Publication 783 For 2023

Description

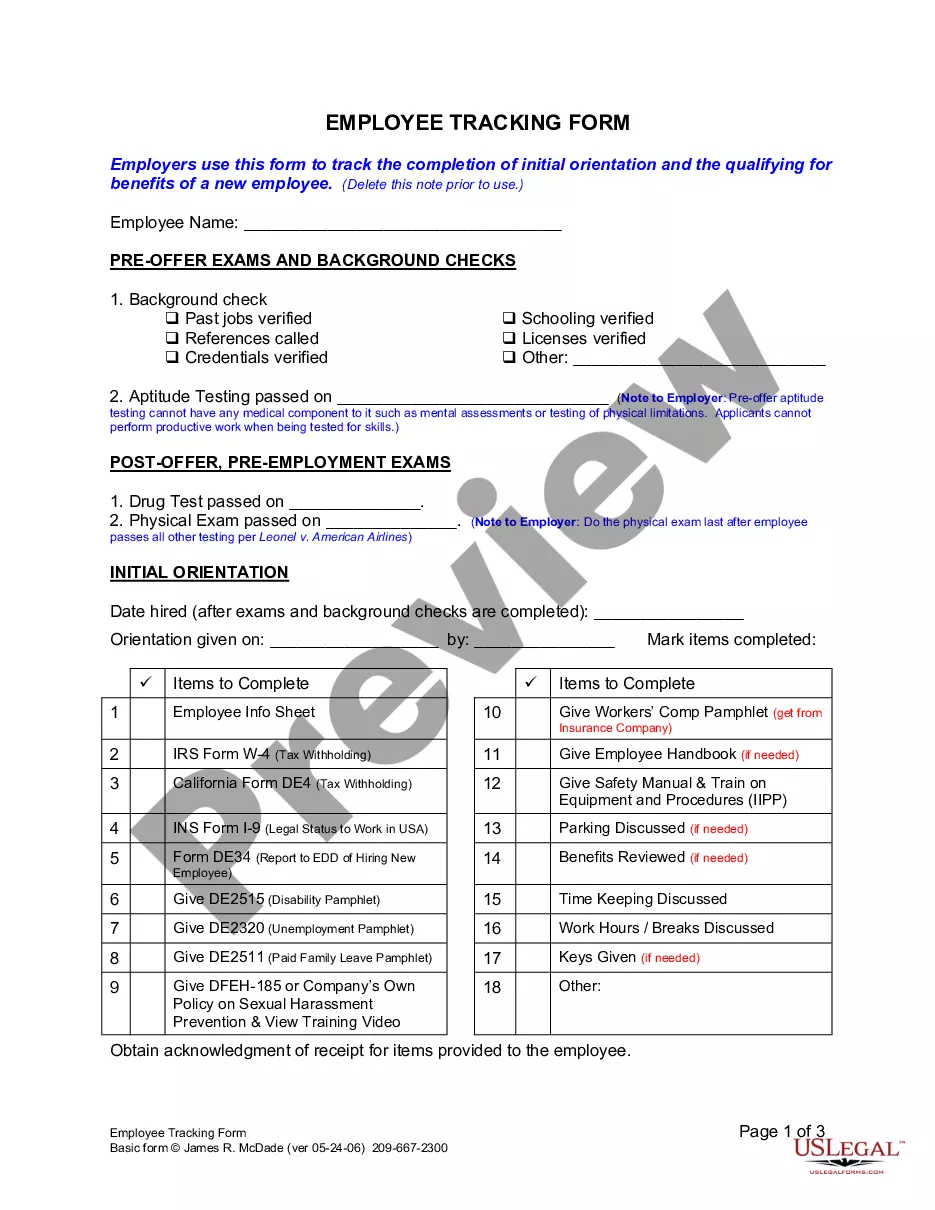

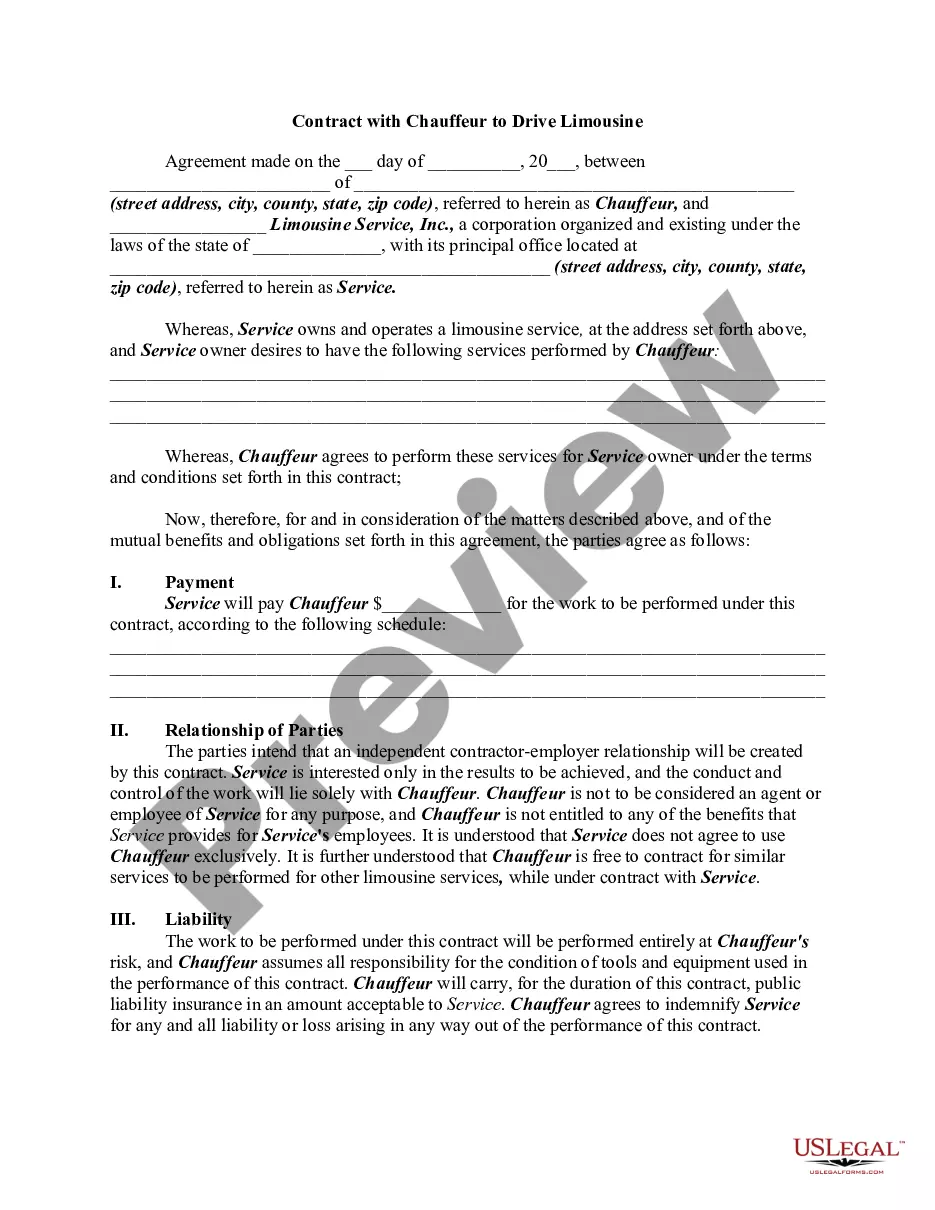

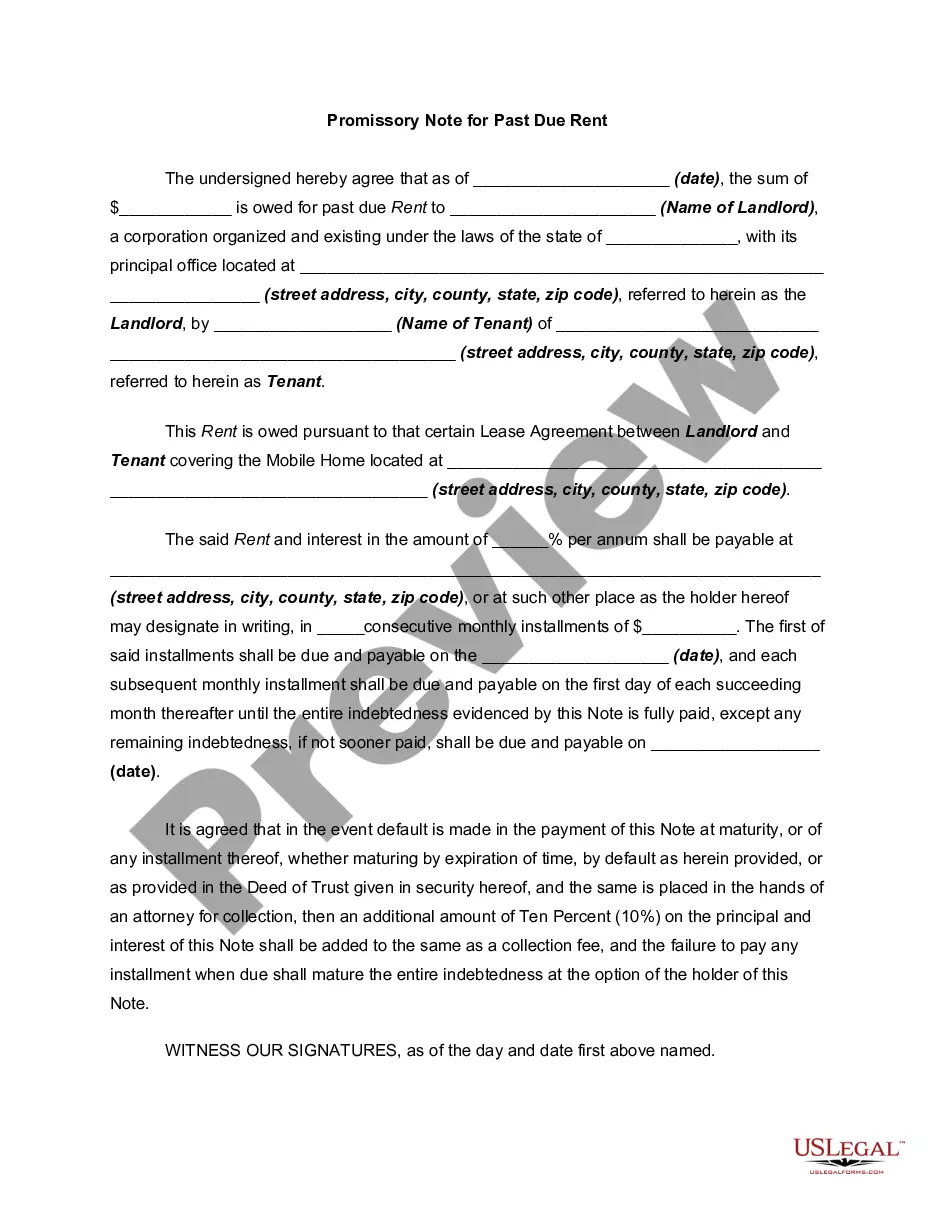

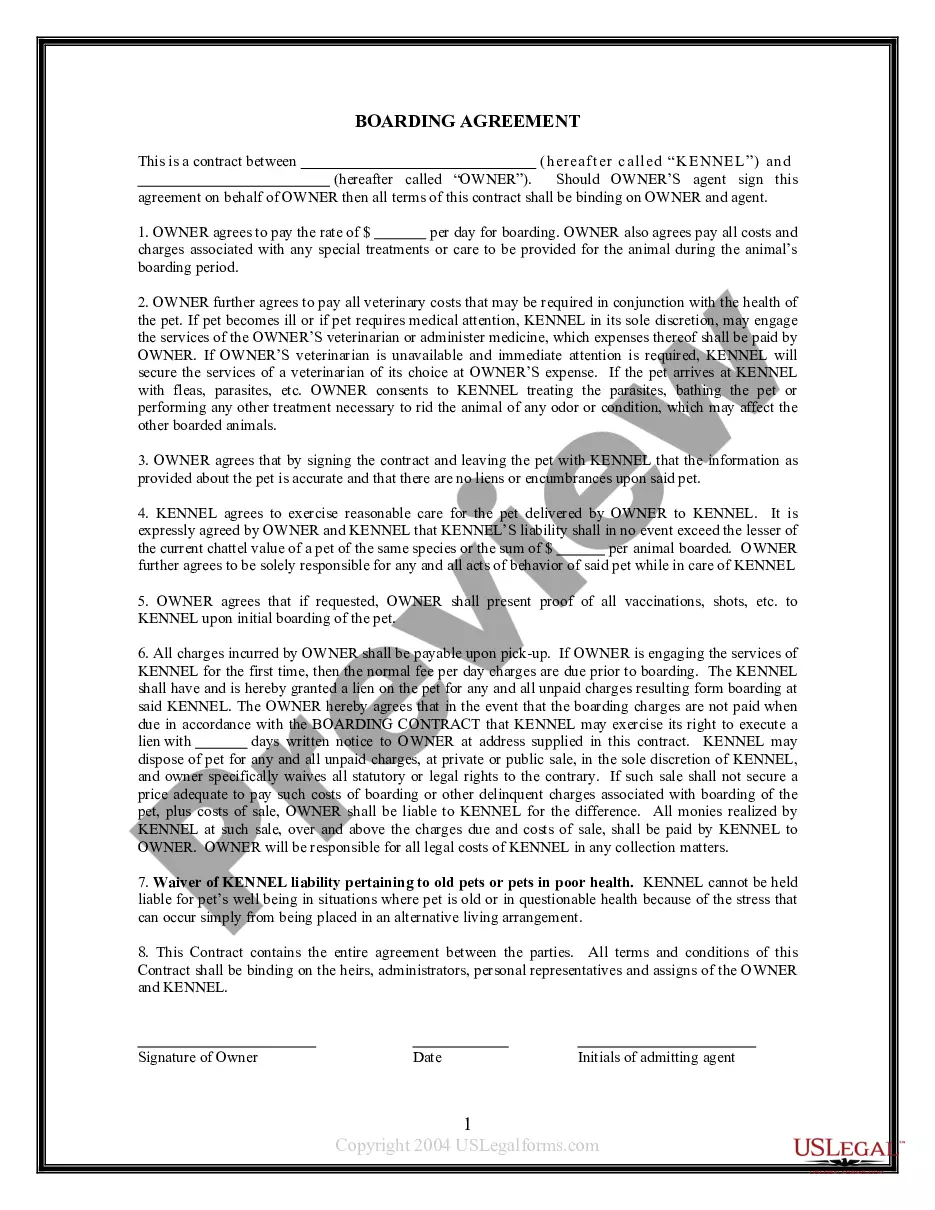

How to fill out Application For Certificate Of Discharge Of IRS Lien?

Handling legal paperwork and operations could be a time-consuming addition to your day. Publication 783 For 2023 and forms like it often need you to look for them and understand the best way to complete them effectively. Therefore, whether you are taking care of financial, legal, or personal matters, using a thorough and convenient online library of forms close at hand will help a lot.

US Legal Forms is the top online platform of legal templates, featuring more than 85,000 state-specific forms and numerous tools to help you complete your paperwork effortlessly. Check out the library of pertinent papers available with just a single click.

US Legal Forms offers you state- and county-specific forms offered at any moment for downloading. Safeguard your document management processes using a top-notch support that lets you put together any form in minutes without extra or hidden charges. Simply log in to your profile, find Publication 783 For 2023 and download it right away from the My Forms tab. You can also gain access to previously downloaded forms.

