Liability Parent Under Withholding

Description

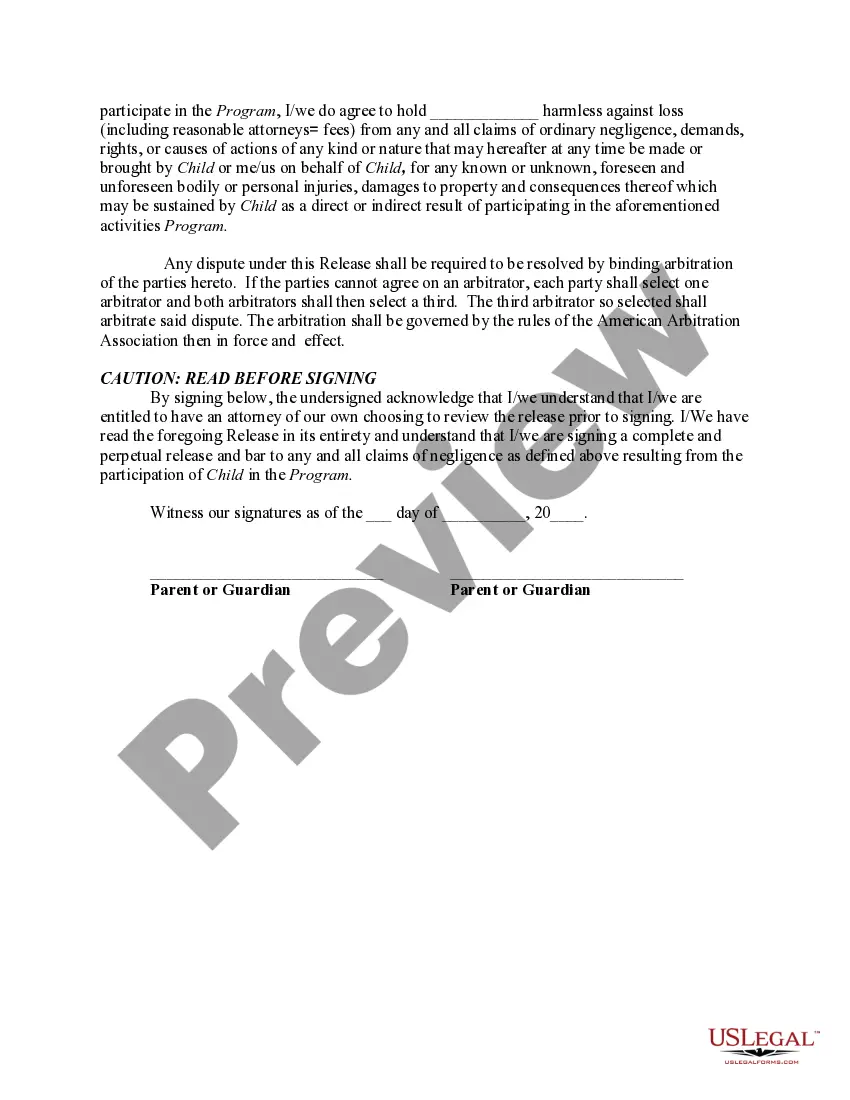

How to fill out Release From Liability By Parent Or Guardian For Students Under The Age Of 18 To Participate In On-Site Dance, Gymnastics And Yoga Classes?

Obtaining legal document samples that comply with federal and local regulations is essential, and the internet provides a multitude of options to select from.

However, what is the purpose of wasting time hunting for the accurately crafted Liability Parent Under Withholding template online when the US Legal Forms digital library already has such resources gathered in one location.

US Legal Forms is the largest online legal repository with over 85,000 fillable templates created by attorneys for any business and personal circumstances. They are easy to navigate with all documents categorized by state and intended use.

- Our specialists stay updated on legislative changes, ensuring your documents are current and compliant when obtaining a Liability Parent Under Withholding from our site.

- Acquiring a Liability Parent Under Withholding is straightforward for both existing and new clients.

- If you already possess an account with an active subscription, Log In and download the document sample you require in the appropriate format.

- If you're new to our platform, follow the guidelines below.

- Examine the template using the Preview feature or the text description to ensure it fits your needs.

Form popularity

FAQ

"This guide gives information for payers and agents who make payments to non-residents of Canada for income such as interest, dividends, rents, royalties, pensions, and acting services in a film or video production.

From a foreign beneficiary. Form W-8BEN must include an Individual Taxpayer Identification Number (ITIN). W-8BEN, withholding is required at the 30% tax rate regardless of any reduced withholding rate or modified withholding rules provided by an applicable tax treaty.

Child: The dependent child age is up to 18 years. Once the child is older than 18, you may be able to claim them if they have a mental or physical infirmity. Parent or grandparent: To make a claim, the person must be dependent on you and live with you in your home. Only one person can make the claim.

Withholding application form. If you request a refund of overpaid tax, we'll aim to issue your refund within 28 days of receiving all the required information. You must make your request in writing and attach evidence to support your application. Complete the application form online (it can be saved to your computer).

Completing the NR4 Summary Year end or tax year-end. ... Line 1 - Non-resident account number. ... Name and address of payer or agent. ... Line 88 - Total number of NR4 slips filed. ... Lines 18 and 22 - Amounts reported on NR4 slips. ... Lines 26 and 28 - Amounts reported on forms NR601 or NR602. ... Line 30 - Total.