Assignment Of Judgment California

Description

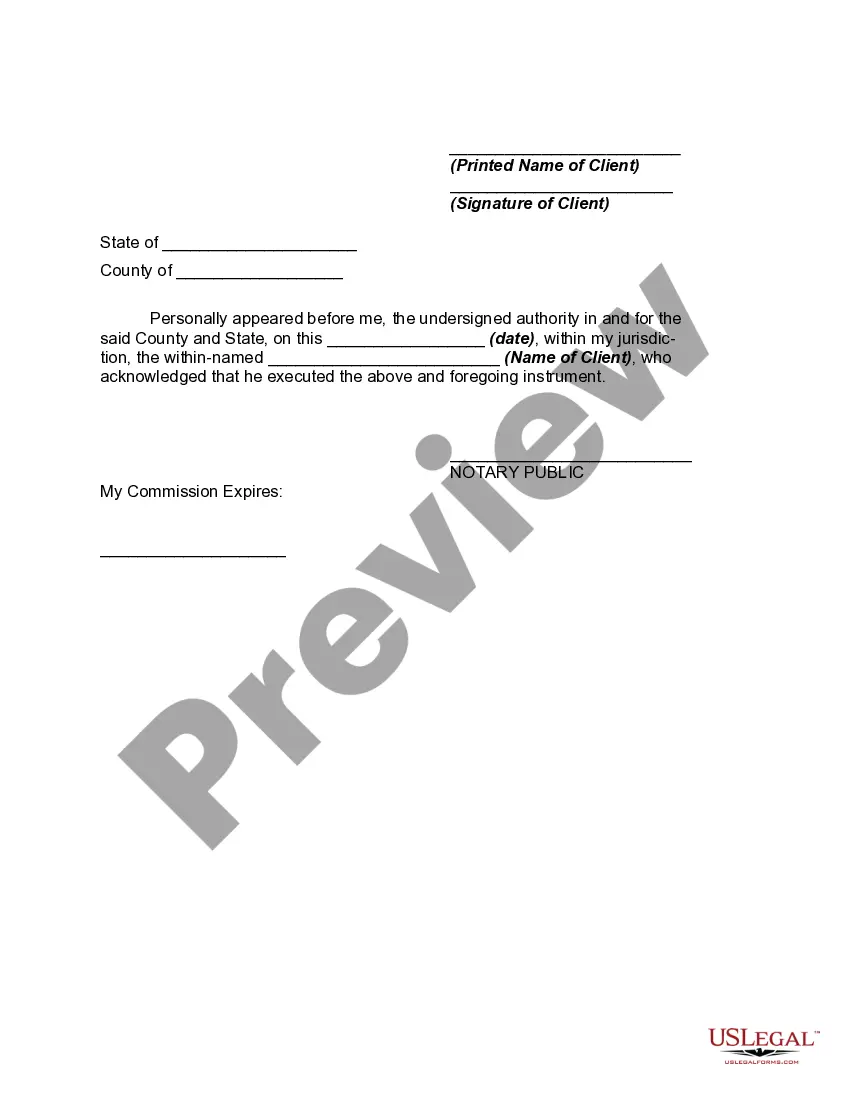

How to fill out Assignment Of Judgment To Attorney For Collection?

Whether for corporate purposes or personal issues, everyone must handle legal circumstances at some point in their lives. Finalizing legal documentation requires meticulous focus, beginning with selecting the appropriate form template.

For example, if you select an incorrect version of the Assignment Of Judgment California, it will be rejected upon submission. Hence, it is vital to have a trustworthy source of legal documents like US Legal Forms.

With an extensive US Legal Forms catalog available, you will never waste time searching for the appropriate template online. Utilize the library's straightforward navigation to find the correct template for any circumstance.

- Acquire the template you require by utilizing the search field or catalog browsing.

- Review the form's details to confirm it aligns with your case, state, and area.

- Click on the form's preview to inspect it.

- If it is the wrong document, return to the search feature to find the Assignment Of Judgment California example you need.

- Download the file if it corresponds with your criteria.

- If you possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing plan.

- Fill in the account registration form.

- Select your payment option: use a credit card or PayPal account.

- Choose the document format you prefer and download the Assignment Of Judgment California.

- After saving it, you can complete the form using editing software or print it out to fill in manually.

Form popularity

FAQ

You should file the abstract of judgment at the county recorder's office in the county where the judgment was entered. It is crucial to ensure that you have the correct information and forms, which are specific to your case. By filing at the right location, your assignment of judgment in California will be properly documented. UsLegalForms offers streamlined access to forms and filing procedures that can assist you in this step.

In California, an abstract of judgment generally remains in effect for 10 years from the date it is recorded. However, if you want to enforce the judgment after this period, you may be able to renew it for another 10 years. Understanding these timelines is vital when managing any assignment of judgment in California. Consult with UsLegalForms to find more details about managing your judgments effectively.

When a credit card company files a judgment against you, it means the court has ruled in favor of the creditor. This can lead to wage garnishments, bank levies, or liens against your property. A judgment significantly impacts your credit score and your ability to obtain future credit. Understanding the assignment of judgment in California can help you navigate your options and protect your interests.

S corporations are not subject to Colorado income tax. However, an S corporation can file a composite return on behalf of their partner/shareholders OR they can pass the liability through to the partner/shareholders who report the income on their personal returns.

To form a Colorado S corp, you'll need to ensure your company has a Colorado formal business structure (LLC or corporation), and then you can elect S corp tax designation. If you've already formed an LLC or corporation, file Form 2553 with the Internal Revenue Service (IRS) to designate S corp taxation status.

The website has a guide that walks you through that process as well. Step 1: Name your Colorado LLC. Your first step is to decide on a name for your Colorado LLC. ... Step 2: Appoint a registered agent in Colorado. ... Step 3: File Colorado Articles of Organization. ... Step 4: Create an operating agreement. ... Step 5: Apply for an EIN.

You must file online and pay the $50 filing fee. The SOS will process the Articles of Incorporation usually within 24 hours. Once your corporation is formed, you will need to obtain an Employer Identification Number from the IRS.

Afterward, in Step 6, we'll explain how to file for S corp tax status as either an LLC or corporation. Choose a name. ... Choose a registered agent. ... File Colorado Articles of Organization. ... Create an operating agreement. ... Apply for an EIN. ... File the form to apply for S corp election.

An S CORPORATION must file Form 106 for any year it is doing business in Colorado. Doing business in a state is defined as having income arising from the activity of one or more employees located in the state; or arising from the fact that real or personal property is located in the state for business purposes.

To form an S Corp in California, you must file Form 2553 (Election by a Small Business Corporation) with the IRS and then complete additional requirements with the state of California, including filing articles of incorporation, obtaining licenses and permits, and appointing directors.