Chapter 11 Chapter 7 Chapter 13 With No Money

Description

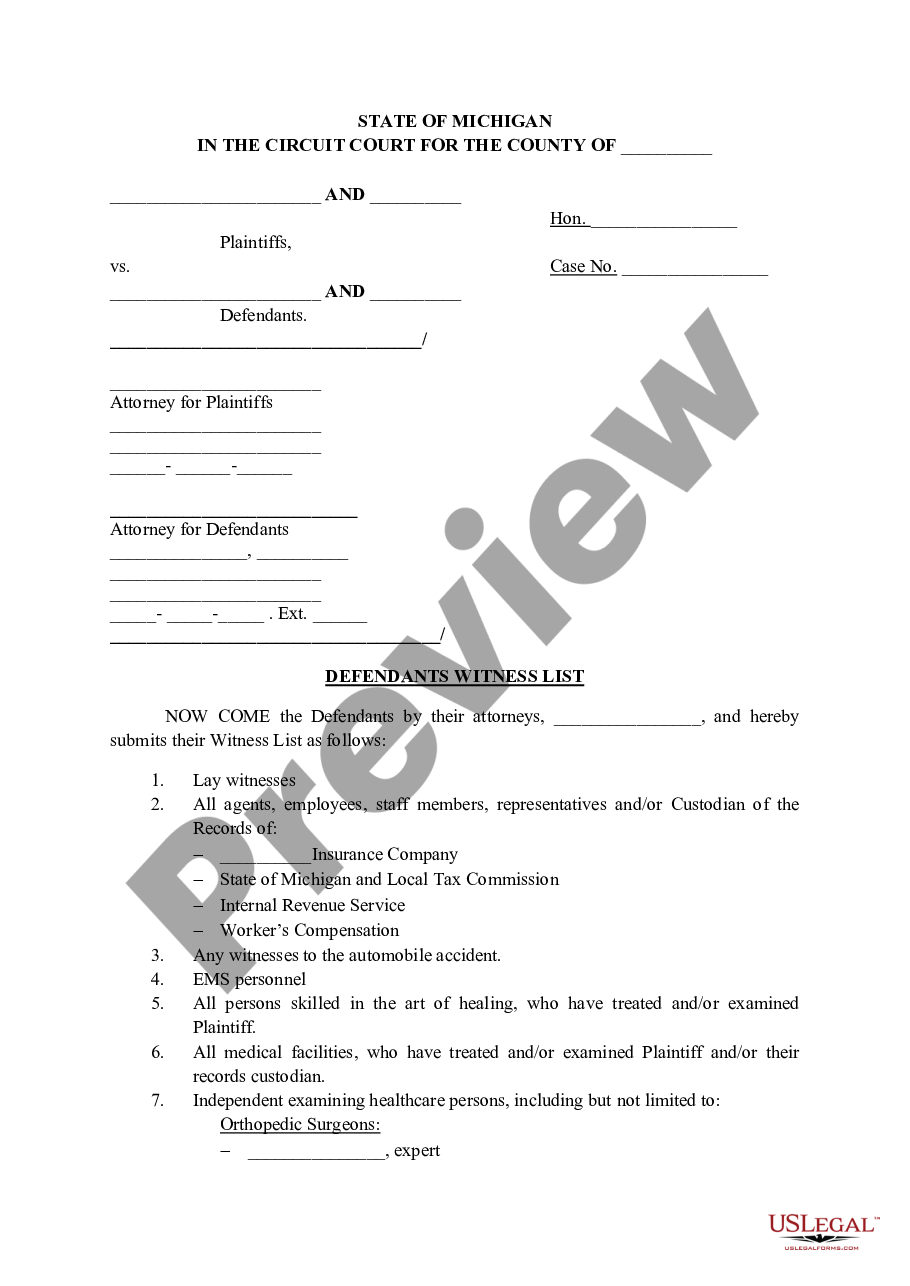

How to fill out List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

Locating a reliable source for the most up-to-date and pertinent legal templates is a significant part of navigating bureaucratic processes.

Selecting the appropriate legal documents requires precision and meticulousness, which is why sourcing Chapter 11 Chapter 7 Chapter 13 With No Money exclusively from trustworthy providers, such as US Legal Forms, is crucial. An incorrect template can squander your time and hinder your progress.

Once you have the form on your device, you can edit it using a tool or print it out and fill it in by hand. Eliminate the stress associated with your legal paperwork. Explore the vast US Legal Forms library where you can find legal templates, verify their applicability to your scenario, and download them promptly.

- Employ the catalog navigation or search bar to locate your template.

- Examine the form’s description to verify it meets the criteria for your state and locality.

- View the form preview, if available, to confirm that it is indeed the one you need.

- Continue your search and look for the suitable template if the Chapter 11 Chapter 7 Chapter 13 With No Money does not fulfill your requirements.

- If you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your selected forms in My documents.

- If you do not yet have an account, click Buy now to obtain the form.

- Select the payment plan that meets your needs.

- Proceed with the registration to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Select the file format for downloading Chapter 11 Chapter 7 Chapter 13 With No Money.

Form popularity

FAQ

The bankruptcy trustee can also sue your friends and family to regain the assets or money. Other ways people hide assets is by lying about the possession of or destroying assets. Moving assets to other bank accounts or property or falsifying information to make it seem like the assets are of little or no value.

Calculating your Household Income To determine your Chapter 7 bankruptcy income limit, add the last six months of your gross income ? this is what you earned before taxes and other deductions were taken out.

The average payment for a Chapter 13 case overall is probably about $500 to $600 per month. This information, however, may not be very helpful for your particular situation. It takes into account a large number of low payment amounts where low income debtors are paying very little back.

Making a significant income won't stop you from filing for bankruptcy. Still, it might determine whether you must file for Chapter 7 or Chapter 13 to wipe out qualifying debt. Your ability to file a particular chapter will depend on your income and, in some cases, your deductible expenses.

The Minimum Percentage of Debt Repayments In A Chapter 13 Bankruptcy Is 8 To 10 Percent.