Divorce Child Support Withholding

Description

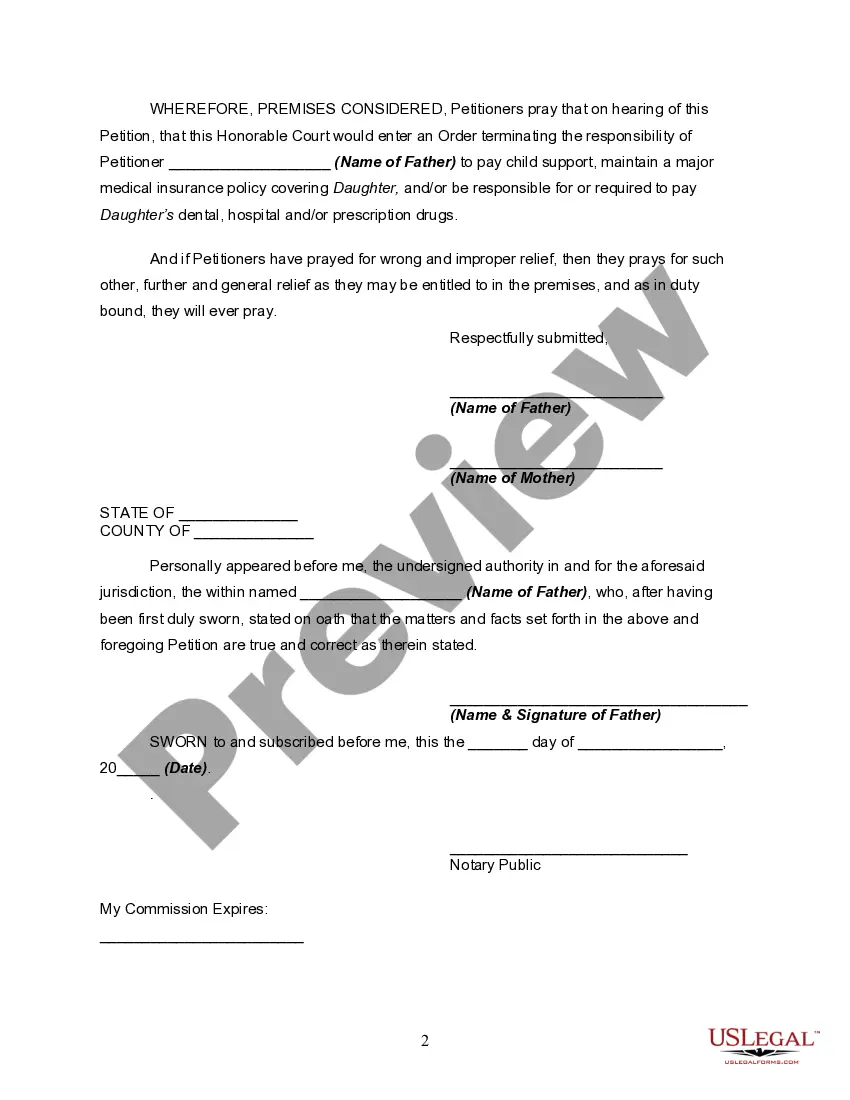

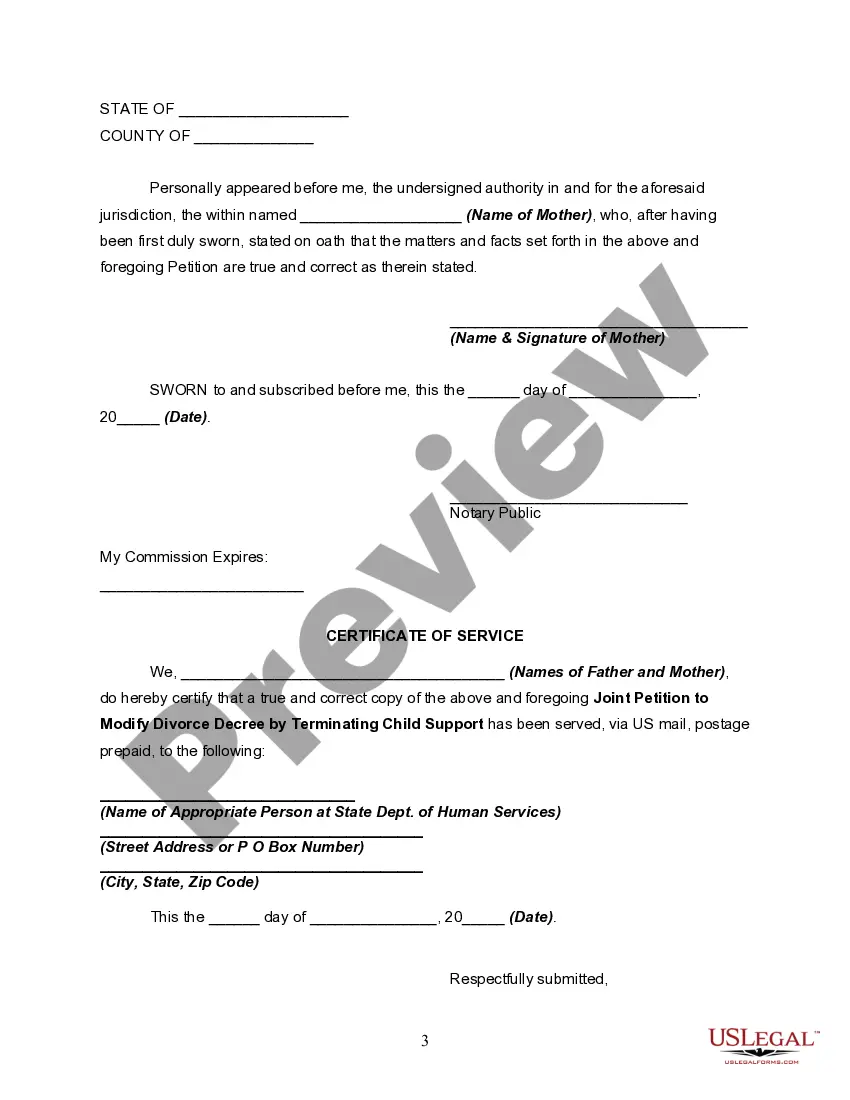

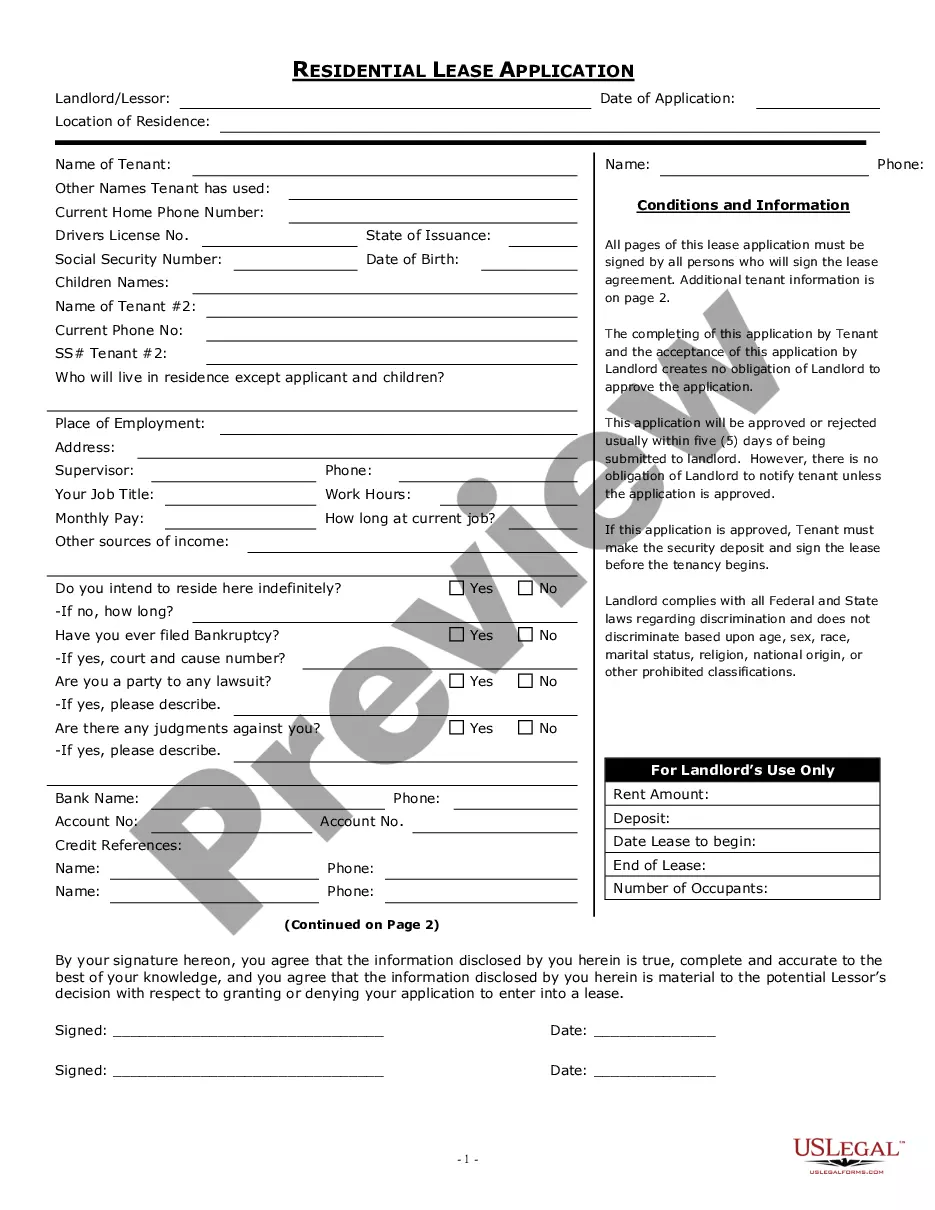

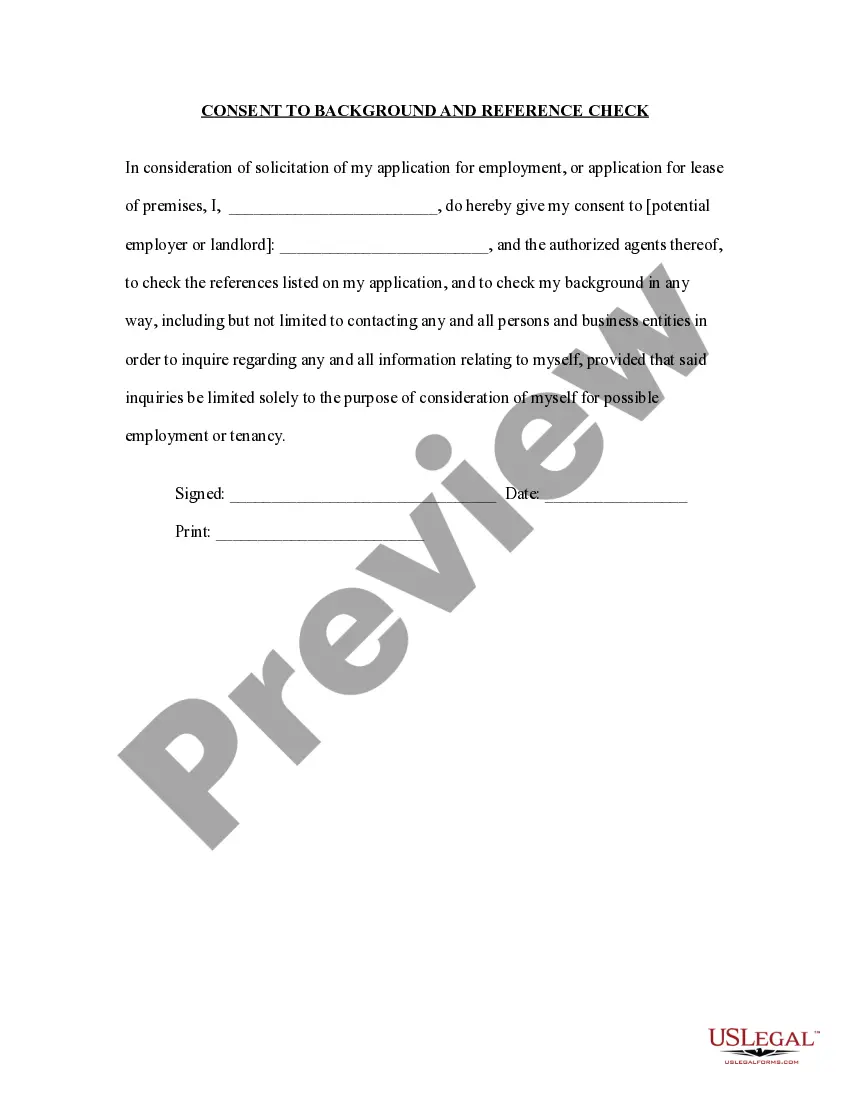

How to fill out Joint Petition To Modify Or Amend Divorce Decree By Terminating Child Support - Minor Left Home, Living Independently, Refuses To Work Or Go To School?

Locating a reliable source for the latest and suitable legal templates is a significant part of managing bureaucracy. Securing the correct legal documents necessitates precision and carefulness, which clarifies why it is crucial to obtain samples of Divorce Child Support Withholding exclusively from reputable sources, such as US Legal Forms. An incorrect template can squander your time and prolong the issue you are facing. With US Legal Forms, your concerns are minimal. You can access and review all information regarding the document’s applicability and significance for your case and in your jurisdiction.

