Claims Chapter 13 Formula

Description

How to fill out List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

It’s well-known that you cannot instantly become a legal authority, nor can you quickly learn how to prepare Claims Chapter 13 Formula without having a specialized education. Assembling legal documents is a lengthy process that requires specific training and expertise. So why not let the experts handle the creation of the Claims Chapter 13 Formula.

With US Legal Forms, one of the most comprehensive legal template repositories, you can find anything from court documents to templates for internal corporate communications. We understand the significance of compliance and adherence to federal and state laws and guidelines. That’s why, on our site, all templates are location-specific and current.

Here’s how to get started on our website and acquire the document you need in just a few minutes.

You can regain access to your forms from the My documents section at any time. If you’re an existing customer, you can simply Log In and find and download the template from the same section.

Regardless of the purpose of your documents—whether financial, legal, or personal—our website has you covered. Try US Legal Forms today!

- Find the form you need using the search bar at the top of the page.

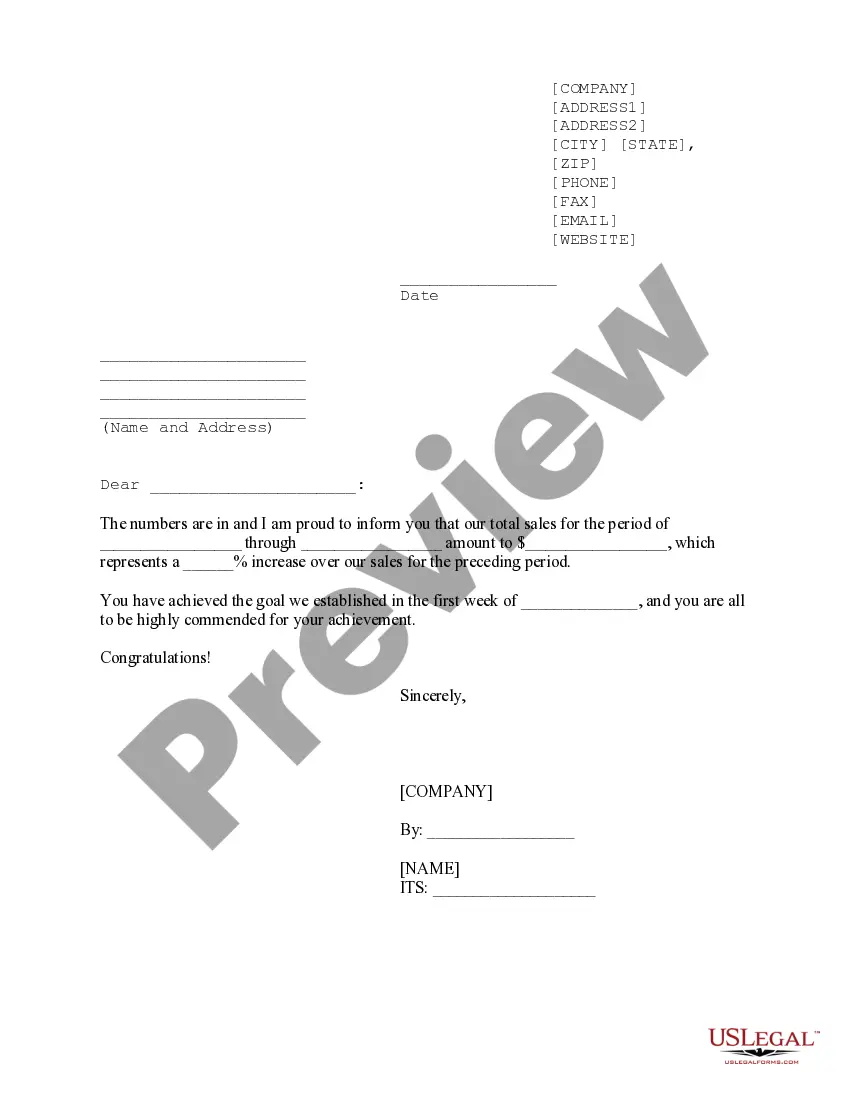

- Preview it (if this option is available) and read the accompanying description to see if Claims Chapter 13 Formula is what you’re looking for.

- If you require another template, start your search again.

- Create a free account and choose a subscription option to purchase the form.

- Select Buy now. Once the payment is completed, you can obtain the Claims Chapter 13 Formula, fill it out, print it, and send or mail it to the relevant individuals or organizations.

Form popularity

FAQ

To calculate the total average monthly payment, add all amounts that are contractually due to each secured creditor in the 60 months after you file for bankruptcy. Then divide by 60. 33c.

What is Disposable Personal Income? After-tax income. The amount that U.S. residents have left to spend or save after paying taxes is important not just to individuals but to the whole economy. The formula is simple: personal income minus personal current taxes.

Other Required Payments Through a Chapter 13 Bankruptcy Plan There usually are two other payments included in the Chapter 13 bankruptcy plan. The first is the trustee's fee, which is 10% of the total amount paid into the case.

To calculate your monthly payment amount in a Chapter 13 bankruptcy, calculate your income for the six months before your bankruptcy filing. Deduct allowable expenses to determine your disposable income. Pay your priority debtors and any secured debts that you want to keep after the bankruptcy.

The disposable income calculation starts with your gross income. You must also be a wage earner in order to file a Chapter 13. Then, certain expenses are deducted based on an IRS deduction. The deduction is based upon a national average, taking into consideration the metropolitan area you live.