Stock Assignment Separate From Certificate

Description

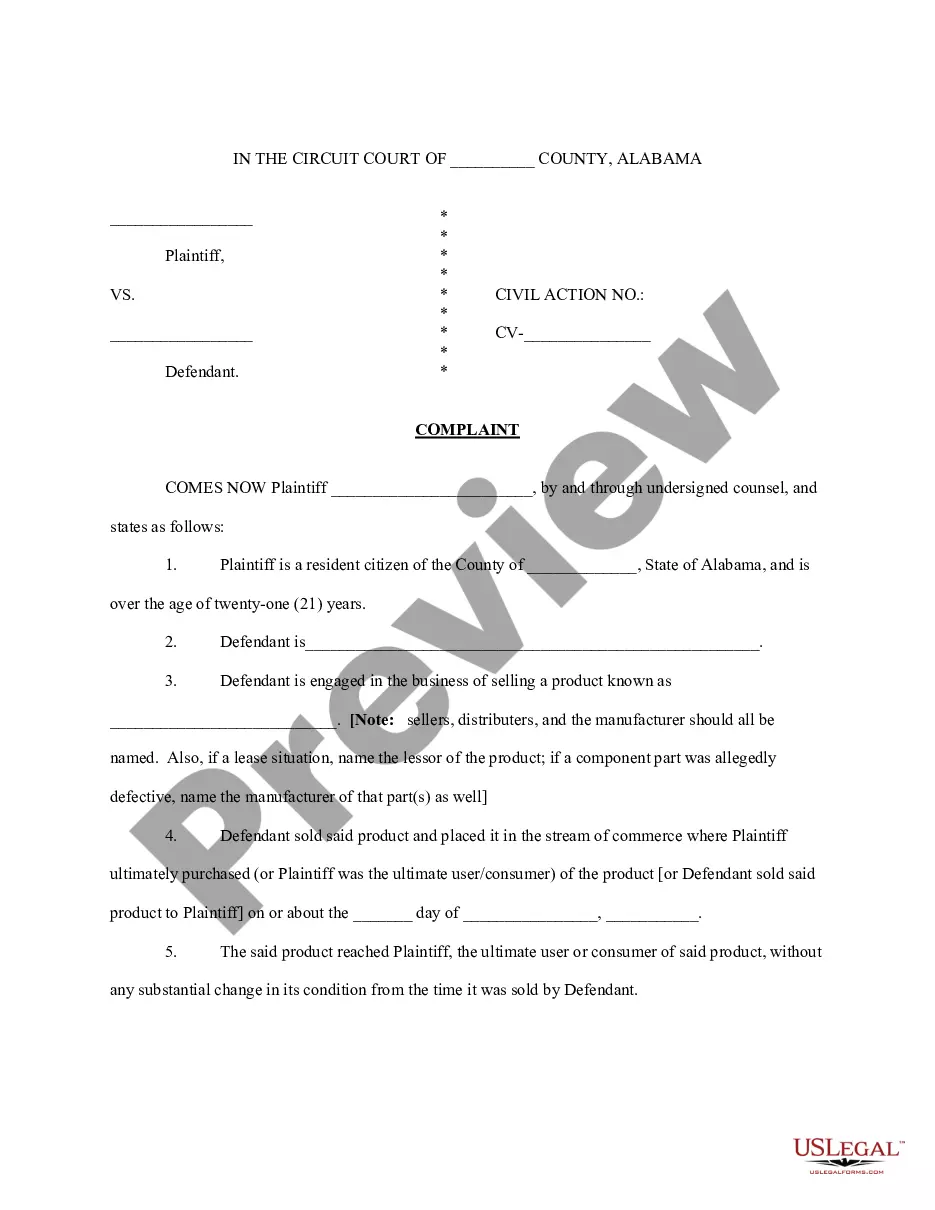

How to fill out Bill Of Sale And Assignment Of Stock By Separate Instrument?

- Log in to your US Legal Forms account if you're a returning user and verify that your subscription is active. If needed, renew your subscription according to your payment plan.

- Explore the preview mode and description of the stock assignment form to ensure it meets your specific requirements and jurisdiction.

- If the form doesn't match your needs, utilize the Search feature to find an alternative template that fits your criteria.

- After selecting the correct form, click the Buy Now button and choose a subscription plan that works for you. You must create an account to access the extensive library of forms.

- Complete your purchase by entering your payment information via credit card or PayPal.

- Finally, download the required form to your device and access it anytime via the My Forms section in your profile.

Using US Legal Forms not only saves time but also provides users with the confidence that their legal documents are accurate and compliant with regulations.

Start your simple journey to legal compliance today by visiting US Legal Forms and exploring their comprehensive offerings!

Form popularity

FAQ

When considering stock assignment separate from certificate, it's important to understand that stock certificates themselves do not physically split. Instead, a stock split typically means that the total number of shares increases while the overall value remains consistent. This process often adjusts the value per share but keeps the total investment unchanged. If you're looking to manage stock assignment and clarify this process, US Legal Forms can provide the necessary resources and documentation.

One disadvantage of a share certificate is the risk of loss or damage to the physical document. If you lose your certificate, it may take time and effort to replace it. Additionally, managing stocks digitally can be more efficient. By considering stock assignment separate from certificate methods, you can avoid these drawbacks and streamline your investment processes.

A share of stock represents your ownership in a company, while a certificate of stock is a physical document that evidences this ownership. In today's digital world, many people opt for electronic records rather than traditional certificates. Understanding this distinction can help you navigate your investments better, especially when exploring stock assignment separate from certificate options.

Typically, when you buy shares today, you do not receive a physical certificate. Most transactions occur electronically, and you receive an electronic record instead. This method enhances security and convenience. Additionally, knowing about stock assignment separate from certificate can help when managing your assets.

Another term for a stock certificate is a stock document or evidence of ownership. This document confirms your ownership of a specific number of shares in a company. However, with the shift to digital record-keeping, you may not need a physical certificate. This ties into the concept of stock assignment separate from certificate, which allows for straightforward handling of your investments.

Yes, you can sell your shares without having a physical share certificate. Many companies now use electronic records for their stocks, allowing for easier transactions. You just need to provide the necessary information about your holdings. Exploring stock assignment separate from certificate options can simplify your selling process.

To transfer stock without a certificate, you may need to provide a stock assignment separate from certificate along with identification and ownership records. It is essential to contact the stock issuer to understand their specific procedures. Utilizing legal resources, like uslegalforms, can simplify the process and help ensure your rights are well protected.

Yes, you typically need separate stock transfer forms for different classes of shares. Each class may have distinct requirements and regulations governing their transfer. To ensure compliance and a smooth transfer process, it’s often wise to consult legal expertise or platforms like uslegalforms, which provide tailored resources for your specific needs.

Selling stock with a certificate typically requires you to endorse the certificate before delivering it to the buyer or a broker. This endorsement confirms your intent to transfer ownership. Depending on the situation, a stock assignment separate from certificate may also expedite the sales process and facilitate secure transactions.

Transferring ownership of a stock often involves filling out a stock transfer form and possibly a stock assignment separate from certificate. This form should include details about both the sender and receiver of the stock. After completion, submit these forms to the issuing company for processing, ensuring a seamless transition of ownership.