Sample Answer To Petition For Nullity Of Marriage Philippines

Description

How to fill out Answer Or Response To Petition Or Complaint For Dissolution Of Marriage Or Divorce?

Legal oversight can be overwhelming, even for seasoned professionals.

When you are looking for a Sample Response to Petition for Nullity of Marriage in the Philippines and do not have the opportunity to spend time searching for the correct and current version, the process can be stressful.

Access a repository of articles, guides, and references related to your situation and requirements.

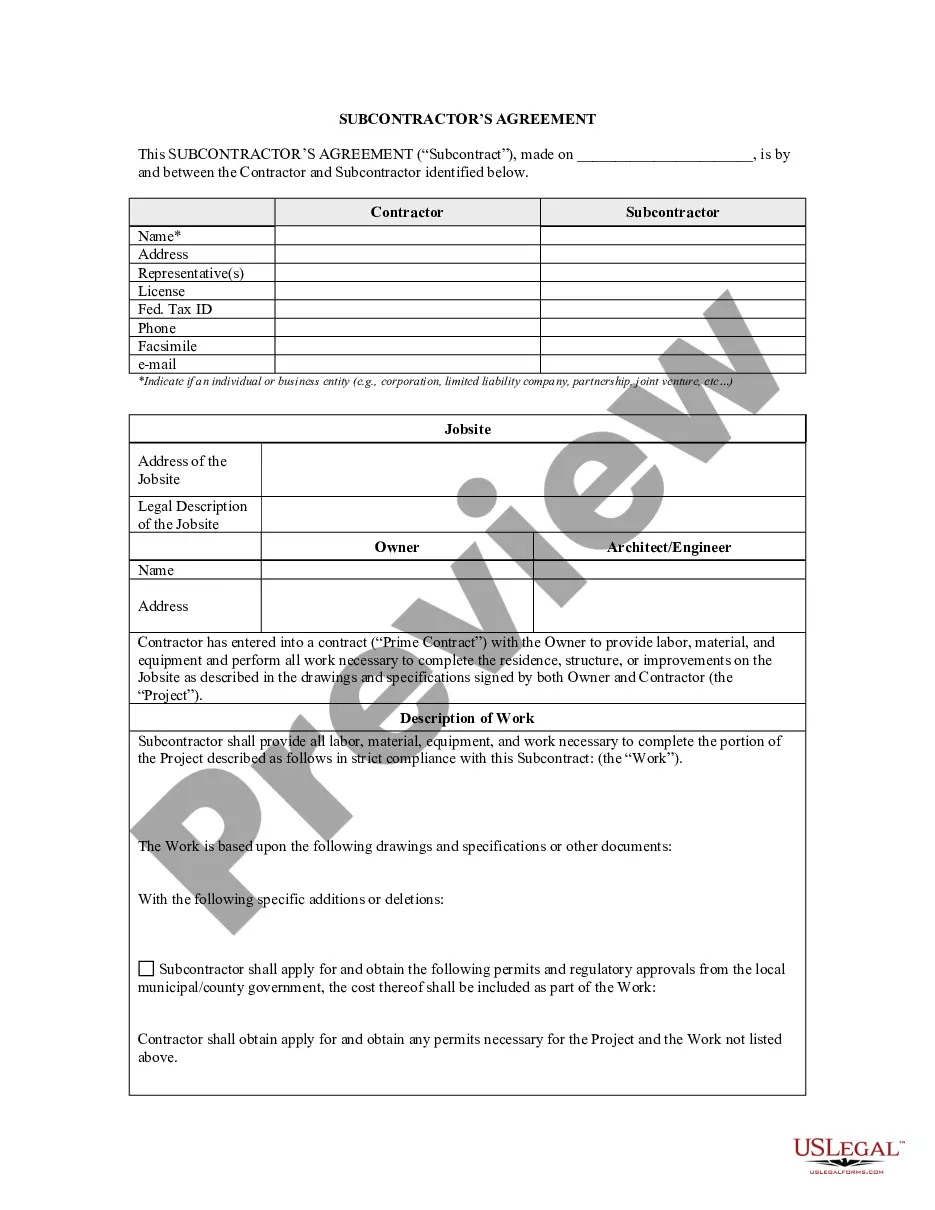

Save time and effort searching for the documents you need, and take advantage of US Legal Forms’ smart search and Review feature to locate the Sample Response to Petition for Nullity of Marriage in the Philippines and download it.

Ensure that the sample is recognized in your state or county. Click Buy Now when you're ready. Choose a monthly subscription plan. Select the file format you need, then Download, complete, eSign, print, and submit your document. Take advantage of the US Legal Forms web catalog, backed with 25 years of experience and credibility. Transform your daily document management into a seamless and user-friendly process today.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents tab to review the documents you’ve previously downloaded and manage your folders as you wish.

- If this is your first time using US Legal Forms, create an account and gain unlimited access to all platform benefits.

- Follow these steps after selecting the form you require.

- Confirm that this is the correct form by previewing it and reviewing its description.

- Access state- or county-specific legal and business templates.

- US Legal Forms encompasses all needs you may have, from personal to corporate documents, all in one location.

- Utilize advanced tools to complete and manage your Sample Response to Petition for Nullity of Marriage in the Philippines.

Form popularity

FAQ

A petition for Declaration of Nullity of marriage in the Philippines is a formal request made to the court to declare a marriage invalid. This legal action can be based on various grounds recognized under Philippine law. It’s advisable to prepare a Sample answer to petition for nullity of marriage Philippines to clearly outline your reasons and evidence for seeking nullity.

The new vehicle owner: Will not pay state or local tax on a gift transaction; and. Cannot use or transfer the license plates that were on the vehicle at the time it was gifted (if applicable).

While some car owners consider selling the car for a dollar instead of gifting it, the DMV gift car process is the recommended, not to mention more legitimate, way to go.

Can you sell a car for $1? In short, yes. But while selling a car for $1 will allow you to avoid capital gains and gifts taxes, the recipient of the car will have to pay whatever rate of sales tax your state charges on used vehicles when they transfer the title.

What You'll Need to Do to Transfer your Vehicle Title in Missouri Visit any DOS License office near you. ... Submit the required documents, your application, ID and your payment. Receive a temporary vehicle title. Receive your vehicle title via U.S. mail.

General Affidavit Form (DOR-768) Non-Use (notary required): Must be completed when applicant asks to license a vehicle that has not been operated on the highways, and applicant wishes to have registration fee prorated. Submitting an affidavit of non-use does NOT exempt the applicant from applicable renewal penalties.

If you are gifting your vehicle, you need to obtain the following paperwork: A completed vehicle title signed over to the new vehicle owner (in the sale price? section of the vehicle title, write ?GIFT? A current safety and/or emissions inspection certificate (if applicable)

The new vehicle owner: Will not pay state or local tax on a gift transaction; and. Cannot use or transfer the license plates that were on the vehicle at the time it was gifted (if applicable).

You must submit the notarized lien release (copy or original), your current title (if in your possession) and pay an $8.50 title fee and a $6 processing fee. The new title (in your name, without the lien) should issue within 3-5 business days, and will then be mailed to you (at the address provided on the application).