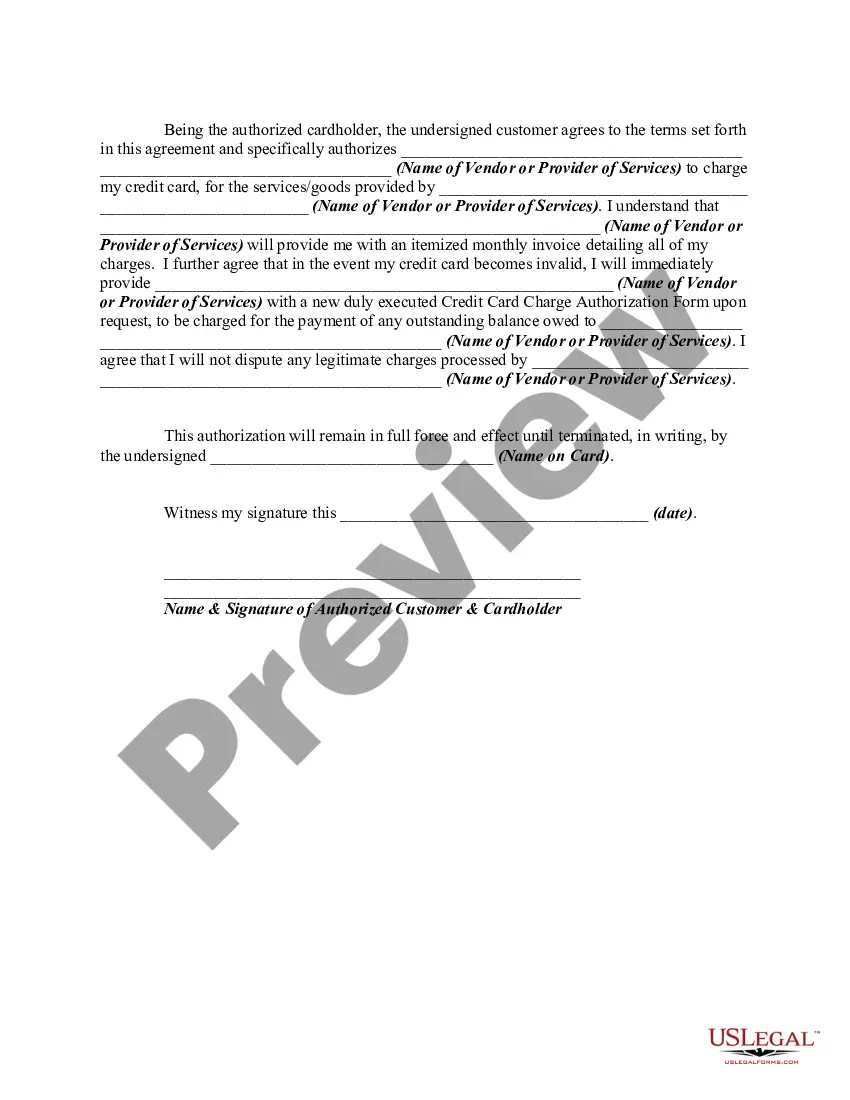

Credit Card Charge Form With Interest Calculator

Description

How to fill out Credit Card Charge Authorization Form?

Creating legal documents from the ground up can occasionally feel daunting. Certain situations may entail lengthy research and significant financial investment.

If you seek a more direct and budget-friendly approach to generating a Credit Card Charge Form With Interest Calculator or other documents without unnecessary complications, US Legal Forms is readily available.

Our online inventory of over 85,000 current legal forms addresses nearly every component of your financial, legal, and personal matters. With just a few clicks, you can swiftly obtain state- and county-compliant forms carefully crafted by our legal experts.

Utilize our platform whenever you require trustworthy and dependable services for quickly locating and downloading the Credit Card Charge Form With Interest Calculator. If you are familiar with our website and have set up an account before, simply

US Legal Forms has a flawless reputation and over 25 years of experience. Join us today and make document preparation something straightforward and efficient!

- Review the form preview and descriptions to confirm you have located the document you need.

- Verify that the form you select meets the criteria of your state and county.

- Choose the most appropriate subscription plan to purchase the Credit Card Charge Form With Interest Calculator.

- Download the document. Then complete, validate, and print it out.

Form popularity

FAQ

To determine how much interest you will be charged, first find your APR and convert it into a daily rate. Next, track your balance variations throughout the billing period. Multiply your average daily balance by the daily rate, then multiply by the number of days in the billing cycle. Our credit card charge form with interest calculator is a fantastic resource to streamline this process and provide clear insights into your potential interest charges.

To calculate the interest charged on a credit card, start by identifying the annual percentage rate (APR) from your credit card agreement. Convert this percentage into a daily rate by dividing it by 365. Then, multiply the daily rate by your average daily balance for the billing cycle, and finally, multiply that result by the number of days in the billing cycle. A convenient tool for this process is our credit card charge form with interest calculator, which simplifies these calculations for your convenience.

To claim credit card interest on your taxes, start by determining if your credit card interest is eligible for a deduction. You can use a Credit card charge form with interest calculator to help you track your interest payments accurately. Keep detailed records of your credit card statements, as the IRS may require documentation. Finally, consult a tax professional or refer to IRS guidelines to ensure you file correctly, maximizing any potential benefits.

Calculating 5% interest on $1,000 involves multiplying $1,000 by 0.05, which results in $50. This amount represents what you would earn in interest after one year. To make these calculations easier, consider our credit card charge form with interest calculator.

Credit card interest charges are based on your balance and the card’s APR. The credit card issuer calculates interest daily and summarizes it in your monthly statement. To understand these computations better, you can use our credit card charge form with interest calculator.

If you calculate $10,000 at 5% interest for one year, you would earn $500 in interest. Over multiple years, you can benefit even more with compound interest. For accurate projections over time, consider using our credit card charge form with interest calculator.

Living off the interest from $3 million is possible depending on the interest rate you receive. For instance, at a conservative 4% interest rate, you could expect about $120,000 per year. Our platform offers tools, including a credit card charge form with interest calculator, to help you effectively plan your finances.

To calculate the interest for an Annual Percentage Rate (APR) of 26.99% on $5,000, you would multiply $5,000 by 0.2699. This results in approximately $1,349.50 in annual interest. Utilizing the credit card charge form with interest calculator can help you better manage these high-interest scenarios.

5% annual interest on $1,000 would be calculated by multiplying $1,000 by 0.05. This results in $50 of interest earned in one year. If you ever need an interest calculator for credit card charges, our credit card charge form can assist you efficiently.

To find 5% interest on $10,000, simply multiply the amount by the interest rate in decimal form. In this case, 5% as a decimal is 0.05. Therefore, 5% of $10,000 equals $500. Using a credit card charge form with interest calculator can help simplify similar calculations.