Credit Business Form Application With Database

Description

How to fill out Line Of Credit Or Loan Agreement Between Corporate Or Business Borrower And Bank?

Whether for commercial reasons or personal affairs, everyone must deal with legal matters at some point in their lifetime.

Filling out legal documents requires meticulous care, starting with selecting the correct form template.

With a vast US Legal Forms library available, you won't need to waste time searching for the appropriate sample online. Utilize the library’s straightforward navigation to find the right template for any circumstance.

- Locate the example you need by utilizing the search bar or catalog navigation.

- Review the document’s details to ensure it corresponds with your situation, state, and county.

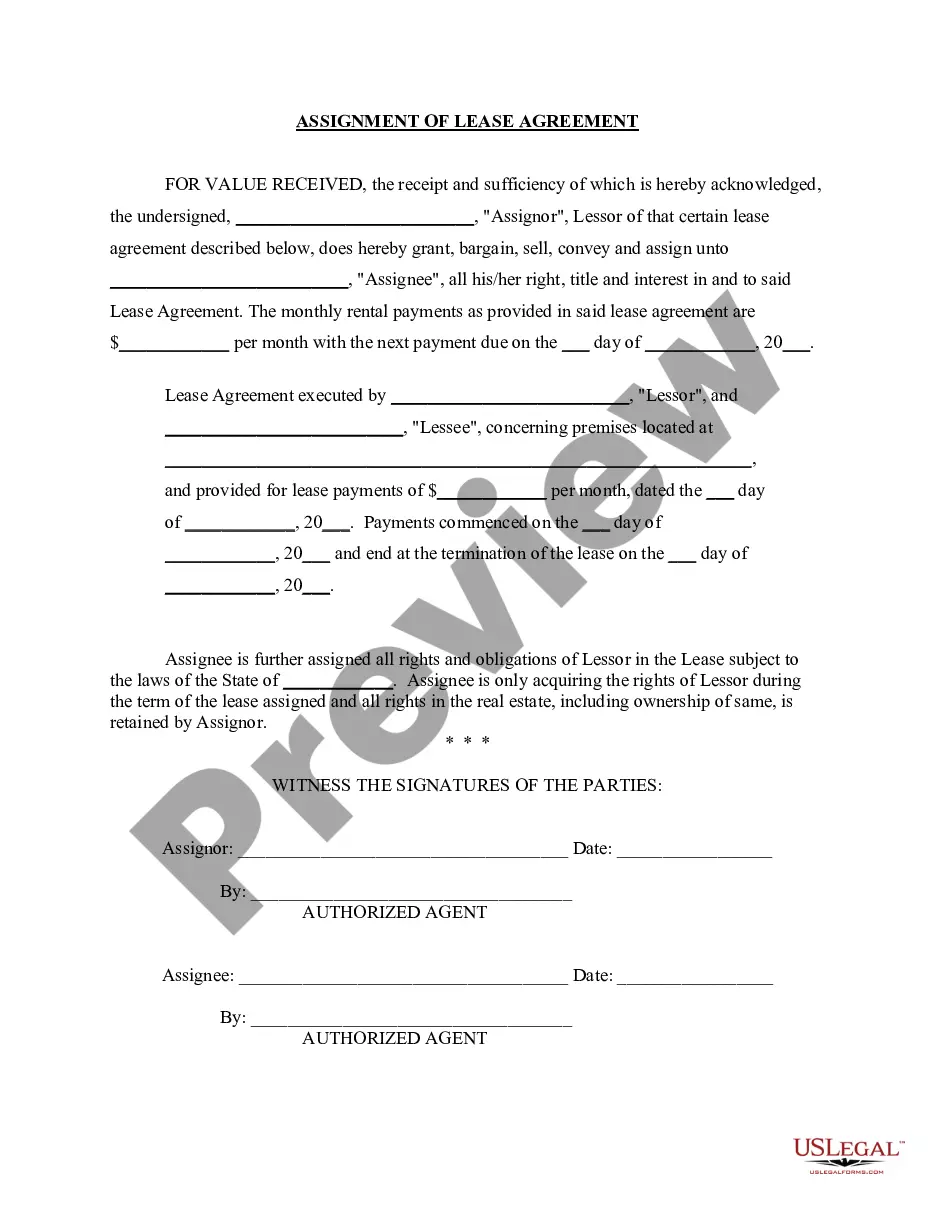

- Click on the document’s preview to examine it.

- If it is the incorrect form, return to the search function to find the Credit Business Form Application With Database sample you need.

- Download the file if it meets your specifications.

- If you possess a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- If you haven't set up an account yet, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the document format you desire and download the Credit Business Form Application With Database.

- Once it is downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

Required fields should include pertinent contact information. You must know the company's name (ask for both the legal and DBA names), billing and shipping addresses, tax ID, purchaser's (accounts payable or accounts receivable) contact information, business owner(s), and officer(s) information, and so on.

Can I Get a Business Credit Card with a DBA? When you have a business, no matter how small or big it is, you can apply for a business credit card. The legal name of your business will appear on your card, so if you have already registered a DBA you can include this in your credit card application.

WHAT TO INCLUDE IN A BUSINESS CREDIT APPLICATION Name of the business, address, phone and fax number. Names, addresses, Social Security numbers of principals. Type of business (corporation, partnership, proprietorship) Industry. Number of employees. Bank references. Trade payment references.

As the name hints, you need to operate a business in order to apply for a business credit card. However, card issuers have pretty lenient requirements when it comes to defining a business. If you tutor in your spare time, freelance or resell products, you'll likely qualify as a business owner.

Writing & Reviewing a Credit Application: What You Need to Know Customer's Name. ... Customer's Address and Telephone Number. ... Customer's Employer Identification Number (EIN) ... Customer's Bank Information and Credit References. ... Guarantor's Name, Address, Telephone, Social Security Number, Etc. ... Signature Line.