Interest States Statement With Multiple Conditions

Description

How to fill out Assignment Of Interest In United States Patent?

Acquiring legal templates that comply with federal and local laws is crucial, and the internet presents numerous choices to choose from.

However, what's the benefit of squandering time looking for the correct Interest States Statement With Multiple Conditions example online when the US Legal Forms online repository already has such templates assembled in one location.

US Legal Forms is the largest online legal directory featuring over 85,000 fillable documents created by attorneys for any professional and personal situation.

Explore the template using the Preview feature or via the text description to ensure it suits your requirements.

- They are user-friendly to navigate with all documents categorized by state and intended use.

- Our experts monitor legislative changes, ensuring that your form is always current and compliant when obtaining an Interest States Statement With Multiple Conditions from our platform.

- Acquiring an Interest States Statement With Multiple Conditions is quick and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document template you require in the appropriate format.

- If you're a newcomer to our site, follow the steps outlined below.

Form popularity

FAQ

In the new changes to Regulation F, the frequency at which a collections agency can contact a consumer has changed. This change, presented in Section 1006.14B21A, addresses telephone call frequency and restricts agencies to contacting a consumer seven times within seven consecutive days.

Here's what every debt letter should include: Date of the letter. Lawyer's name, firm, and address. Client's name and address. A subject line that states its purpose. The precise amount the client owed your firm and the date when the payment was due. Instructions on how to pay the debt and the new deadline.

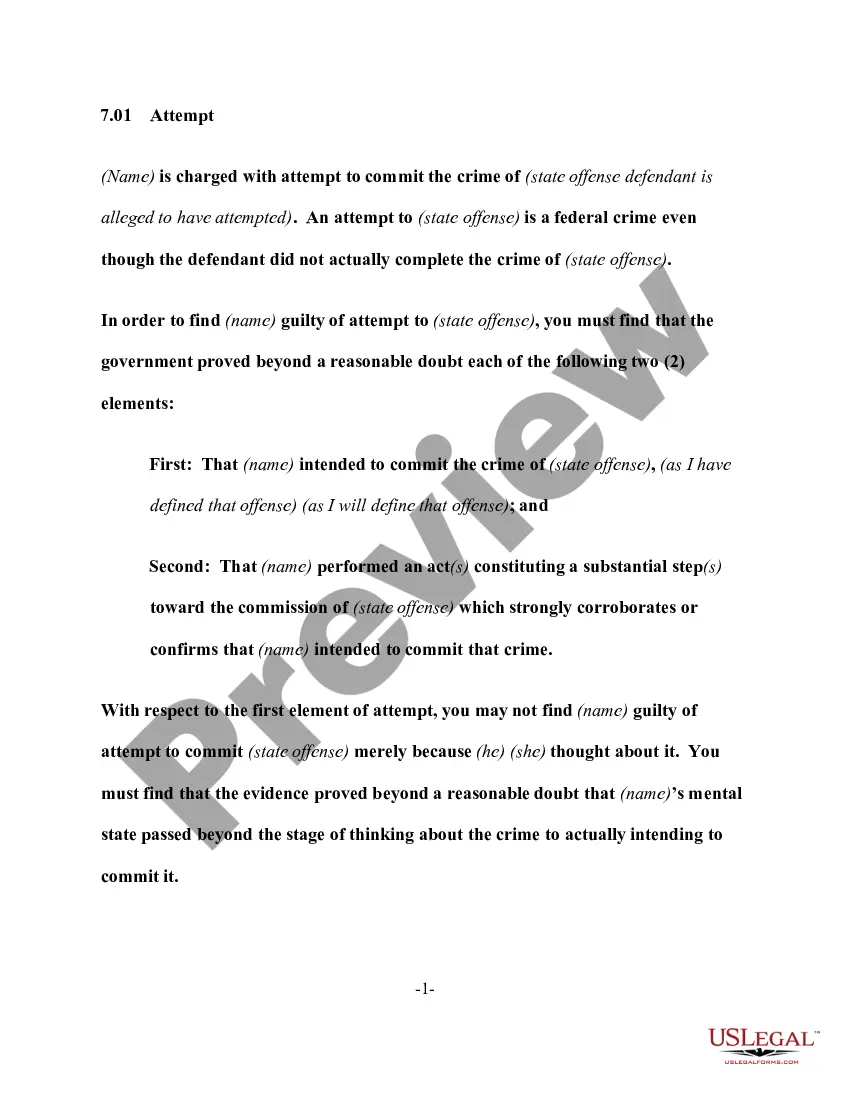

The Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive, unfair, or deceptive practices to collect debts from you, including: Misrepresenting the nature of the debt, including the amount owed. Falsely claiming that the person contacting you is an attorney.

