Tax Sale Taxes For Students Everfi Answers 1098-t

Description

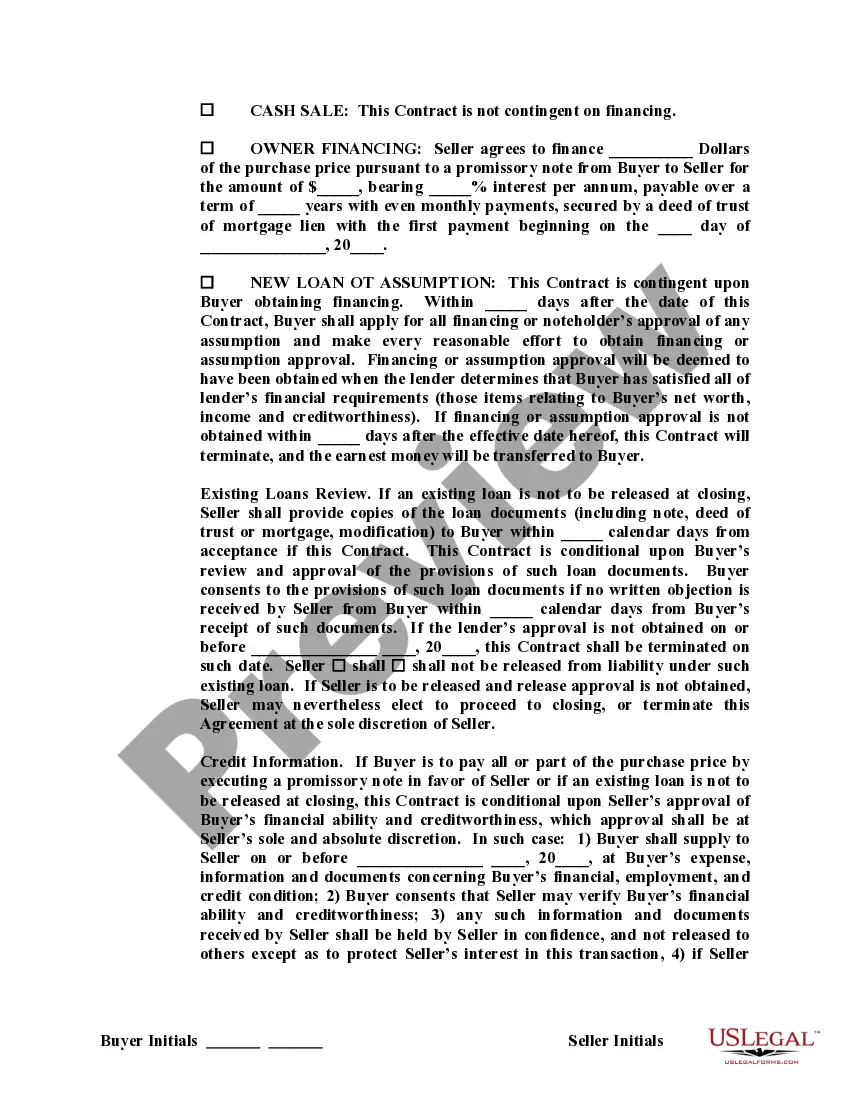

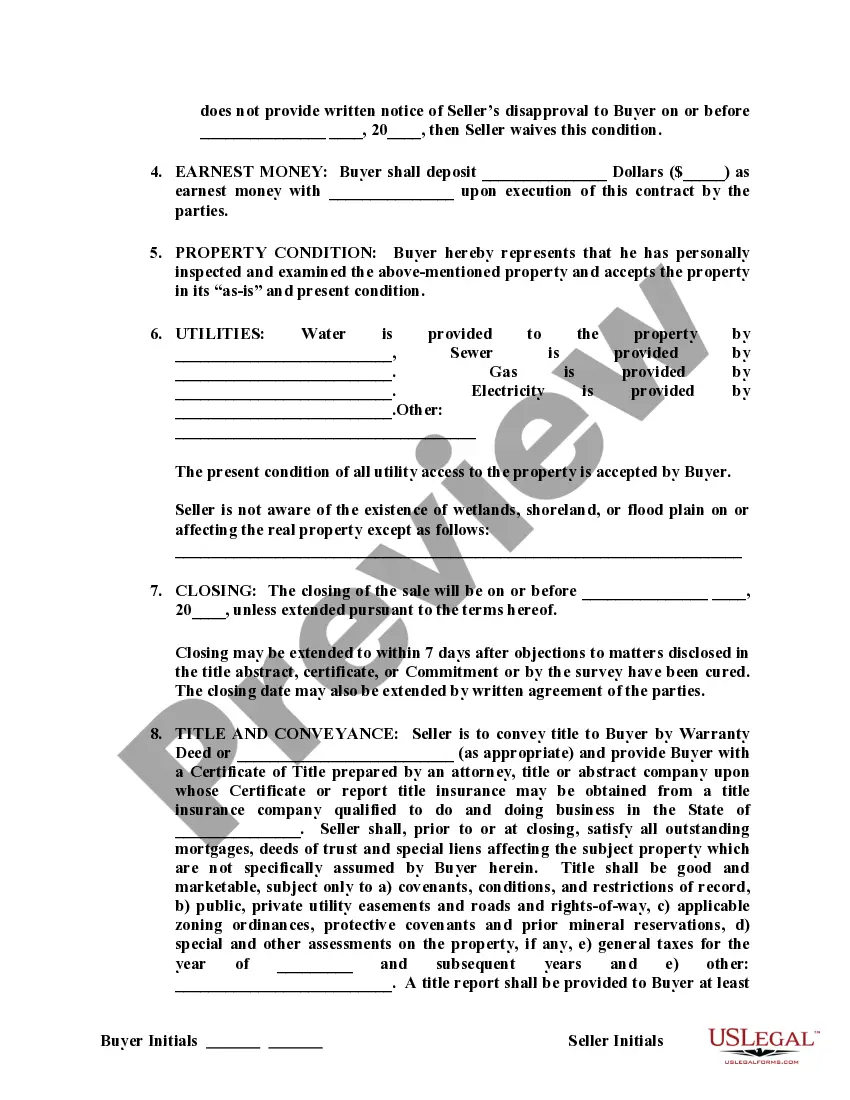

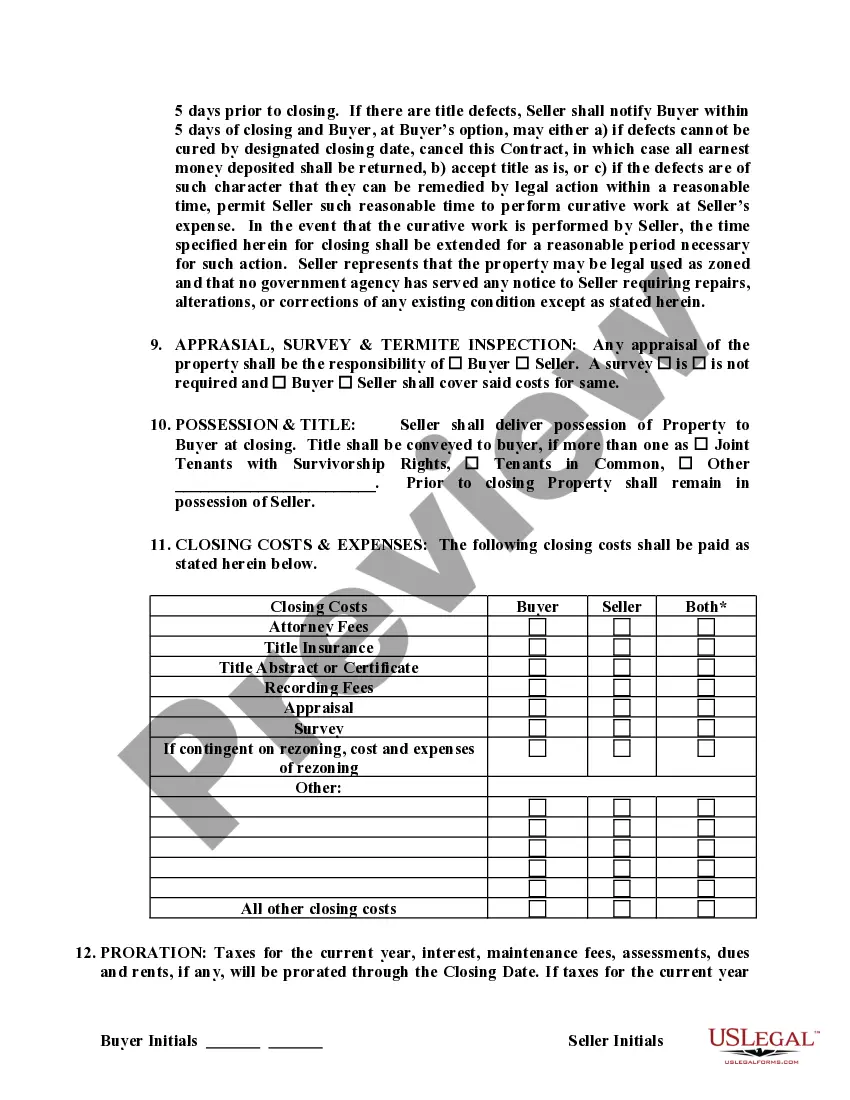

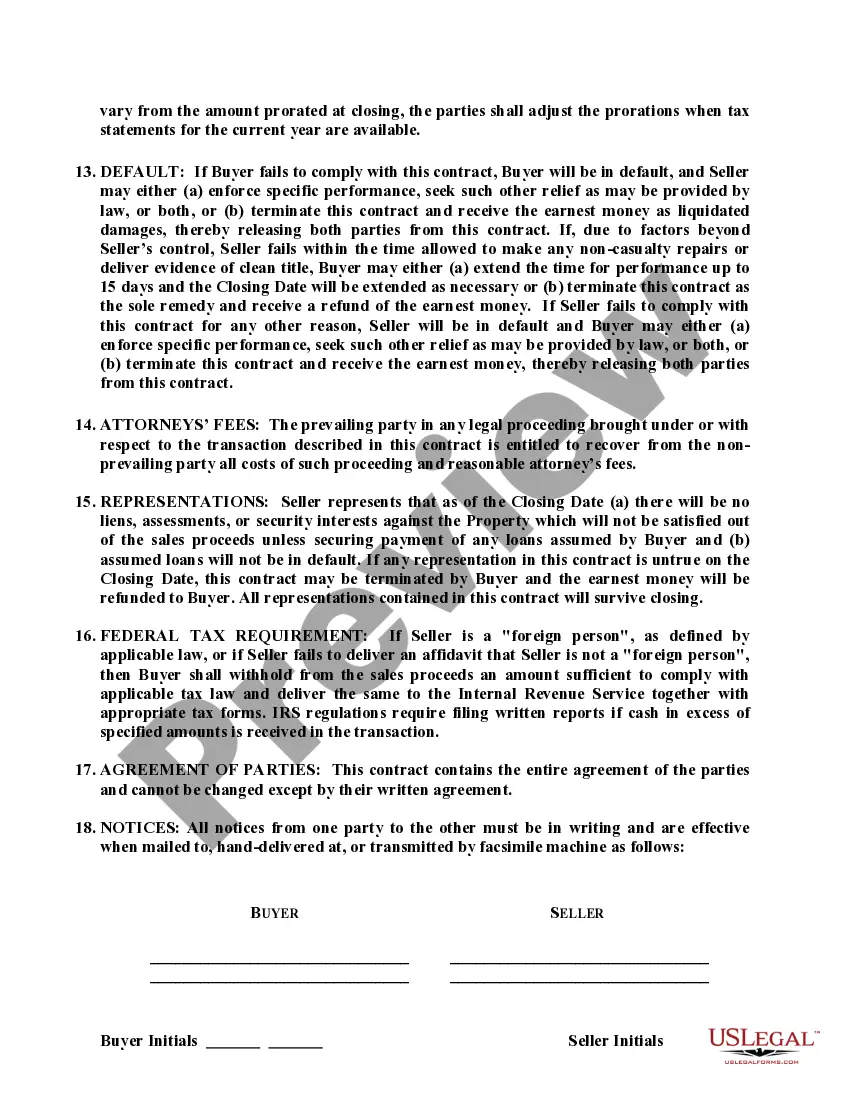

How to fill out Contract For The Sale And Purchase Of Real Estate - No Broker - Residential Lot Or Land?

Finding a reliable source for the most up-to-date and suitable legal documents is half the challenge of managing bureaucracy.

Identifying the correct legal forms requires accuracy and diligence, which is why it's crucial to obtain samples of Tax Sale Taxes For Students Everfi Answers 1098-t exclusively from credible providers, such as US Legal Forms.

