Hipaa Health Form For College Students

Description

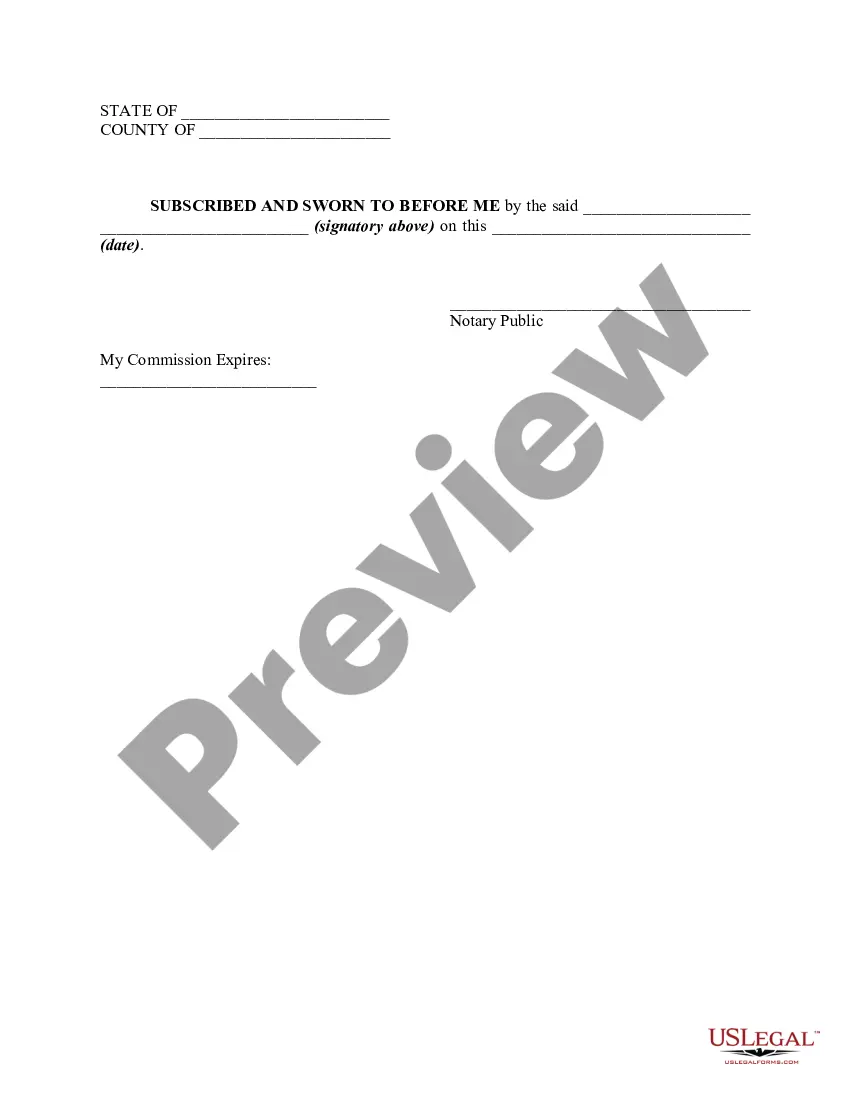

How to fill out HIPAA - Health Insurance Portability And Accountability Act - Release - Authorization To Release Information To A Third Party?

Securing a reliable source for obtaining the latest and suitable legal templates is just part of the challenge when dealing with bureaucracy.

Selecting the appropriate legal documents demands precision and carefulness, which is why it is essential to obtain examples of the Hipaa Health Form For College Students exclusively from credible sources like US Legal Forms. An incorrect template will squander your time and delay your situation.

Eliminate the complications related to your legal documentation. Browse through the extensive US Legal Forms collection to discover legal templates, ensure their applicability to your situation, and download them immediately.

- Utilize the library navigation or search function to locate your sample.

- Review the form’s details to determine if it aligns with the requirements of your state and area.

- Preview the form, if available, to confirm it is the document you need.

- Return to the search and identify the correct document if the Hipaa Health Form For College Students does not meet your needs.

- Once you are certain about the form’s appropriateness, download it.

- If you are a registered user, click Log in to verify and access your chosen templates in My documents.

- If you do not yet have an account, click Buy now to obtain the form.

- Choose the pricing plan that fits your needs.

- Proceed with registration to complete your purchase.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading the Hipaa Health Form For College Students.

- Once you have the form on your device, you can modify it using the editor or print it to complete it manually.

Form popularity

FAQ

At death, a copy of the trust generally suffices for all parties in place of the original. Generally a court is not involved in administering a trust. But safeguarding the original copy of your living trust should be the goal. The safest place, though inconvenient, is in a San Diego bank or credit union.

Revocable Living Trust Amendments & Restatements: Cost starts at $400 for a simple amendment or $1,200 for a full restatement. Special Needs Trust: Cost starts at $3,000 for a stand-alone document or $1,500 when created in conjunction with a revocable living trust-based estate plan.

A trust is not a public record. So, the general public or anyone who is not a beneficiary does not have a right to know about the assets in your trust.

In California, there are three steps to getting a copy of a trust document: Make a written demand for a copy of the Trust and its amendments, if any; Wait 60 days; and. If you do not receive a copy of the Trust within 60 days of making your written demand, file a petition with the probate court.

Under California law (Probate Code section 16061.7) every trust beneficiary, and every heir-at-law of the decedent, is entitled to receive a copy of the trust document. However, the beneficiaries only have the right to obtain a copy of the trust when their rights have vested.

A trust is not a public record. So, the general public or anyone who is not a beneficiary does not have a right to know about the assets in your trust.

Amending a revocable trust usually requires additional paperwork, but can be accomplished by strikeouts and handwritten additions to the original document. Whether the amendment is by a separate document, of changes on the original trust document, it requires a date and signature.

The California Probate Law section 16061.7 provides for the beneficiaries right to see the trust. Trustees should furnish beneficiaries and heirs with copies of the trust document.