Social Security Number For Foreigners

Description

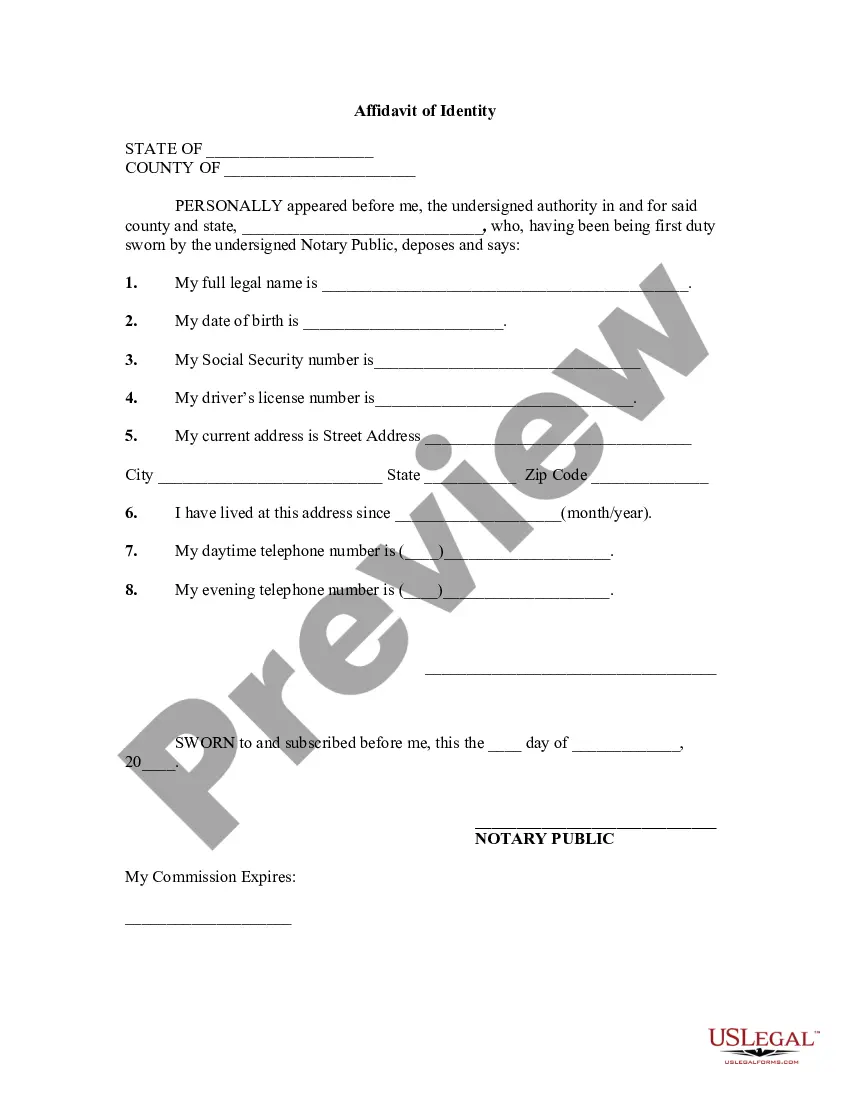

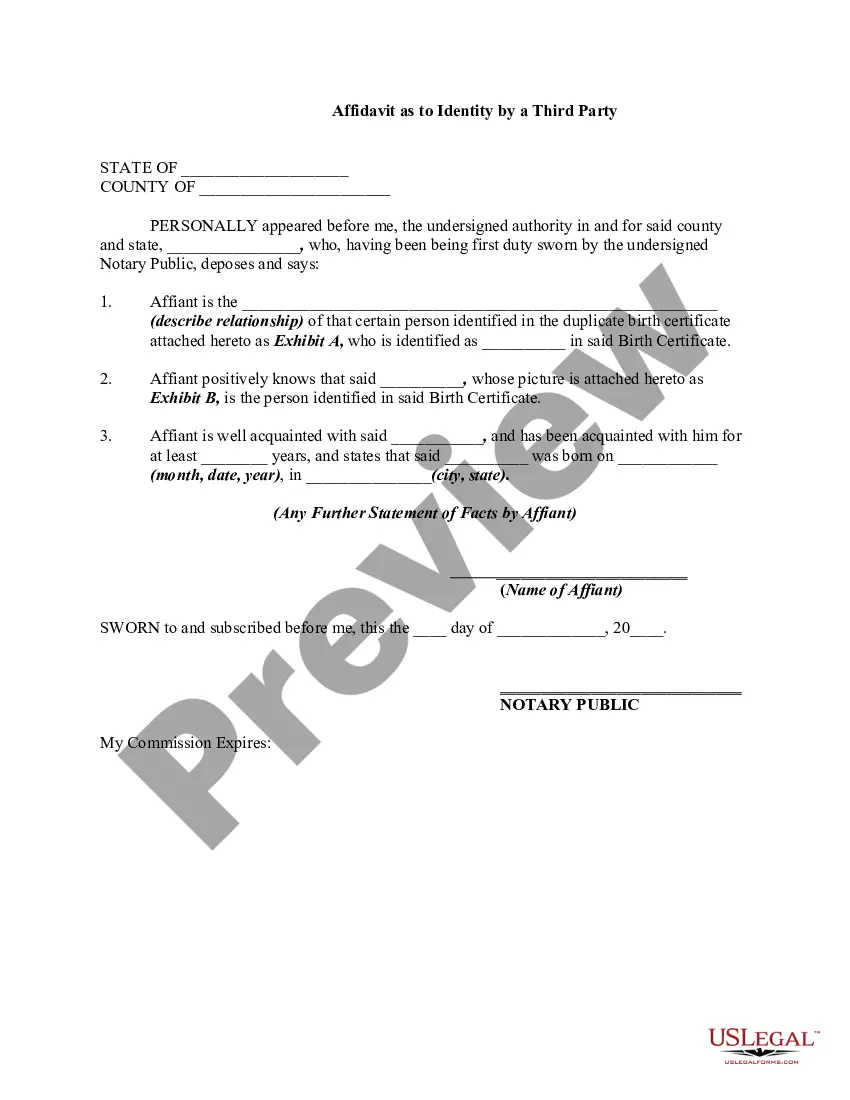

How to fill out Affidavit Of Identity And Lack Of Social Security Number?

- If you are a returning user, log into your account and locate the required form template by selecting the Download button. Ensure your subscription is currently active for uninterrupted access.

- For first-time users, begin by checking the Preview mode and detailed descriptions of the forms. This step ensures you select the correct template that aligns with your specific needs and complies with your local jurisdiction.

- If the form does not meet your expectations, utilize the Search tab at the top of the page to find an alternative template. Once you find what you need, proceed to the next step.

- Purchase the required document by clicking the Buy Now button and selecting your desired subscription plan. You will need to create an account to explore the full breadth of resources available.

- Complete your purchase by entering your credit card details or using your PayPal account to finalize the subscription.

- Download your selected form to your device. You can access it later under the My documents section of your profile for ease of completion.

With US Legal Forms, individuals and attorneys can execute legal documents effortlessly using a vast and user-friendly library. The service stands out due to its extensive collection and access to premium expert assistance.

Start your journey today and ensure your legal documentation is straightforward and hassle-free. Explore US Legal Forms for your Social Security Number needs!

Form popularity

FAQ

Yes, having a Social Security number is generally required for all U.S. citizens. It is used for various purposes, including taxation and tracking earnings over a person's lifetime. Social Security numbers are crucial for building credit, opening bank accounts, and applying for government benefits. If you are a foreigner seeking to understand the relevance of this for your situation, uslegalforms can help clarify your path.

No, you cannot apply for a Social Security number from outside the U.S. The process requires you to be present in the country with the right documentation. Once you arrive, you can apply for the Social Security number for foreigners. If you have questions about the documentation needed, uslegalforms can offer valuable insights.

Currently, you cannot apply for a U.S. Social Security number online if you are a foreigner. The application requires you to provide physical documents in person. However, you can gather all the necessary information and forms online before your visit. Utilizing uslegalforms can help you ensure that you have everything ready beforehand.

