Warning Letter Sample For Employee

Description

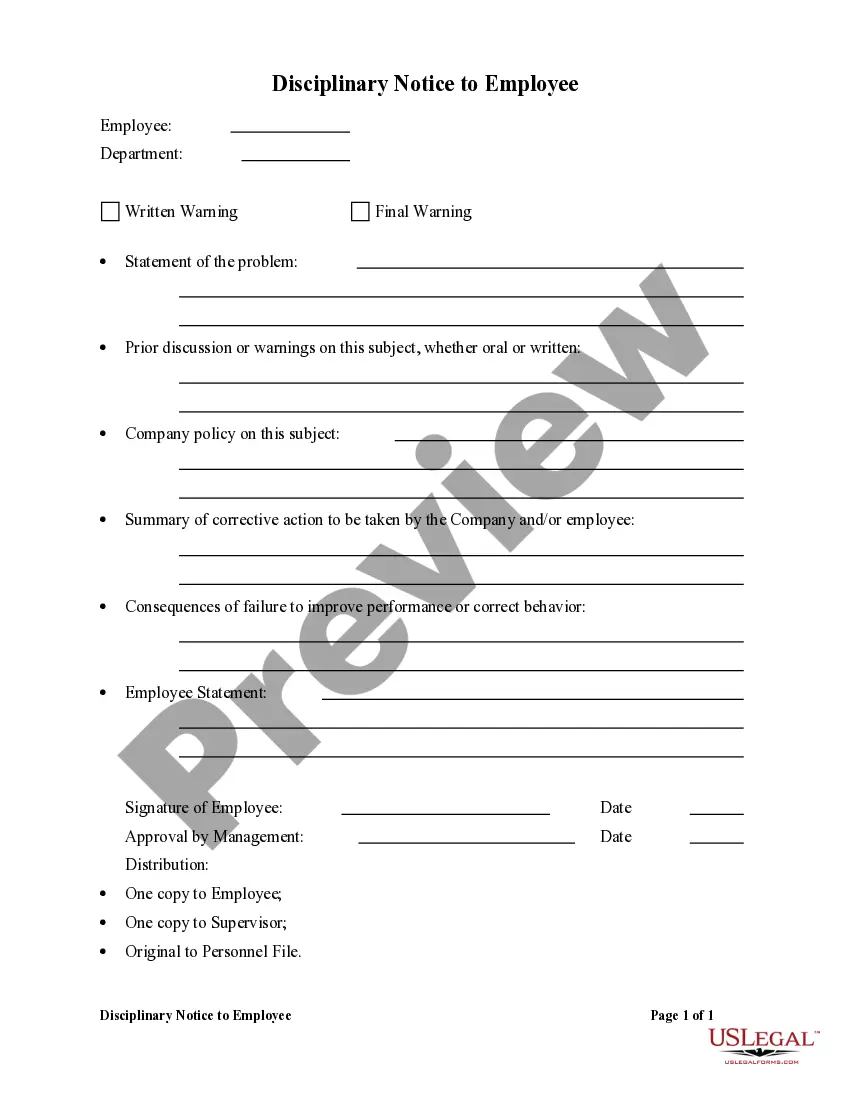

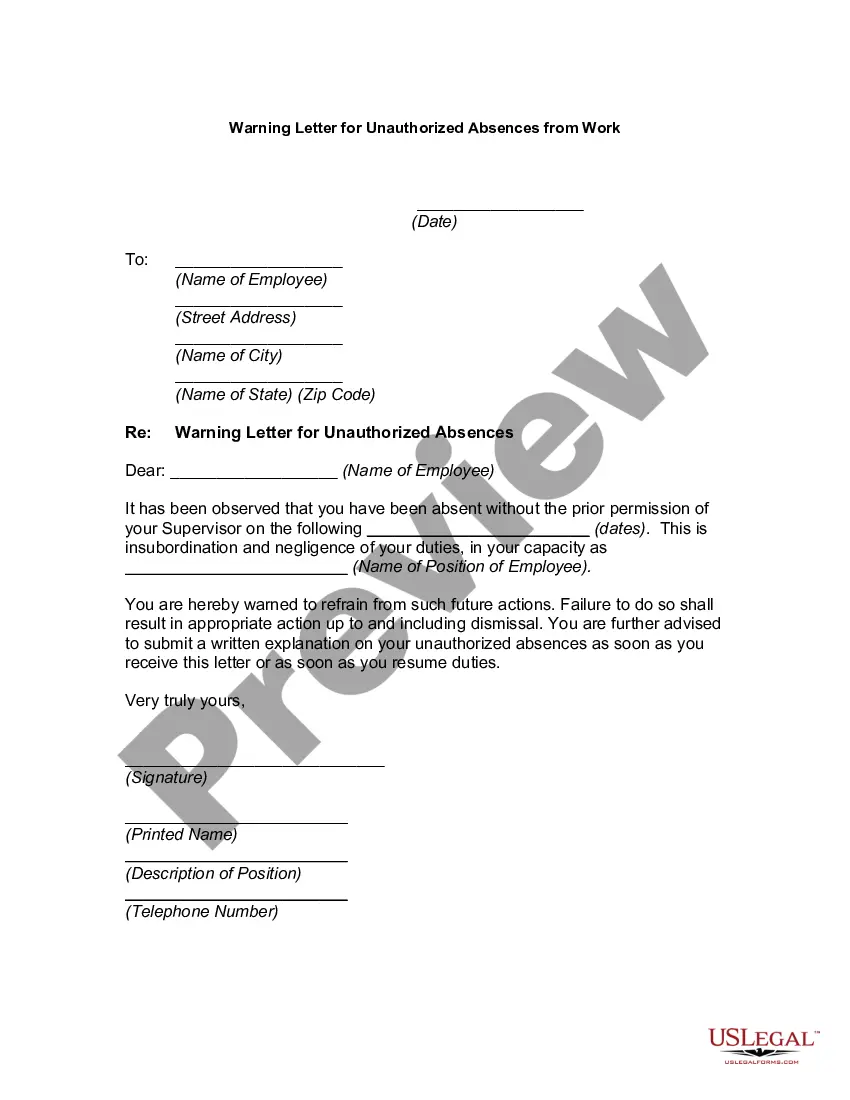

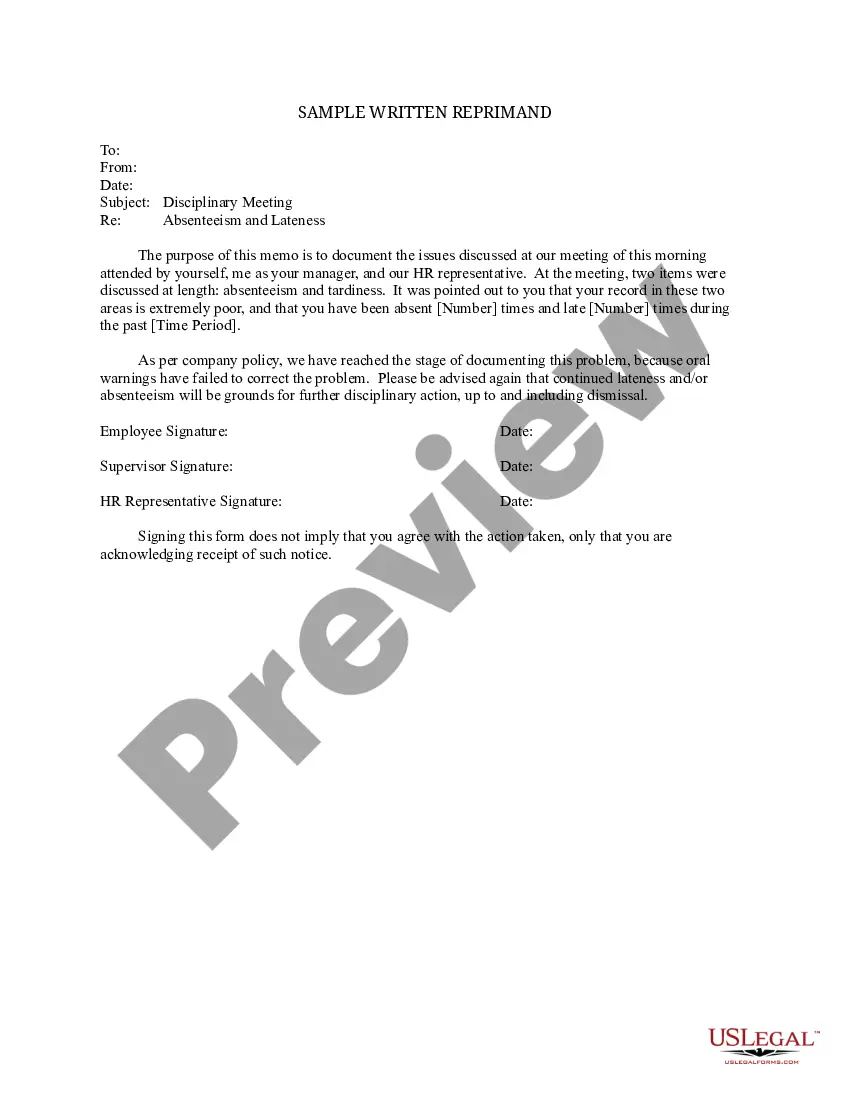

How to fill out Sample Disciplinary Letter For Excessive Absenteeism?

It’s well known that you cannot instantly become a legal expert, nor can you quickly learn how to efficiently create a Warning Letter Sample For Employee without possessing an appropriate background.

Drafting legal documents is a lengthy endeavor that demands specific education and expertise. So why not entrust the creation of the Warning Letter Sample For Employee to the professionals.

