Paternity Family Code

Description

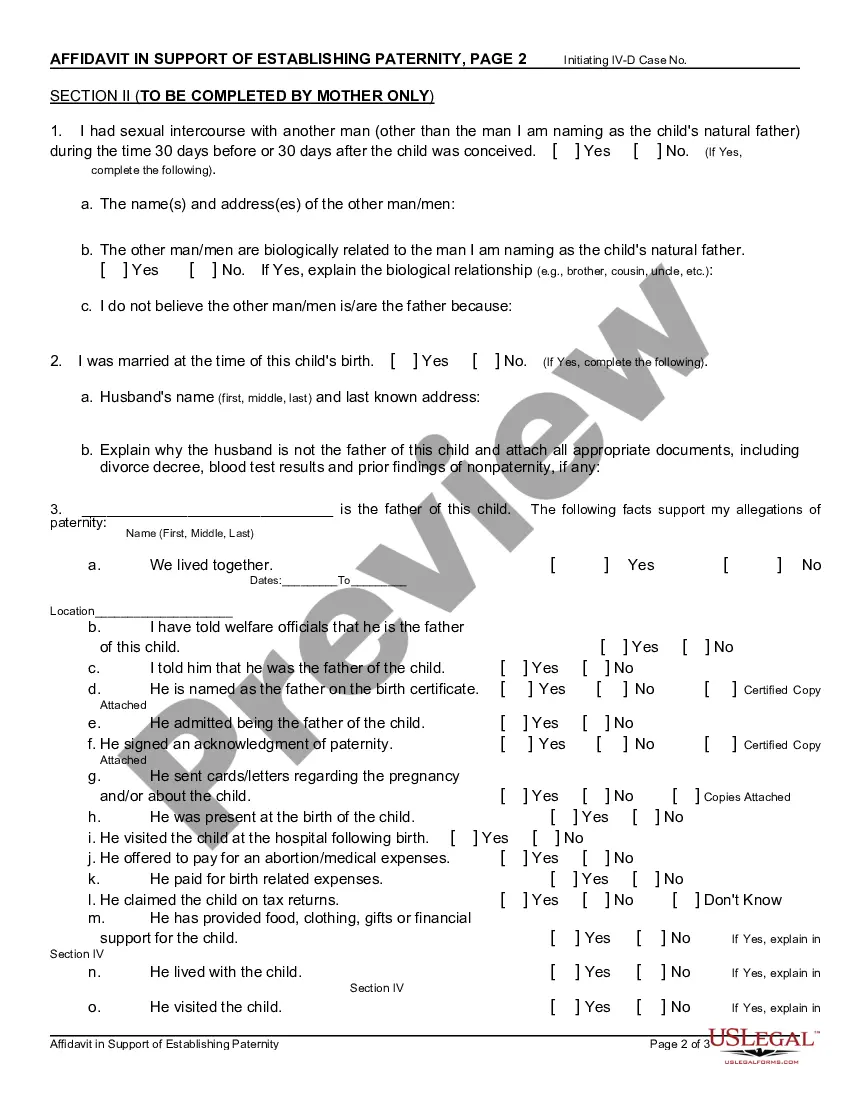

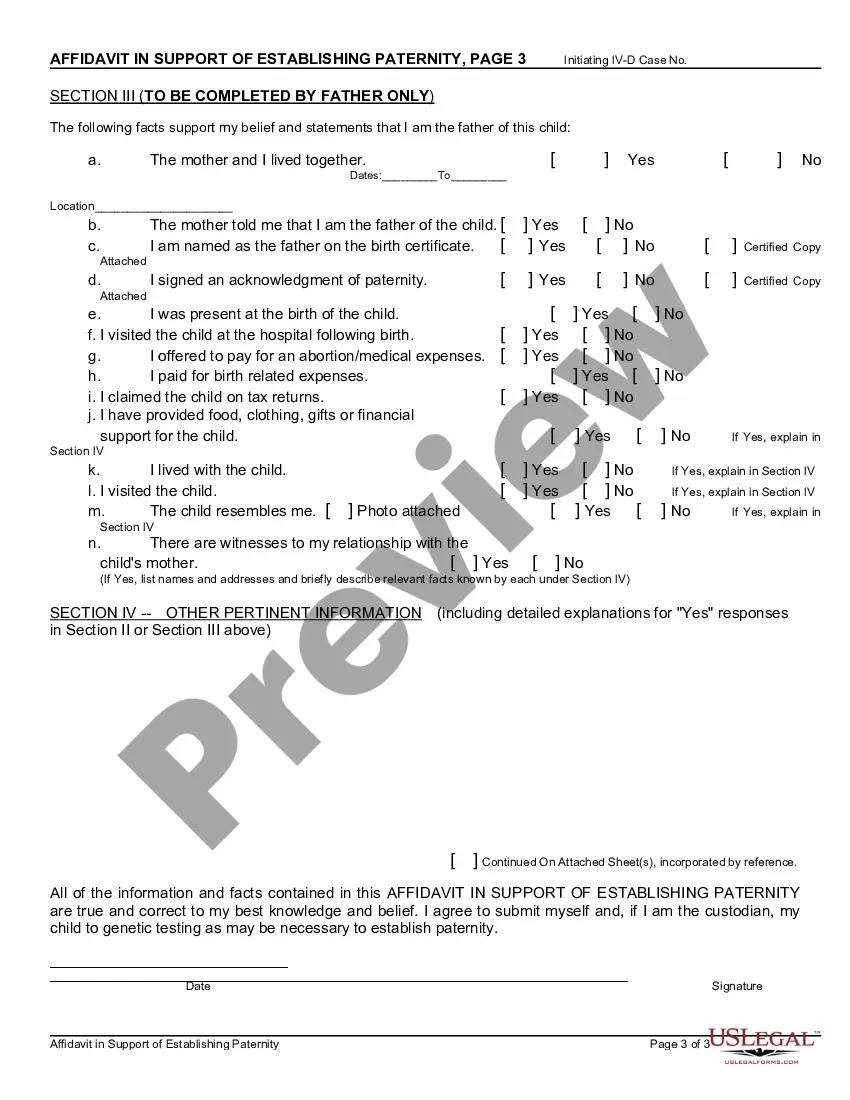

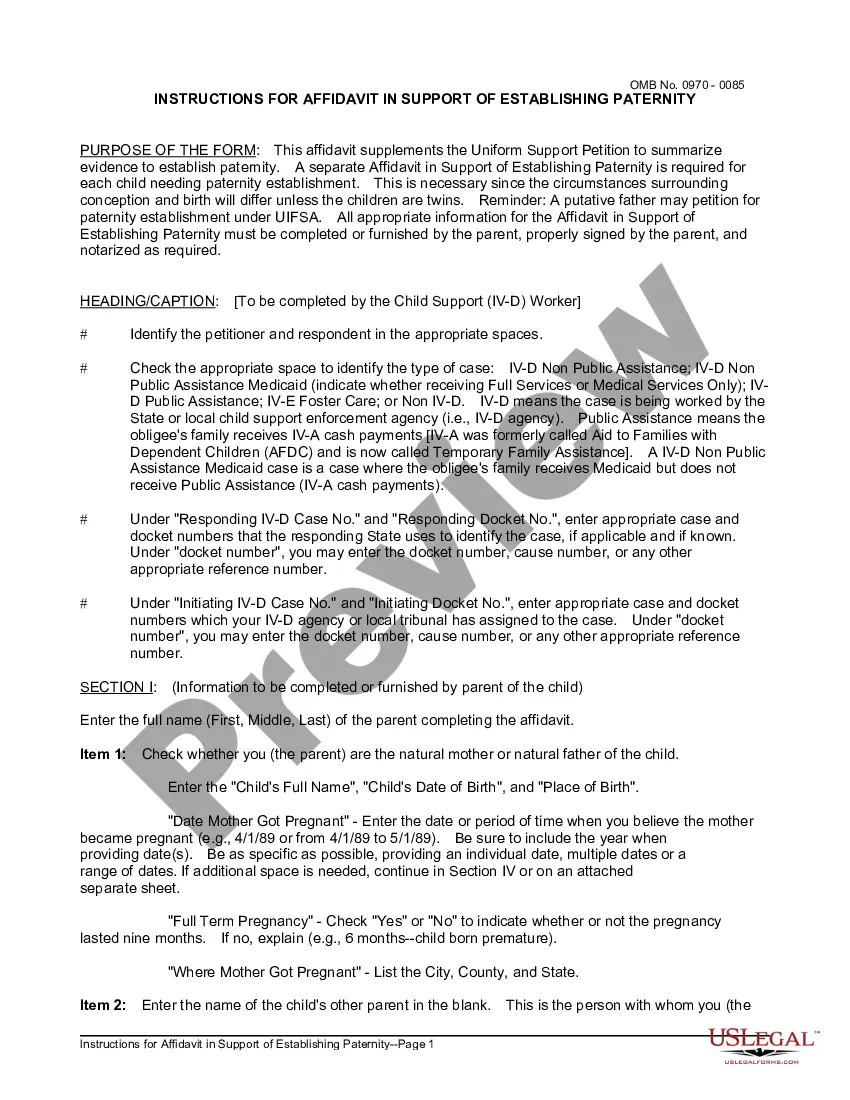

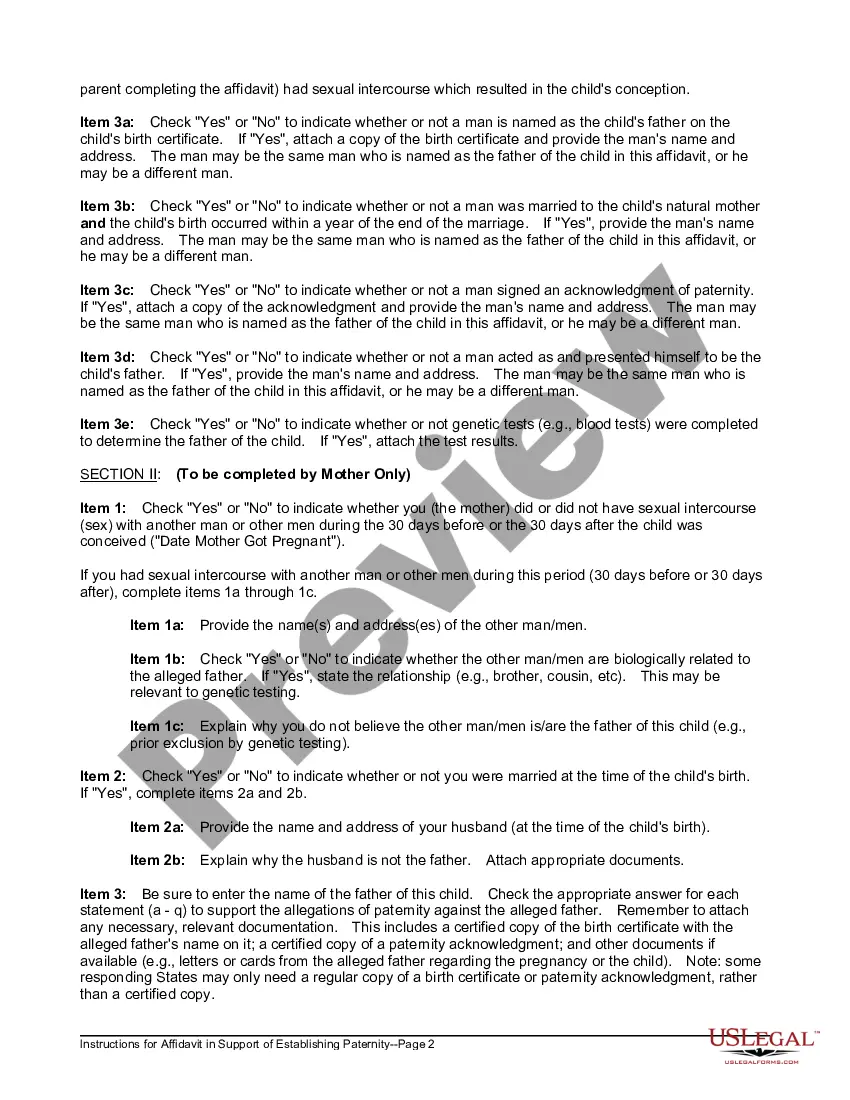

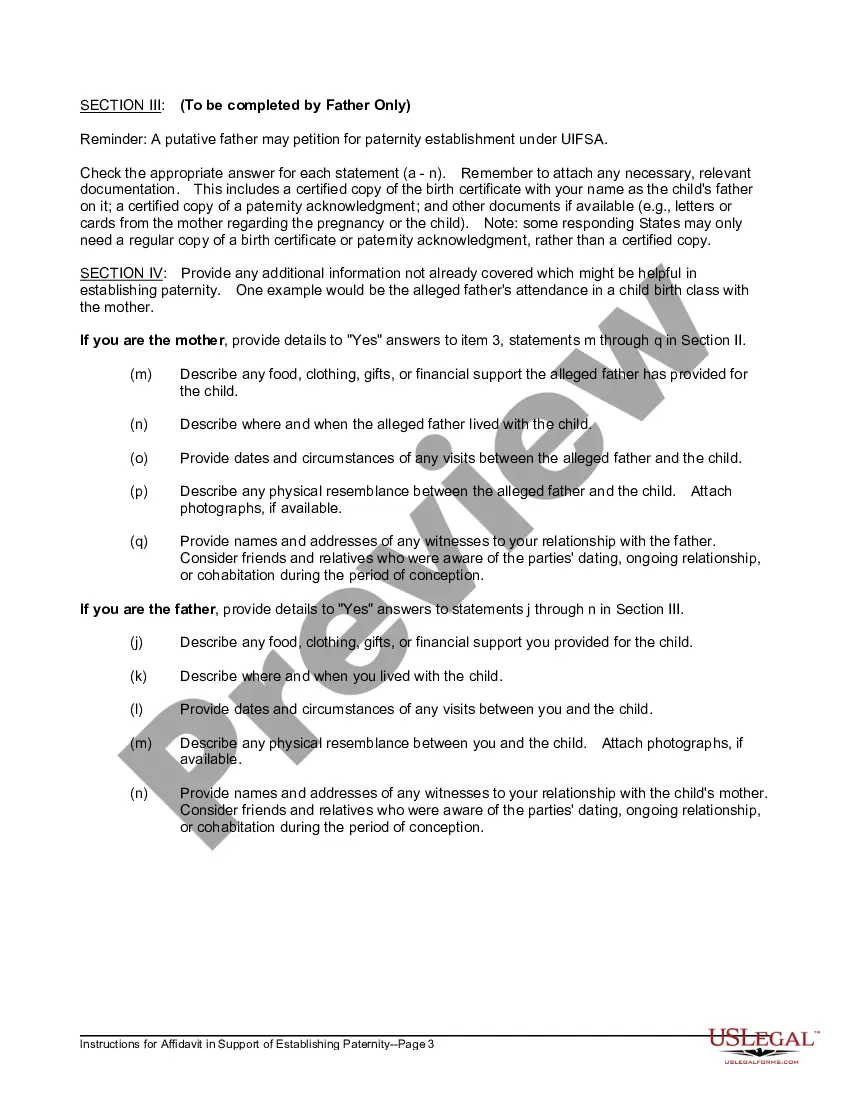

How to fill out Affidavit In Support Of Establishing Paternity?

Managing legal documents and processes can prove to be a lengthy addition to your routine.

Paternity Family Code and similar forms frequently require you to find them and comprehend how to fill them out proficiently.

Thus, whether you are addressing financial, legal, or personal issues, having a comprehensive and user-friendly online archive of forms at your disposal will be immensely beneficial.

US Legal Forms is the leading online platform for legal templates, boasting over 85,000 state-specific forms and a variety of resources to assist you in completing your documents with ease.

