Second Trial For Tushita

Description

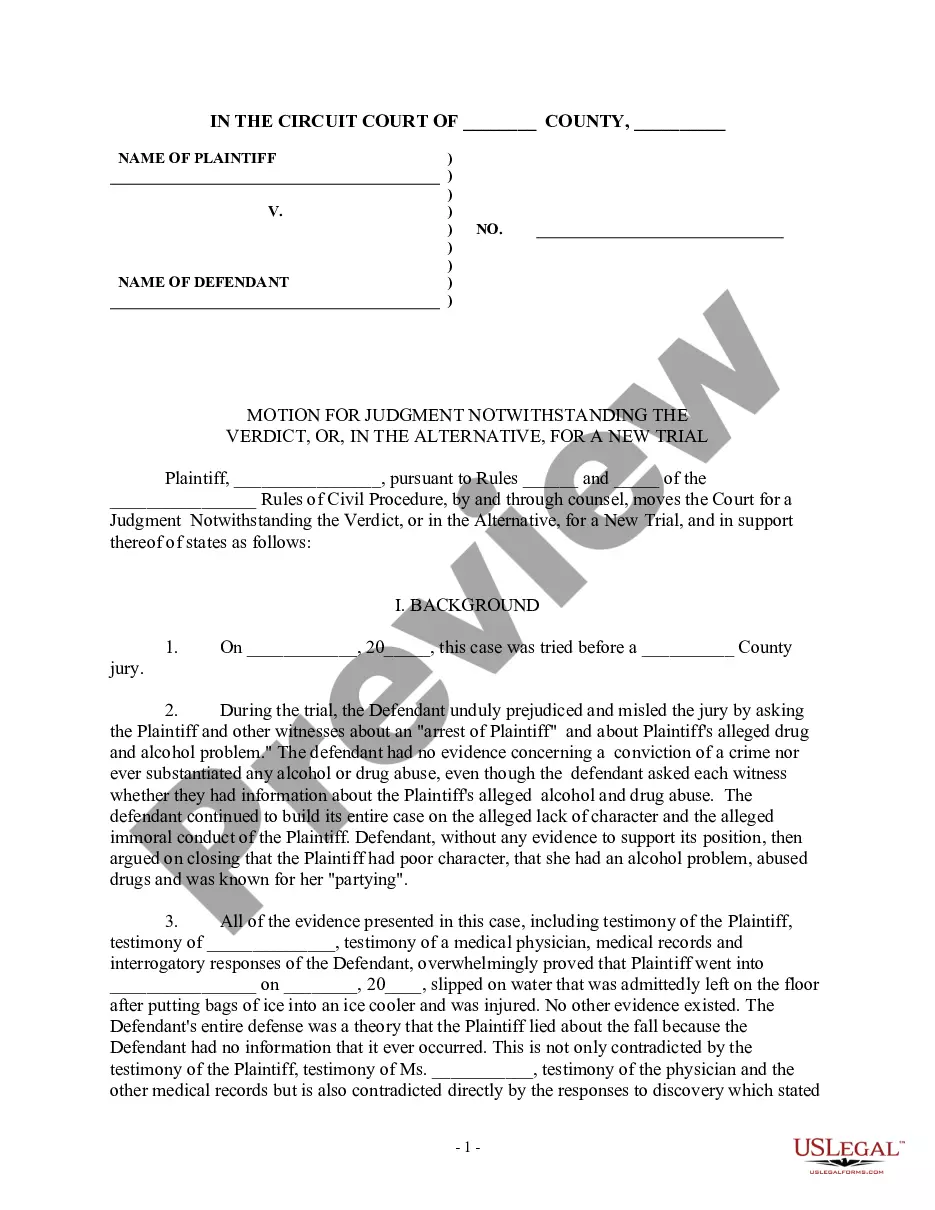

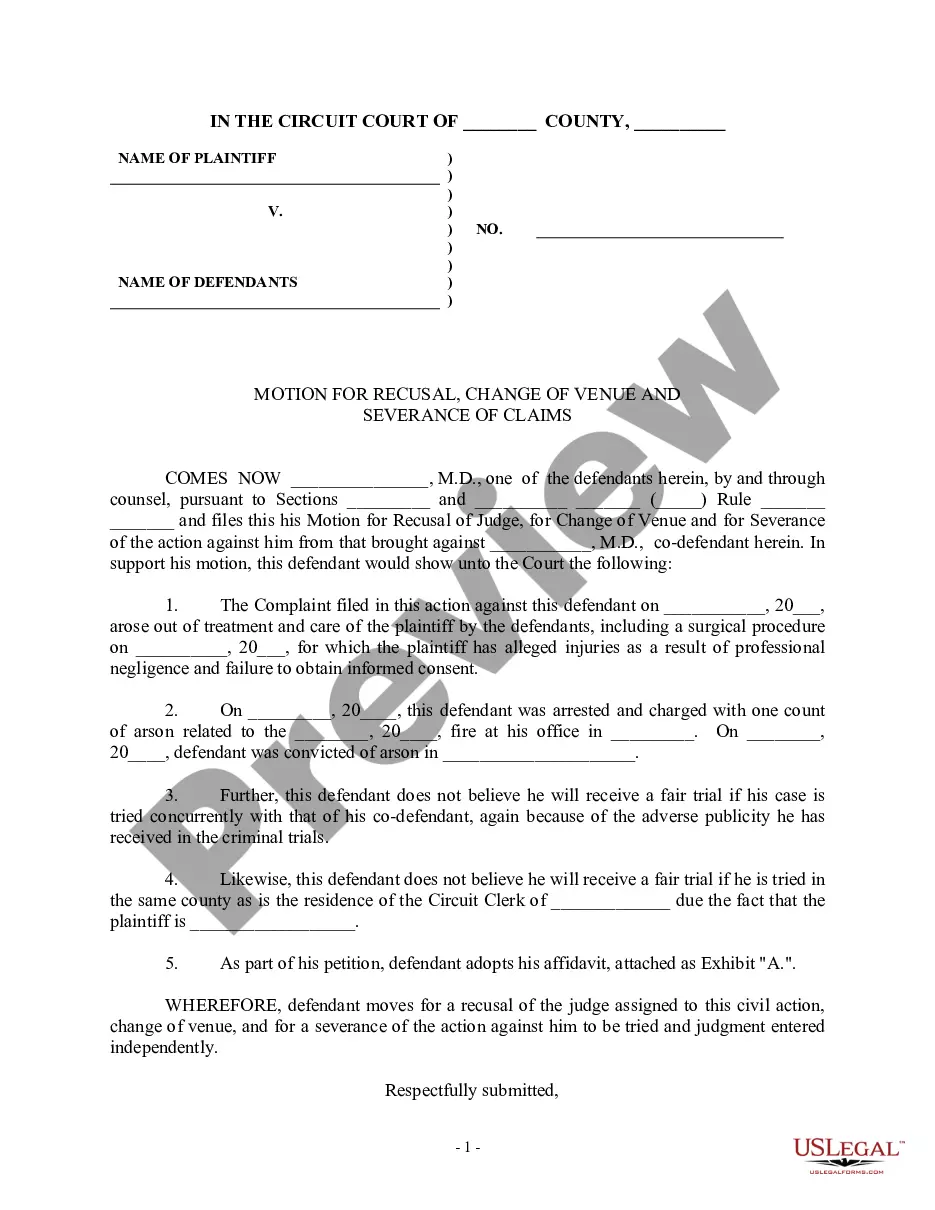

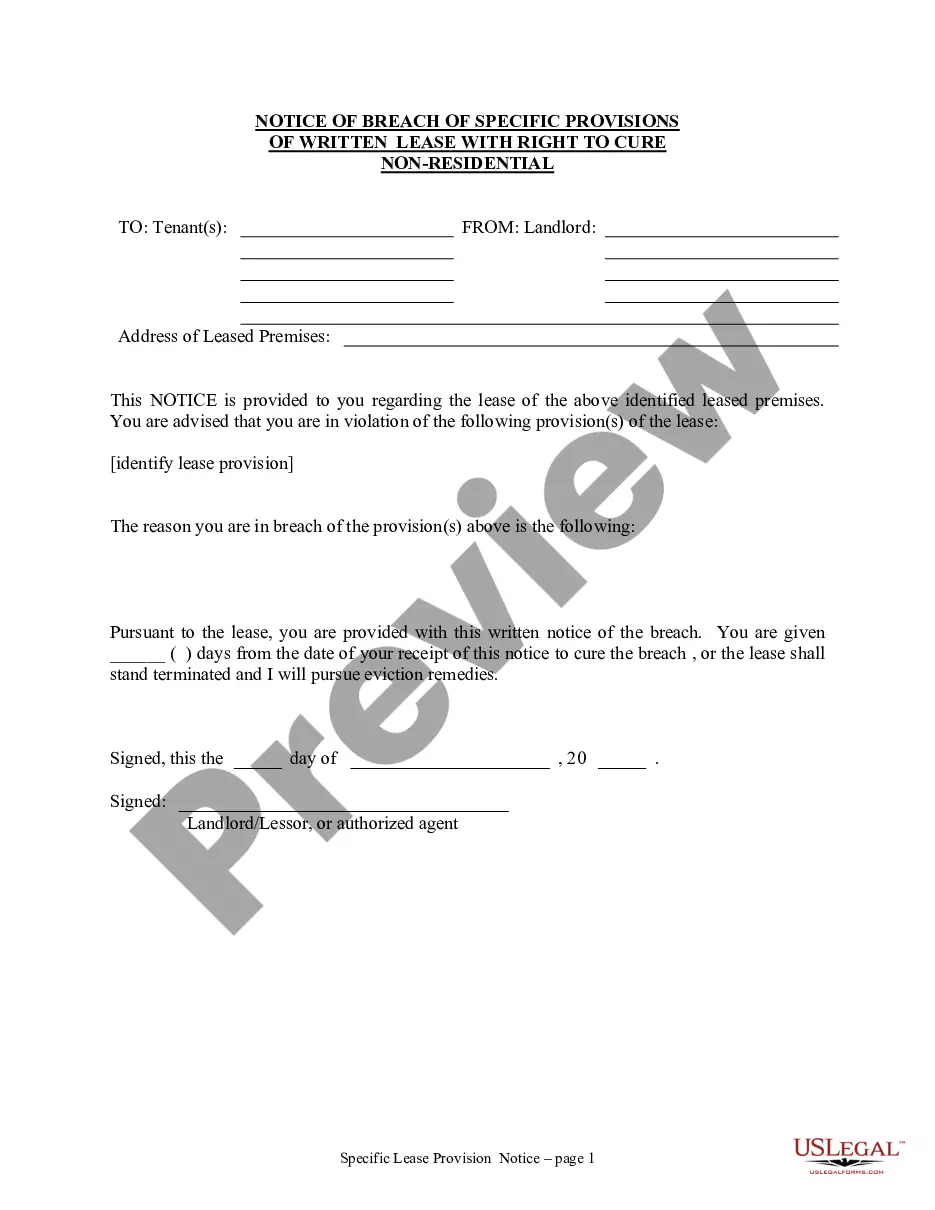

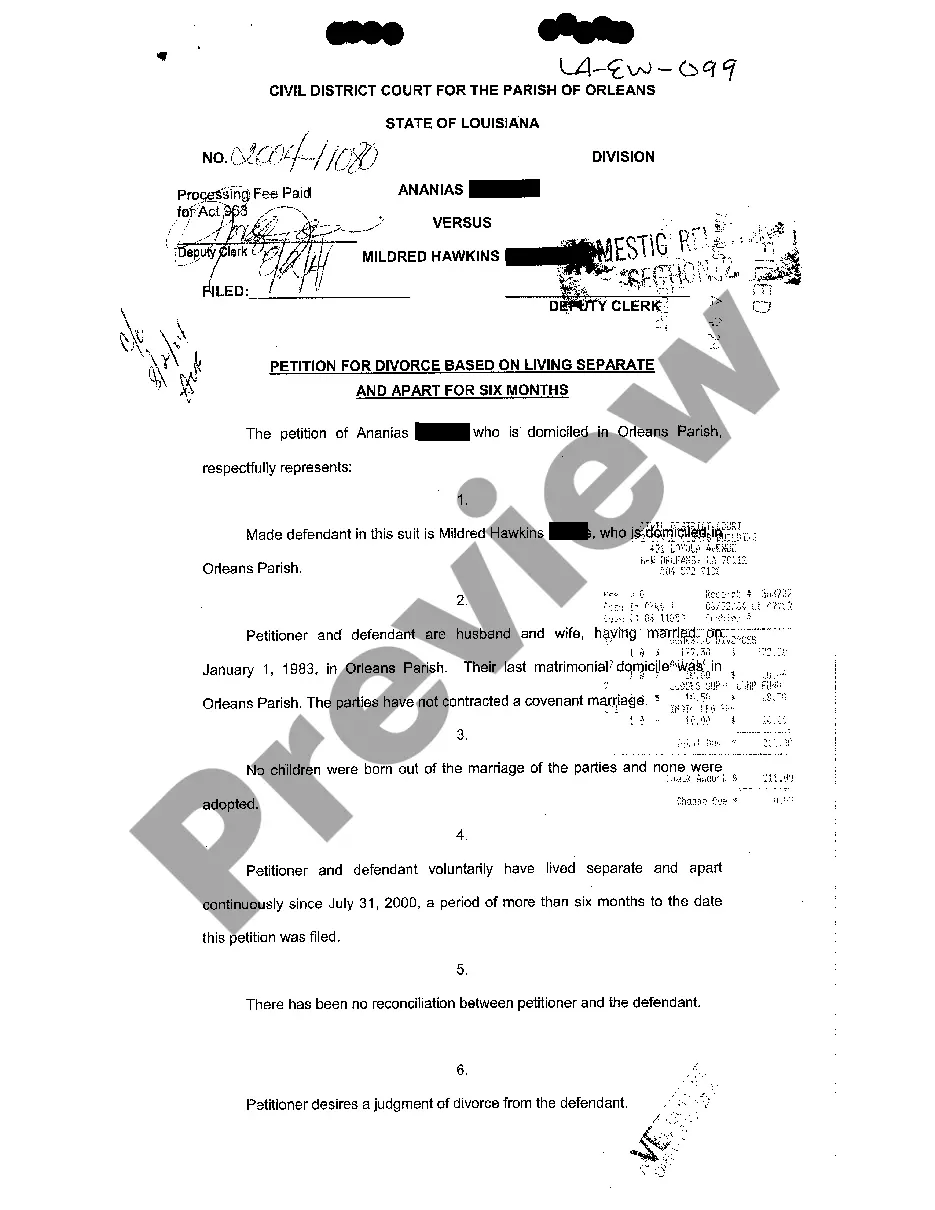

How to fill out Motion For New Trial?

Legal administration can be vexing, even for the most adept practitioners.

When you are looking for a Second Trial For Tushita and lack the time to devote to locating the suitable and current version, the processes can be anxiety-inducing.

Tap into a resource library of articles, guides, and materials pertinent to your situation and requirements.

Save time and effort searching for the forms you require, and take advantage of US Legal Forms’ sophisticated search and Review tool to obtain Second Trial For Tushita.

Confirm that this is the correct form by previewing it and examining its description.

- If you possess a subscription, Log In to your US Legal Forms account.

- Search for the form and acquire it.