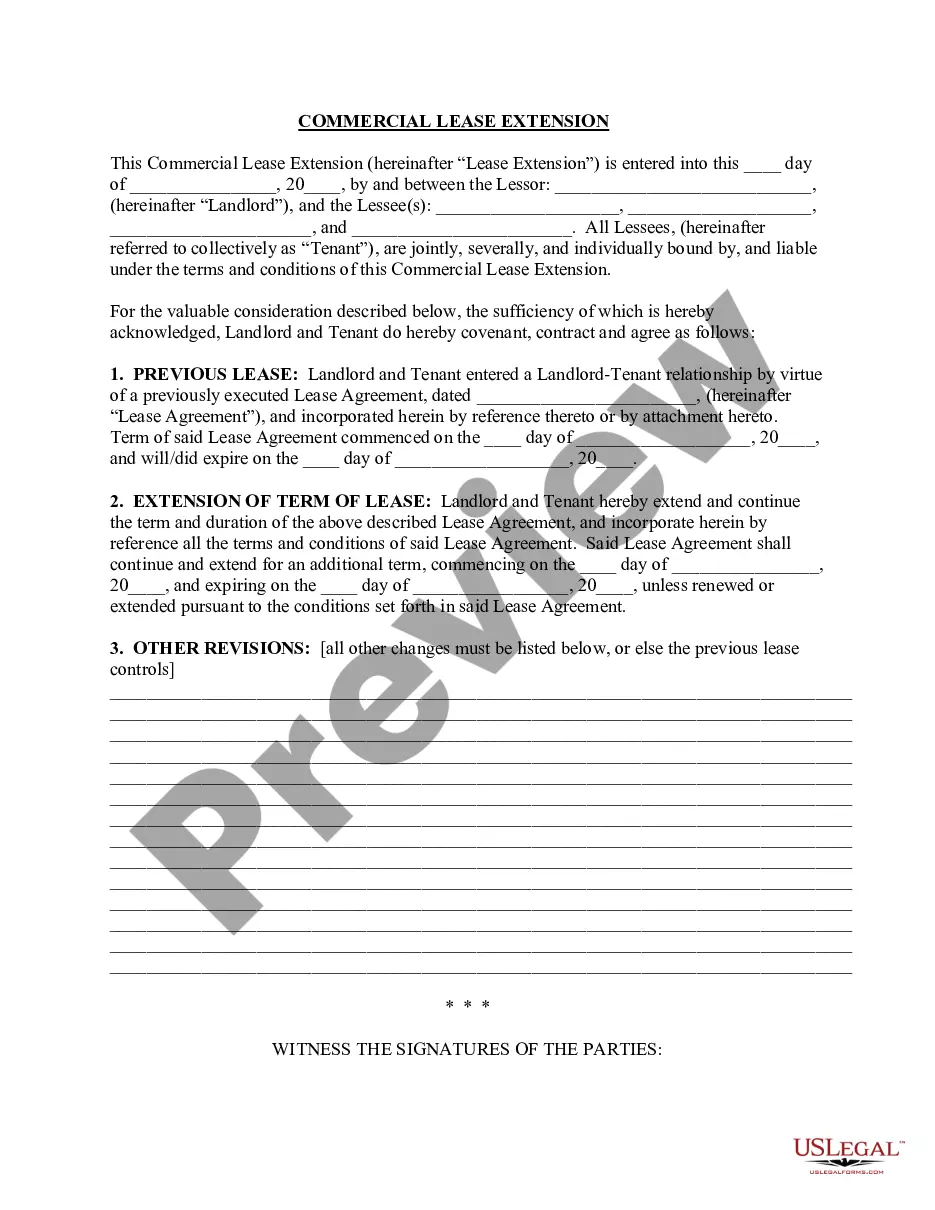

With US Legal Forms, which boasts one of the largest libraries of legal documents, you can locate everything from court forms to templates for internal corporate correspondence.

If you require any other document, start your search anew.

Create a free account and choose a subscription plan to buy the template.

- We recognize how vital it is to comply with federal and state laws and regulations.

- That’s why all documents on our site are location-specific and current.

- Begin by visiting our website to obtain the document you require in no time.

- Utilize the search bar at the top of the page to find the document you need.

- Preview it (if this option is available) and review the accompanying description to determine if the Warning Letter Sample For Employee is what you need.

Form popularity

FAQ

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

Do you need to notarize a Loan Agreement? First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

In general, a personal loan contract is just as legally binding between friends or family as it would be with a bank. However, a contract between friends or family might be simpler or have fewer terms.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

If you are an existing customer of the lender, with whom you have a savings or salary account, fixed deposits, or have taken loans in the past, you may not be required to submit documents. However, you may be required to submit relevant information via an application form online, as mentioned above.

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability.

What is a Promissory Note? A Promissory Note documents the borrower's legally binding promise to repay a loan under certain terms and conditions.