Payment Authorization Form Form For Bank

Description

How to fill out Credit Card Charge Authorization Form?

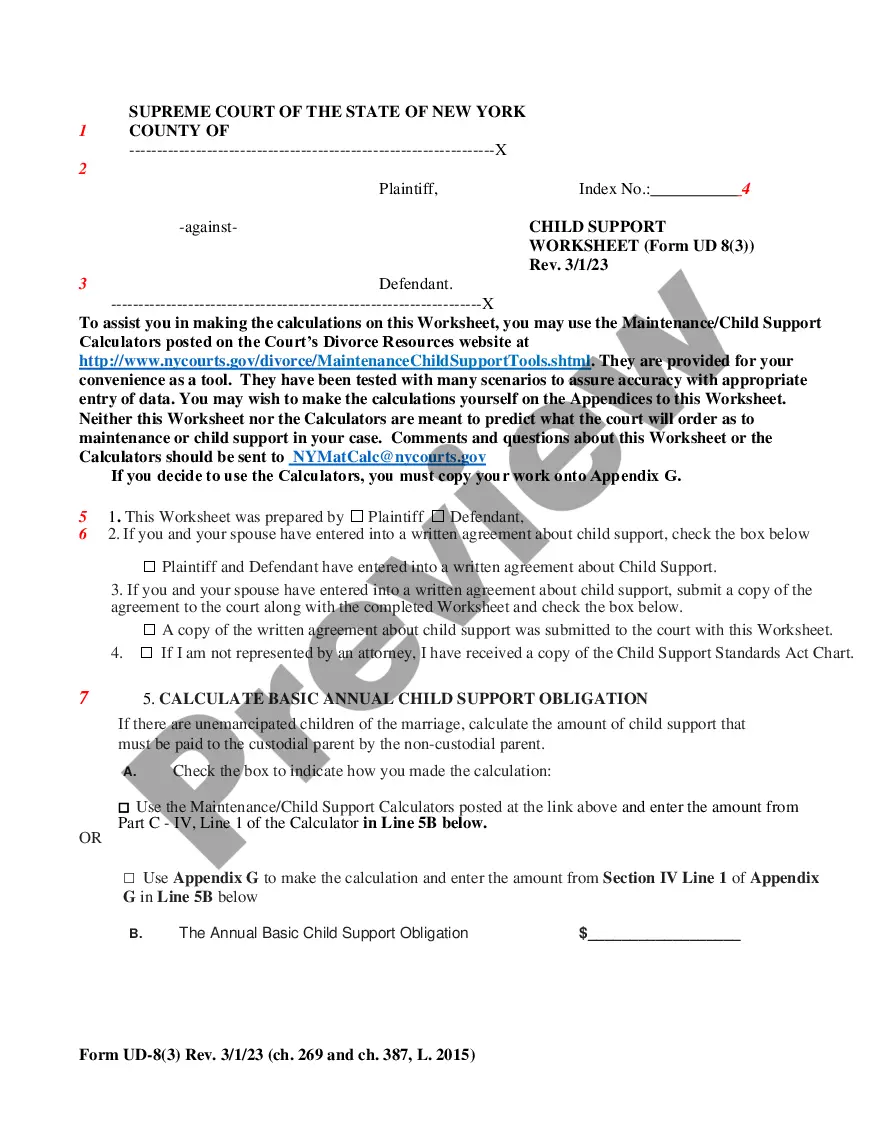

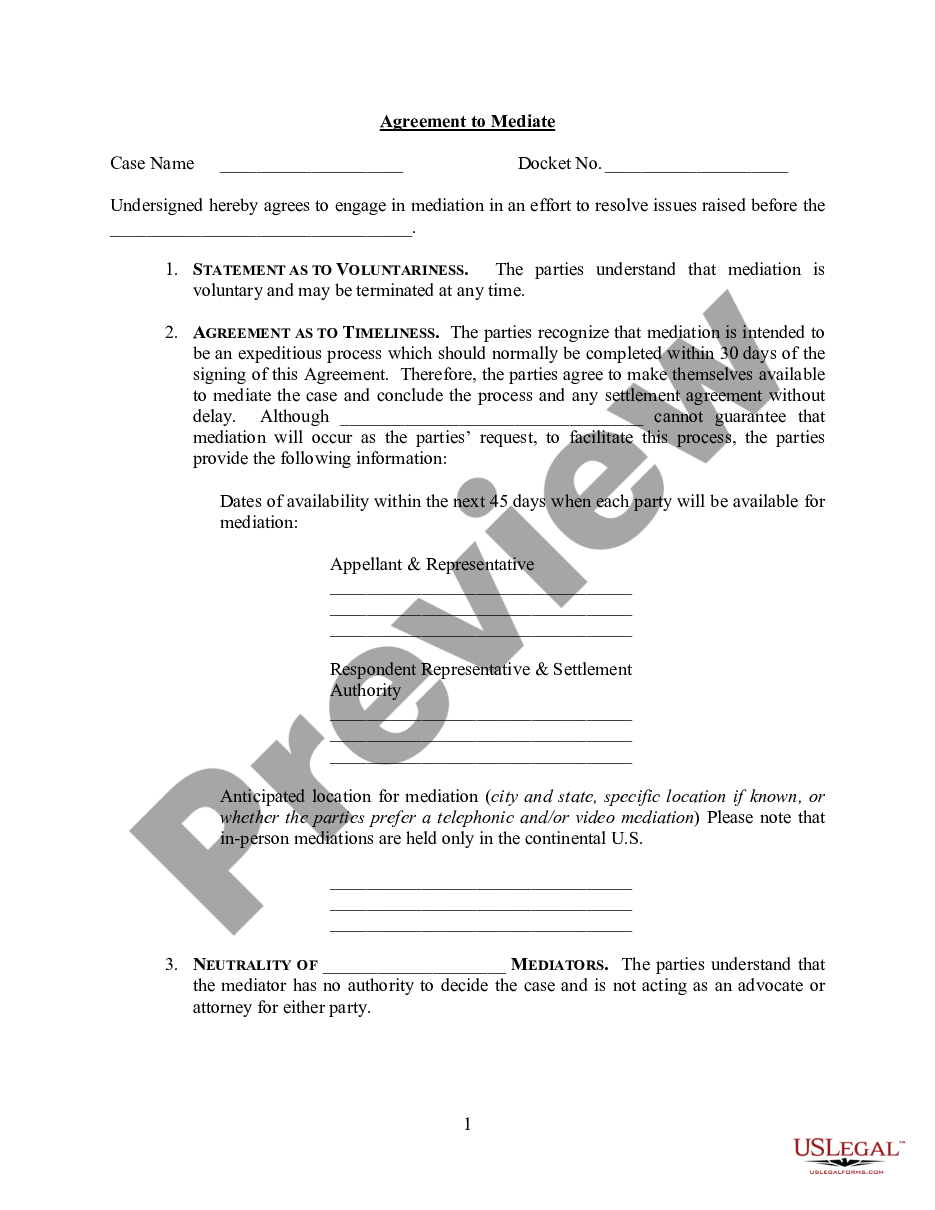

Whether for commercial reasons or for individual concerns, everyone must confront legal issues at some stage in their lives.

Filling out legal forms demands meticulous consideration, beginning with selecting the proper template.

With an extensive US Legal Forms collection available, you do not need to waste time searching for the right template online. Use the library's user-friendly navigation to find the suitable form for any circumstance.

- For example, if you select an incorrect edition of the Payment Authorization Form for Bank, it will be denied once you submit it.

- Thus, it is essential to have a reliable source of legal documents such as US Legal Forms.

- To obtain a Payment Authorization Form for Bank template, follow these simple steps.

- 1. Retrieve the needed template using the search bar or catalog browsing.

- 2. Review the form's details to ensure it aligns with your situation, jurisdiction, and region.

- 3. Click on the form preview to inspect it.

- 4. If it is not the correct document, return to the search feature to locate the Payment Authorization Form for Bank template you need.

- 5. Acquire the file if it meets your requirements.

- 6. If you already possess a US Legal Forms account, click Log in to access previously stored documents in My documents.

- 7. If you do not have an account yet, you can download the form by clicking Buy now.

- 8. Choose the appropriate pricing option.

- 9. Complete the account registration form.

- 10. Choose your payment method: utilize a credit card or PayPal account.

