Release Liability Form Blank Form 114

Description

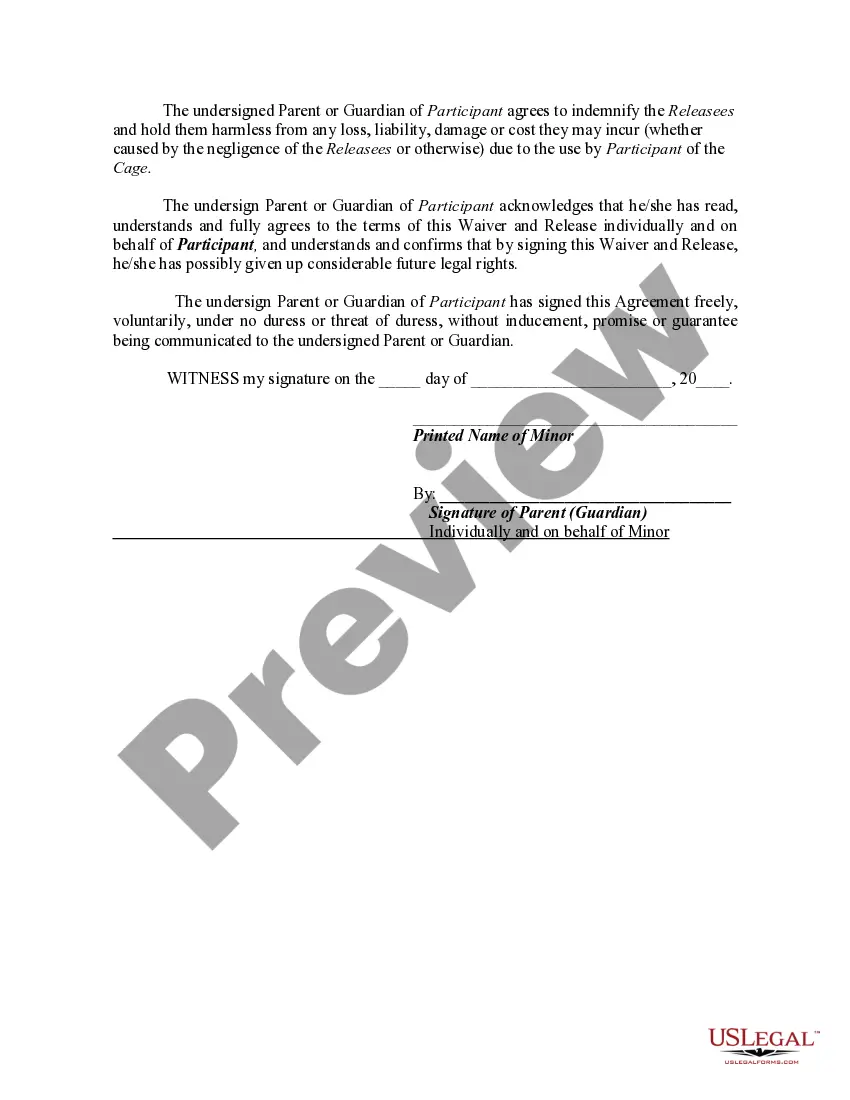

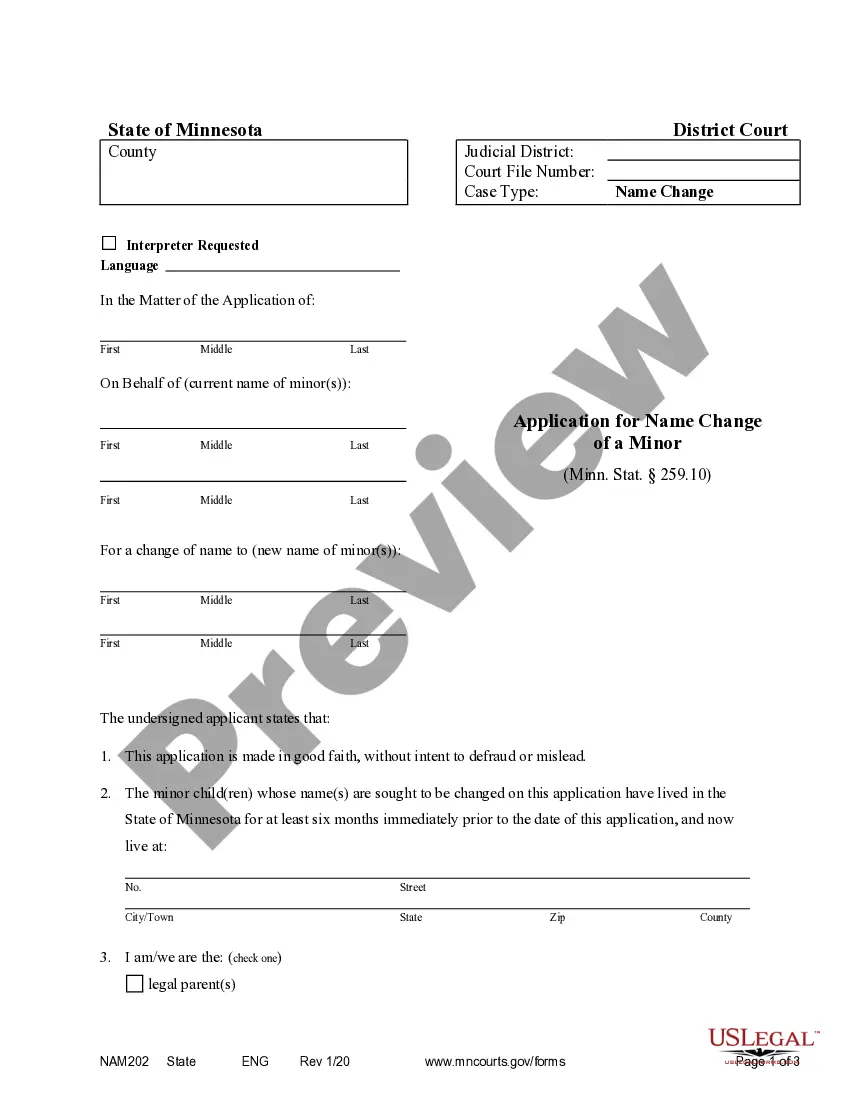

How to fill out Waiver And Release From Liability For Using Indoor Softball And Baseball Batting Cage - Minor?

Accessing legal templates that adhere to federal and local laws is essential, and the internet provides numerous options to choose from.

However, what’s the benefit of using valuable time searching for the correct Release Liability Form Blank Form 114 example online when the US Legal Forms digital library already compiles such templates in one location.

US Legal Forms is the largest online legal repository with over 85,000 customizable templates created by attorneys for various professional and personal situations. They are easy to navigate, with all documents organized by state and intended use. Our experts keep pace with legal updates, ensuring that your documentation is always current and compliant when obtaining a Release Liability Form Blank Form 114 from our platform.

All documents available through US Legal Forms are reusable. To re-download and complete previously obtained forms, navigate to the My documents section in your account. Take advantage of the most extensive and user-friendly legal document service!

- Acquiring a Release Liability Form Blank Form 114 is straightforward for both existing and new clients.

- If you already possess an account with an active subscription, Log In and download the document template you need in the appropriate format.

- If you are a newcomer to our site, follow the instructions below.

- Review the template using the Preview feature or through the textual description to ensure it meets your needs.

