Delivery Notice With Instructions

Description

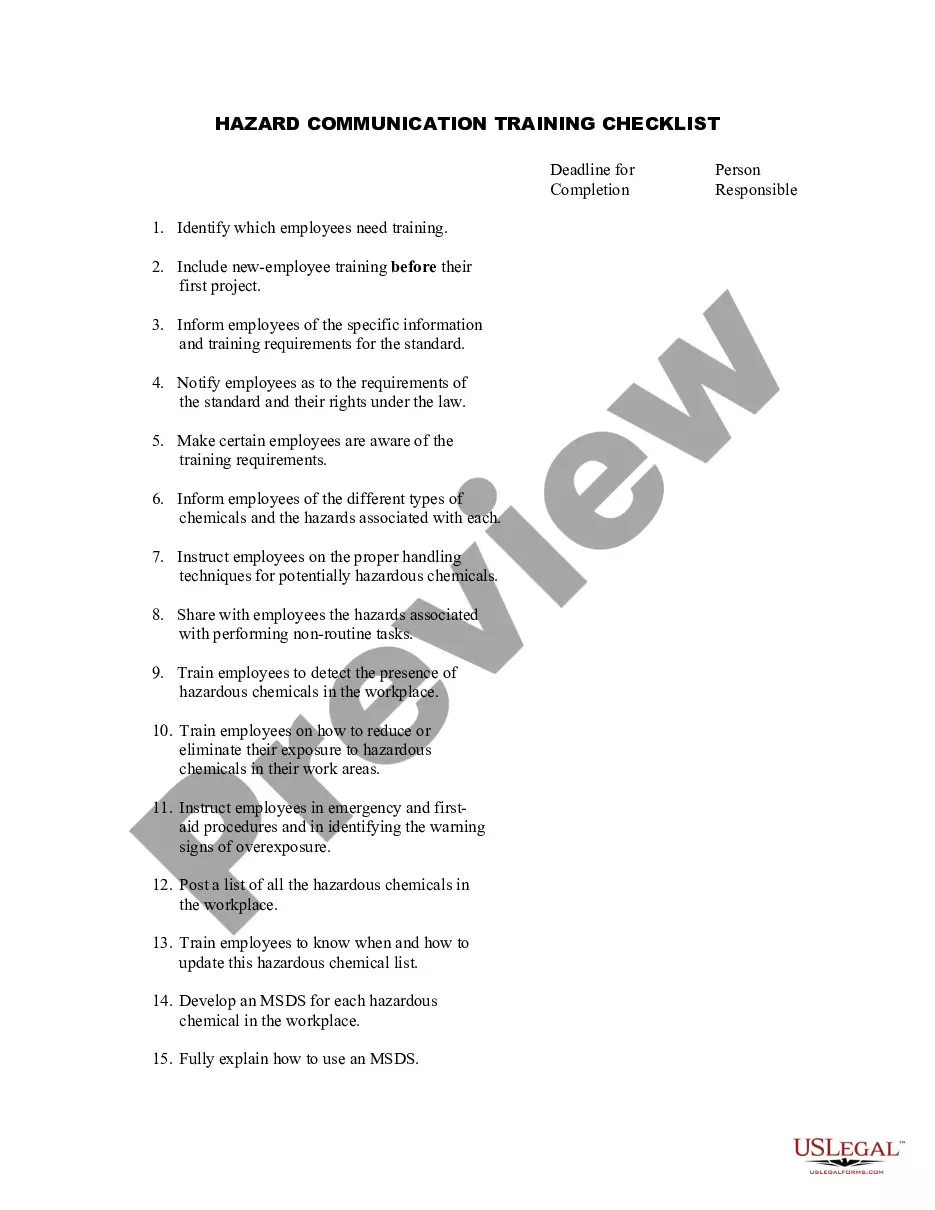

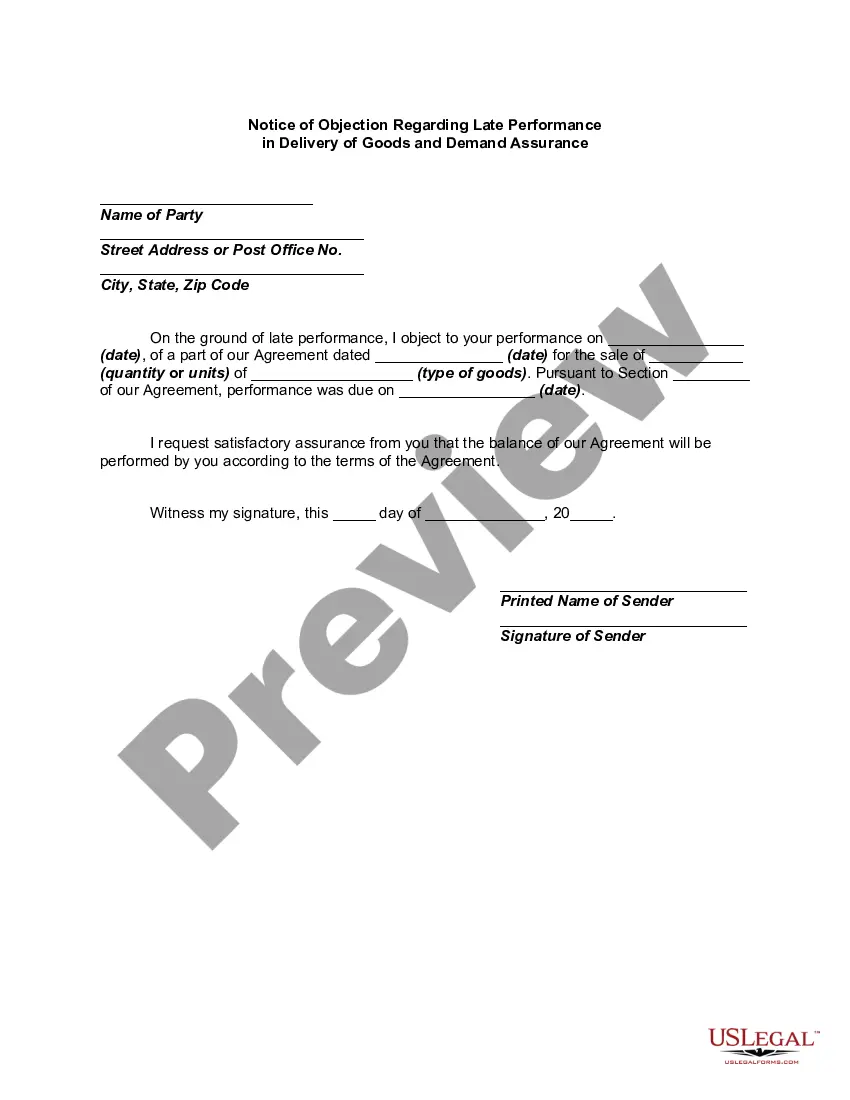

How to fill out Notice Of Objection Regarding Late Performance In Delivery Of Goods And Demand Assurance?

Accessing legal document examples that comply with both federal and local regulations is vital, and the internet provides numerous options to select from.

However, what is the advantage of spending time searching for the properly drafted Delivery Notice With Instructions template online when the US Legal Forms digital repository already has such documents assembled in one location.

US Legal Forms is the premier online legal repository with over 85,000 editable templates prepared by attorneys for any business and personal situation. They are simple to navigate with all files organized by state and intended purpose.

Take advantage of the most comprehensive and user-friendly legal paperwork service!

- Our experts stay updated with legislative changes, so you can rest assured your documents are current and compliant when acquiring a Delivery Notice With Instructions from our site.

- Obtaining a Delivery Notice With Instructions is swift and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and preserve the document sample you need in the proper format.

- If you are visiting our site for the first time, follow the steps below.

