State Liability Premises With Debt Relief

Description

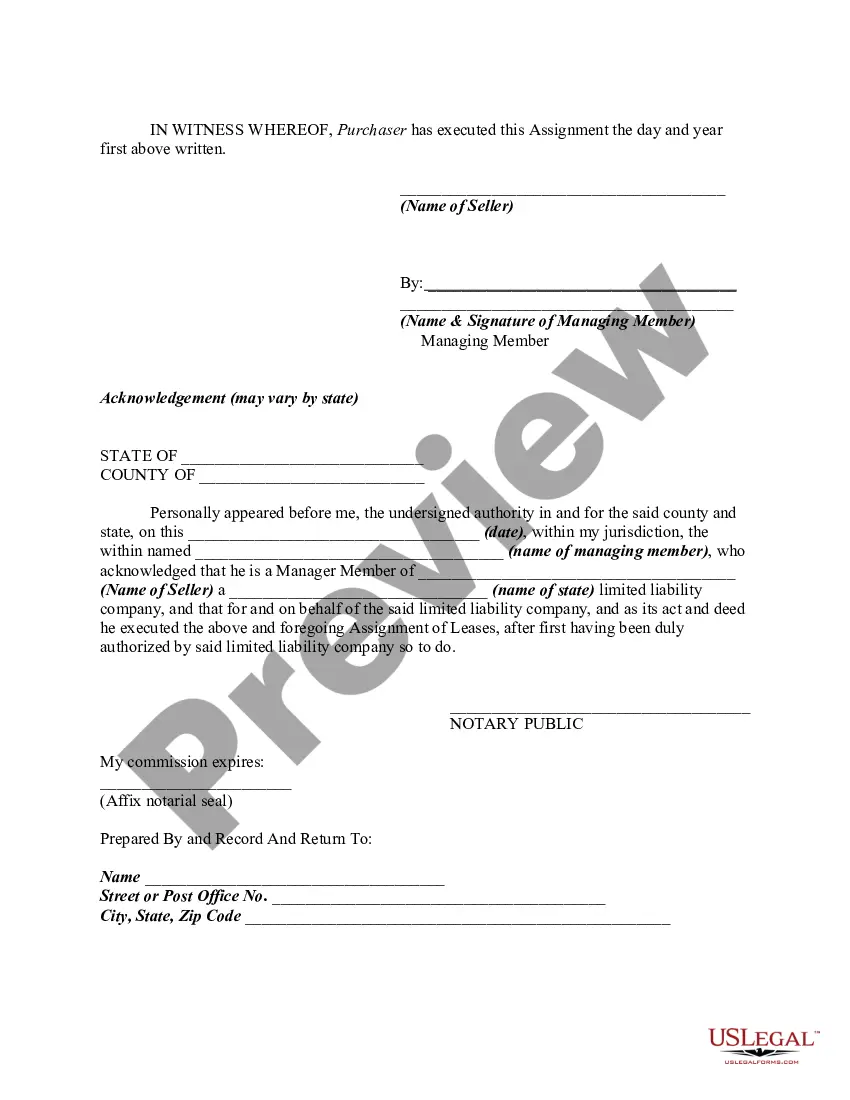

How to fill out Assignment Of General And Specific Leases?

Acquiring legal forms that adhere to federal and local regulations is essential, and the internet provides numerous alternatives to select from.

However, why spend time searching for the appropriate State Liability Premises With Debt Relief template online when the US Legal Forms digital library has all such documents consolidated in one location.

US Legal Forms is the premier online legal repository featuring over 85,000 editable forms crafted by attorneys for various business and personal situations.

Review the template using the Preview feature or through the text outline to ensure it meets your requirements.

- They are straightforward to navigate with all documents organized by state and intended use.

- Our experts keep abreast of legal amendments, ensuring your files are always current and compliant when obtaining a State Liability Premises With Debt Relief from our platform.

- Acquiring a State Liability Premises With Debt Relief is simple and efficient for both existing and new members.

- If you already possess an account with an active subscription, Log In and save the document sample you require in your desired format.

- If you are new to our site, follow the steps below.

Form popularity

FAQ

Yes, the National Debt Relief Company is a legitimate organization that specializes in helping individuals manage their debts. They offer services focused on negotiating with creditors, which can lead to lower payments and potential debt forgiveness. If you're exploring state liability premises with debt relief, their resources may provide valuable insights.

It typically lists each person's assets, debts, and outlines how they'll be handled should the couple divorce later on. Prenups can be a valuable financial tool. While they may be difficult to think about while planning a wedding, prenups can provide comfort in knowing you'll be protected. Let's dive in.

A prenup usually covers financial topics like property division, debt allocation, alimony (i.e., spousal support), and more. Prenups can also cover non-financial topics like pet ownership, confidentiality, infidelity, etc.

Couples together must attend six hours of instruction together in a premarital preparation course.

For example, let's say John (breadwinner) and Jennie (stay-at-home mom) have a prenup with a lump sum clause of $30,000. This means that, upon the marriage coming to an end, John must pay Jennie $30,000. Keep in mind this is not alimony; it's separate from that. You can have a lump sum clause and alimony.

South Carolina courts will generally uphold a prenuptial agreement if both parties execute it knowingly and voluntarily. Both parties should be represented and advised by independent legal counsel to understand the agreement they are signing.

Key Points: Support and Division of Assets. Most prenuptial agreements address two key concepts: division of assets (defining and dividing the marital property between the two spouses) at the end of a marriage, and support (ongoing payments from one spouse to the other) upon dissolution of the marriage.

7 Things to Include in Your Prenuptial Agreement Premarital Assets. ... Premarital Debts. ... Spousal Support and Waiving the Right to Alimony. ... Financial Responsibilities. ... Provisions for Children from Previous Relationships. ... Business Earnings. ... Retirement Accounts.

Prenuptial Agreements are two-sided contracts signed before a couple is married. It outlines each spouse's assets and debts, and expected future assets and debts, and how they will be managed if the partners choose to part ways, voluntarily or by death.