Option To Buy Contract For Stocks

Description

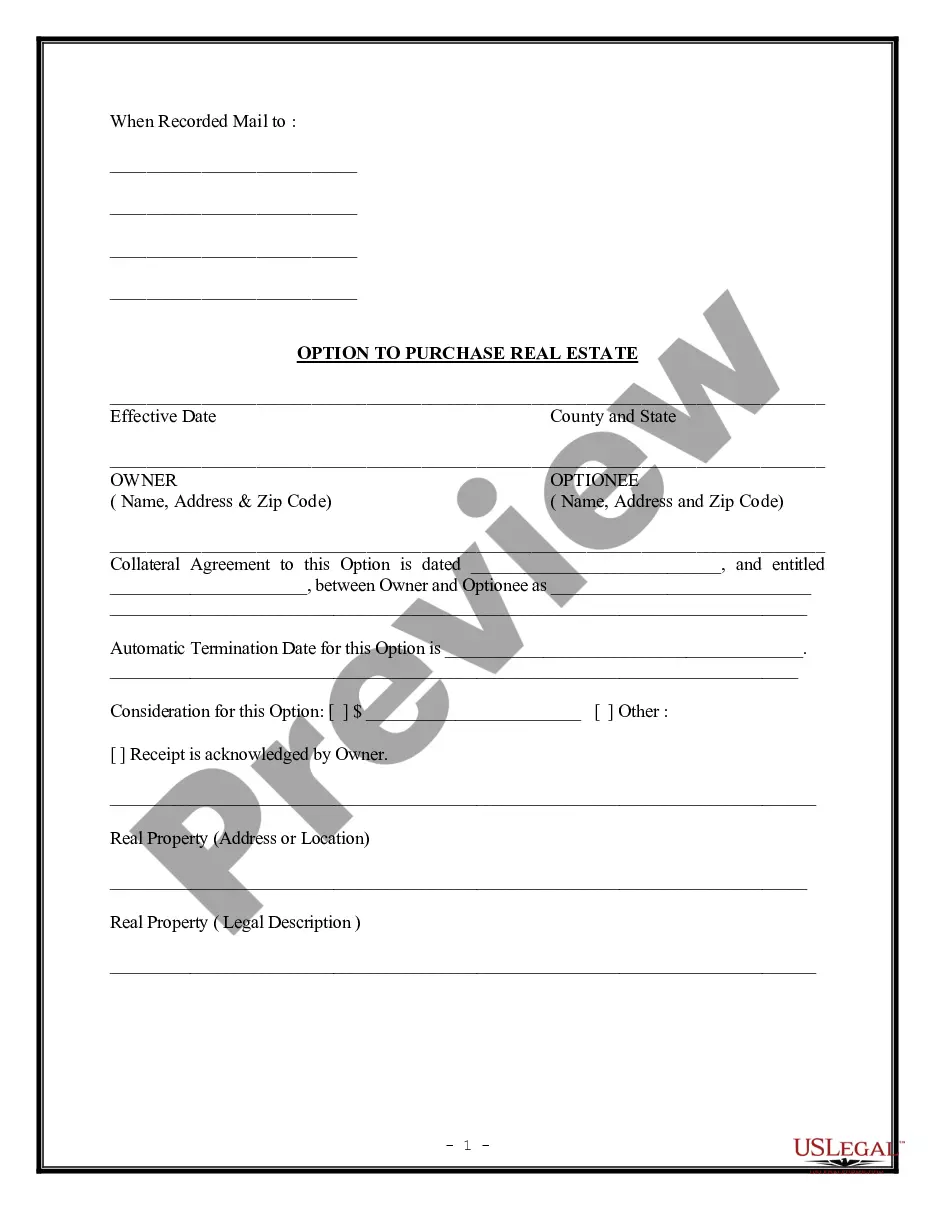

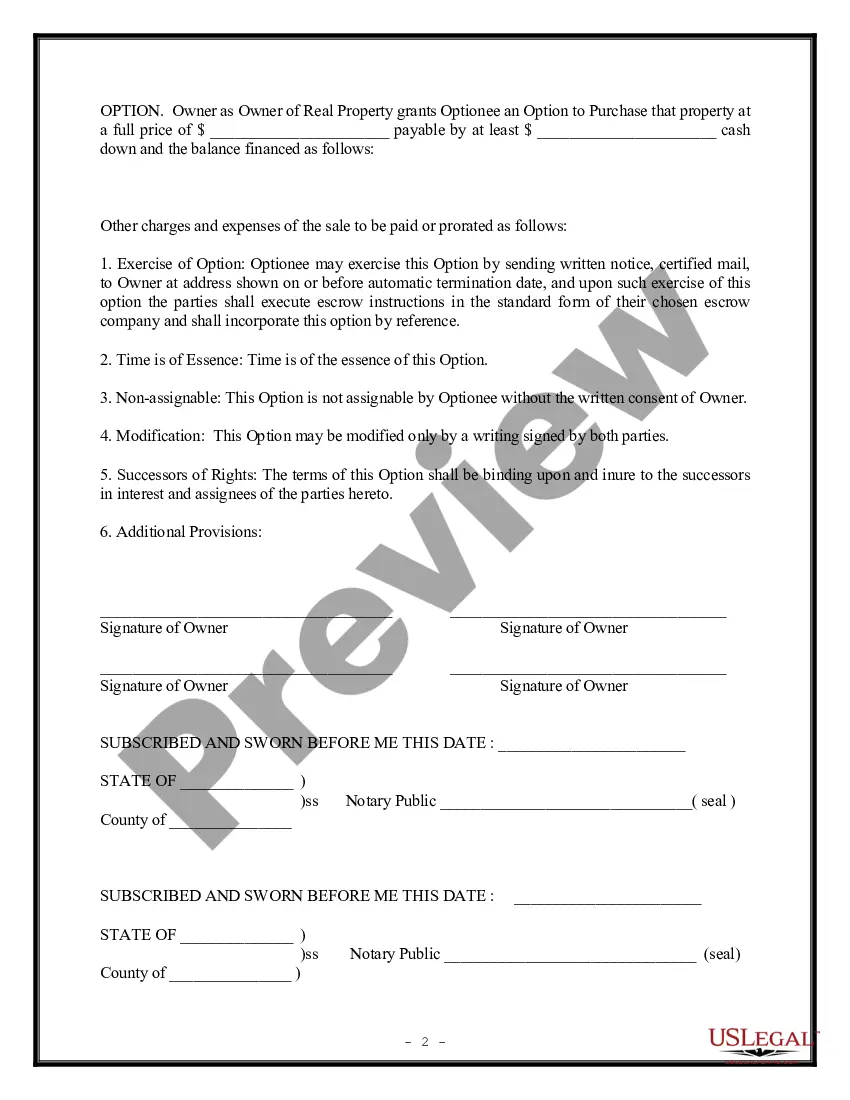

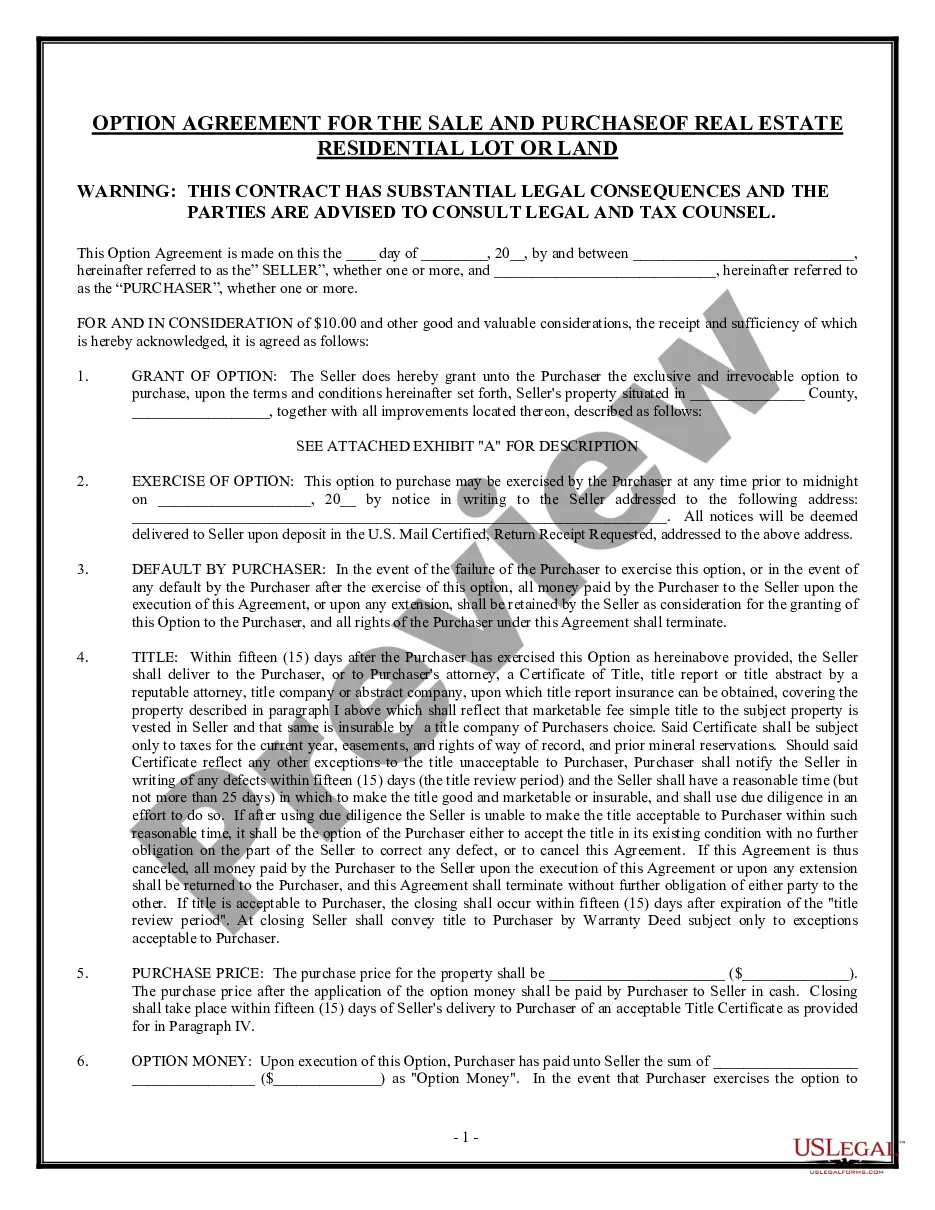

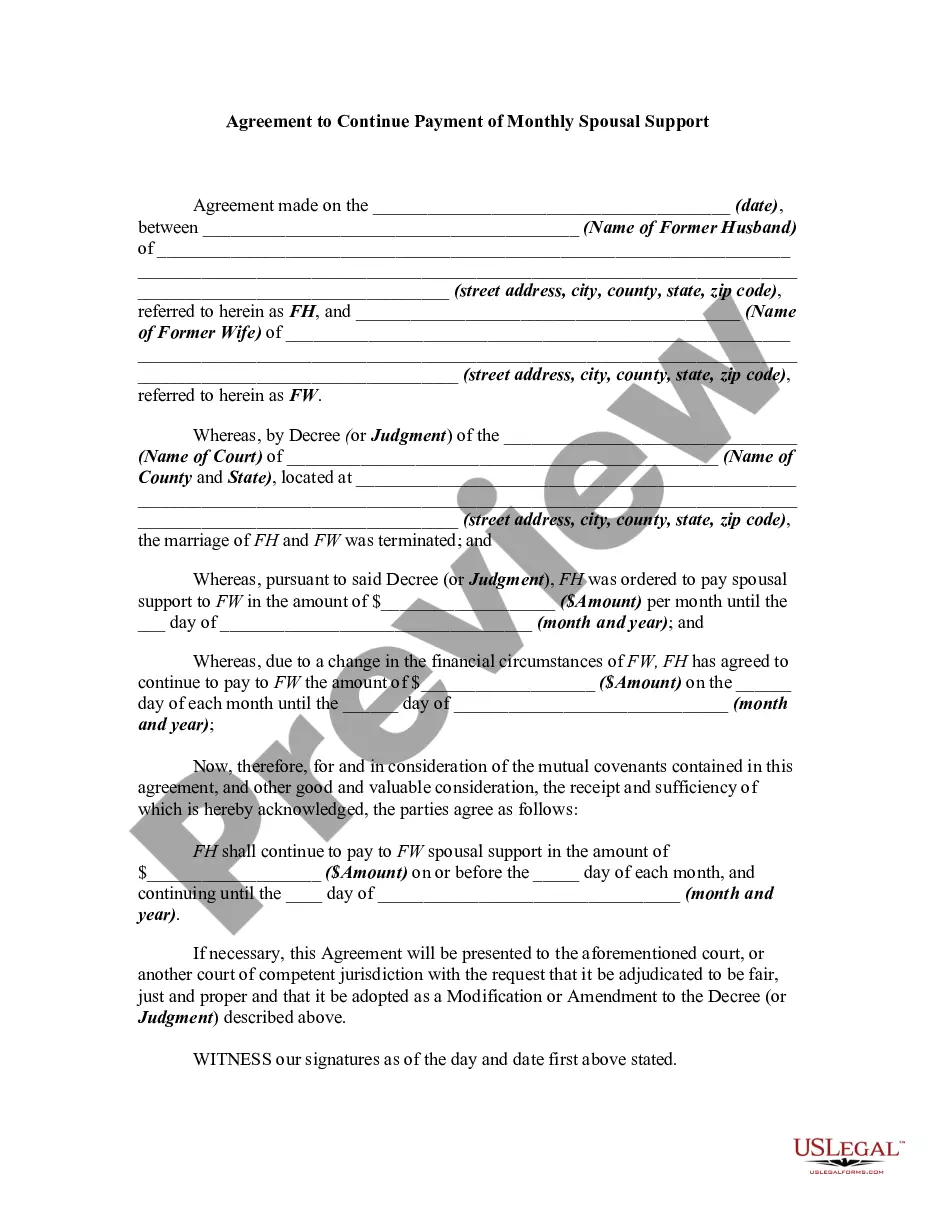

How to fill out Option To Purchase - Residential?

Using legal templates that comply with federal and local laws is crucial, and the internet offers a lot of options to choose from. But what’s the point in wasting time searching for the right Option To Buy Contract For Stocks sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the greatest online legal library with over 85,000 fillable templates drafted by lawyers for any professional and life case. They are simple to browse with all files organized by state and purpose of use. Our experts keep up with legislative updates, so you can always be confident your form is up to date and compliant when acquiring a Option To Buy Contract For Stocks from our website.

