Addendum To Will For Personal Property

Description

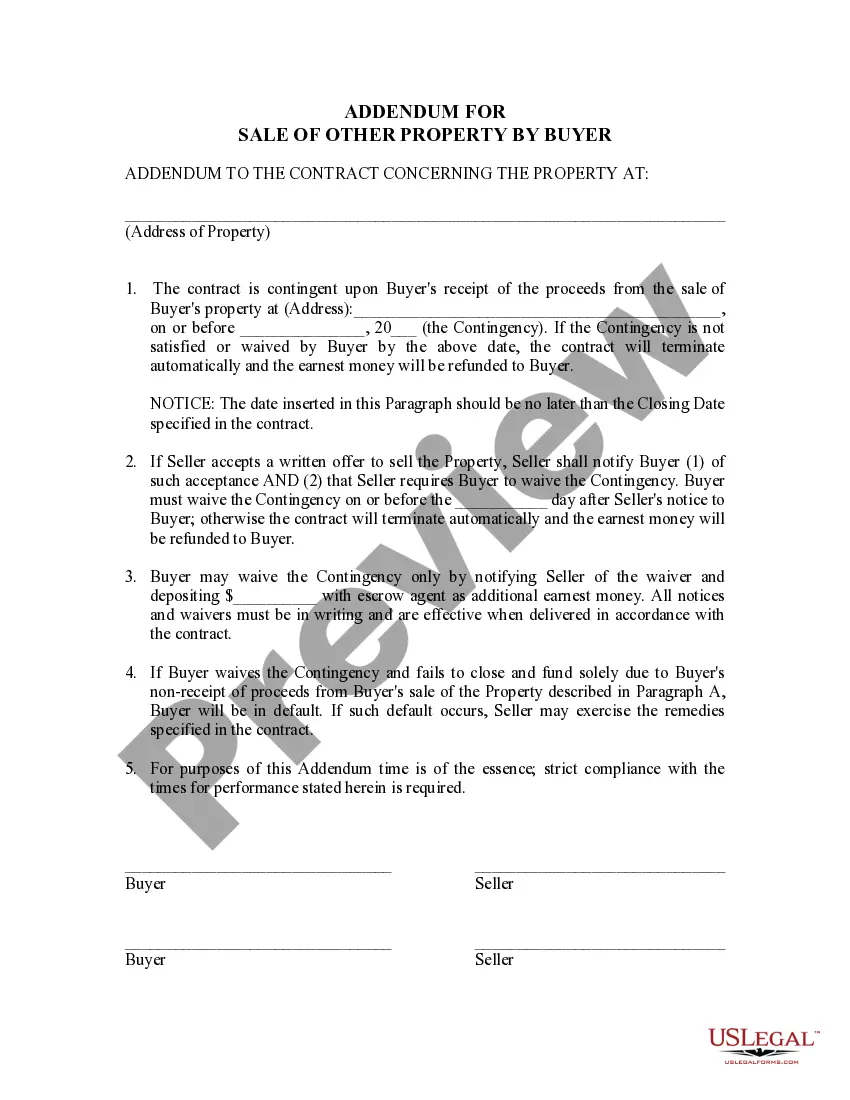

How to fill out Addendum For Sale Of Other Property By Buyer?

Accessing legal documents that adhere to federal and state regulations is essential, and the internet provides a wide array of options to select from.

However, what’s the benefit of spending time searching for the properly constructed Addendum To Will For Personal Property template online when the US Legal Forms digital library already has such documents compiled in one location.

US Legal Forms is the premier online legal repository with more than 85,000 fillable documents crafted by lawyers for any professional and personal situation. They are easy to navigate with all forms categorized by state and intended use. Our specialists keep pace with legislative changes, ensuring that your documents are always current and compliant when acquiring an Addendum To Will For Personal Property from our platform.

All documents available through US Legal Forms are reusable. To retrieve and complete previously acquired forms, access the My documents tab in your account. Experience the most extensive and user-friendly legal document service!

- Acquiring an Addendum To Will For Personal Property is straightforward and fast for both existing and new users.

- If you currently possess an account with an active subscription, Log In and save the document sample you require in your desired format.

- If you are new to our platform, follow the procedures below.

- Examine the template using the Preview feature or through the text outline to confirm it fulfills your requirements.

- If necessary, find another sample using the search function located at the top of the page.

- Click Buy Now once you’ve found the suitable form and select a subscription plan.

- Establish an account or sign in and complete a payment via PayPal or a credit card.

- Choose the appropriate format for your Addendum To Will For Personal Property and download it.

Form popularity

FAQ

As a type of specialty home financing, a land contract is similar to a mortgage. However, rather than borrowing money from a lender or bank to buy real estate, the buyer makes payments to the real estate owner, or seller, until the purchase price is paid in full.

Unlike some states, Michigan does not require that sellers involve a lawyer in the house-selling transaction. Even if it's not required, you might decide to engage a lawyer at some point in the process?for example, to review the final contract or to assist with closing details.

In Michigan, sellers typically pay for the title and closing service fees, transfer taxes, and recording fees at closing. Optional costs for sellers include buyer incentives, pro-rated property taxes, or for an attorney. Buyers, on the other hand, pay for things like mortgage, appraisal, and inspection fees.

One important requirement is that all contracts for purchase or sale of real estate must be in writing. An offer made and accepted in a phone call or conversation is not enforceable. The buyer in a FSBO process should be prepared to make an offer in writing.

How to sell a house by owner Determine the fair market value. ... List your property and find a buyer. ... Negotiate and secure an offer. ... Create a Real Estate Purchase Agreement and secure finances. ... Transfer the property title.

So whether a seller selling a property on a land contract actually triggers due-on-sale provisions is debatable, since the land contract purchaser does not obtain title until they pay off the contract. Therefore, memorandums of a land contract are recorded in the county to put the world on notice of a transaction.

Steps to Sell a House by Owner in Michigan Price Your Home for Sale. Prep Your House. Market Your Property. Manage Showings. Review, Compare, and Negotiate Offers. Close the Sale with a Professional.

How Much Are Transfer Taxes in Michigan? The state transfer tax rate in Michigan is $3.75 for every $500 of property value, or 0.75% of the transferred property's value. In addition to the state tax, each individual county levies an additional transfer tax of $0.55 per $500.