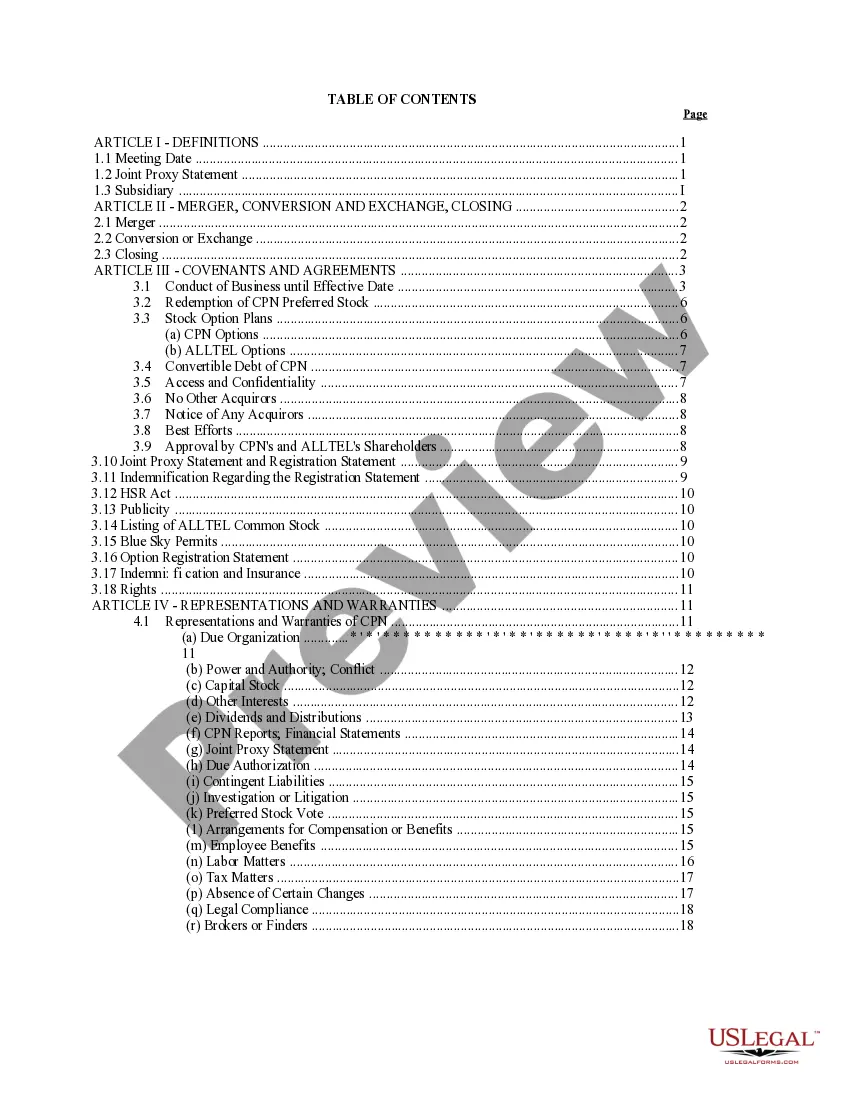

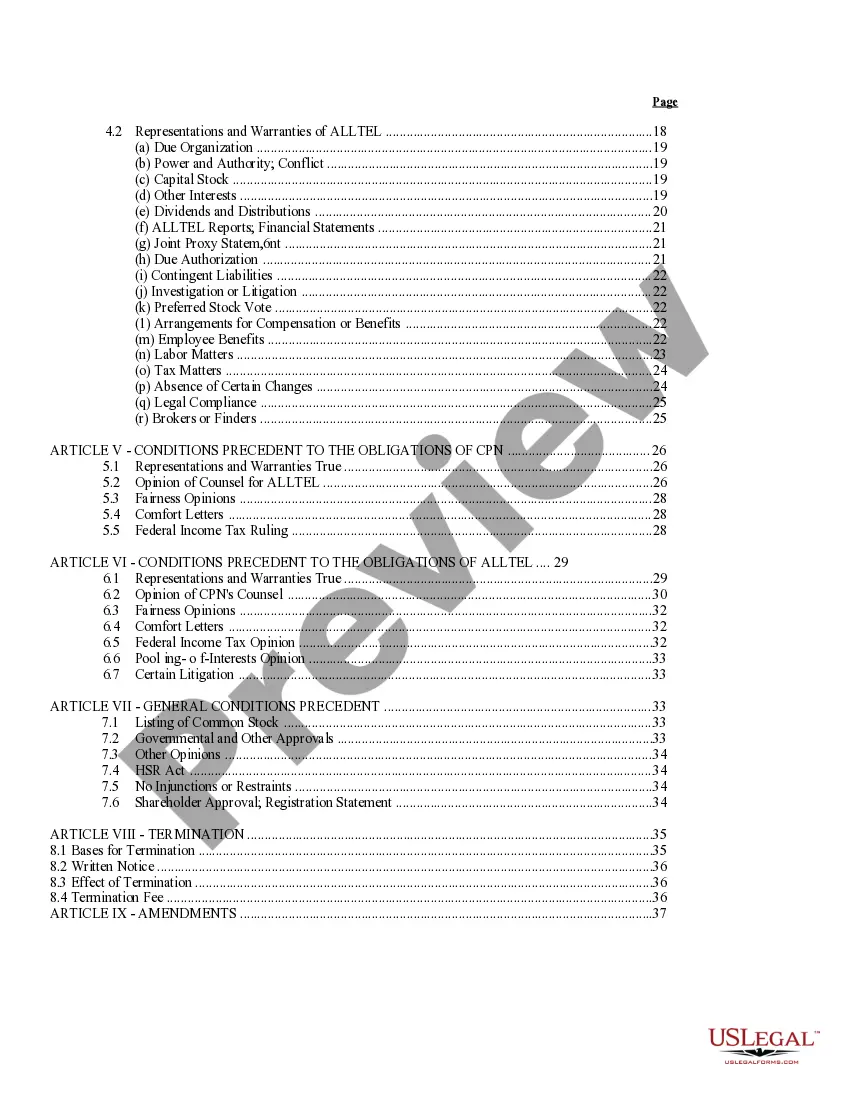

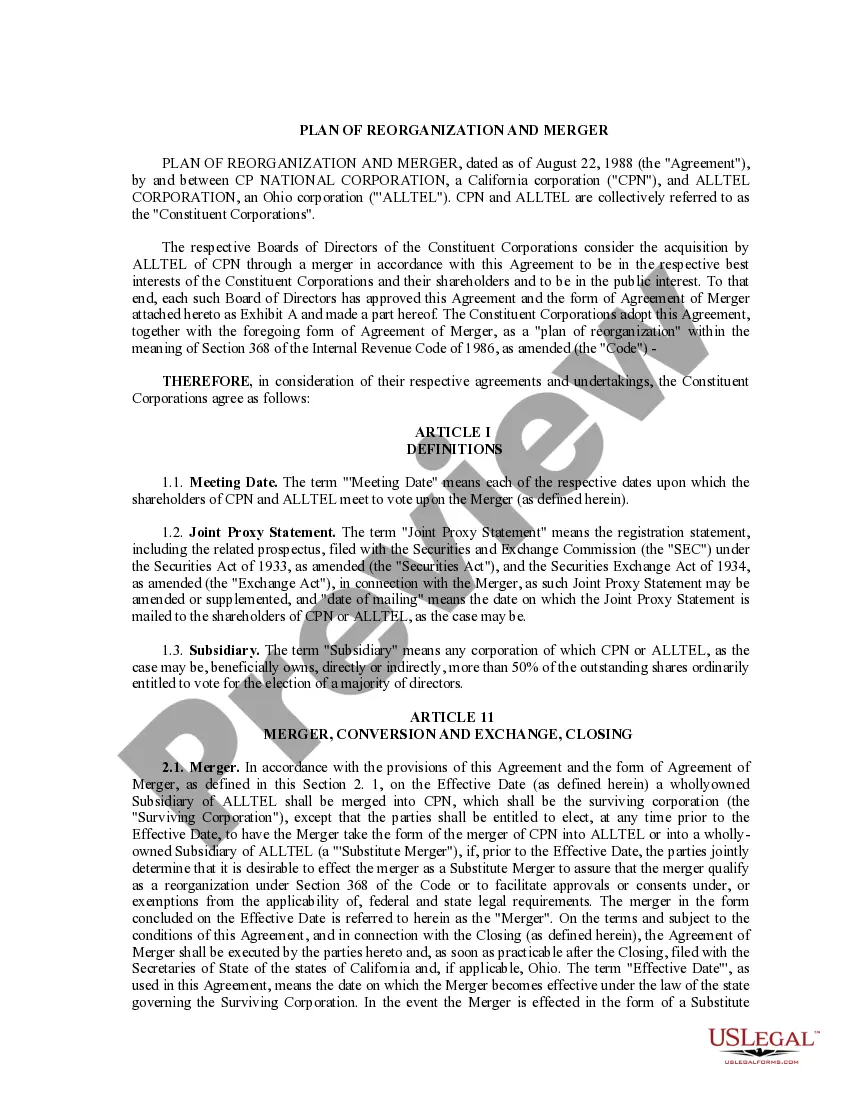

Merger Between Corp Formula

Description

How to fill out Plan Of Reorganization And Merger Between CP National Corp. And Alltel Corp.?

Drafting legal paperwork from scratch can sometimes be daunting. Some cases might involve hours of research and hundreds of dollars invested. If you’re looking for a a simpler and more cost-effective way of preparing Merger Between Corp Formula or any other forms without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our online catalog of over 85,000 up-to-date legal forms covers virtually every element of your financial, legal, and personal affairs. With just a few clicks, you can instantly access state- and county-specific forms diligently put together for you by our legal professionals.

Use our website whenever you need a trusted and reliable services through which you can quickly locate and download the Merger Between Corp Formula. If you’re not new to our services and have previously set up an account with