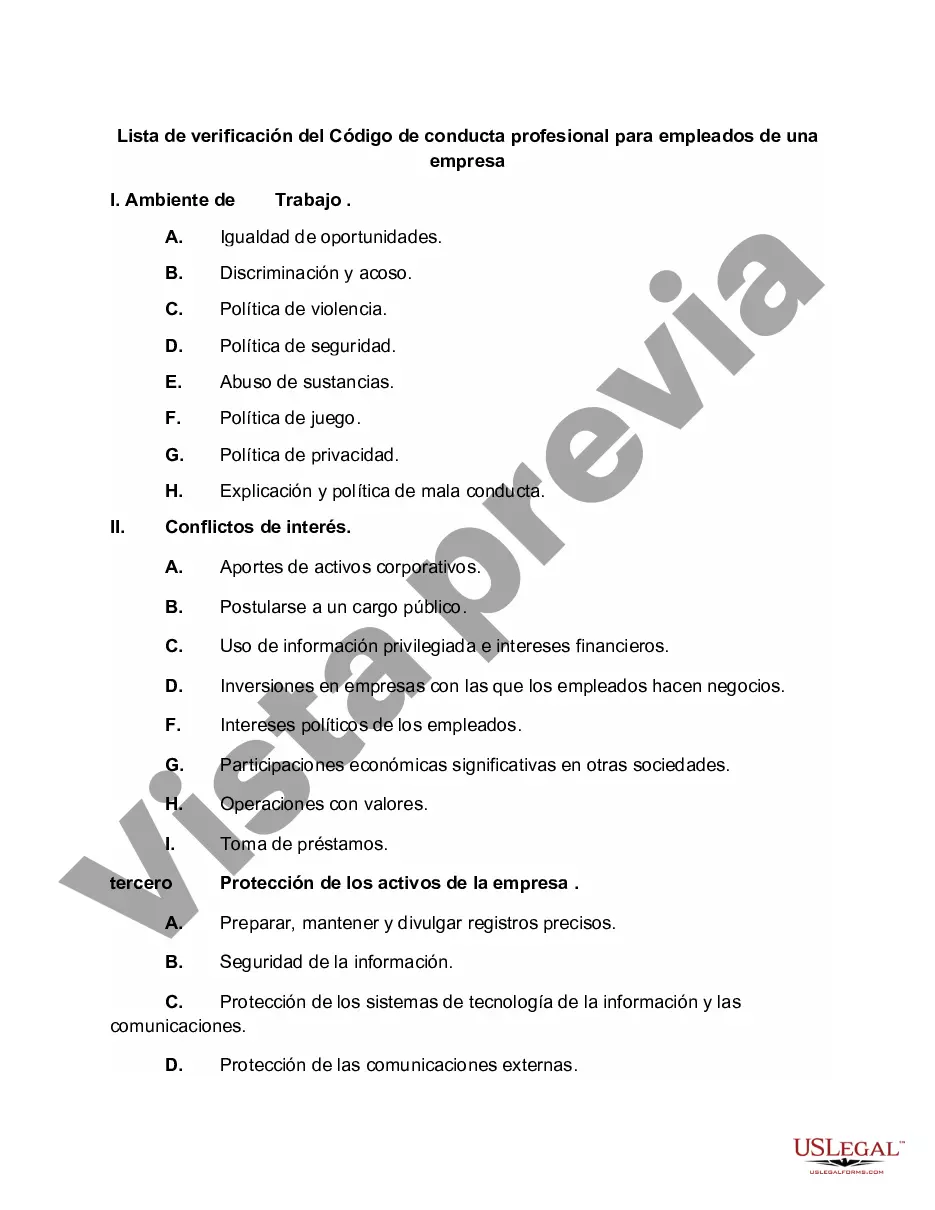

Code Of Conduct Checklist Within The Financial Services Sector - Checklist for Code of Professional Conduct for Employees of a Business

Description

How to fill out Code Of Conduct Checklist Within The Financial Services Sector?

There’s no further justification to spend hours searching for legal documents to comply with your local state requirements.

US Legal Forms has gathered all of them in one location and enhanced their availability.

Our platform provides over 85,000 templates for various business and individual legal situations categorized by state and area of application. All forms are professionally prepared and verified for accuracy, ensuring you can confidently obtain an updated Code Of Conduct Checklist Within The Financial Services Sector.

Creating formal documents under federal and state laws and regulations is quick and simple with our library. Try US Legal Forms today to maintain your documentation in order!

