Addendum Buyer Seller Withholding

Description

How to fill out Addendum For Sale Of Other Property By Buyer?

Using legal document samples that meet the federal and state regulations is essential, and the internet offers numerous options to pick from. But what’s the point in wasting time searching for the right Addendum Buyer Seller Withholding sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the greatest online legal library with over 85,000 fillable templates drafted by lawyers for any business and personal scenario. They are simple to browse with all documents arranged by state and purpose of use. Our experts keep up with legislative changes, so you can always be sure your paperwork is up to date and compliant when acquiring a Addendum Buyer Seller Withholding from our website.

Getting a Addendum Buyer Seller Withholding is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the preferred format. If you are new to our website, adhere to the steps below:

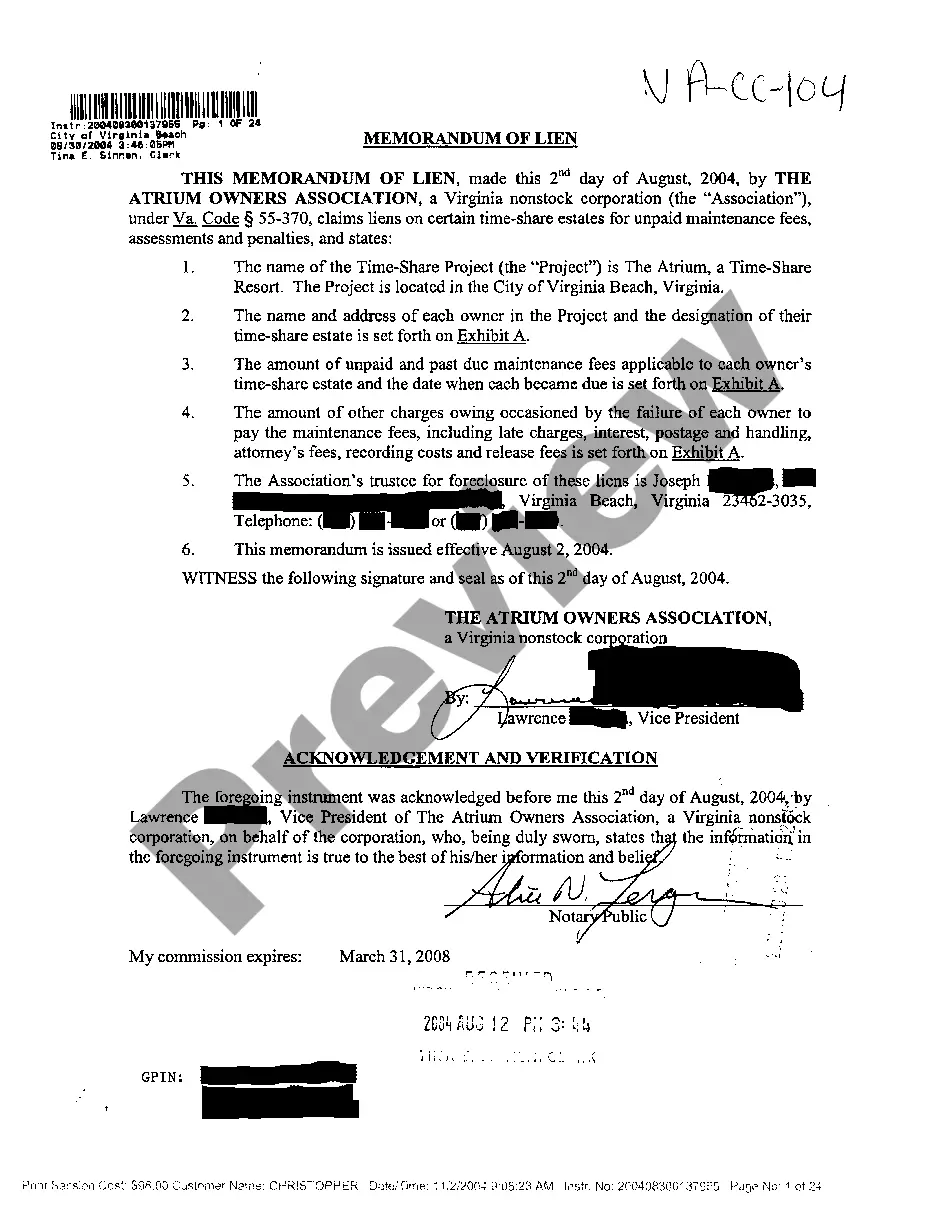

- Take a look at the template utilizing the Preview feature or via the text description to make certain it meets your needs.

- Browse for a different sample utilizing the search tool at the top of the page if needed.

- Click Buy Now when you’ve found the correct form and opt for a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your Addendum Buyer Seller Withholding and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and fill out previously obtained forms, open the My Forms tab in your profile. Enjoy the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

FIRPTA: What It Is and How It Works FIRPTA requires that any individual who is selling a property in the U.S. that is not a U.S. citizen will have 15% of the gross sales price withheld at closing. This 15% withholding must then be remitted to the Internal Revenue Service (IRS) within 20 days after closing.

This forty-plus-year-old mechanism was designed to help ensure that non-U.S. citizens do not escape paying taxes on income from the sale of U.S. real property. It requires the buyer of real property from a foreign seller to withhold a portion of the sale price and remit the tax to the Internal Revenue Service (IRS).

To ensure collection of the FIRPTA tax, any transferee or buyer acquiring a U.S. property interest must deduct and withhold a tax equal to 15 percent of the amount realized on the disposition.

If you are classified as a foreign individual, the rate of FIRPTA withholding is 15% of the purchase price. Withhold this particular withholding tax when you close on your property deal. The rate of FIRPTA withholding for a foreign corporation is equal to 21% of the gain.

FIRPTA Rates and Withholding For example, let's say that a foreign corporation sells property for $10 million. At the closing, the purchaser would withhold 15 percent of the sale price, which in this case would be $1.5 million (15 percent of $10 million).