us, simply log in to your account, select the template and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No problem. It takes minutes to set it up and explore the catalog. But before jumping directly to downloading Merger Between Corp Formula, follow these tips:

- Check the document preview and descriptions to ensure that you have found the document you are searching for.

- Make sure the template you select conforms with the regulations and laws of your state and county.

- Pick the best-suited subscription option to get the Merger Between Corp Formula.

- Download the file. Then fill out, sign, and print it out.

US Legal Forms has a spotless reputation and over 25 years of experience. Join us now and transform document completion into something easy and streamlined!

Form popularity

FAQ

Small Business Merger Guidelines Compare and analyze the corporate structures. Determine the leadership of the new company. Compare the company cultures. Determine the branding of the new company. Analyze all financial positions. Determine operating costs. Do your due diligence. Conduct a valuation of all companies.

The mains steps for building a merger model are: Making Acquisition Assumptions. Making Projections. Valuation of Each Business. Business Combination and Pro Forma Adjustments. Deal Accretion/ Dilution.

How to Build a Merger Model? Step 1 ? Determine the Offer Value Per Share (and Total Offer Value) Step 2 ? Structure the Purchase Consideration (i.e. Cash, Stock, or Mix) Step 3 ? Estimate the Financing Fee, Interest Expense, Number of New Share Issuances, Synergies, and Transaction Fee.

Mergers and Acquisitions (M&A) ? Valuation Discounted cash flow (DCF) method: The target's value is calculated based on its future cash flows. Comparable company analysis: Relative valuation metrics for public companies are used to determine the value of the target.

Valuations of Mergers and Acquisitions In order to calculate Net Present Value (NPV), you must: Determine the expected cash flows of the target company. Determine the effect the merger will have on the combined cost of capital of the new entity. Determine the amount that will be paid for the target company.