- If you are acquainted with our platform and already have an account, ensure your subscription is current before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also access all saved documents at any time by opening the My documents tab in your profile.

- If you're new to our platform, completing the process will take a few additional steps.

- Here’s how new users can find the Code Of Conduct Checklist Within The Financial Services Sector in our library.

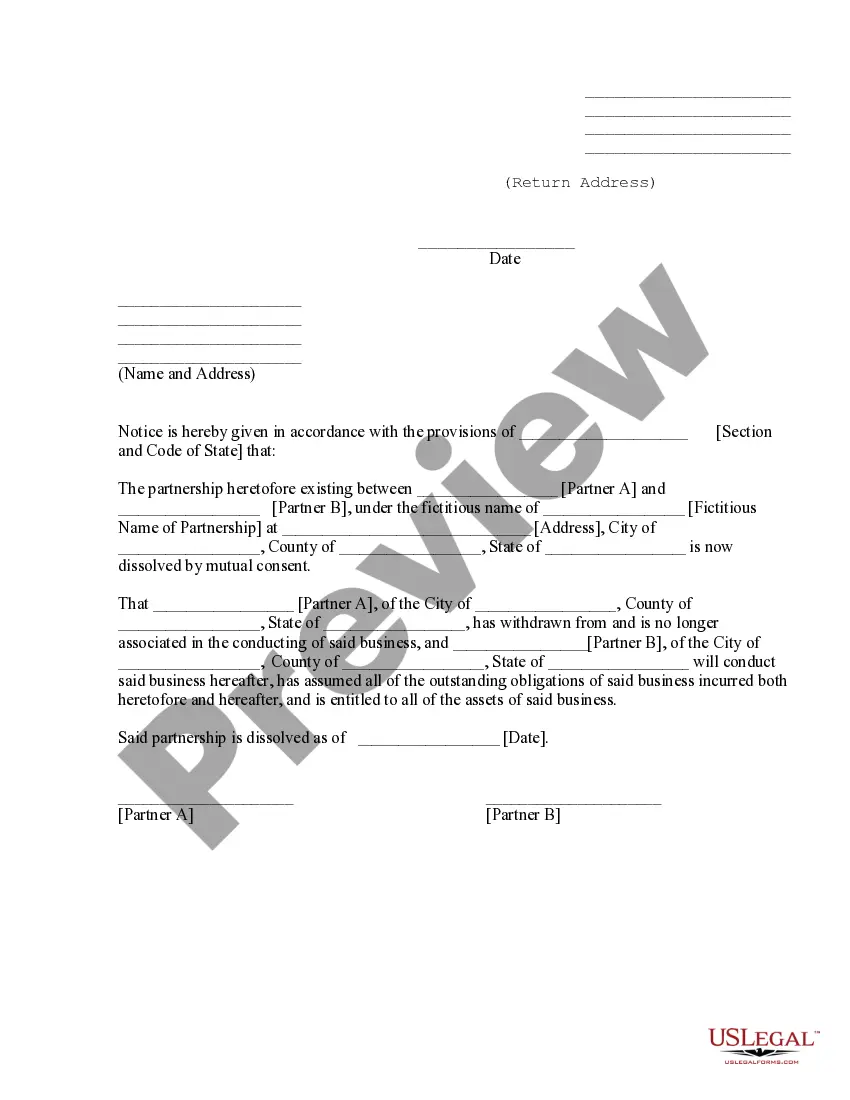

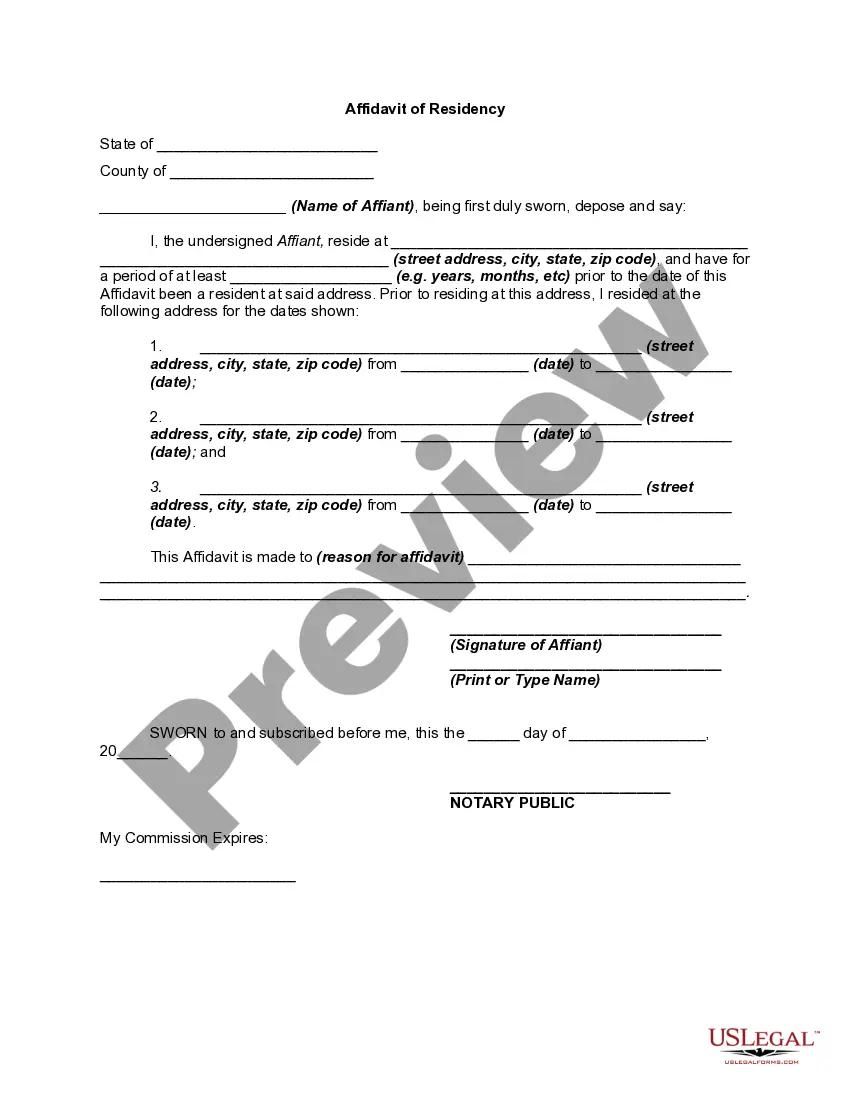

- Examine the page content carefully to ensure it includes the sample you need.

- To assist, utilize the form description and preview options if available.

- Employ the Search bar above to find another sample if the previous one didn’t meet your needs.

- Click Buy Now next to the template title when you identify the suitable one.

- Select the most appropriate subscription plan and create an account or Log In.

- Complete payment for your subscription via credit card or PayPal to proceed.

- Choose the file format for your Code Of Conduct Checklist Within The Financial Services Sector and download it to your device.

- Print your form to fill it out by hand, or upload the sample if you prefer to use an online editor.

Form popularity

FAQ

The purpose of a compliance checklist is to provide a clear roadmap for organizations to follow to meet legal and regulatory obligations. In the financial services sector, the Code of conduct checklist helps employees understand their responsibilities and the importance of adherence. This tool serves to promote accountability and foster a culture of compliance within the organization. Ultimately, it aims to reduce compliance risks and protect the business from potential penalties.