Obtaining a Option To Buy Contract For Stocks is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the right format. If you are new to our website, adhere to the instructions below:

- Analyze the template using the Preview feature or through the text outline to ensure it fits your needs.

- Browse for another sample using the search tool at the top of the page if necessary.

- Click Buy Now when you’ve located the right form and choose a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Select the best format for your Option To Buy Contract For Stocks and download it.

All templates you find through US Legal Forms are multi-usable. To re-download and complete previously obtained forms, open the My Forms tab in your profile. Enjoy the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

Traders write an option by creating a new option contract that sells someone the right to buy or sell a stock at a specific price (strike price) on a specific date (expiration date). In other words, the writer of the option can be forced to buy or sell a stock at the strike price.

Example of an Option. Suppose that Microsoft (MFST) shares trade at $108 per share and you believe they will increase in value. You decide to buy a call option to benefit from an increase in the stock's price. You purchase one call option with a strike price of $115 for one month in the future for 37 cents per contract ...

You will have to typically apply for options trading and be approved. You will also need a margin account. When approved, you can enter orders to trade options much like you would for stocks but by using an option chain to identify which underlying, expiration date, and strike price, and whether it is a call or a put.

A share option is a contract pursuant to which one party has the right (but not the obligation) to acquire shares from another person or to sell shares to another person at a specific price (or at a price calculated ing to a specified formula) on a particular date or a range of dates or at any time during a ...

To buy a put option, follow these four steps: Choose the strike price: This will normally be somewhat below where the stock is currently trading. Choose an expiration date: This could typically be from a month to a year in the future. ... Decide how many contracts to buy: Each option contract is for 100 shares of stock.