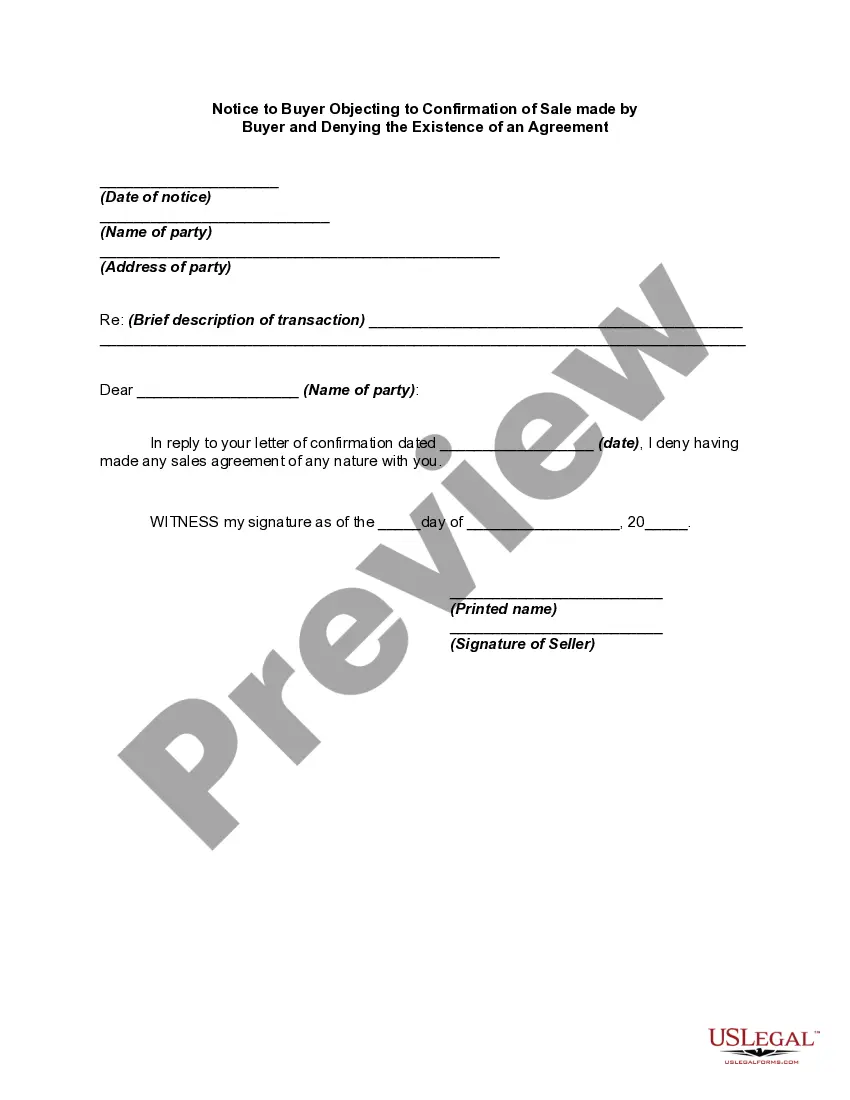

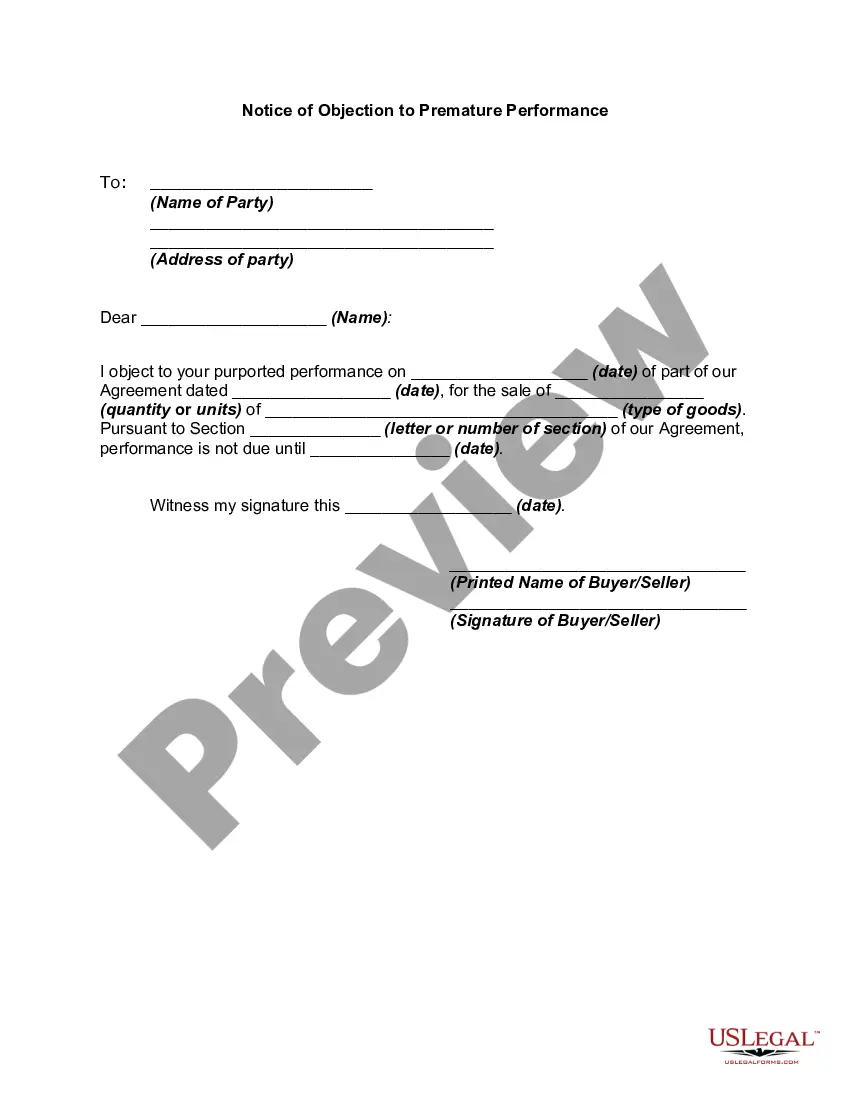

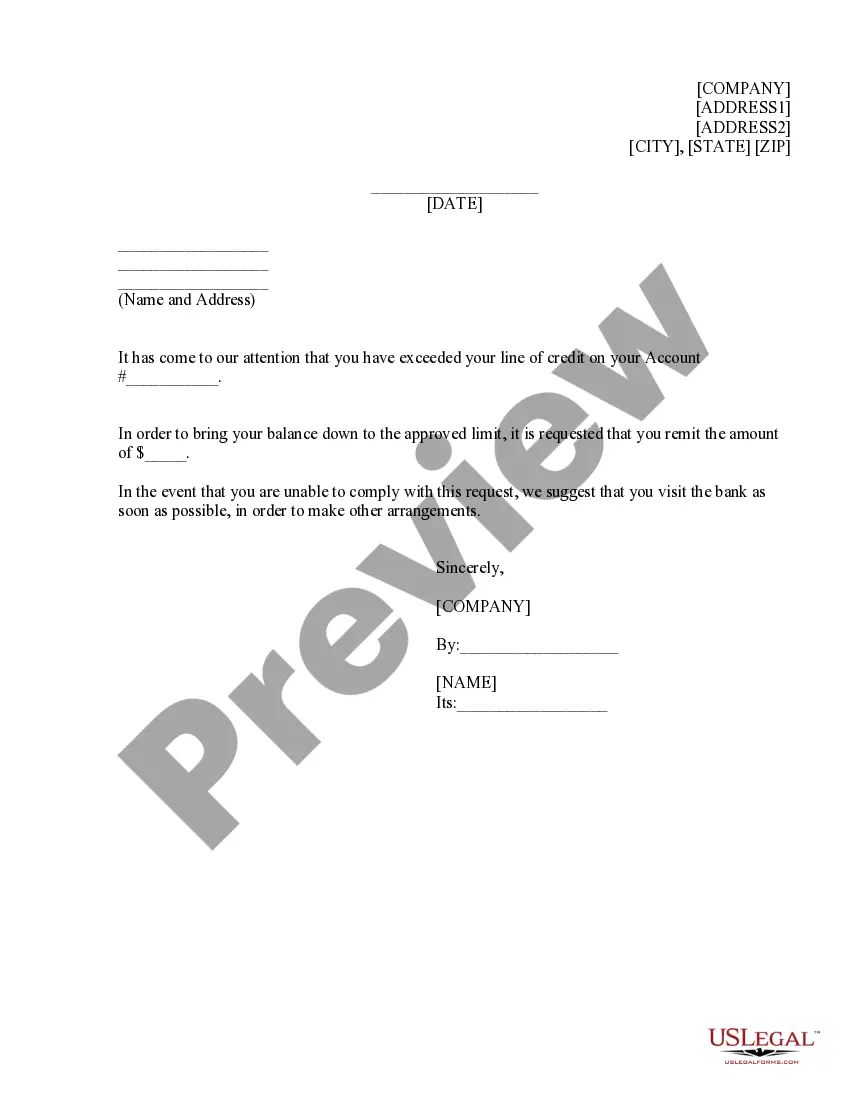

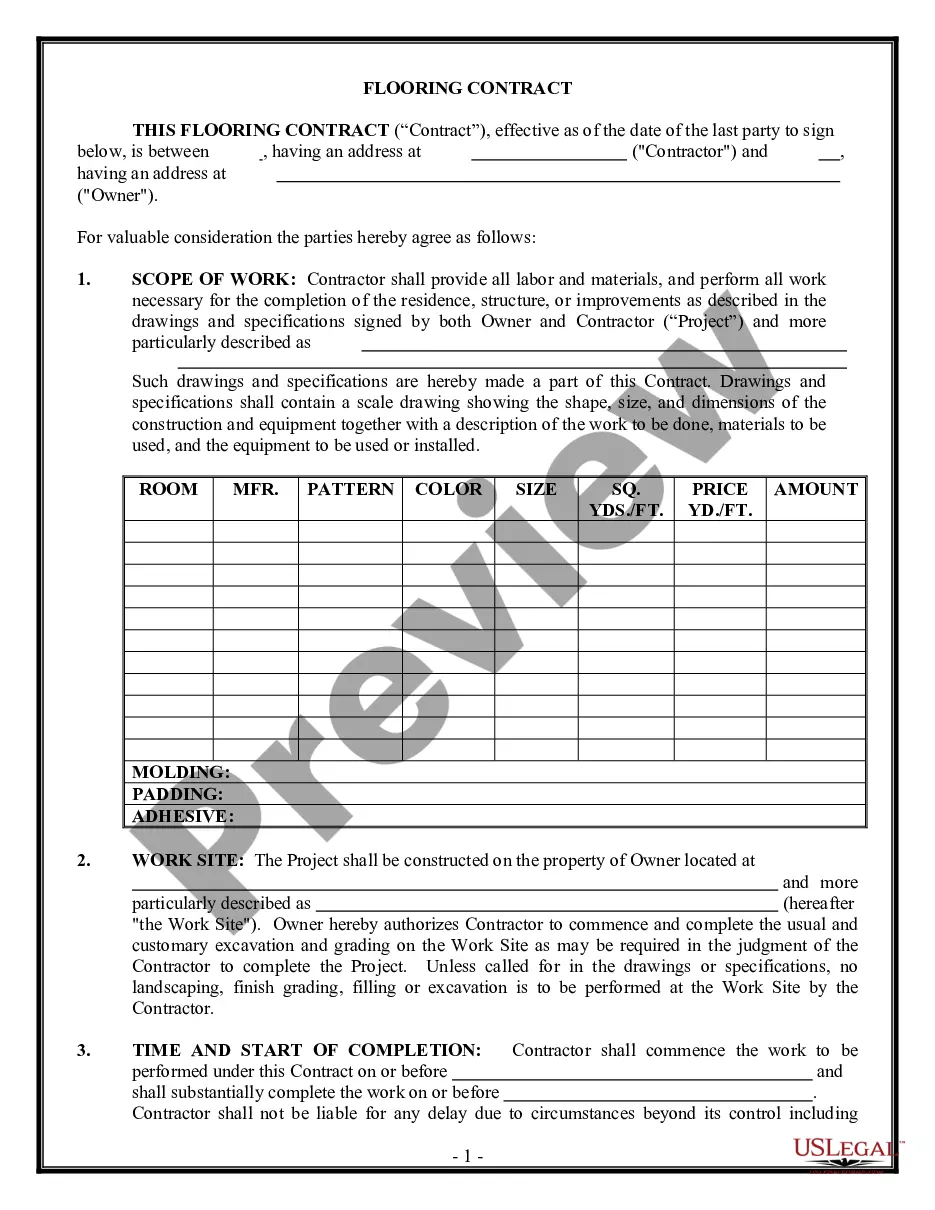

- Review the template using the Preview feature or through the text description to confirm it meets your requirements.

Form popularity

FAQ

Debt relief is designed to help people struggling with certain kinds of unsecured debts including credit cards, personal loans, payday loans, medical bills, and the like. To be eligible, you'll typically need to owe several thousands of dollars in debt and be behind on payments.

InCharge provides free, nonprofit credit counseling and debt management programs to Arizona residents. If you live in Arizona and need help paying off your credit card debt, InCharge can help you.

Yes, National Debt Relief is a legitimate BBB-accredited company with an A+ score from the Better Business Bureau, accreditation from the International Association of Professional Debt Arbitrators and American Fair Credit Council, and nearly 36,000 reviews on Trustpilot averaging 4.7 stars.

National Debt Relief has been accredited by the Better Business Bureau since 2013 and has an A+ rating. On Trustpilot, National Debt Relief has an excellent rating of 4.7 out of 5 stars, based on over 36,000 reviews.

Debt relief qualifications To qualify for National Debt Relief's settlement program, there are a few factors at play. You must owe more than $7,500 in debt and be at least several months behind on payments. You must also be able to make monthly payments to National Debt Relief at an agreed-upon rate.

Debt relief companies work to settle your debts, reducing the total amount you owe. But in addition to a large fee, their services can come with risks, including credit damage, a large tax bill, and even potential lawsuits.

A debt relief program is a method for managing and paying off debt. It typically involves hiring a debt relief company to employ one or more strategies that help you get debt under control, such as by reducing the amount you owe, lowering your interest rate, or securing better terms.

Stopping payments on your bills (as most debt relief companies suggest) will damage your credit score. Debt settlement companies can charge fees. Not all debt settlement companies are reputable, so you'll have to do your research.