Follow these steps to complete your Divorce Child Support Withholding.

Once you have the form on your device, you can modify it using the editor or print it and complete it by hand. Eliminate the complications that come with your legal paperwork. Explore the extensive US Legal Forms library where you can find legal templates, verify their applicability to your case, and download them instantly.

- Utilize the catalog navigation or search bar to locate your template.

- Review the form’s description to determine if it meets your state and local criteria.

- Examine the form preview, if available, to verify that the template is indeed what you need.

- Return to the search and seek the suitable document if the Divorce Child Support Withholding does not meet your requirements.

- If you are confident about the form’s relevance, download it.

- If you are a registered user, click Log in to verify and access your selected templates in My documents.

- If you do not have an account, click Buy now to acquire the form.

- Select the pricing plan that suits your needs.

- Proceed with the registration to finalize your purchase.

- Complete your transaction by choosing a payment method (credit card or PayPal).

- Choose the file format for downloading Divorce Child Support Withholding.

Form popularity

FAQ

The applicable CCPA withholding limit for this employee can be found on the income withholding order and is 55% ($1000 x 0.55 = $550). Since $400 does not exceed the CCPA withholding limit, the employer must withhold $400 from this lump sum payment.

The law in Texas requires child support to be taken directly out of the obligor's paycheck. When child support is established, an order called an Employer's Order to Withhold Income for Child Support, also called the Withholding Order, will be signed by the judge and sent to the obligor's employer.

The maximum payment a parent owes will not exceed 50 percent of their adjusted weekly income. In this example, the parent would not be told to pay more than $500 a week in child support, no matter how many children are involved.

An employer who does not comply with the order/notice is liable for the following: To the obligee for the amount not paid. To the obligor/employee for the amount withheld and not paid. For reasonable attorney's fees and court costs.

Is there a limit to the amount of money that can be taken from my paycheck for child support? 50 percent of disposable income if an obligated parent has a second family. 60 percent if there is no second family.