- 11. Select the file format you prefer and download the Payment Authorization Form for Bank.

- 12. After downloading, you can either fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

A payment authorization form is a document that allows you to authorize payments from your bank account. It typically includes your banking information, the amount to be processed, and your signature. This form is essential for businesses that need to ensure they have permission to withdraw funds from their customers’ accounts. Using a payment authorization form for bank transactions increases security and reduces the risk of errors.

The information on such a form must include: Cardholder's name. Card number. Card network (Visa, Mastercard, American Express, Discover, etc.) Card expiration date. Cardholder's billing zip code. Business name. Statement authorizing charges. Cardholder's signature and the date they signed.

An Authorization Letter allows you as an account holder to grant another trusted individual to perform banking transactions on your behalf. This letter, addressed to an institutional representative, allows the bank to know that the person holding the letter is operating with your permission.

Typically it contains: The cardholder's credit card information: Card type, Name on card, Card number, Expiration date. The merchant's business information. Cardholder's billing address. Language authorizing the merchant to charge the customer's card on file. Name and signature of the cardholder. Date.

The script you use to obtain authorization must include: The date of debit. The amount (or alternatively, the method of determining the amount) Payer's name. Payer's contact number. The account to be debited: ... Date of authorization. A statement that the authorization is for a Single Entry ACH debit (for one-off payments)