Statement Social Security Sample Withheld

Description

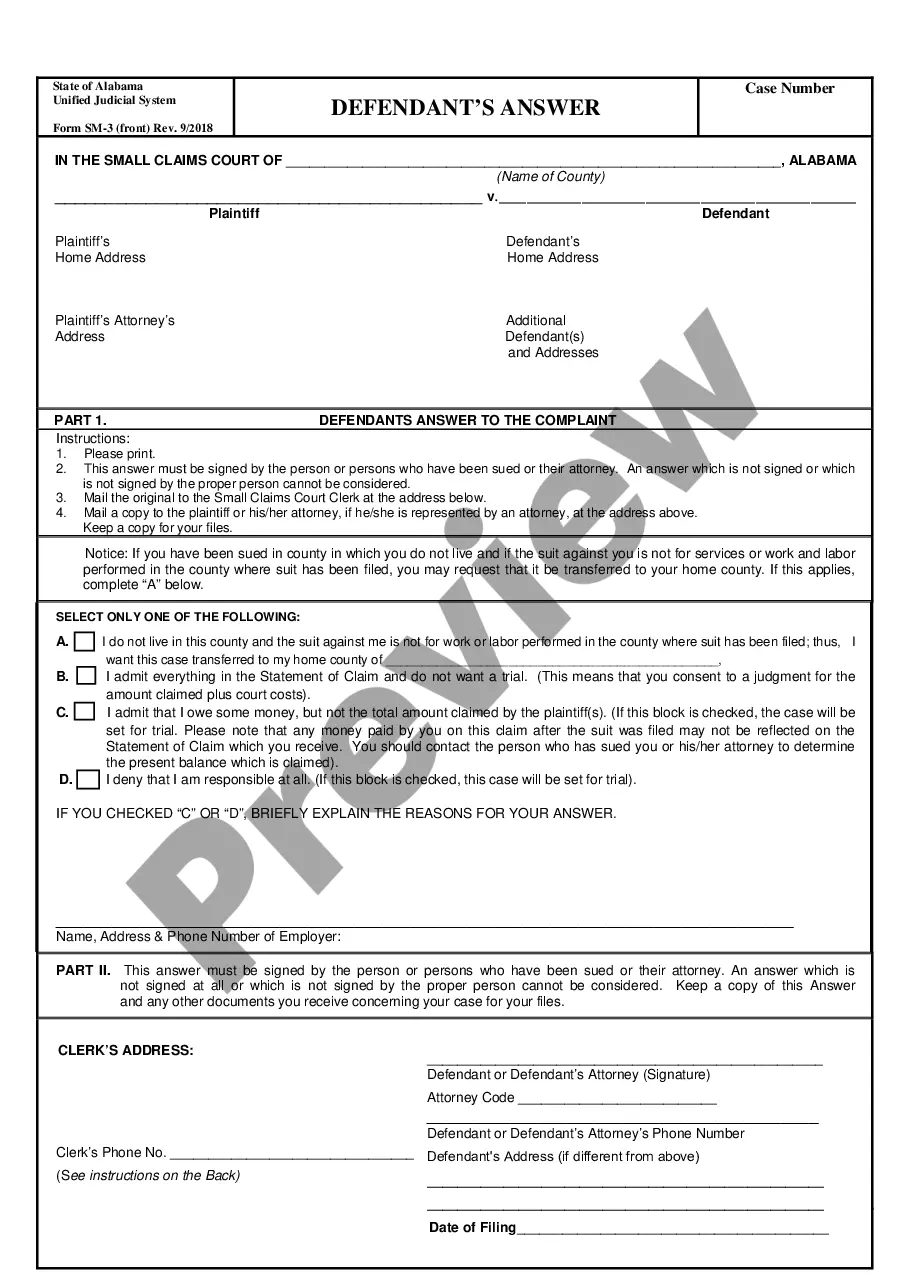

How to fill out Letter Or Statement To Social Security Administration In Order To Establish Claimant's Date Of Eligibility For Benefits?

