Creditors Chapter 13 With No Money

Description

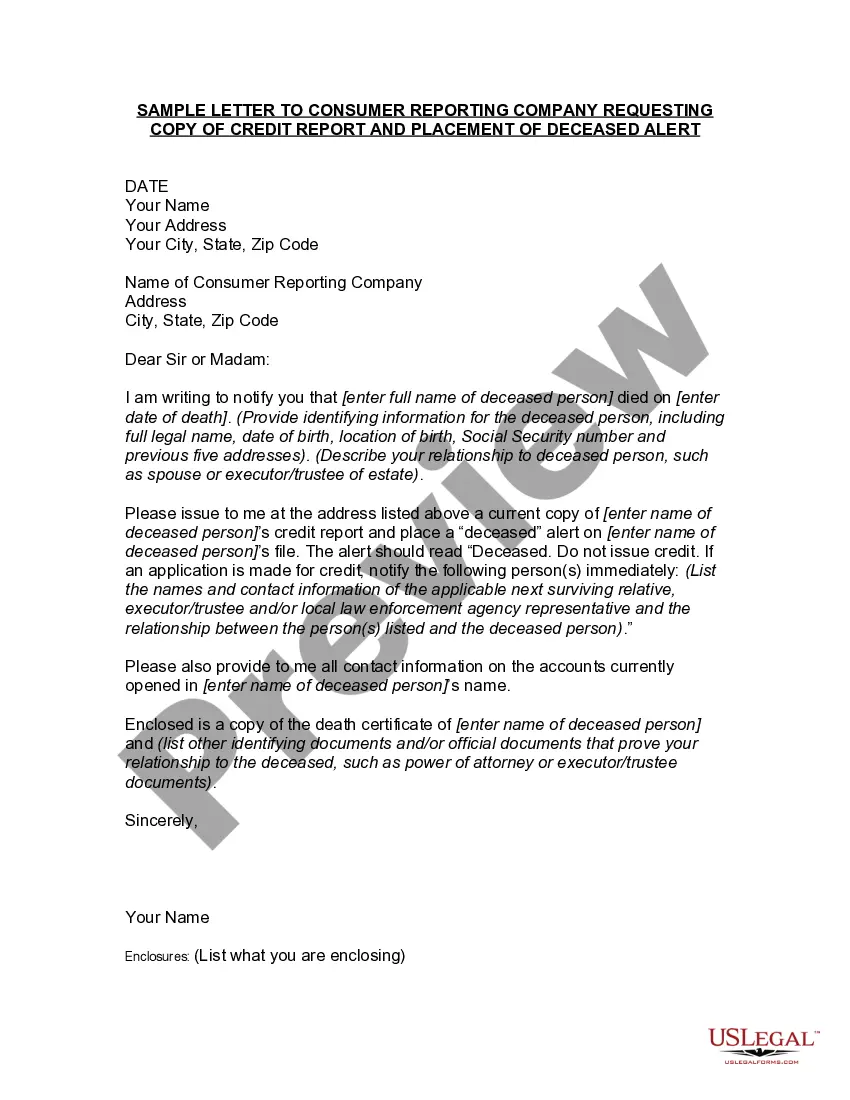

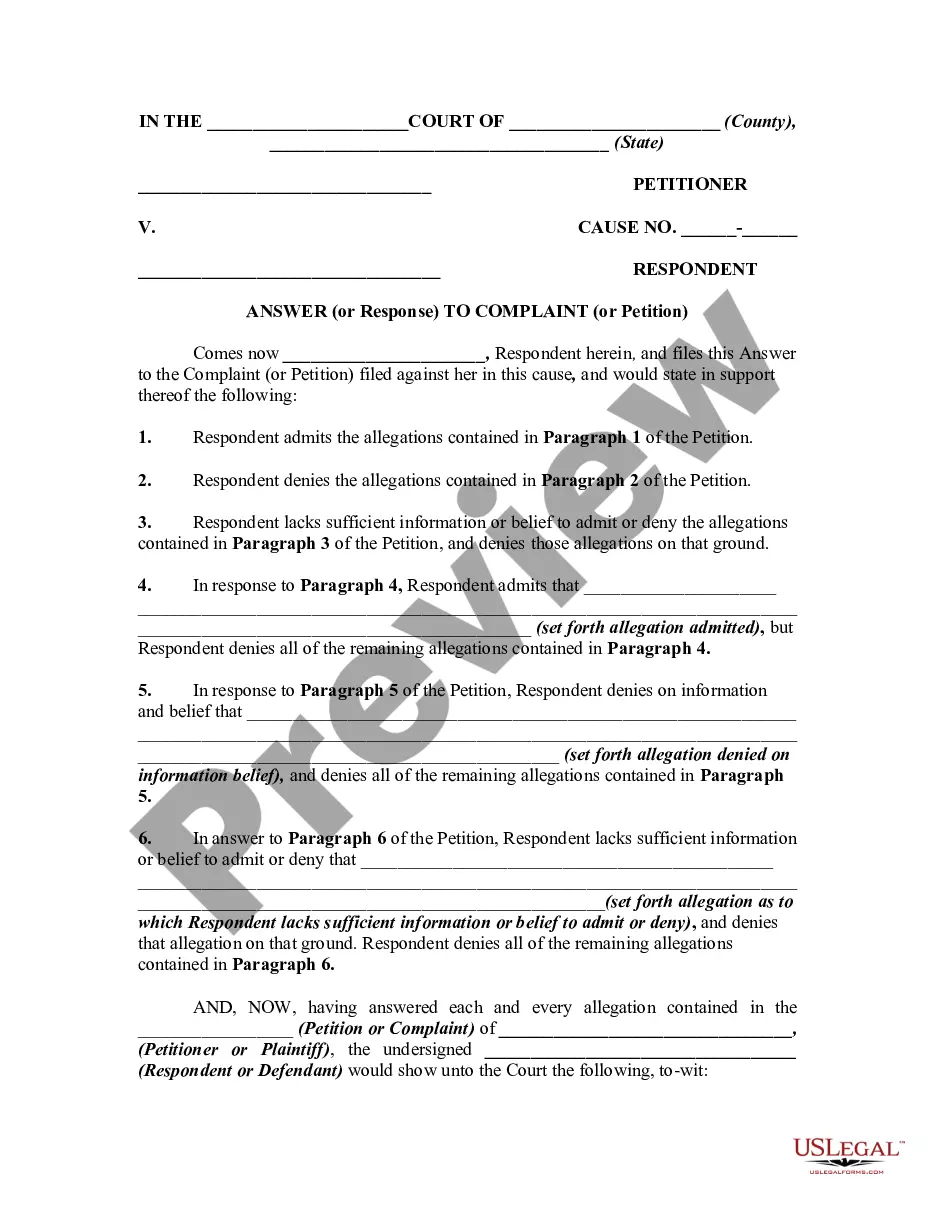

How to fill out List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

It’s no secret that you can’t become a law professional immediately, nor can you figure out how to quickly prepare Creditors Chapter 13 With No Money without having a specialized background. Creating legal forms is a long process requiring a certain training and skills. So why not leave the creation of the Creditors Chapter 13 With No Money to the specialists?

With US Legal Forms, one of the most comprehensive legal template libraries, you can access anything from court papers to templates for in-office communication. We understand how important compliance and adherence to federal and local laws and regulations are. That’s why, on our website, all forms are location specific and up to date.

Here’s start off with our website and get the document you require in mere minutes:

- Discover the document you need with the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to figure out whether Creditors Chapter 13 With No Money is what you’re searching for.

- Start your search over if you need any other form.

- Register for a free account and select a subscription plan to buy the form.

- Choose Buy now. As soon as the transaction is complete, you can get the Creditors Chapter 13 With No Money, fill it out, print it, and send or send it by post to the necessary people or organizations.

You can re-access your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your paperwork-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

Dischargeable Debts ? As opposed to nondischargeable debts, these debts are up for discharge (elimination) when your case concludes. Some examples of dischargeable debts in Chapter 13 include credit card debt, medical bills, utility bills, and personal loans.

The Chapter 13 Hardship Discharge After confirmation of a plan, circumstances may arise that prevent the debtor from completing the plan. In such situations, the debtor may ask the court to grant a "hardship discharge." 11 U.S.C. § 1328(b).

The Chapter 13 Trustee is required to report to the Bankruptcy Court if you fail to make payments on time or in full. The Court may then enter an order dismissing your case and withdrawing the protection of the Bankruptcy Court. If that occurs, you then could be subject to creditor collection efforts and other actions.

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.

Unsecured creditors have more limited protections in chapter 13. However, not all unsecured creditors have the same rights: those with priority claims are entitled to full repayment, while those with non-priority claims are entitled only to a portion of the debtor's income, whether or not it fully repays the debt.