Who May File A Lien Against Real Property For Payment Of Services Rendered

Description

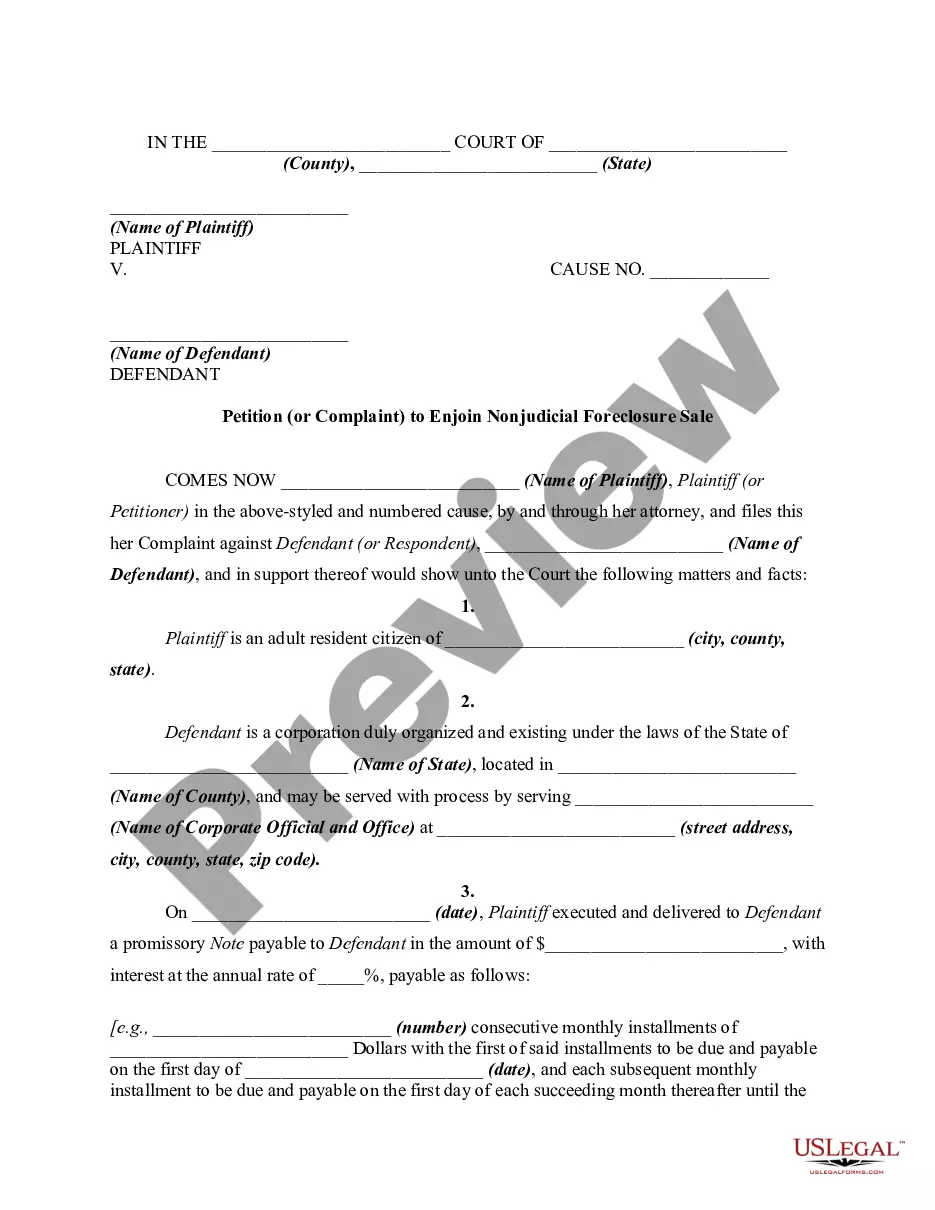

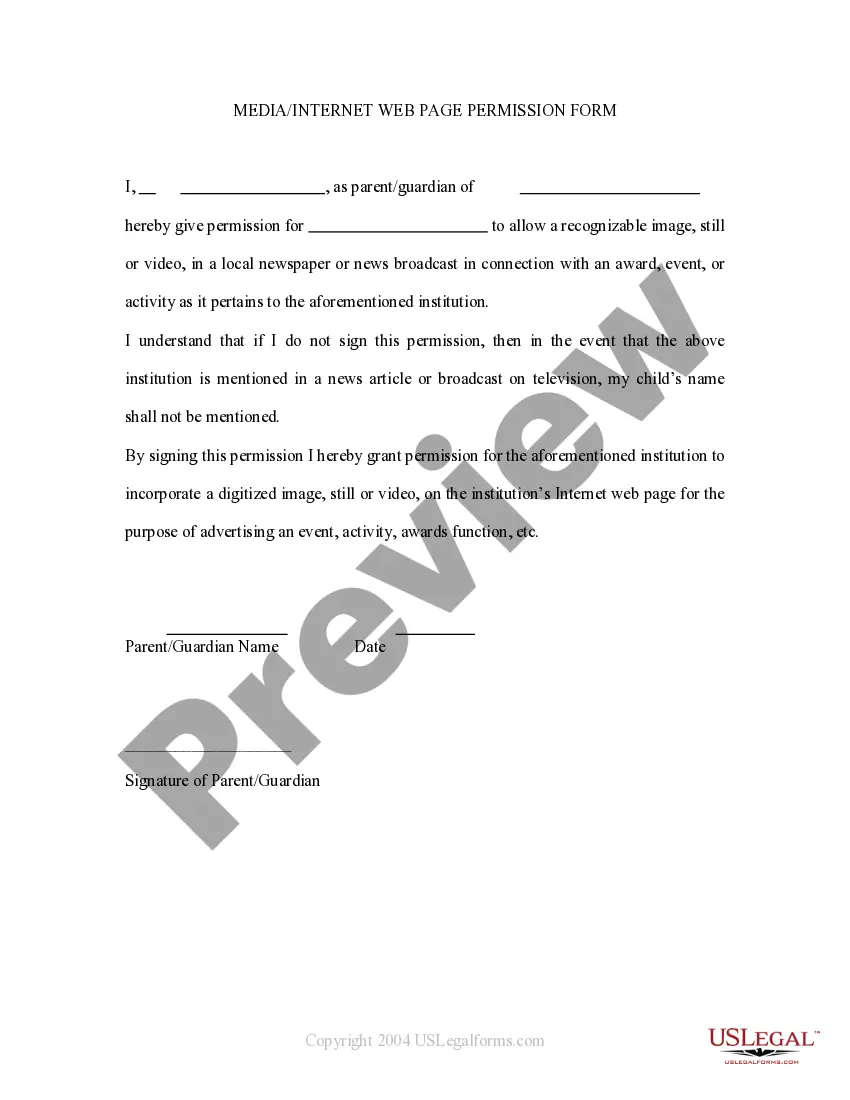

How to fill out Complaint Or Petition By Purchaser Against Possessor Of Real Property After A Foreclosure Sale Pursuant To A Deed Of Trust?

- Access your account if you're a returning user by clicking here. Verify that your subscription is active and proceed to download your required form by selecting the Download button.

- If you're new to US Legal Forms, start by reviewing the form description and preview mode to ensure it addresses your needs and complies with local jurisdiction laws.

- If you can't find the appropriate template, utilize the Search tab above to locate a suitable document. Once you find the right one, proceed to the next step.

- Purchase the necessary form by clicking the Buy Now button and selecting your preferred subscription plan, which requires you to create an account to access all library resources.

- Complete the payment process by entering your credit card information or using your PayPal account to secure your subscription.

- After your purchase, download the form to your device so you can complete it. You can also access it anytime from the My Forms section of your profile.

Utilizing US Legal Forms empowers individuals and attorneys alike by providing a vast library of over 85,000 legal forms that are easy to fill out and edit, ensuring accuracy in your legal documents.

In conclusion, filing a lien against real property for payment is straightforward with the right resources. US Legal Forms can guide you through this process seamlessly. Start your journey today and ensure your legal rights are protected!

Form popularity

FAQ

No, someone cannot put a lien on your property for no reason; there must be a legitimate claim for services or debt. Filing a lien requires documentation that proves the debt exists. Familiarizing yourself with who may file a lien against real property for payment of services rendered can help you protect your property from unjust claims.

The limitation on a lien often refers to the timeframe within which a lien must be filed or enforced. This period varies by jurisdiction and can range from a few months to several years, depending on the type of lien. To act in your best interest, it's important to understand these limitations and act promptly to secure payment for services rendered.

When real property is subject to a lien, it is said to be encumbered. This means that there is a legal claim that could impact the owner’s ability to sell or refinance the property until the lien is resolved. Understanding the implications of a lien can help property owners and service providers navigate their rights and responsibilities effectively.

The minimum amount to file a lien can vary by state, with some requiring a certain dollar threshold to initiate the process. Typically, the amount must be significant enough to warrant the administrative effort of filing. It’s essential to consult local laws or resources like USLegalForms to determine specific requirements in your area.

