Answer To Petition For Declaratory Judgment Texas

Description

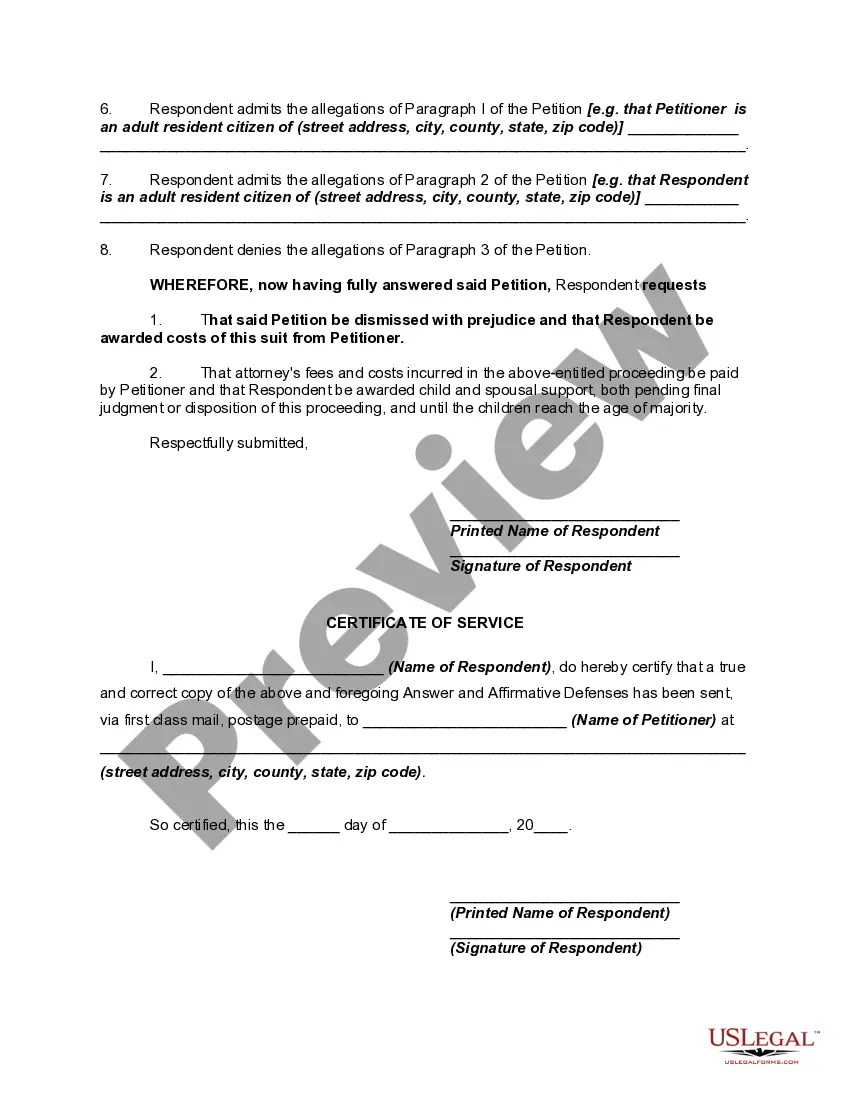

How to fill out Answer Or Response To Petition Or Complaint For Dissolution Of Marriage Or Divorce?

Regardless of whether it’s for corporate reasons or personal issues, everyone encounters legal circumstances at some stage in their existence. Filling out legal documents requires meticulous focus, starting with choosing the appropriate form example.

For instance, if you select an incorrect version of the Answer To Petition For Declaratory Judgment Texas, it will be rejected upon submission. Thus, it is crucial to have a reliable source for legal documents like US Legal Forms.

With an extensive US Legal Forms collection available, you won’t need to waste time searching for the correct template across the web. Make use of the library’s straightforward navigation to find the suitable form for any situation.

- Acquire the template you require by using the search tool or catalog navigation.

- Review the form’s details to confirm it aligns with your case, state, and county.

- Click on the form’s preview to inspect it.

- If it is not the correct document, return to the search option to find the Answer To Petition For Declaratory Judgment Texas sample that you need.

- Download the template if it satisfies your requirements.

- If you already have a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you haven't registered an account yet, you can acquire the form by clicking Buy now.

- Select the appropriate pricing choice.

- Complete the account registration form.

- Choose your payment method: you can utilize a credit card or PayPal account.

- Select the document format you wish and download the Answer To Petition For Declaratory Judgment Texas.

- Once downloaded, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

If you work for a person or a company and earn $600 or more paid to you in cash (again that means paid to you by cash, check, trade, credit card payment?just no taxes taken out) within a year they are required by law to send you a 1099-MISC.

As an independent contractor, vendor, freelancer or other individual receiving nonemployee compensation, you typically do not work for the person or business as an employee. If you don't work as an employee, you'll typically have your earnings reported on a Form 1099-NEC and will need to prepare a W-9.

Independent contractors fill out a Form W-9. Employees fill out Form W-4. Self-employed workers use the Form W-9 to provide their taxpayer identification number (TIN) to companies that they do work for. Employees use the Form W-4 to inform their employers of how much income tax to withhold from their paycheck.

The terms 1099 contractor and W-2 employee refer to the tax forms used for each type of worker. To record and report income, independent contractors get 1099-MISC tax forms, and employees get W-2 tax forms.

If you are a contractor employed by a firm or individual to provide a service, they will almost certainly require you to fill out a W-9 form. You must validate information such as your name, residence, and tax id. The IRS website has all of the W-9 pages available and step-by-step instructions on filling them out.

Forms 1099 report non-employee income to the recipient of the money and to the IRS. Income reported on a 1099 is then entered on Form 1040 with several other financial details to determine whether you owe tax or can expect a refund. All taxpayers must file a 1040 if they earn more than a certain threshold of income.

How is Form 1099-NEC completed? Obtain a copy of Form 1099-NEC from the IRS or a payroll service provider. Provide the name and address of both the payer and the recipient. Calculate the total compensation paid. Note the amount of taxes withheld if backup withholding applied.

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.