Regardless of whether it's for commercial reasons or personal matters, individuals inevitably have to handle legal issues at some point in their lives. Filling out legal documents requires meticulous attention, starting with selecting the correct form template. For instance, if you choose an incorrect version of a Statement Social Security Sample Withheld, it will be rejected when you submit it. Hence, it is vital to have a reliable source of legal documents like US Legal Forms.

If you need to obtain a Statement Social Security Sample Withheld template, follow these simple steps: Get the sample you require by using the search bar or catalog navigation. Review the form’s details to confirm it aligns with your situation, state, and locality. Click on the form’s preview to inspect it. If it’s the wrong document, return to the search feature to find the Statement Social Security Sample Withheld template you actually need. Download the template once it meets your requirements. If you have a US Legal Forms account, just click Log in to access previously saved documents in My documents. If you haven’t created an account yet, you can obtain the form by clicking Buy now. Choose the appropriate pricing option. Complete the account registration form. Select your payment method: use a credit card or PayPal account. Choose the document format you prefer and download the Statement Social Security Sample Withheld. After it is saved, you can fill out the form using editing software or print it and complete it by hand.

Choose the appropriate pricing option. Complete the account registration form. Select your payment method: use a credit card or PayPal account. Choose the document format you prefer and download the Statement Social Security Sample Withheld. After it is saved, you can fill out the form using editing software or print it and complete it by hand.

- Regardless of whether it's for commercial reasons or personal matters, individuals inevitably have to handle legal issues at some point in their lives.

- Filling out legal documents requires meticulous attention, starting with selecting the correct form template.

- For instance, if you choose an incorrect version of a Statement Social Security Sample Withheld, it will be rejected when you submit it.

- Hence, it is vital to have a reliable source of legal documents like US Legal Forms.

- If you need to obtain a Statement Social Security Sample Withheld template, follow these simple steps.

- Get the sample you require by using the search bar or catalog navigation.

- Review the form’s details to confirm it aligns with your situation, state, and locality.

- Click on the form’s preview to inspect it.

- If it’s the wrong document, return to the search feature to find the Statement Social Security Sample Withheld template you actually need.

- Download the template once it meets your requirements.

- If you have a US Legal Forms account, just click Log in to access previously saved documents in My documents.

- If you haven’t created an account yet, you can obtain the form by clicking Buy now.

Form popularity

FAQ

From your Social Security income, federal taxes, and sometimes state taxes are withheld based on your earnings and personal circumstances. Other deductions may include Medicare premiums if applicable. It's essential to be aware of these withholdings to understand your net income better. Using a Statement social security sample withheld can clarify what these deductions look like on your benefit statements.

To instruct Social Security to withhold taxes from your benefits, you must complete a specific form, such as the IRS Form W-4V. This form allows you to specify the percentage of your benefits you want withheld. After submitting the form, review your payment statements to ensure that the correct amount is being withheld. A Statement social security sample withheld can serve as a reference to help you understand your options.

Filling out your withholding form requires accurate personal information, including your filing status and number of dependents. Make sure to follow the instructions carefully, as they guide you through each section. Additionally, consider using the IRS withholding calculator to estimate your tax withholding accurately. Using a Statement social security sample withheld can also help you visualize how the form should be completed.

Social Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $160,200 (in 2023), while the self-employed pay 12.4 percent.

Withholding on Social Security Benefits You can elect to have federal income tax withheld from your Social Security benefits if you think you'll end up owing taxes on some portion of them. Federal income tax can be withheld at a rate of 7%, 10%, 12%, or 22% as of the tax year 2022.

A beneficiary must file IRS Form W-4V, Voluntary Withholding Request with the Social Security Administration to authorize voluntary withholding of Federal Income tax. The IRS Form W-4V has allowed individuals to select one of several percentage rates of withholding since this option became available.

Example of Social Security Taxes The Social Security tax is a regressive tax, meaning that a larger portion of lower-income earners' total income is withheld, compared with that of higher-income earners.

Withholding on Social Security Benefits You can elect to have federal income tax withheld from your Social Security benefits if you think you'll end up owing taxes on some portion of them. Federal income tax can be withheld at a rate of 7%, 10%, 12%, or 22% as of the tax year 2022.