Disclosures Truth Lending With The Risk

Description

How to fill out General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures?

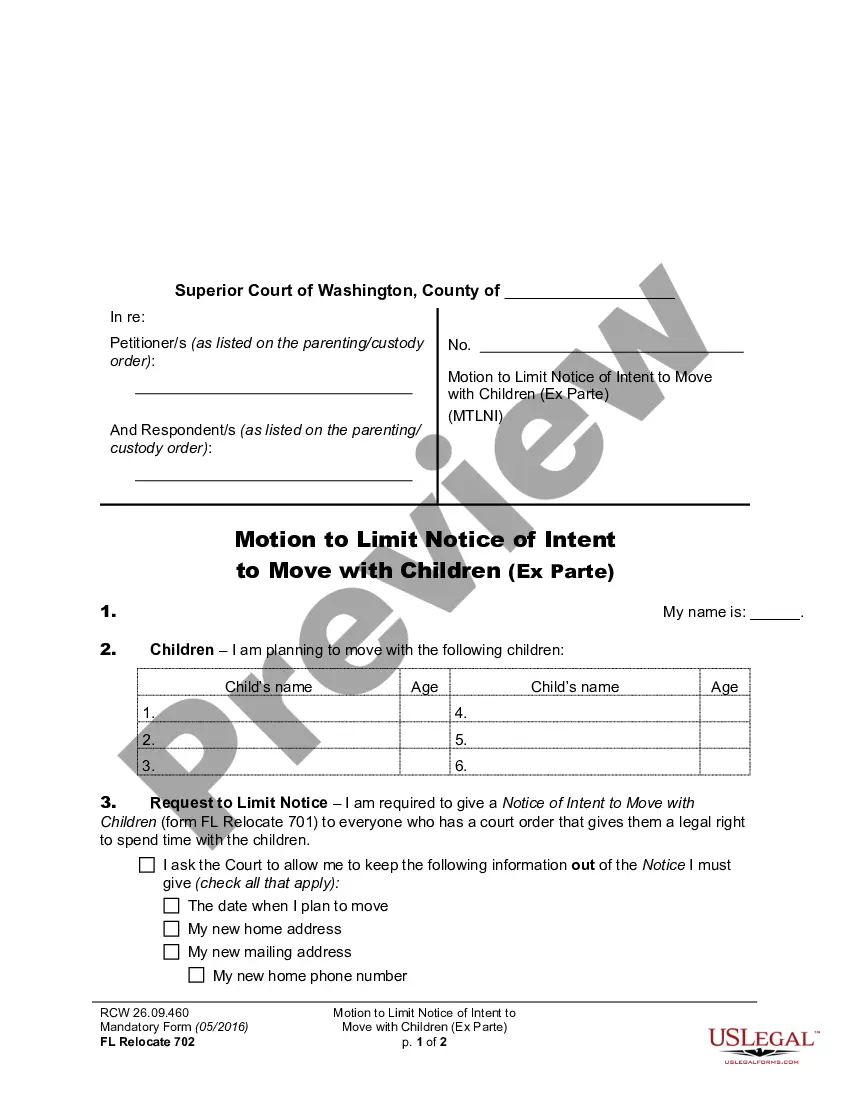

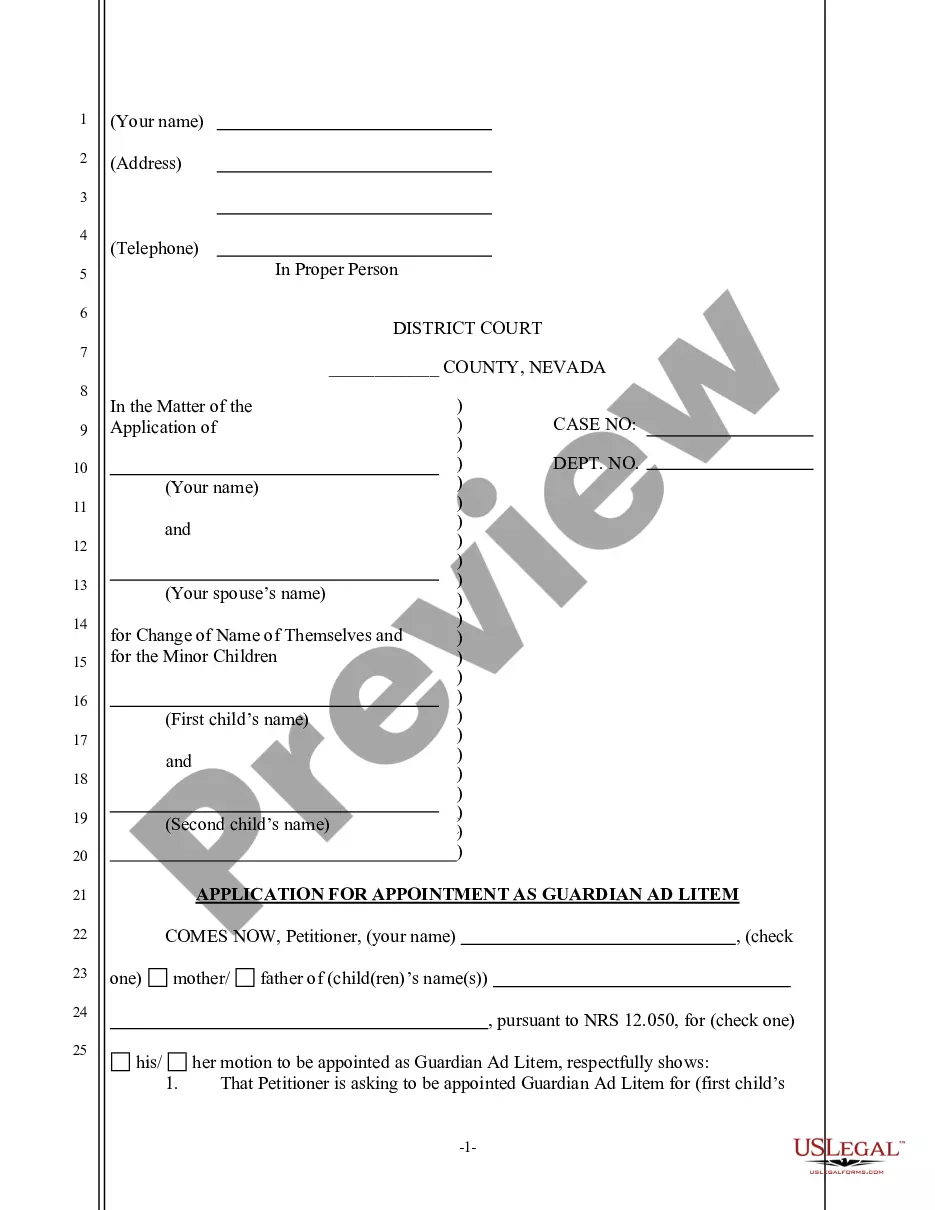

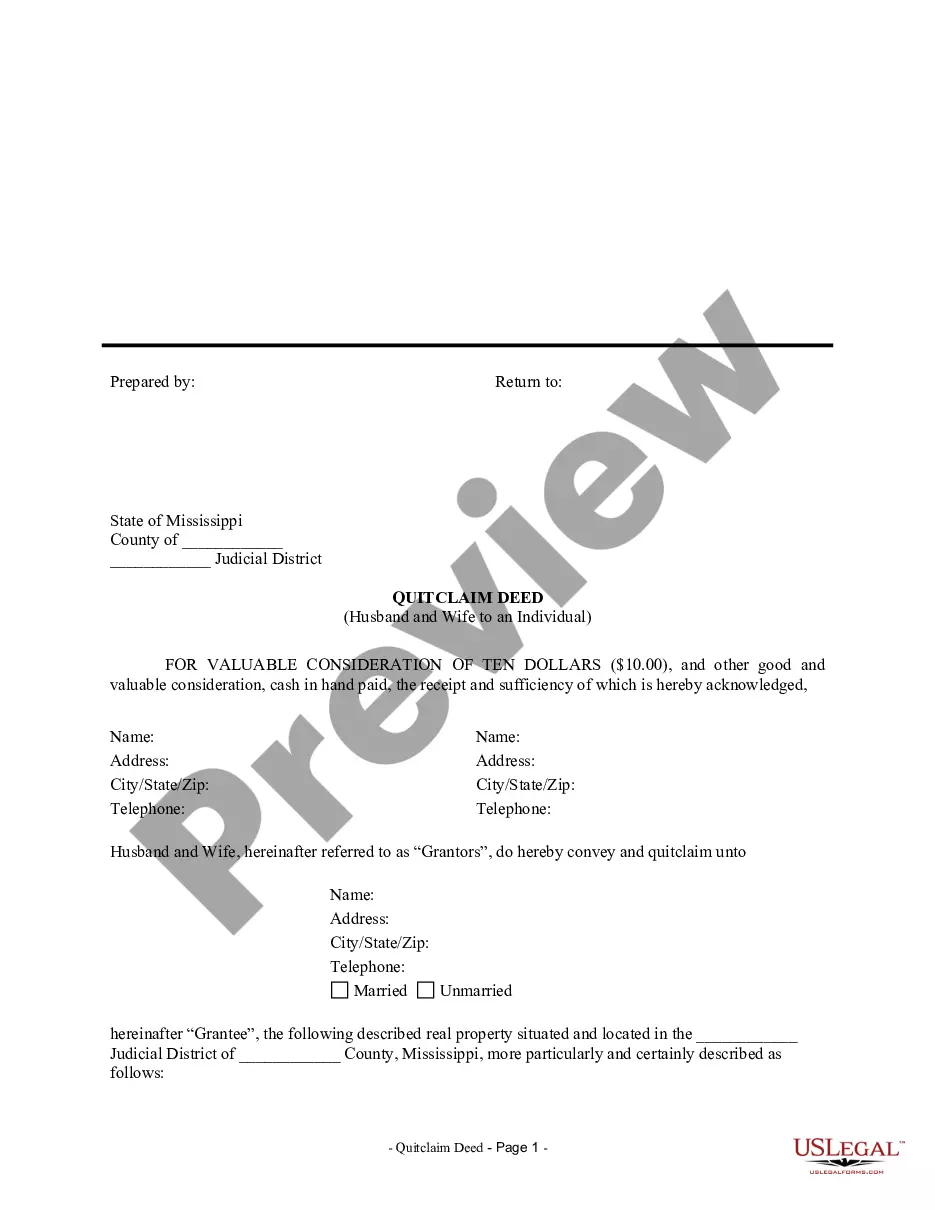

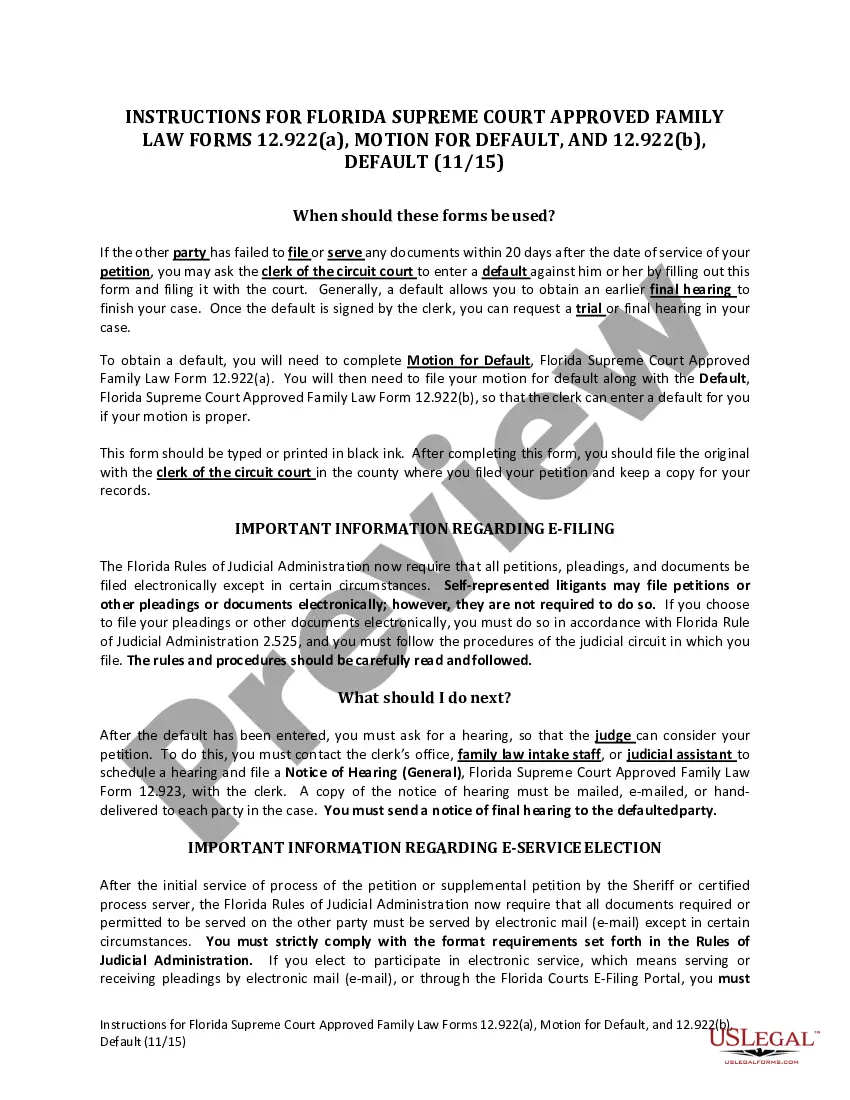

- If you're a returning user, log in to your account and make sure your subscription is current. Download the template you need by hitting the Download button.

- For first-time users, start by reviewing the Preview mode and description of the forms available. Confirm you select one that aligns with your local jurisdiction.

- If the form doesn't meet your needs, utilize the Search feature to find a more suitable template before proceeding.

