Claims Against Creditor For Incorrect Reporting

Description

How to fill out Release Of Claims Against Estate By Creditor?

Utilizing legal templates that adhere to federal and state regulations is essential, and the web provides numerous options to choose from.

However, what is the purpose of squandering time searching for the correct Claims Against Creditor For Incorrect Reporting example online when the US Legal Forms digital library already has such documents compiled in one spot.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by lawyers for various professional and personal scenarios. They are easy to navigate, with all files categorized by state and intended use.

Maximize your use of the most comprehensive and user-friendly legal documentation service!

- Our experts keep abreast of legal updates, ensuring that your form is always current and compliant when acquiring a Claims Against Creditor For Incorrect Reporting from our site.

- Obtaining a Claims Against Creditor For Incorrect Reporting is straightforward and rapid for both existing and new users.

- If you possess an account with a valid subscription, Log In and download the necessary document sample in the preferred format.

- If you are new to our website, follow the steps outlined below.

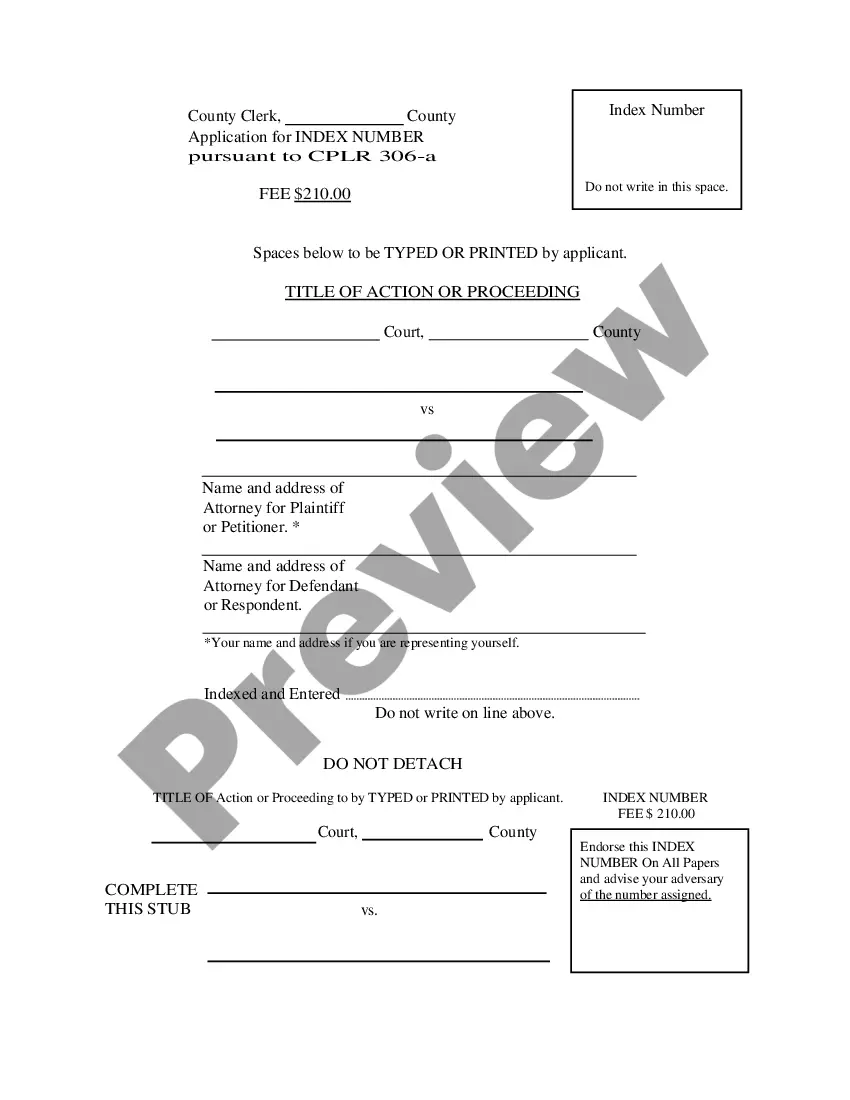

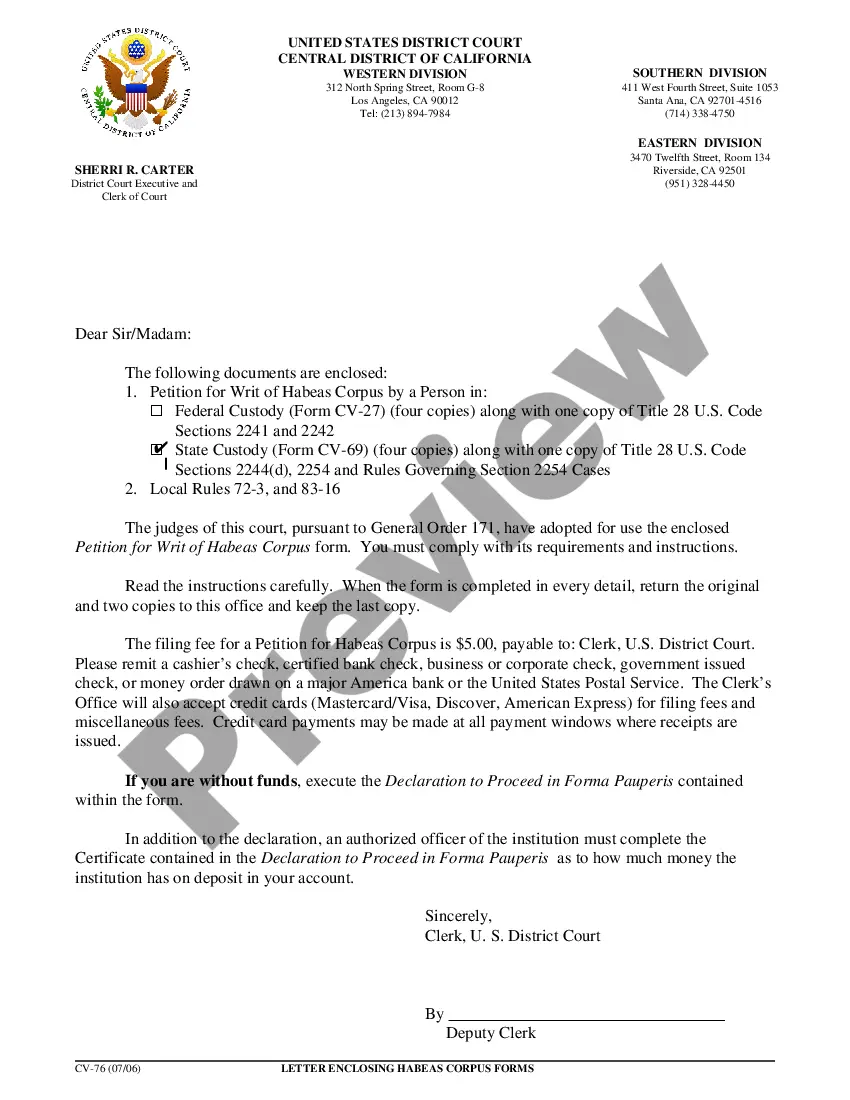

- Review the template using the Preview function or through the text description to confirm it meets your requirements.

Form popularity

FAQ

North Dakota's Lemon Law (contained in N.D.C.C. Chapter 51-07) applies only to new cars. It does not apply to any other motorized vehicle or to used cars. When you buy a used car, you buy it ?as is,? unless a warranty is included in the purchase.

