Employment Employees Form With Two Points

Description

How to fill out Employment Conditions For Potential Employees?

Locating a reliable source for obtaining the latest and suitable legal samples is a significant part of managing bureaucracy.

Selecting the correct legal documents demands accuracy and careful consideration, which is why it's crucial to gather samples of Employment Employees Form With Two Points solely from reputable providers, such as US Legal Forms.

Once you have the form on your device, you can modify it using the editor or print it out and complete it by hand. Eliminate the hassle that comes with your legal documentation. Explore the vast US Legal Forms catalog to find legal examples, assess their applicability to your situation, and download them instantly.

- Use the directory navigation or search functionality to locate your sample.

- Examine the form’s description to determine if it meets the standards of your state and region.

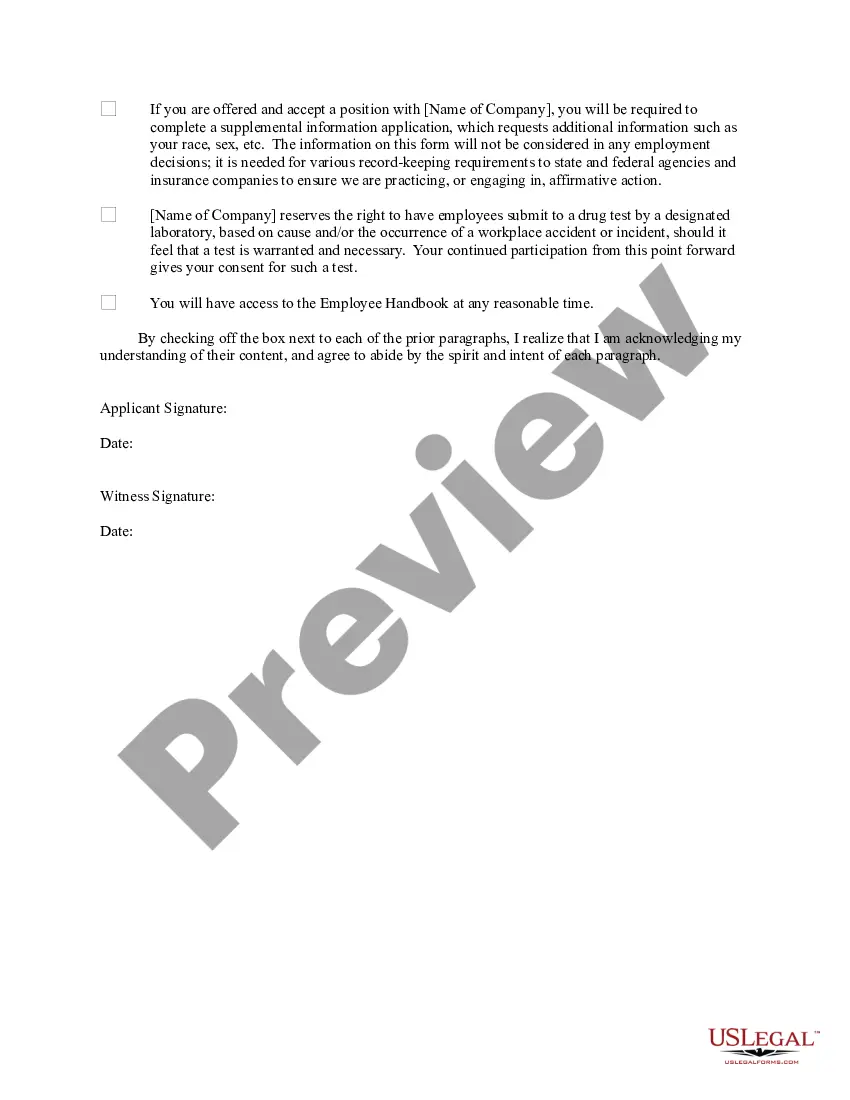

- Preview the form, if available, to confirm that the template is indeed what you need.

- If the Employment Employees Form With Two Points does not fulfill your requirements, continue searching for the appropriate document.

- If you are confident about the form’s applicability, proceed to download it.

- If you are an existing user, click Log in to verify your identity and access your chosen forms in My documents.

- If you haven't created an account yet, click Buy now to acquire the form.

- Select the pricing option that meets your needs.

- Continue with the registration process to finalize your purchase.

- Conclude your transaction by selecting a payment option (credit card or PayPal).

- Choose the document format for downloading Employment Employees Form With Two Points.

Form popularity

FAQ

Filling out a W-2 for an employee involves providing accurate details about their earnings and taxes withheld. You'll need to enter the employee's personal information, total wages, and deductions. Ensure that each section is completed correctly to avoid discrepancies when your employee files taxes. To streamline this task, consider using UsLegalForms, which simplifies your Employment employees form with two points.

The point system for employees' performance quantifies achievements and productivity by assigning points based on specific criteria. This could include punctuality, quality of work, and collaboration efforts. By defining benchmarks, employees become more aware of their contributions and can strive for improvement. Implementing an Employment employees form with two points makes this process manageable.

To figure out how much you should add, first think about how much of a refund you'd like to see after doing your taxes. Once you know your desired amount: Divide that by the number of paychecks you get in a year. Take the result and add that number to what the calculator told you to put on line 4(c)

If there are only two jobs held at the same time in your household, you may check the box in Step 2 on the forms for both jobs. The standard deduction and tax brackets will be divided equally between the two jobs. You will not need to furnish a new Form W-4 to account for pay changes at either job.

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).