Official Chapter 13 Without Permission

Description

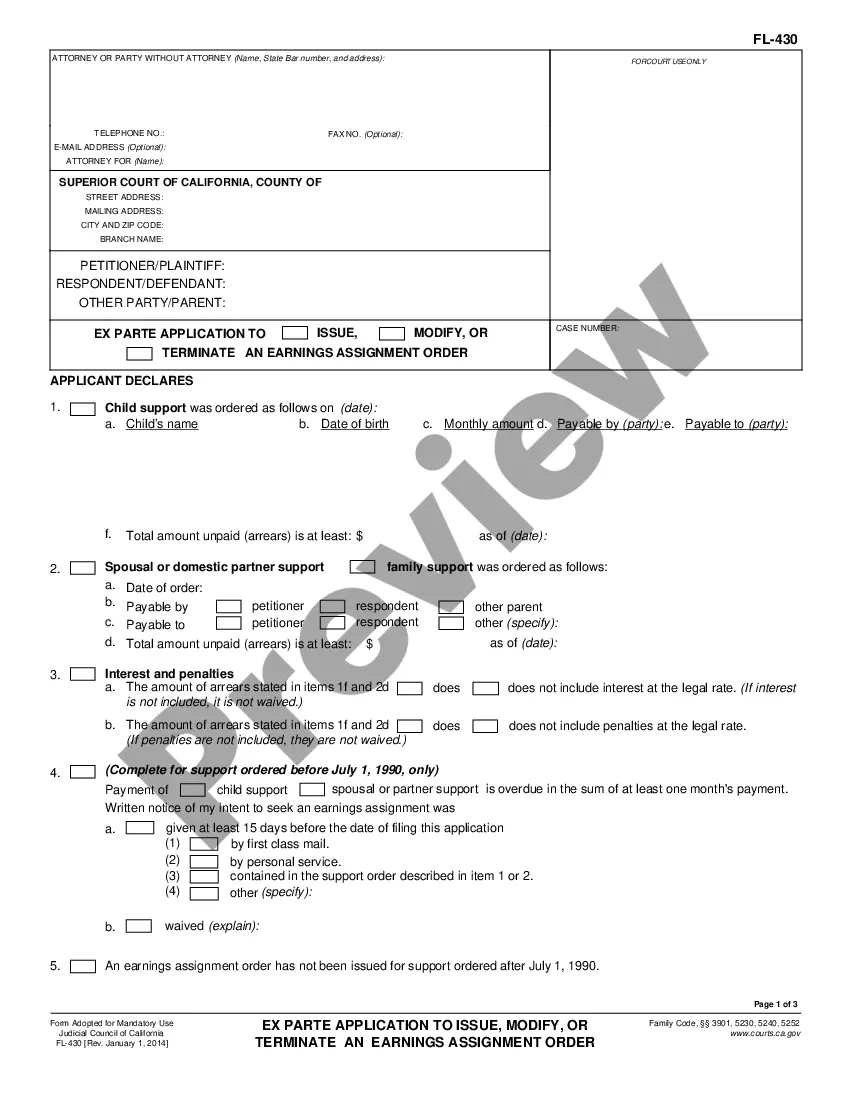

How to fill out List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

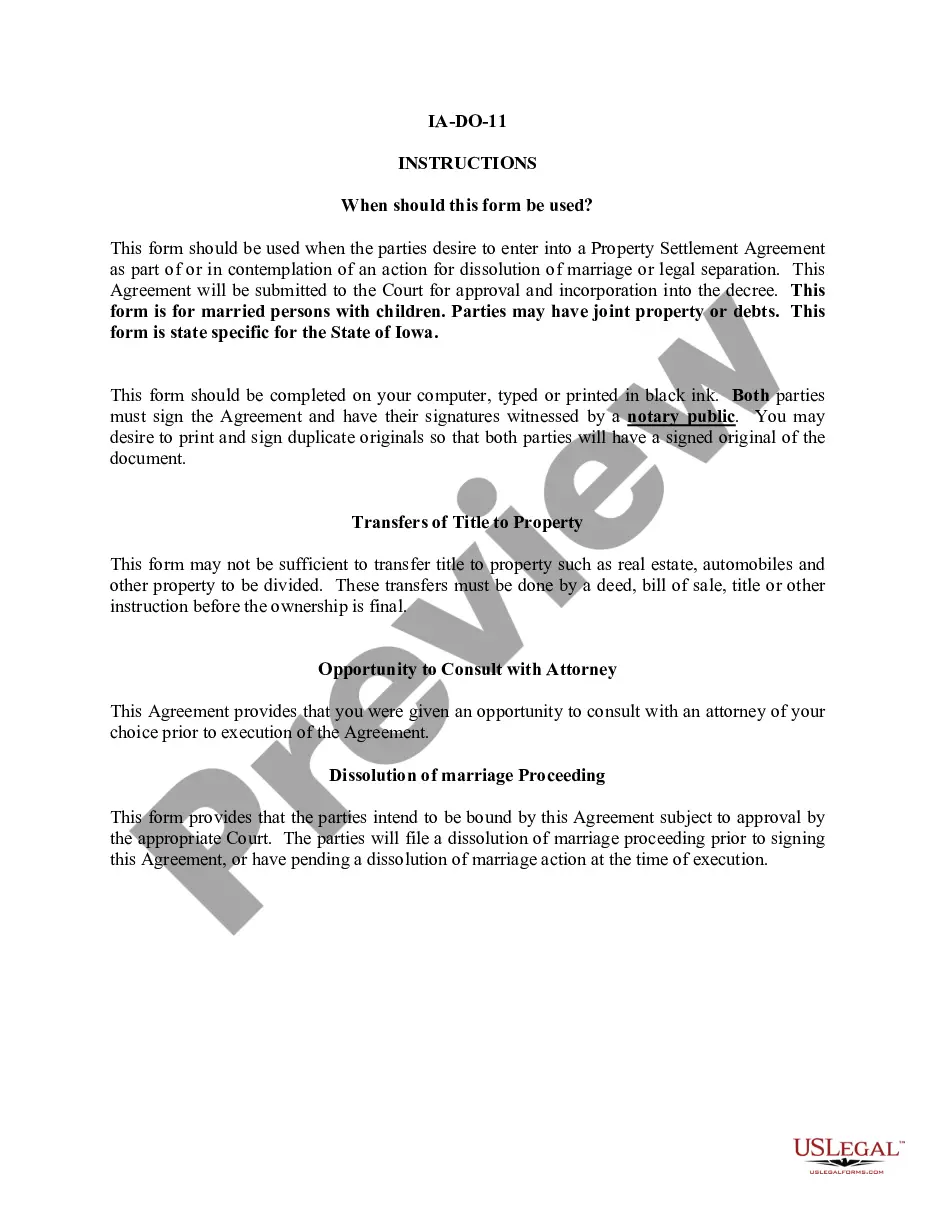

It's clear that you can't become a legal authority instantly, nor can you learn to swiftly prepare Official Chapter 13 Without Permission without possessing a specialized education.

Assembling legal papers is a lengthy task that demands specific training and expertise. So why not entrust the preparation of the Official Chapter 13 Without Permission to the specialists.

With US Legal Forms, one of the most extensive legal document repositories, you can find everything from judicial filings to templates for internal corporate communication.

Begin your search anew if you need additional templates. Create a free account and choose a subscription plan to acquire the template.

Select Buy now. After the payment is processed, you can retrieve the Official Chapter 13 Without Permission, complete it, print it, and send or deliver it to the required parties or organizations.

- Understand how crucial compliance and observance of federal and local regulations are.

- That’s why, on our platform, all templates are tailored to specific locations and are current.

- Here’s commence with our website and obtain the document you need within minutes.

- Identify the form you require by utilizing the search feature at the top of the site.

- Examine it (if this feature is available) and review the accompanying description to determine whether Official Chapter 13 Without Permission is the document you seek.

Form popularity

FAQ

Debts not discharged in chapter 13 include certain long term obligations (such as a home mortgage), debts for alimony or child support, certain taxes, debts for most government funded or guaranteed educational loans or benefit overpayments, debts arising from death or personal injury caused by driving while intoxicated ...

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.

Hear this out loud PauseHowever, if you choose to voluntarily dismiss a Chapter 13 case, you would stop making payments and then respond to the trustee. The trustee would file a motion after the failure to make payments. After that, the debtor should be able to get dismissed from the bankruptcy.

By this time, any existing balance of certain qualifying debts will already be wiped out by the bankruptcy discharge. Due to a variety of possible reasons, Chapter 13 can be denied. To avoid such a denial, it is highly advisable to consult with the best bankruptcy lawyers in your area.

Skipping a Chapter 13 plan payment can negatively impact your Chapter 13 case. If you miss a payment under the plan, the court can decide to dismiss your case or change your bankruptcy case to Chapter 7. Under a Chapter 7 bankruptcy, the court can liquidate your nonexempt assets to pay your outstanding debts.