Could it be the first time utilizing US Legal Forms? Sign up and set up a free account in a few minutes and you’ll get access to the form library and Publication 783 For 2023. Then, follow the steps below to complete your form:

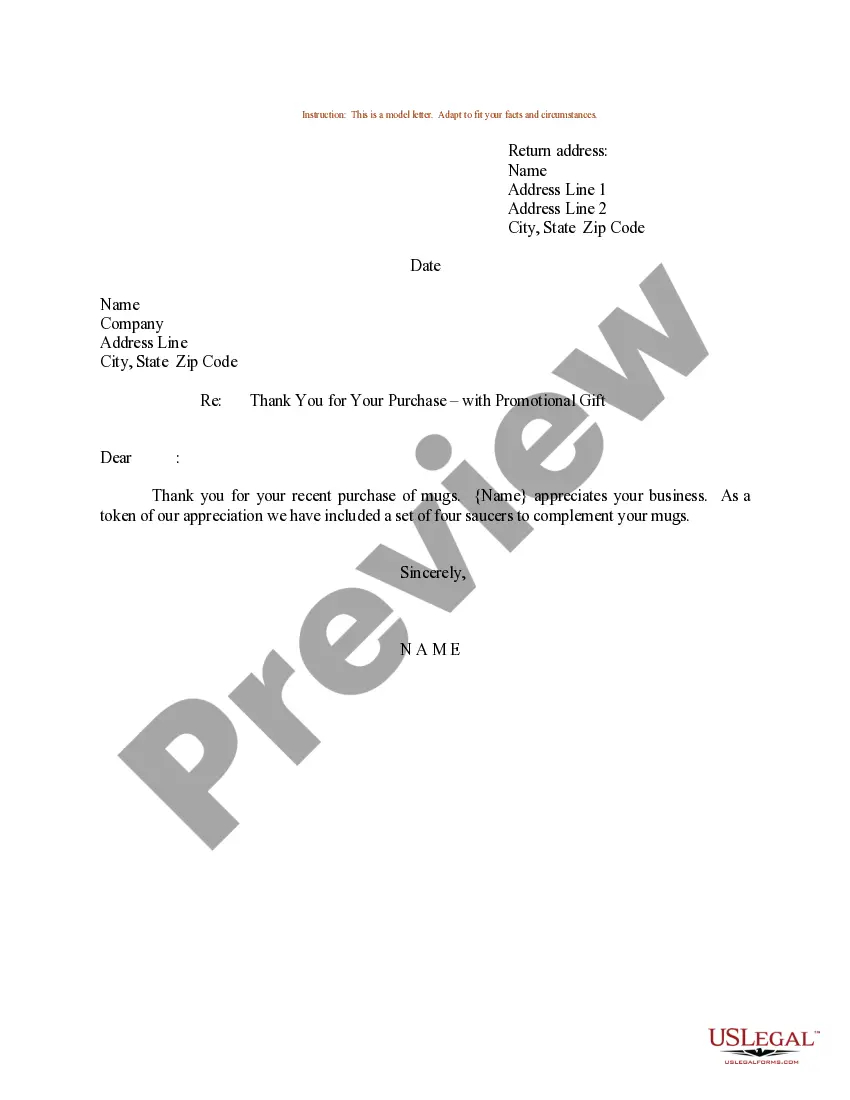

- Be sure you have the correct form by using the Preview option and reading the form description.

- Select Buy Now once ready, and select the subscription plan that is right for you.

- Select Download then complete, eSign, and print out the form.

US Legal Forms has 25 years of expertise supporting consumers manage their legal paperwork. Find the form you require today and improve any operation without breaking a sweat.

Form popularity

FAQ

Hear this out loud PauseNOTE: For information on paying a tax debt or other debt owed to the state of Ohio, please contact the Attorney General's Collections Enforcement Section online or by calling 877-607-6400.

Hear this out loud PauseThe state of Ohio allows county treasurers to pursue the delinquent property taxes directly, or the county treasurer may sell a tax lien certificate to the public. A tax lien certificate provides the holder with a right to collect or enforce the tax lien, many times through foreclosure.

Hear this out loud PauseState Tax Liens Once the tax is paid, the State of Ohio will issue the debtor a Release and Satisfaction of Judgment. To properly release the state tax lien, the debtor must file this document in the Clerk of Courts' office along with the appropriate fees and all outstanding court costs.

To obtain more information about the lien, contact the Attorney General's Office. For business taxes call 1-888-246-0488. For individual taxes call 1-888-301-8885.

Hear this out loud PauseOhio Judgment Law Attorney General's Office need only refile a tax lien every 15 years in Common Pleas Court to keep the lien operative against the tax debtor. A lien must be canceled after 40 years.