Is this your first time utilizing US Legal Forms? Register and create a complimentary account in just a few minutes, granting you access to the form library and Paternity Family Code. Next, follow the steps outlined below to finalize your form: Ensure you've located the correct form using the Preview function and reviewing the form description.

- Explore the library of relevant documents available to you with merely a click.

- US Legal Forms provides you with state- and county-specific forms that are accessible at any moment for download.

- Safeguard your document management processes with a high-quality service that enables you to prepare any form within minutes without incurring additional or hidden charges.

- Simply Log In to your account, locate Paternity Family Code, and download it instantly from the My documents tab.

- You may also access previously saved forms.

Form popularity

FAQ

To obtain a copy of the declaration of paternity in California, you can request it through the California Department of Child Support Services or visit your local county vital records office. It’s important to provide necessary identification and details about the declaration. Utilizing the resources provided by the Paternity family code can help streamline this process.

They have also taken steps to remove all medical collections under $500. This last step went into effect on April 11, 2023, and with this change, it's estimated that roughly half of those with medical debt on their reports will have it removed from their credit history.

If more than two years have tolled since the violation of the FCRA, then any cause of action as to that specific violation may be prescribed.

CLAIM: A new law passed by Congress ?allows you to permanently remove any negative debt? from your credit report that is over two years old. AP'S ASSESSMENT: False. The law referenced in the video to support that claim, the Fair Credit Reporting Act, has been around since 1970.

? You have the right to know what is in your file. In addition, all consumers are entitled to one free disclosure every 12 months upon request from each nationwide credit bureau and from nationwide specialty consumer reporting agencies. See .consumerfinance.gov/learnmore for additional information.

A Summary of Your Rights Under the Fair Credit Reporting Act. The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of. information in the files of consumer reporting agencies. There are many types of consumer.

The FCRA requires agencies to remove most negative credit information after seven years and bankruptcies after seven to 10 years, depending on the kind of bankruptcy.

The Fair Credit Reporting Act (FCRA), a federal law, requires this.

Federal Legislative Activity in 2023 Amend Section 604(c) of the FCRA to address the treatment of pre-screening report requests. Section 604(c) governs the furnishing of reports in connection with credit or insurance transactions that are not initiated by the consumer. [1]