Property Liabilities With Priority Except

Description

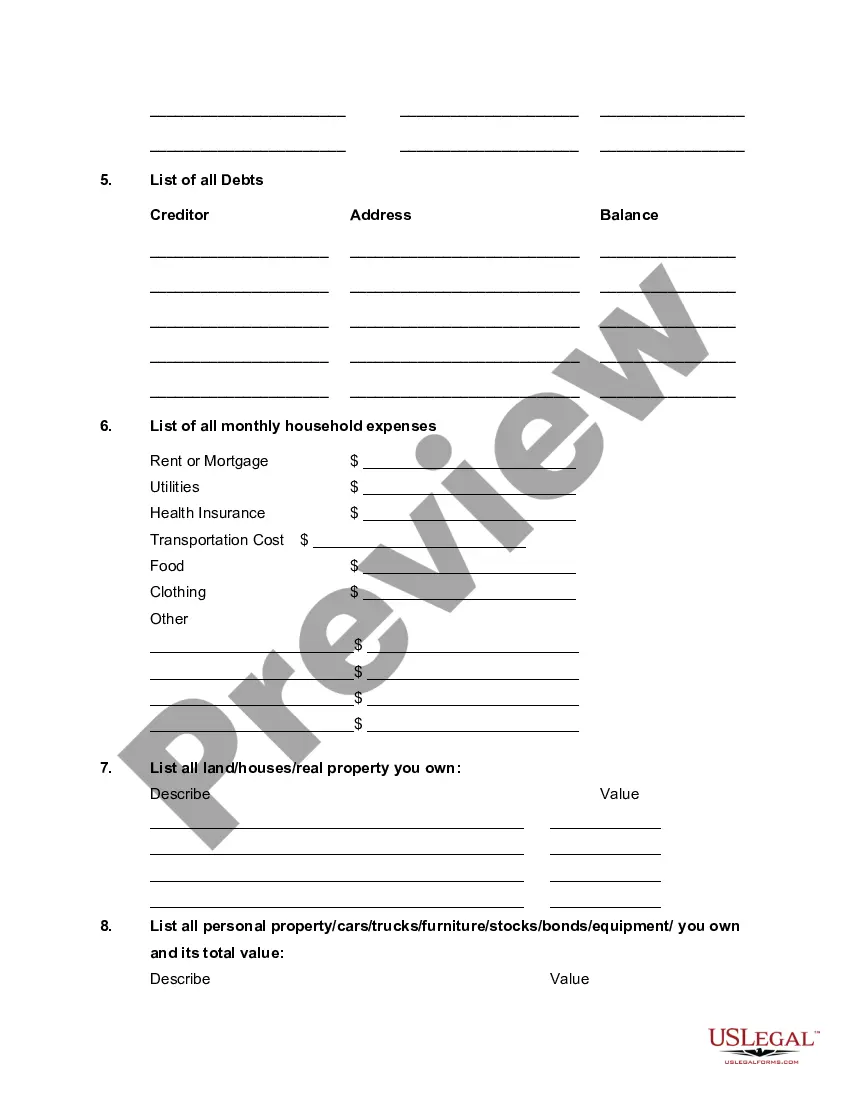

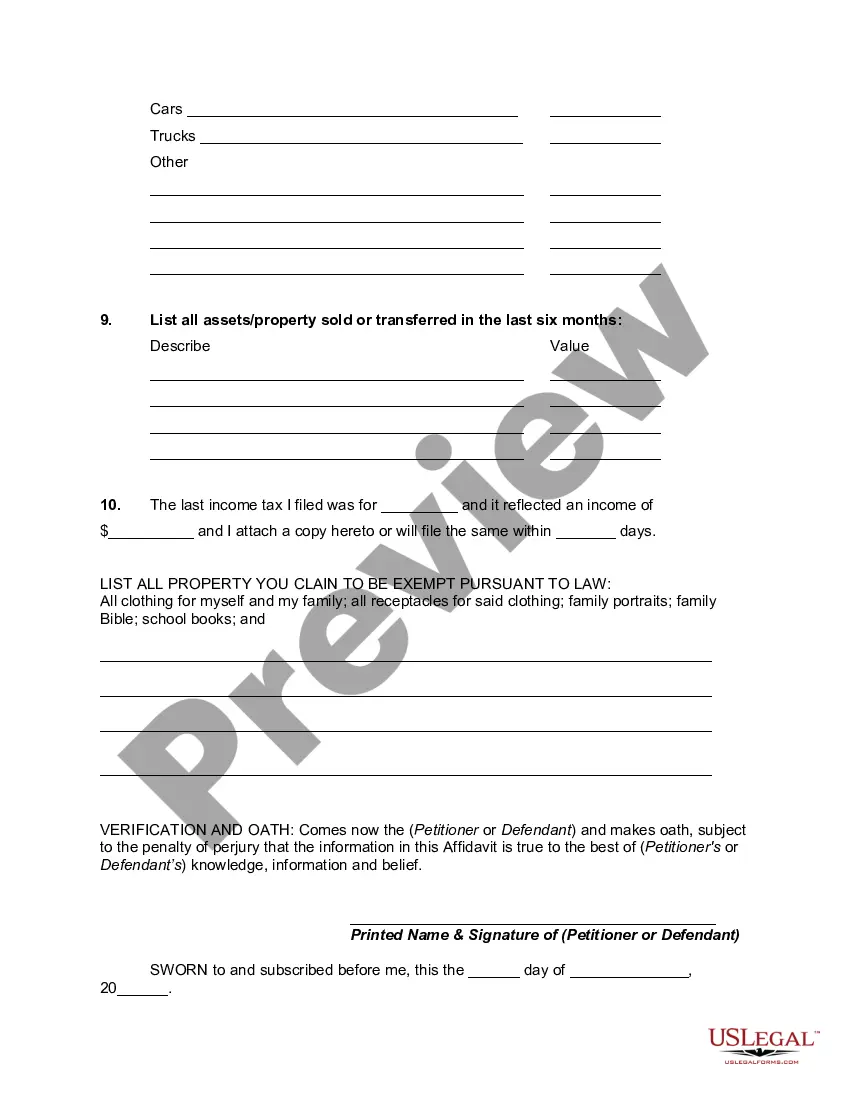

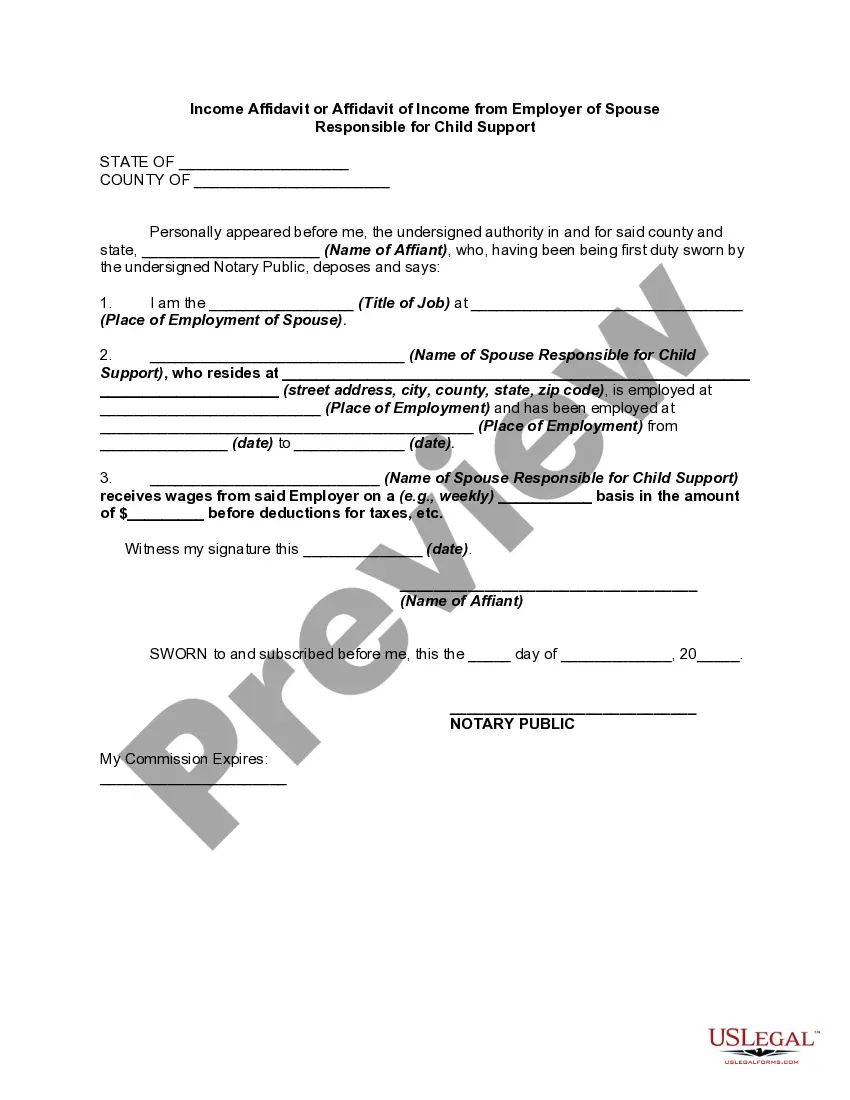

How to fill out Affidavit Or Proof Of Income And Property - Assets And Liabilities?

Identifying a reliable resource for obtaining the latest and pertinent legal templates is part of the challenge when dealing with bureaucracy.

Finding the appropriate legal documents requires precision and meticulousness, which is why it's essential to source Property Liabilities With Priority Except only from trusted providers, such as US Legal Forms.

Once you have the template on your device, you can edit it with the editor or print it for manual completion. Alleviate the stress related to your legal documentation by exploring the extensive US Legal Forms archive, where you can discover legal templates, assess their suitability for your circumstances, and download them instantly.

- Utilize the catalog navigation or search bar to find your template.

- Check the form’s details to ascertain if it meets the criteria for your state and locality.

- Preview the form, if possible, to confirm it matches what you're looking for.

- Return to the search to find the correct document if the Property Liabilities With Priority Except does not align with your requirements.

- If you are certain about the form’s suitability, proceed to download it.

- As a registered member, click Log in to verify and access your selected forms in My documents.

- If you don't have an account yet, click Buy now to purchase the template.

- Choose the pricing plan that meets your needs.

