Independent Contractor Based With Llc

Description

How to fill out Determining Self-Employed Independent Contractor Status?

Locating a reliable source to obtain the latest and suitable legal templates is part of the challenge of dealing with bureaucracy. Identifying the correct legal documents requires precision and careful consideration, which is why it is essential to source Independent Contractor Based With Llc exclusively from trustworthy providers, such as US Legal Forms. An incorrect template will squander your time and hinder your current situation. With US Legal Forms, you have minimal concerns. You can access and verify all the specifics regarding the document’s application and suitability for your circumstances and in your state or county.

Follow these steps to finalize your Independent Contractor Based With Llc.

Once you have the form on your device, you can modify it using the editor or print it and fill it out by hand. Remove the stress associated with your legal documentation. Explore the extensive US Legal Forms collection where you can discover legal templates, assess their relevance to your circumstances, and download them immediately.

- Utilize the catalog navigation or search bar to locate your sample.

- Examine the form’s description to ensure it meets the criteria of your state and region.

- Preview the form, if available, to confirm it is the one you desire.

- Return to the search and seek a suitable template if the Independent Contractor Based With Llc does not fulfill your requirements.

- Once you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to validate and access your chosen templates in My documents.

- If you do not possess an account yet, click Buy now to acquire the template.

- Select the pricing plan that suits your needs.

- Proceed to the registration to complete your purchase.

- Finalize your transaction by choosing a payment method (credit card or PayPal).

- Choose the document format for downloading Independent Contractor Based With Llc.

Form popularity

FAQ

One of the most advantageous ways to get paid from your LLC is as a W-2 employee. Using this method, you will receive a regular paycheck as would an employee of any business. This is a good way to have a predictable income for your personal finances.

How to Fill Out W9 for Single Member LLC - YouTube YouTube Start of suggested clip End of suggested clip Then you would put your own personal name in line. One. If you're an LLC that's taxed as an SMoreThen you would put your own personal name in line. One. If you're an LLC that's taxed as an S corporation. Or if you're a partnership or another kind of corporation.

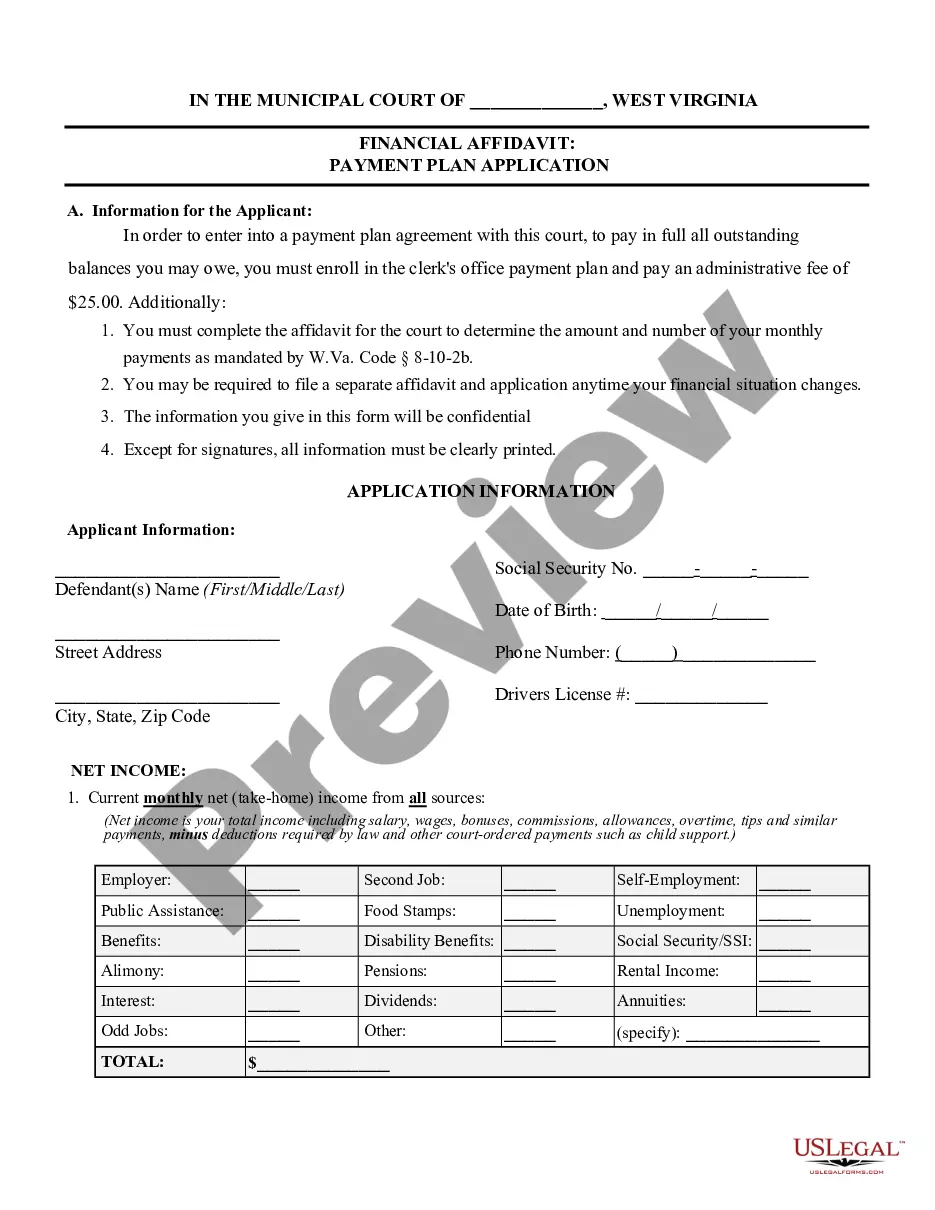

Service-provider (independent contractor): First name, middle initial, and last name. Social Security number. Address. Start date of contract (if no contract, date payments equal $600 or more) Amount of contract, including cents (if applicable) Contract expiration date (if applicable)

For most businesses however, the best way to minimize your tax liability is to pay yourself as an employee with a designated salary. This allows you to only pay self-employment taxes on the salary you gave yourself ? rather than the entire business' income.

If you are a sole proprietor or single-member limited liability company (LLC), you should enter your own name on line 1 as well. Partnerships, multiple-member LLCs, C corporations, and S corporations should enter the entity's name as shown on the entity's tax return. The second line is for your business's name, if any.