Self Employed Ss With Covid

Description

How to fill out Determining Self-Employed Independent Contractor Status?

Acquiring a reliable source for obtaining the most up-to-date and suitable legal templates is part of the challenge of navigating bureaucracy.

Selecting the appropriate legal documents requires precision and meticulousness, which is why it is essential to obtain samples of Self Employed Ss With Covid solely from reputable sources, such as US Legal Forms. An incorrect template will squander your time and delay the matter at hand. With US Legal Forms, you have minimal concerns.

Once you have the form on your device, you can edit it with the editor or print it and complete it by hand. Eliminate the hassle associated with your legal paperwork. Browse the extensive US Legal Forms catalog where you can discover legal templates, evaluate their suitability for your situation, and download them instantly.

- Utilize the library navigation or search bar to find your template.

- Review the form’s details to determine if it meets the criteria of your state and county.

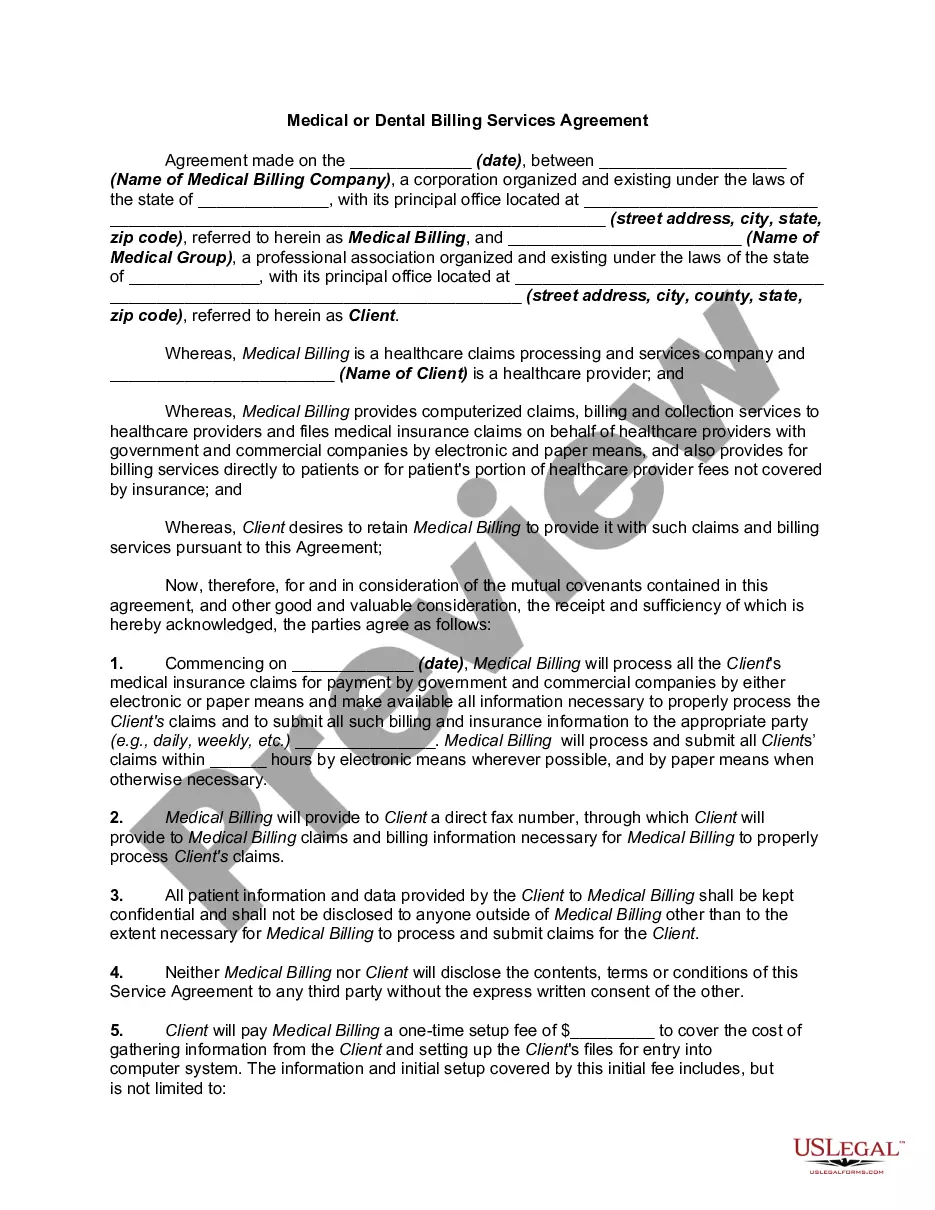

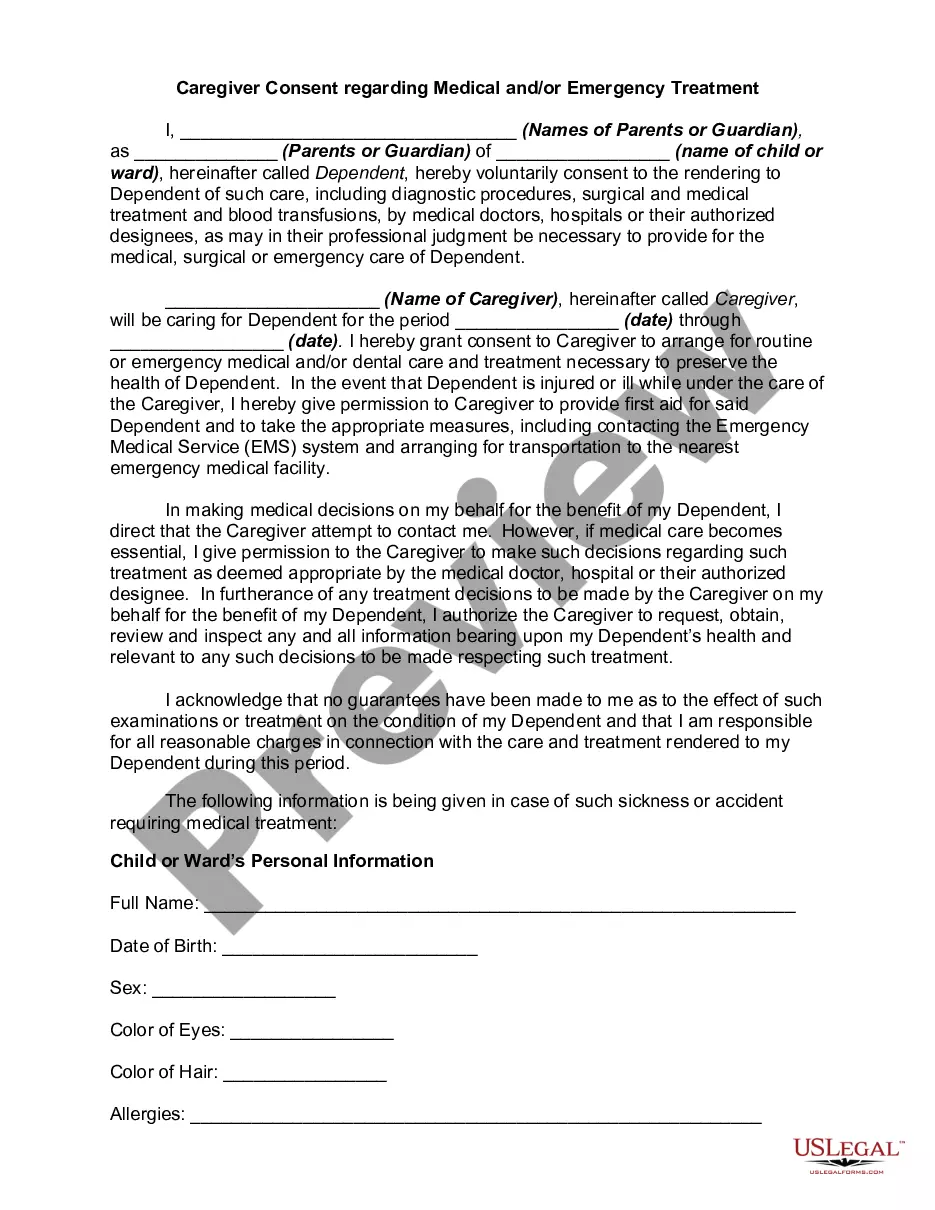

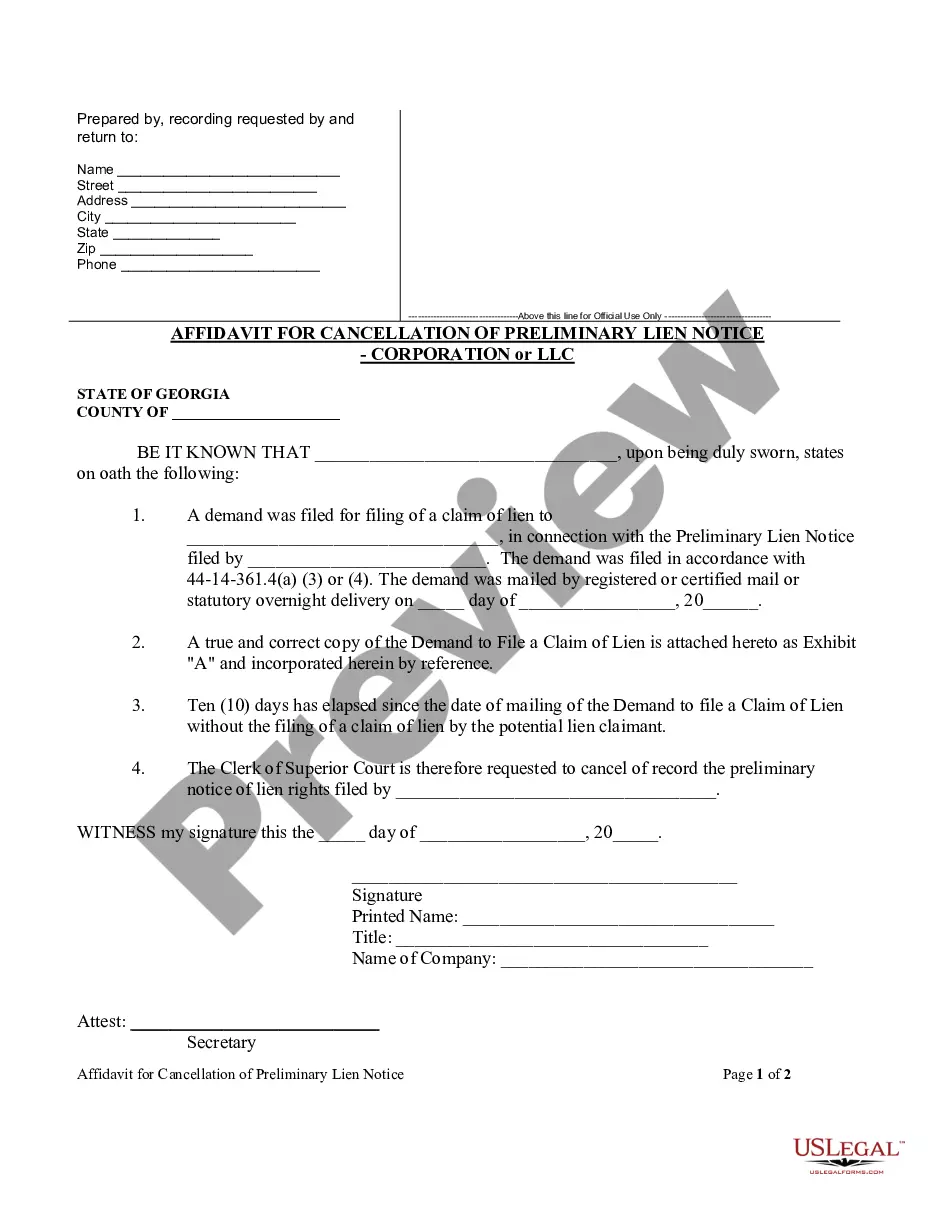

- Check the form preview, if available, to confirm that the form is indeed the one you are looking for.

- Return to the search and find the correct document if the Self Employed Ss With Covid does not satisfy your needs.

- When you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your selected templates in My documents.

- If you do not have an account yet, click Buy now to acquire the form.

- Choose the pricing plan that aligns with your requirements.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Self Employed Ss With Covid.

Form popularity

FAQ

Generally, you are self-employed if any of the following apply to you. You carry on a trade or business as a sole proprietor or an independent contractor. You are a member of a partnership that carries on a trade or business. You are otherwise in business for yourself (including a part-time business or a gig worker).

Income such as tips, gratuities, or occasional earnings may not be shown on your T4 slips. If they are not included on your T4 slips, report them on line 10400 of your return. It is your responsibility to keep track of the earnings you receive through your employment.

Report your gross and net income (or loss) from self-employment income on lines 13499 to 14300 of your return. If you have a loss, show it in brackets.

If the worker is a self-employed individual, they must operate a business and be engaged in a business relationship with the payer. For more information, go to Businesses taxes.

Report your self-employment income on separate lines for each source by entering your gross income and net income in lines 13500 to 14300 of your income tax and benefit return.