A debt collection letter should include the following information: The amount the debtor owes you. The initial due date of the payment. A new due date for the payment, whether ASAP or in the future. Instructions on how to pay the debt.

A debt validation letter is what a debt collector sends you to prove that you owe them money. This letter shows you the details of a specific debt, outlines what you owe, who you owe it to, and when they need you to pay.

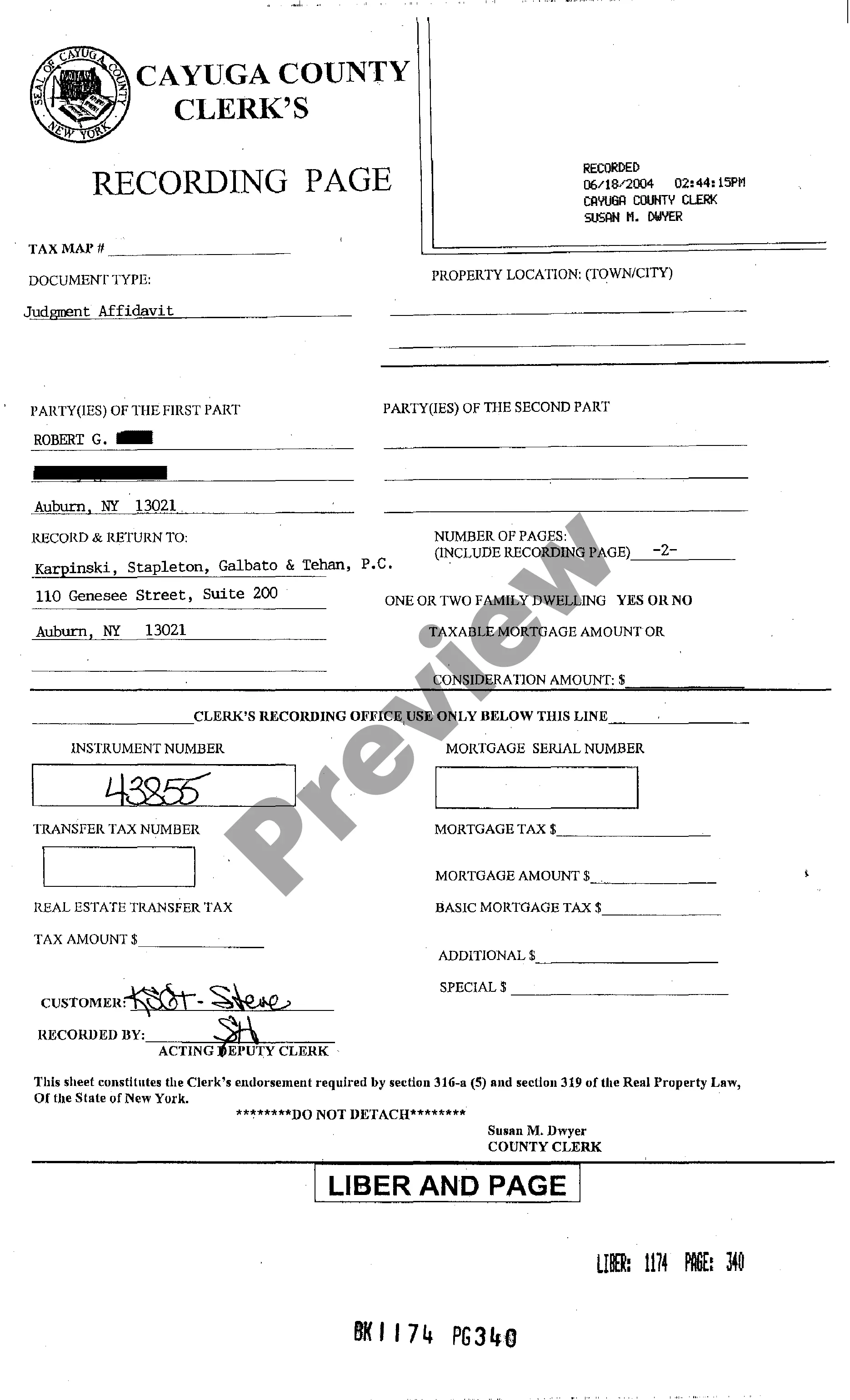

To take legal action to collect a debt, the creditor (the person or company owed money) files a lawsuit against the debtor (the person who owes the money). Once a debt collection lawsuit is filed with the court, the creditor must give the debtor notice of the lawsuit (service).