No, you cannot apply for a Social Security number before entering the USA. You must be physically present in the country to start the application process. Once you arrive and have the necessary documentation, you can apply for a Social Security number for foreigners. For streamlined assistance, consider using uslegalforms to navigate the requirements.

Yes, a foreigner can apply for a Social Security number in the USA. To do so, you must have a valid work visa or a specific status that permits you to work in the country. The Social Security number for foreigners is essential for tax purposes and accessing various benefits. If you need assistance with the application process, platforms like uslegalforms can provide useful resources and guidance.

B1 B2 visa holders typically cannot apply for a Social Security number since these visas do not grant employment authorization. However, if a B1 B2 visa holder later obtains work authorization, they may then apply. It is crucial to understand the conditions of your visa and how they relate to obtaining a Social Security number for foreigners. For more information, seek help through resources like US Legal Forms.

Foreigners can apply for a Social Security number by completing the SS-5 application form at a local Social Security office. You will need to provide necessary documentation, including proof of immigration status, work eligibility, and identity. Having the correct paperwork speeds up the application process for a Social Security number for foreigners. Online platforms like US Legal Forms can guide you in preparing your application.

Choosing between an ITIN and a Social Security number depends on your situation. Generally, individuals who can qualify for a Social Security number should obtain one, as it provides wider access to social benefits. However, if you are a foreigner not eligible for an SSN, an ITIN is a valid route to fulfill tax obligations. Consider your unique circumstances and consult US Legal Forms for tailored advice.

Individuals who cannot obtain a Social Security number and need to file taxes in the United States qualify for an ITIN. This includes non-resident aliens, dependents of U.S. citizens or residents, and certain visa holders. The ITIN specifically caters to those fulfilling tax obligations without being eligible for a Social Security number for foreigners. Use guides on platforms like US Legal Forms to assist with your application.

Instead of a Social Security number, individuals may use an Individual Taxpayer Identification Number (ITIN) or an Employer Identification Number (EIN) for certain purposes. The ITIN is vital for tax filing, while the EIN is primarily used for business-related tax matters. Understanding the correct application of these identifiers is essential for compliance. Explore resources on US Legal Forms to find the right guidance.