- Select the Buy Now option once you've located your desired document. Choose a subscription plan that works for you and create your account for full access.

- Complete your purchase by entering your payment information via credit card or PayPal, securing your subscription.

- After purchasing, download the form to your device. You can also access it later through the My Forms section in your profile.

In conclusion, US Legal Forms is your go-to resource for reliable and comprehensive legal documentation. With a robust collection and access to premium support, you can navigate the legal landscape with confidence. Start streamlining your document needs today!

Form popularity

FAQ

The specific section of the Truth in Lending Act that mandates disclosures prior to the consummation of a credit transaction is Regulation Z. This regulation ensures that consumers receive essential information that outlines the costs of credit before they finalize their agreement. Adhering to these requirements aids in transparency and informed decision-making for borrowers. Utilizing resources like uslegalforms can provide clarity on these disclosures truth lending with the risk.

The TILA-RESPA disclosure rule aims to simplify and clarify the lending process. It combines two federal laws that govern mortgage disclosures, specifically the Truth in Lending Act and the Real Estate Settlement Procedures Act. Understanding these disclosures is crucial for borrowers to grasp the terms of their loans and any associated risks.

The Truth in Lending Act requires explicit disclosures about credit terms and costs. These must include the APR, total finance charges, payment schedules, and any adjustable-rate terms. Understanding these Disclosures Truth Lending with the risk helps you compare offers and make informed choices about your financial commitments.

Under the Disclosures Truth Lending with the risk, credit card companies must disclose key information. This includes the annual percentage rate (APR), the payment terms, any fees charged for late payments, the total costs of credit, the conditions under which rates can increase, and the method for calculating variable rates. These disclosures help you fully understand the terms of your credit card agreement.