Sales Receipt For Bike

Description

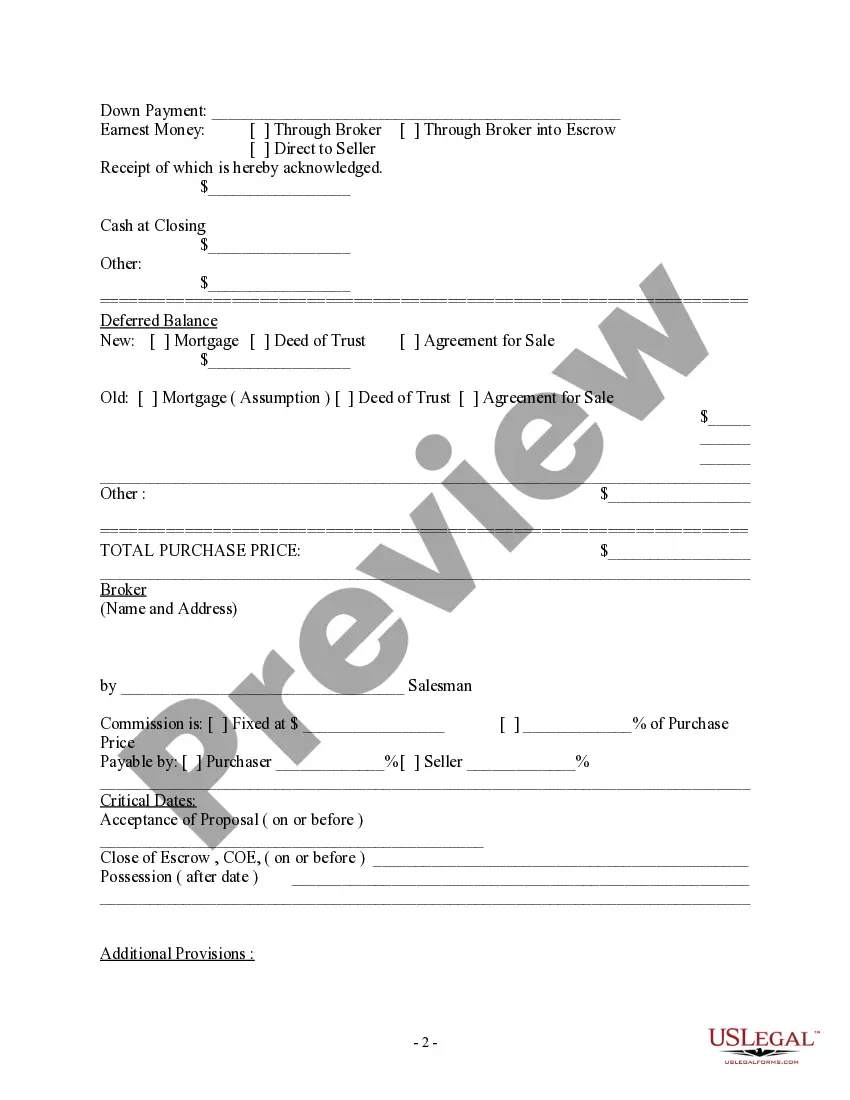

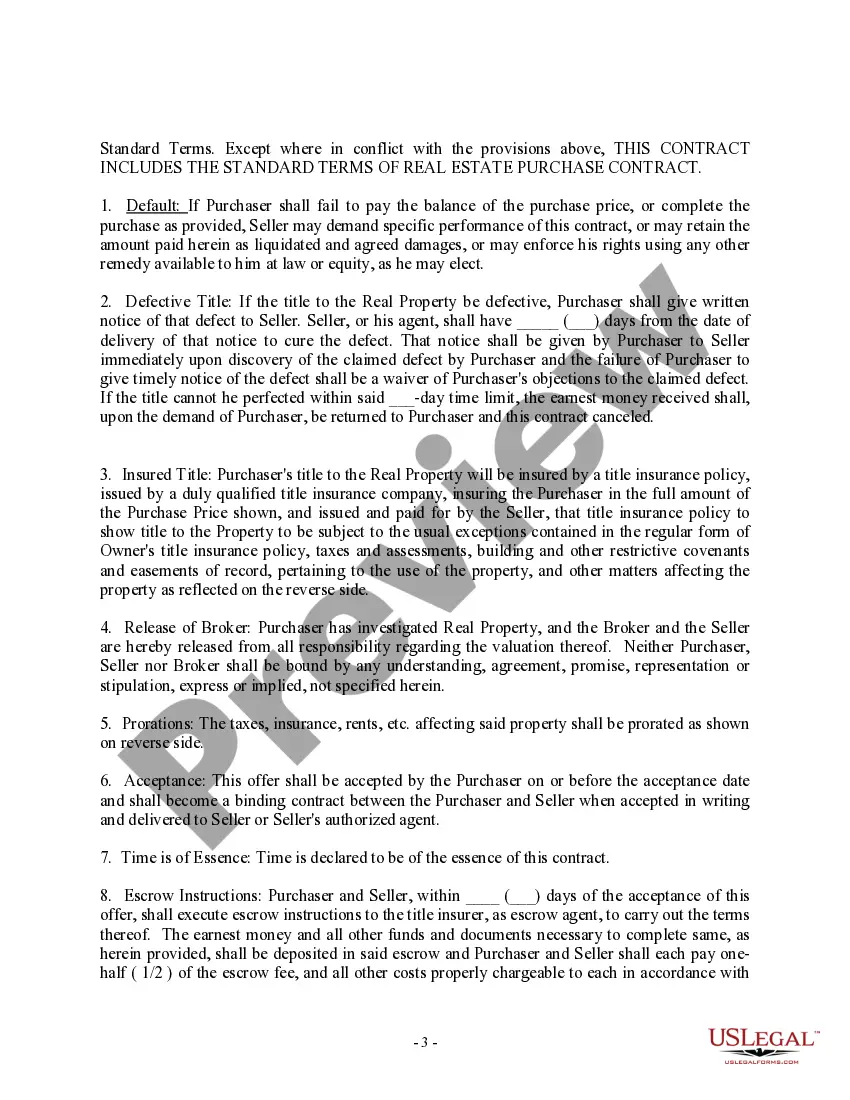

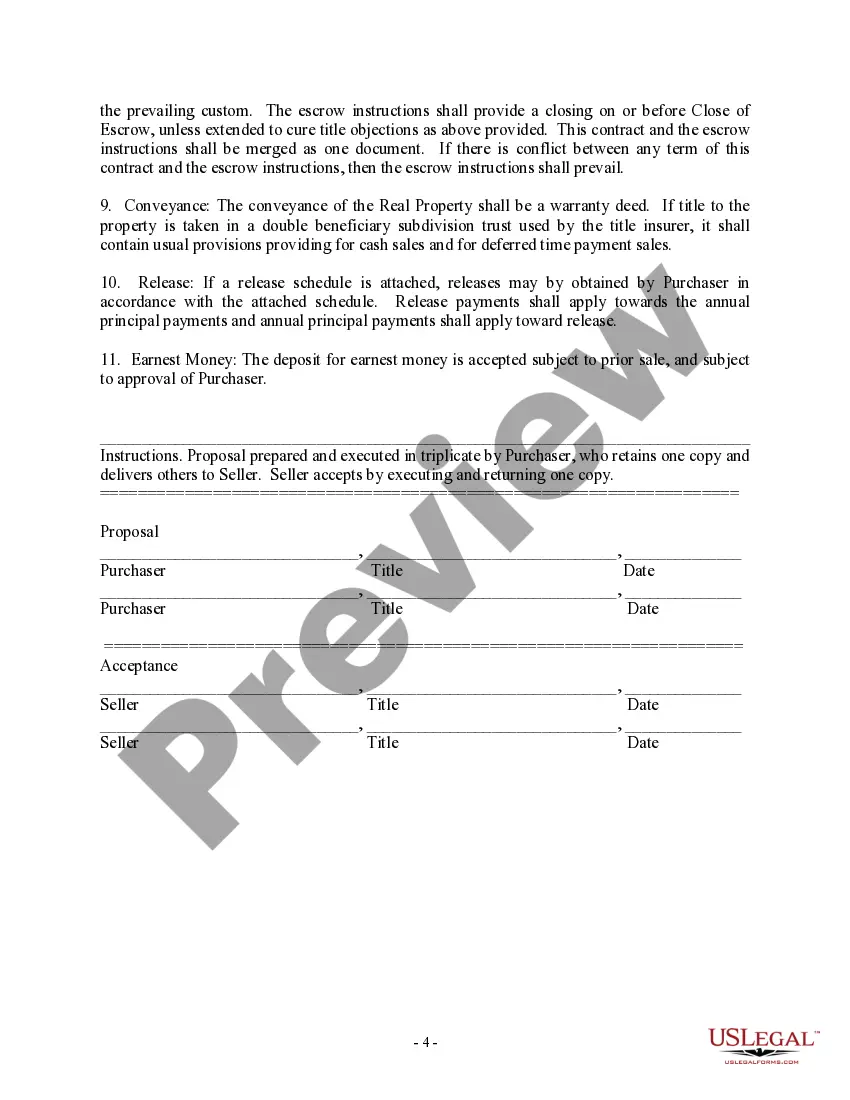

How to fill out Purchase Contract And Receipt - Residential?

It’s well known that you cannot instantly become a legal authority, nor can you quickly learn how to prepare a Sales Receipt For Bike without a specific expertise.

Compiling legal documents is a lengthy procedure that necessitates certain education and capabilities.

So why not entrust the crafting of the Sales Receipt For Bike to the experts.

You can regain access to your documents from the My documents section at any time. If you’re a returning customer, you can easily Log In, and locate and download the template from the same section.

No matter the intent of your documentation—whether financial, legal, or personal—our platform has you covered. Give US Legal Forms a try now!

- Find the document you need by utilizing the search bar at the top of the webpage.

- Preview it (if this feature is available) and review the accompanying description to see if Sales Receipt For Bike is what you seek.

- Initiate your search again if you require another document.

- Create a free account and select a subscription option to purchase the document.

- Click Buy now. Once the payment is processed, you can obtain the Sales Receipt For Bike, complete it, print it, and deliver or mail it to the appropriate people or entities.

Form popularity

FAQ

The document includes a description of the vehicle, registration information, price, and method of payment. By signing the receipt, the buyer acknowledges that the vehicle is sold without any warranty or guarantees. The buyer should keep this receipt as their proof of payment for, and ownership of, their motorcycle.

Include at least the following information on your sales receipts: Your business name, address, and phone number. Sale date and time. Transaction number. Product or service description. Cost. Tax, if required.

A bike receipt template usually includes information such as the customer's name and contact details, date of purchase, bike details (make, model, serial number), itemized list of accessories or additional parts purchased, pricing, and a total amount.

Information You Must Include Contact information for your business, including phone number and email address. Invoice or sales receipt date with day, month, and year. Description of products or services purchased with quantity sold. Itemized list of corresponding prices for each product or service.

No matter how you're making your receipt, every receipt you issue should include: The number, date, and time of the purchase. Invoice number or receipt number. The number of items purchased and price totals. The name and location of the business the items have been bought from. Any tax charged. The method of payment.