Interest States Statement Format

Description

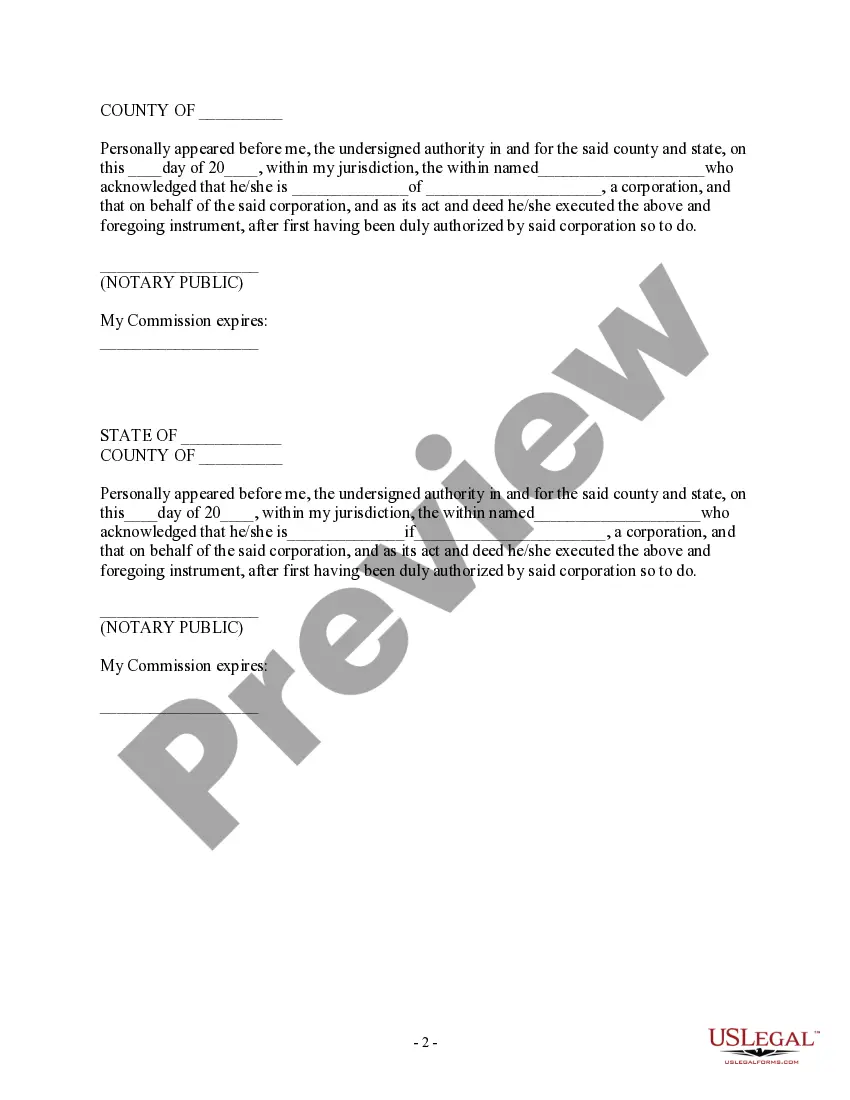

How to fill out Assignment Of Interest In United States Patent?

Whether for professional purposes or for personal matters, everyone must handle legal issues sooner or later in their lives.

Completing legal documents requires meticulous attention, starting with choosing the correct form template.

With a comprehensive US Legal Forms catalog available, you will never have to waste time searching for the right template online. Use the library’s straightforward navigation to find the suitable form for any situation.

- For example, if you select an incorrect version of an Interest States Statement Format, it will be declined upon submission.

- Thus, it is vital to find a trustworthy source of legal documents such as US Legal Forms.

- If you are looking to obtain an Interest States Statement Format template, follow these easy steps.

- 1. Access the sample you need using the search bar or catalog navigation.

- 2. Review the form’s description to ensure it aligns with your situation, state, and county.

- 3. Click on the form’s preview to inspect it.

- 4. If it is the wrong form, return to the search function to locate the Interest States Statement Format template you require.

- 5. Download the document if it meets your specifications.

- 6. If you have a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- 7. If you do not have an account yet, you can acquire the form by clicking Buy now.

- 8. Select the appropriate pricing option.

- 9. Complete the profile registration form.

- 10. Choose your payment method: use a credit card or PayPal account.

- 11. Select the file format you prefer and download the Interest States Statement Format.

- 12. Once saved, you can fill out the form using editing software or print it to complete it manually.

Form popularity

FAQ

INT reports interest income earned, while a 1099DIV provides details on dividend income received from investments. Understanding this distinction is crucial when applying the interest states statement format on your tax return. If you earn interest from bonds or bank accounts, focus on the 1099INT for reporting purposes. This knowledge helps you accurately classify your income and prepare your tax return accordingly.

It is important that you return the completed EGID Durable Power of Attorney form and the Identification Form by mailing them to EGID, Attn. Member Accounts, P. O. Box 11137, Oklahoma City, OK 73136-9998, or faxing them to EGID Member Accounts, 405-717-8939.

The principal, or such other person, shall sign in the presence of two (2) witnesses, each of whom shall sign his or her name in the presence of the principal and each other. (2) The witnesses shall not be under eighteen (18) years of age or related to the principal by blood or marriage.

An Oklahoma durable power of attorney can be a financial power of attorney, a general power of attorney, or medical power of attorney. A durable power of attorney does not need to be signed in the presence of a notary public and it does not need to be signed by witnesses.

A power of attorney in fact for the conveyance of real estate or any interest therein, or for the execution or release of any mortgage therefor, shall be executed, acknowledged and recorded in the manner required by this chapter for the execution, acknowledgment and recording of deeds and mortgages, and shall be ...

A springing durable power of attorney ?springs? into effect when you become incapacitated. However, a springing durable power of attorney does not take effect until you become incapacitated. If a durable power of attorney is not springing, the durable power of attorney will take effect the moment you have signed it.

Last year, on November 1, 2021, the new Oklahoma Uniform Durable Power of Attorney Act took effect, which inadvertently repealed the Oklahoma statutory provisions that authorized executing a durable power of attorney for the purpose of making healthcare decisions.

If the POA or DPOA involves real estate, it must be filed with the County Clerk in the county the real estate resides. You may file a POA with the Court Clerk, but if this is done it becomes a public record.

While Oklahoma does not technically require you to get your POA notarized, notarization is strongly recommended. Under Oklahoma law, when you sign your POA in the presence of a notary public, you signature is presumed to be genuine?meaning your POA is more ironclad.