Amount Support With Texas

Description

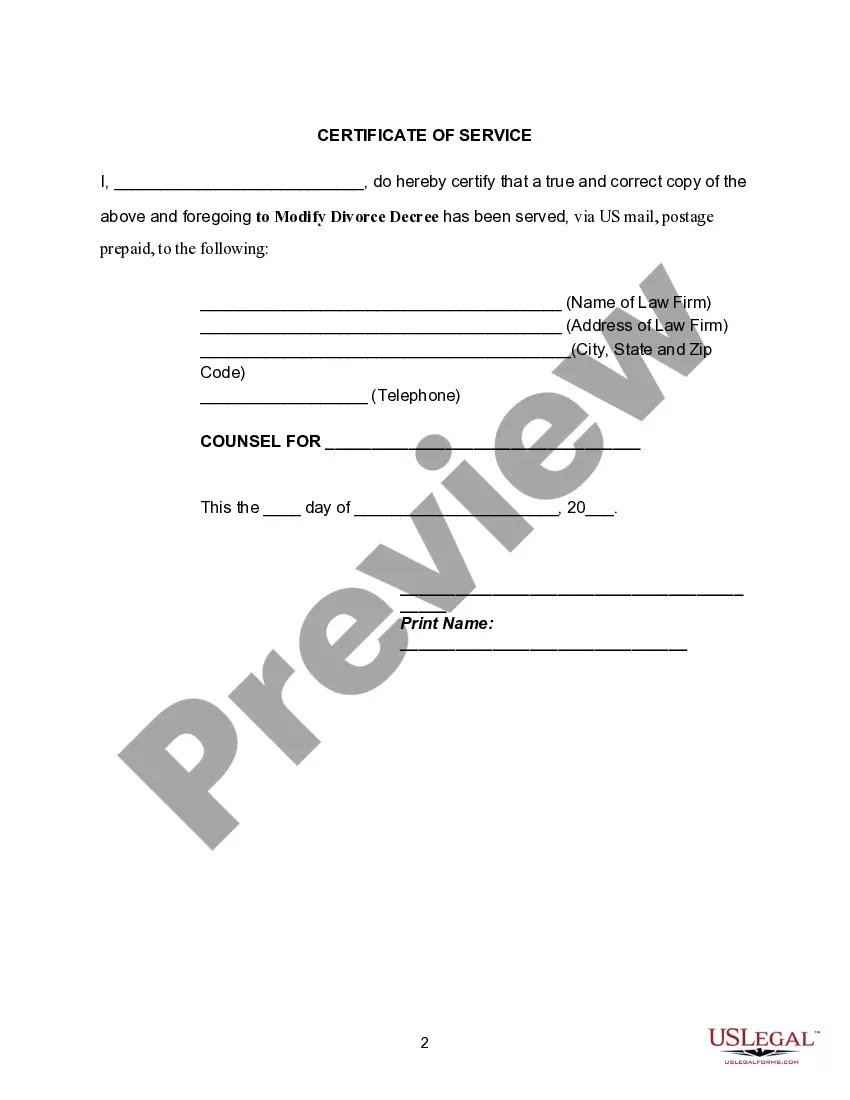

How to fill out Motion To Modify Or Amend Divorce Decree To Provide For Increase In Amount Of Child Support?

Handling legal documents can be daunting, even for seasoned experts.

If you require an Amount Support With Texas and lack the time to search for the suitable and updated version, the procedures can be overwhelming.

Access a valuable collection of articles, tutorials, handbooks, and materials pertinent to your circumstances and requirements.

Save time and energy searching for the documents you need, and use US Legal Forms’ enhanced search and Review feature to locate Amount Support With Texas and obtain it.

Utilize the US Legal Forms online catalog, supported by 25 years of expertise and reliability. Transform your everyday document management into a smooth and user-friendly process today.

- If you have a monthly subscription, Log Into your US Legal Forms account, search for the form, and obtain it.

- Check your My documents tab to view the documents you have previously downloaded and manage your folders as desired.

- If this is your first visit to US Legal Forms, create a free account and gain unlimited access to all the library’s benefits.

- The following are the steps to take once you receive the form you require.

- Confirm this is the correct document by previewing it and checking its description.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses all your needs, ranging from personal to business documents, all in one location.

- Employ advanced tools to complete and manage your Amount Support With Texas.

Form popularity

FAQ

The price to start an Ohio LLC is $99. Forming your LLC in Ohio starts with filing Articles of Organization with Ohio's Secretary of State. Regular filings (mail, in person, and online) take about 3-7 days to be processed. Expedited filings are available for additional fees, starting at $100 for 2-day process.

Below is a breakdown of the process of forming an LLC in Ohio. Find a Business Idea. Create a Business Plan. Choose a Name for Your Ohio LLC. Appoint a Statutory Agent. File Articles of Organization. Receive Your LLC Certificate. Draft an LLC Operating Agreement. Obtain an EIN.

File Your LLC Ohio Articles of Organization For LLCs based in Ohio, you'll need to fill out and file Form 610. For LLCs organized in other states that wish to do business in Ohio, Form 617 is the correct form. The filing fee for both forms is $99 each, and you can file either online or via mail.

Search for businesses registered to do business in the State of Ohio. Entrepreneurs can use the Ohio Secretary of State's Business Search portal to search for available business names.

No, you don't need to renew your LLC every year in Ohio or file annual reports. Instead, you have to consistently maintain state obligations like registered agent requirements and business levies.

Starting an LLC in Ohio is absolutely free with Inc Authority. Simply pay the mandatory state filing fee of $99 and Inc Authority will take care of the rest for you at no extra charge.

You can form an Ohio LLC online or by submitting Form 610, Articles of Organization for a Domestic Limited Liability Company. The filing fee is $99. To file online, visit the Ohio Secretary of State's business filing portal. Otherwise, you may download the documents and mail them to P.O. Box 670, Columbus, Ohio 43216.

Search for businesses registered to do business in the State of Ohio. You can use the Ohio Secretary of State's Business Search portal to see if a business is registered to do business in Ohio.