A compliance list refers to a detailed compilation of items or actions required to meet industry regulations and standards. In the financial services sector, this list often includes the steps outlined in a Code of conduct checklist, which provides organization and clarity for compliance efforts. It helps ensure that no necessary task is overlooked and assists in tracking progress. This list becomes crucial for maintaining ongoing compliance in a dynamic regulatory environment.

An example of a compliance check includes verifying that all employees completed required training on their organization's Code of conduct checklist within the financial services sector. This verification might involve checking training records or conducting assessments. Additionally, regular audits or self-assessments can serve as compliance checks to ensure that procedures are followed correctly. Implementing these practices helps maintain high compliance standards.

Creating a compliance checklist involves identifying relevant laws and regulations applicable to your business. Begin by breaking down the requirements into actionable steps, ensuring clarity and ease of understanding. You can then organize these steps into a format that is simple to follow, like a bulleted list. Utilizing the Code of conduct checklist within the financial services sector can provide a structured framework and eliminate guesswork in the compliance process.

A compliance checklist is a tool used to ensure that an organization meets regulatory and legal requirements. In the financial services sector, the Code of conduct checklist helps institutions identify essential actions and controls needed to maintain compliance. This checklist serves as a guide for employees to follow protocols and avoid potential violations. By adhering to this checklist, businesses can enhance operational efficiency and mitigate risks.