A lien is a legal claim against a property that serves as security for a debt. It may be filed when someone provides services or materials for a property and payment is not received. Understanding who may file a lien against real property for payment of services rendered helps protect your rights and ensure you receive compensation for your work.

The conditions for a lien to be valid generally require that there is an existing debt, a clearly defined agreement, and proper documentation filed with local authorities. Moreover, the lien claimant must provide evidence that the services rendered were necessary and were indeed completed. These conditions help uphold the integrity of the lien process, giving it legal standing. Being informed about who may file a lien against real property for payment of services rendered is essential for anyone involved in property transactions.

The document that creates a lien is often called a lien notice or lien statement, which must be filed with the appropriate local government office. This official record includes details about the parties involved and the debt owed. For business owners and contractors, having this document prepared correctly is crucial to enforce their rights. Additionally, utilizing platforms like USLegalForms can simplify the process of creating the necessary documentation for anyone looking to file a lien against real property for payment of services rendered.

A lien is created when an individual or entity has a legally enforceable claim over a property to secure payment for services or debt. This can occur through various means, such as a written contract, a court judgment, or statutory provisions. For example, when a contractor completes work on a property but goes unpaid, they may file a lien to assert their right to payment. Knowing who may file a lien against real property for payment of services rendered ensures that your investments are legally protected.

A lien on real estate is a legal right or interest that a lender has in the property, granted until the debt obligation is satisfied. Common examples include mortgages, mechanics' liens, and judgment liens. Essentially, if someone provides services or extends credit related to the property, they may file a lien against it for payment. Understanding who may file a lien against real property for payment of services rendered can help protect your assets.

The document that creates a lien on real estate is commonly referred to as a lien notice or a mechanic's lien. This legal instrument officially notifies the property owner and public that a claim exists against the property for unpaid services. Understanding what document creates a lien on real estate is crucial for both service providers and property owners. If you need help navigating the paperwork, platforms like US Legal Forms provide user-friendly templates to streamline the process.