulations is essential, and the internet provides various choices to select from.

However, why squander time looking for the appropriately prepared Restricted Stock Between For Profit template online when the US Legal Forms digital library has already compiled such documents in one location.

US Legal Forms is the most extensive online legal directory with more than 85,000 editable templates created by attorneys for any business and personal circumstance.

View the template using the Preview feature or through the text description to ensure it satisfies your requirements.

- They are easy to navigate with all documents sorted by state and purpose of use.

- Our specialists stay updated with legislative changes, ensuring you can always trust your documents are current and compliant when obtaining a Restricted Stock Between For Profit from our site.

- Acquiring a Restricted Stock Between For Profit is quick and straightforward for both existing and new users.

- If you have an account with an active subscription, Log In and save the form you need in the desired format.

- If you are new to our site, follow the steps below.

Form popularity

FAQ

The value of RSUs is typically recorded in Box 14 of the W-2, which is labeled "Other." Box 14 doesn't have a standard list of codes, thus allowing employers to enter any description they like. You might see the value of your vested stock followed by "RSU."

Taxation of RSUs The amount reported will equal the fair market value of the stock on the date of vesting, which is also the date of delivery in this case. Therefore, the value of the stock is reported as ordinary income in the year the stock becomes vested.

If you have RSUs the amount should be shown in box 14 of your W-2 copy. This amount should also be included in the wages (box 1) of your W-2. Box 14 is used by employers to list various items and there is not a standard list of codes, you can use the options for "Other Not Listed Here" in place of RSU Gain.

Accounting for Restricted Stock/RSU Grants In general, future compensation expense related to restricted stock grants is based on the fair value of the stock on the grant date. The compensation expense is then recognized over the employees' service/vesting period.

RSUs are considered a form of compensation and are included in your taxable income when they vest. Because RSU income is considered supplemental, the withholding rate can vary between 22% and 37%. Usually, your employer will liquidate a percentage of the shares to cover the withholding requirement.