- Search for an alternative sample with the search function at the top of the page if necessary.

- Click Buy Now once you have located the suitable form and choose a subscription plan.

- Create an account or Log In and pay via PayPal or a credit card.

- Select the format for your Release Liability Form Blank Form 114 and download it.

Form popularity

FAQ

The FinCEN Report 114 documents a taxpayer's foreign financial accounts when the aggregate value in those accounts exceeds $10,000. The Financial Crimes and Enforcement Network (FinCEN) requires you provide this information as part of your reporting obligations as an expat.

FBAR is another name for FinCEN Form 114 (formerly called the Report of Foreign Bank and Financial Accounts), and is used to report foreign financial accounts that held a combined amount of $10,000 or more at any point during the calendar year.

The FinCEN Form 114a, Record of Authorization to Electronically File FBARs is another FBAR form which addresses the needs of individuals who file jointly with a spouse or who prefer to submit FBARs via third party preparers. This form is not filed but prepared and kept for recordkeeping purposes.

Open the Federal Information Worksheet. Scroll down to Part VI, Electronic Filing of Tax Return Information. Mark the checkbox labeled Electronic Filing of Form 114: File Form 114 Report of Foreign Bank and Financial Accounts (FBAR) electronically. From File menu, select Go to Foreign Bank Reporting Form 114.

In order to complete the FBAR form, you will need the following information: Your name, address, and Social Security Number or ITIN. The name, address, and social security number (if any) of all joint owners of the account. Your foreign banks' name and address. The type of account ? bank, securities, or other.