The North Dakota Lemon Law presumes that a manufacturer has had a ?reasonable number of repair attempts? if it has attempted to repair the same problem three (3) or more times or if its repair attempts have lasted a total of thirty (30) days or more regardless of whether split into one (1) or more attempts or involves ...

23-12-13. Persons authorized to provide informed consent to health care for incapacitated persons - Priority. i. A close relative or friend of the patient who is at least eighteen years of age and who has maintained significant contacts with the incapacitated person.

Currently, only seven states have used car lemon laws: Connecticut, California, Massachusetts, Minnesota, New Jersey, New Mexico, and New York. Sadly, even in the states in which they are active, the application of these laws is very limiting and rarely helps.

North Dakota Lemon Law Statutes. North Dakota Century Code Sections 51-07-16 through 51-07-22 gives owners of new vehicles the right to get a full refund or a more reliable replacement, minus a reasonable allowance for use of the new vehicle. The lemon law applies only to new vehicle purchases.

The statute of limitations for actions on notes and contracts, including credit card debt, is six years.

The Consumer Protection and Antitrust Division protects North Dakota consumers from misleading, deceptive, or unlawful trade practices in connection with the sale or advertisement of goods or services by enforcing the state's antitrust laws and consumer fraud laws including, among others, false advertising, do-not-call ...