- Check your My documents tab to view the documents you have previously saved and to manage your folders as desired.

- If it's your first encounter with US Legal Forms, create an account and gain unlimited access to all the platform's benefits.

- Here are the steps to follow after acquiring the form you need.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses any needs you might have, from personal to commercial papers, in a single location.

- Utilize cutting-edge tools to complete and manage your Second Trial For Tushita.

Form popularity

FAQ

You need to be at least level 300 to attempt the Tushita puzzle in the game. Reaching this level opens various possibilities for players to interact with challenging aspects of the game. Completing the puzzle not only enhances your skills but also prepares you for the second trial for Tushita. Remember, leveling up can lead to exciting rewards, so embrace every opportunity during your journey.

After waiting for five minutes, players can acquire Tushita by checking specific spawn points throughout the game. Time your exploration wisely, as Tushita may appear at random intervals. Keep an eye on game announcements or community updates for tips on when and where the fruit might be available. Engaging in discussions with fellow players can provide insights into improving your chances during your second trial for Tushita.

Payment Information The one-time rebate law provided payments of up to $1,300 for eligible taxpayers, including: $520 for married couples filing a joint return with adjusted gross income of $150,000 or less. $260 for all other individuals with adjusted gross income of $75,000 or less.

Before completing the form, you should have an in-depth conversation with your agent, to be sure you trust this person to act on your behalf. For the PoA to be legal, you must sign form in front of a notary or have it signed by two witnesses.

Who is eligible for the rebate? All Minnesota taxpayers with a 2021 adjusted gross income of $75,000 or less are eligible for a payment of $260.

Minimum Filing Requirement If you're Under Age 65202212,90027,150202112,52526,350202012,40026,100201912,20025,7005 more rows ?

Tax Rebate August 2023: $1300 tax rebate is coming; find out here if you'll get it | Marca.

All Minnesota taxpayers with a 2021 adjusted gross income of $75,000 or less are eligible for a payment of $260. Married couples that jointly filed taxes in 2021 with an adjusted gross income of $150,000 or less are eligible for a payment of $520.

There is very good news for taxpayers in Minnesota, USA, given that a stimulus checks September 2023 program is being rolled out in this state. Governor Tim Walz has organised a new scheme that will give many families stimulus checks in the form of a surprise tax rebate.

This rebate was part of the historic 2023 One Minnesota Budget, signed into law by Governor Tim Walz on . ?This rebate will help millions of Minnesotans pay for everyday expenses such as groceries, school supplies, rent, or childcare,? said Revenue Commissioner Paul Marquart.