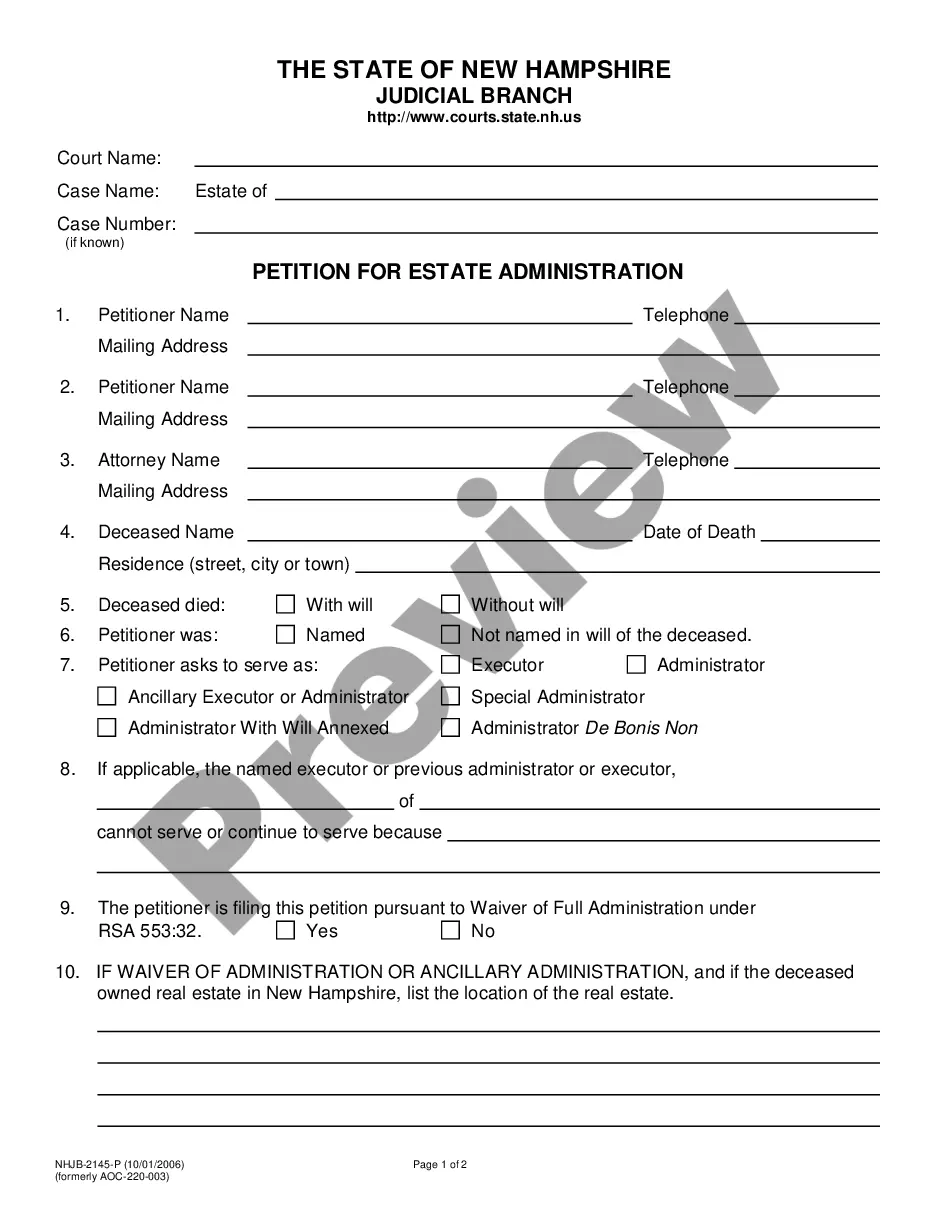

Sample Affidavit For Asylum Application

Description

How to fill out Affidavit And Proof Of Friend And Business Associate In Support Of Asylum Application?

Creating legal documentation from the ground up can occasionally be daunting.

Certain situations may necessitate extensive research and substantial financial outlay.

If you're seeking a more uncomplicated and cost-effective method of drafting a Sample Affidavit For Asylum Application or any other documents without the hassle, US Legal Forms is readily available to assist you.

Our online repository of over 85,000 current legal forms covers nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can easily access state- and county-compliant templates meticulously crafted for you by our legal specialists.

- Utilize our platform whenever you require dependable and trustworthy services to quickly locate and download the Sample Affidavit For Asylum Application.

- If you're familiar with our services and have already created an account, simply Log In to your account, find the template, and download it immediately or re-download it at any time later from the My documents section.

- Not registered yet? No problem. Setting it up and browsing the catalog only takes a few minutes.

- Before diving right into downloading the Sample Affidavit For Asylum Application, keep these pointers in mind.

- Review the document preview and descriptions to ensure you've located the form you need.

Form popularity

FAQ

A subcontractor is a worker who is not your employee. You give a Form 1099 to a subcontractor showing the amounts you paid him. The subcontractor is responsible for keeping his or her own records and paying his or her own income and self-employment taxes.

?[I]f an unlicensed person performs work and is paid for it, the customer then has a choice: if he is happy with the work done, he may allow the unlicensed contractor to keep the funds; if he is unhappy with the work done, he may pursue his legal remedies by suing for damages.?

In short, someone who sets their wage, hours, and chooses the jobs they take on is a subcontractor, while someone whose employer specifies their wage, hours, and work tasks is an employee.

Yes. It may be illegal for the subcontractor to operate without a license, but that does not mean a project owner can simply keep the value of the work performed without paying for it.

Most Construction contractors (both primes and subs) must be licensed with the Arizona Registrar of Contractors; some exemptions apply. To become a licensed contractor, you must submit an application showing you have passed one or more written exams, met appropriate experience requirements, and have sufficient bonding.

Arizona Revised Statutes, Title 32, Chapter 10 requires a contractor be licensed through the Registrar of Contractors (ROC) to legally perform construction or home repair and remodeling jobs having total project cost, including labor and materials, above $1,000 or requiring a building permit.

Contracting without a license in violation of A.R.S. § 32-1151 is a class 1 misdemeanor (A.R.S. § 32-1164). All class 1 misdemeanors carry a maximum term of six months in the county jail and a maximum fine of $2,500 plus an 83% surcharge.