Once the document is on your device, you can edit it using the editor or print it out to fill by hand. Eliminate the hassle associated with your legal documentation. Browse the extensive US Legal Forms catalog to locate legal samples, verify their suitability for your case, and download them right away.

- Utilize the catalog navigation or search bar to find your document.

- Review the form's details to ensure it meets the criteria of your state and county.

- Preview the form, if available, to confirm it is the document you need.

- Return to the search if the Tax Sale Taxes For Students Everfi Answers 1098-t does not fulfill your requirements.

- If you are confident about the document's applicability, proceed to download it.

- If you hold a registered account, click Log in to verify and access your chosen documents in My documents.

- If you do not have an account yet, click Buy now to acquire the document.

- Select the pricing option that fits your needs.

- Move ahead to the registration to finalize your purchase.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Tax Sale Taxes For Students Everfi Answers 1098-t.

Form popularity

FAQ

When considering who should claim the 1098-T tax form, both parents and students must evaluate their financial situations. Generally, if the student qualifies as a dependent, parents can claim the 1098-T to benefit from tax deductions. However, if the student has sufficient income or is not a dependent, they can claim the 1098-T themselves. Understanding tax sale taxes for students everfi answers 1098-t can help make this decision clearer, so ensure you review your options thoroughly.

You will report your 1098-T on your federal tax return, specifically on Form 8863 if you are claiming education credits. Ensure you fill out the necessary sections that ask for the amounts listed on your 1098-T. Proper placement of this form maximizes your chances of receiving all eligible tax benefits. Thus, being informed about tax sale taxes for students everfi answers 1098-t is essential during tax season.

Yes, you should include your 1098-T on your tax return. This form provides crucial information that can affect your tax refund, especially if you qualify for education tax credits. By including this information, you better position yourself to benefit from available deductions and credits. Remember, understanding tax sale taxes for students everfi answers 1098-t can help you realize significant savings.

Filling out a 1098-T in TurboTax is straightforward. Start by importing your 1098-T form directly from your school, or enter the information manually. Ensure you include the amounts associated with qualified tuition, fees, and scholarships. This will help you understand your tax sale taxes for students everfi answers 1098-t accurately while maximizing your potential for education-related tax credits.

To calculate the amounts needed for the 1098-T, gather your tuition payments and any scholarships or grants received throughout the year. The form should reflect the total tuition charged for the academic year minus any adjustments from previous terms. By accurately calculating these amounts, you can efficiently leverage the tax benefits associated with education, helping to manage your tax sale taxes for students Everfi answers 1098-T. If in doubt, consider using resources like USLegalForms to assist you.

When filing taxes, you can use the 1098-T form to report qualified educational expenses on your tax return. It helps determine eligibility for various tax credits and deductions, such as the American Opportunity Credit or the Lifetime Learning Credit. Understanding how to leverage the information on the 1098-T can simplify the process and potentially reduce your liability related to tax sale taxes for students Everfi answers 1098-T. Remember, accurate reporting can lead to substantial savings.

The 1098-T tuition statement contains essential data about the total amount billed for qualified tuition and related expenses, as well as any scholarships and grants received during the year. This information is crucial for students when calculating potential tax deductions or credits. It is a key component in understanding your financial situation in relation to tax sale taxes for students Everfi answers 1098-T. Always ensure you review the form carefully to gather the right details for tax filing.

T form includes crucial details such as the institution's name, the student's identification number, and the amounts for tuition, scholarships, and adjustments. This data is vital for students as it helps them understand their educational costs and potential tax credits. Keeping track of this information can significantly impact tax sale taxes for students Everfi answers 1098T, ensuring you maximize your possible savings. Remember, this form can also be used to verify your educational expenses.

To enter a 1098 on your tax return, you first need to obtain a copy of the form from your educational institution. Next, you will report the figures from the 1098-T in the appropriate section of your tax return form, typically on Form 1040. Correctly entering this information is vital for accurately claiming your education benefits and alleviating tax sale taxes for students Everfi answers 1098-T. If you're unsure, consult a tax professional to guide you through the process.

The purpose of the 1098 tax form is to inform the IRS about expenses related to educational costs, such as tuition and fees. By providing this information, the form helps students and their families claim education-related tax benefits like credits or deductions. It's essential for managing tax sale taxes for students Everfi answers 1098-T, making the tax filing process straightforward. Knowing the purpose of this form enhances your understanding of your financial responsibilities.