- Proceed with the registration to complete your order.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Select the document format for downloading Property Liabilities With Priority Except.

Form popularity

FAQ

Liabilities are typically arranged based on their type and urgency. For property liabilities with priority except, categorize them into secured and unsecured, then further separate them into current and long-term. This structured arrangement helps convey the importance and urgency of each liability, offering a clear financial picture for analyzing potential risks.

For an effective presentation of your property liabilities with priority except, start with current liabilities, followed by long-term liabilities. This arrangement reflects your financial obligations based on their due dates. Listing in this manner clarifies your short-term versus long-term commitments, making it easier for stakeholders to evaluate your financial strategy.

You should list your assets before your property liabilities with priority except. This sequence provides a comprehensive overview of your financial position, showcasing what you own before outlining your obligations. A clear presentation allows potential investors or creditors to understand your overall financial health more easily.

When ordering your property liabilities with priority except, list them from the most critical to the least critical. Start with secured debts, such as those backed by collateral, followed by unsecured debts. This method provides a transparent view of your financial obligations, allowing readers to assess the overall risk of your property assets.

To list your property liabilities with priority except, start by identifying each liability linked to your assets. You should include mortgages, loans, and any financial obligations that affect your property. This clear listing helps you organize your financial responsibilities, making it easier for stakeholders to understand your liabilities.

A priority creditor typically includes a government entity that seeks unpaid taxes or an organization that provides child support. These creditors have the right to receive payments before others during the debt resolution process. Comprehending the role of priority creditors is vital when you examine property liabilities with priority except, as it influences your overall financial health.

An example of a priority claim is a mortgage on a property, where the lender has a legal right to be repaid before other creditors if the property is sold. This claim takes precedence because it is secured by real property. Recognizing such claims is essential to understanding property liabilities with priority except in financial transactions.

Priority liabilities refer to debts that must be addressed first in bankruptcy or liquidation scenarios. These are obligations that the law considers more critical, such as secured loans or governmental debts. Understanding priority liabilities helps you navigate property liabilities with priority except, ensuring you manage your finances effectively.

The priority order for payment of liabilities refers to the sequence in which claims are settled in the case of asset distribution. Generally, secured liabilities take precedence, followed by unsecured liabilities. Understanding this order is crucial, especially when dealing with property liabilities with priority except. If you face such situations, ensuring proper documentation can help you navigate the complexities involved.