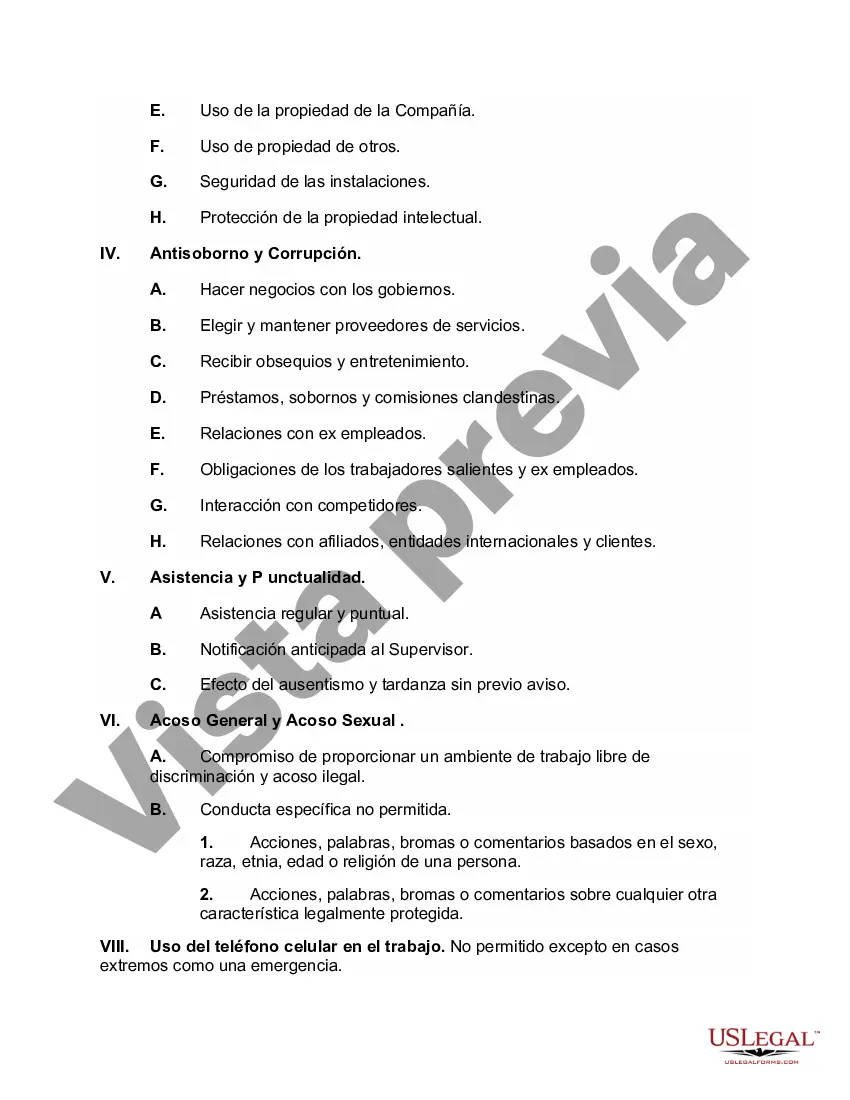

The five codes of ethics outlined by the financial services professional Board emphasize integrity, professionalism, respect, confidentiality, and accountability. These codes establish the ethical standards that professionals in the financial sector must adhere to. Complying with these codes is essential for maintaining trust and fostering long-term relationships with clients. To enhance understanding and application, professionals should consider using a code of conduct checklist within the financial services sector.

The five codes of conduct generally refer to honesty, integrity, respect for stakeholders, commitment to quality, and dedication to professional development. These codes guide behaviors and expectations within the financial services landscape. By following these codes, professionals can ensure they align their actions with industry best practices. A code of conduct checklist within the financial services sector can streamline compliance with these codes.

The five principles of the code of conduct include integrity, respect, accountability, transparency, and teamwork. These principles are crucial in establishing a positive organizational culture in the financial services sector. They empower professionals to act in their clients' best interests while promoting ethical practices. The code of conduct checklist within the financial services sector serves as a practical tool to uphold these principles consistently.

The five rules of conduct emphasize respect, duty, diligence, fairness, and compliance with laws. These rules provide a framework that financial professionals can refer to in their daily activities. They help to create a culture of accountability and respect in the workplace. Implementing the code of conduct checklist within the financial services sector helps reinforce these rules for better governance.

The five fundamental principles of the code of professional conduct include honesty, objectivity, professional competence, confidentiality, and professional behavior. These principles form the foundation for ethical decision-making in the financial services industry. Following them is vital for maintaining a solid reputation and building lasting client relationships. Utilizing the code of conduct checklist within the financial services sector can guide professionals in applying these principles effectively.