Allowance For Spouse Application In Allegheny

Description

Form popularity

FAQ

The Retirement Office is responsible for managing investments and retirement benefits for Allegheny County Employees' Retirement System (ACERS) Plan members ing to Pennsylvania Law. Retirement Office responsibilities include: Providing pension and other retirement benefits to all vested Plan members.

If you want to get close to withholding your exact tax obligation, then claim 2 allowances for both you and your spouse, and then claim allowances for however many dependents you have (so if you have 2 dependents, you'd want to claim 4 allowances to get close to withholding your exact tax obligation).

How many state and local pension plans are there? State and local governments sponsored more than 4,000 pension plans in 2022. Over 34 million members participate in these plans, including active public employees, former public employees who have earned benefits that they are not yet collecting, and current retirees.

Employees may begin collecting full benefits at age 65, if they have completed 10 years of service. If they are still employed when they apply for retirement, however, they need to have completed only three years of service (as long as they are at least age 65).

The non-working spouse, with minimal work history, can receive spousal benefits based on the working spouse's earnings record, up to 50% of the working spouse's full benefit. When the non-working spouse reaches their FRA of 67, they can claim a spousal benefit of $1,250 per month.

Key Takeaways. The maximum spousal benefit is 50% of the other spouse's full benefit. You may be eligible if you're married, divorced, or widowed. You can collect spousal benefits as early as age 62, but in most cases, the benefits are permanently reduced if you start collecting before your full retirement age.

How much can I get from Social Security spousal benefits? The maximum Social Security spousal benefit is 50% of your spouse's or ex-spouse's benefit at full retirement age (FRA). There is no increase to spousal benefits beyond FRA. 3 Retiring early, though, reduces spousal benefits.

Randall, in order for your wife to be eligible for spousal benefits, you need to have already filed for your own benefits. If that's the case and your wife is at least 62 years old, she can apply for her spousal benefit.

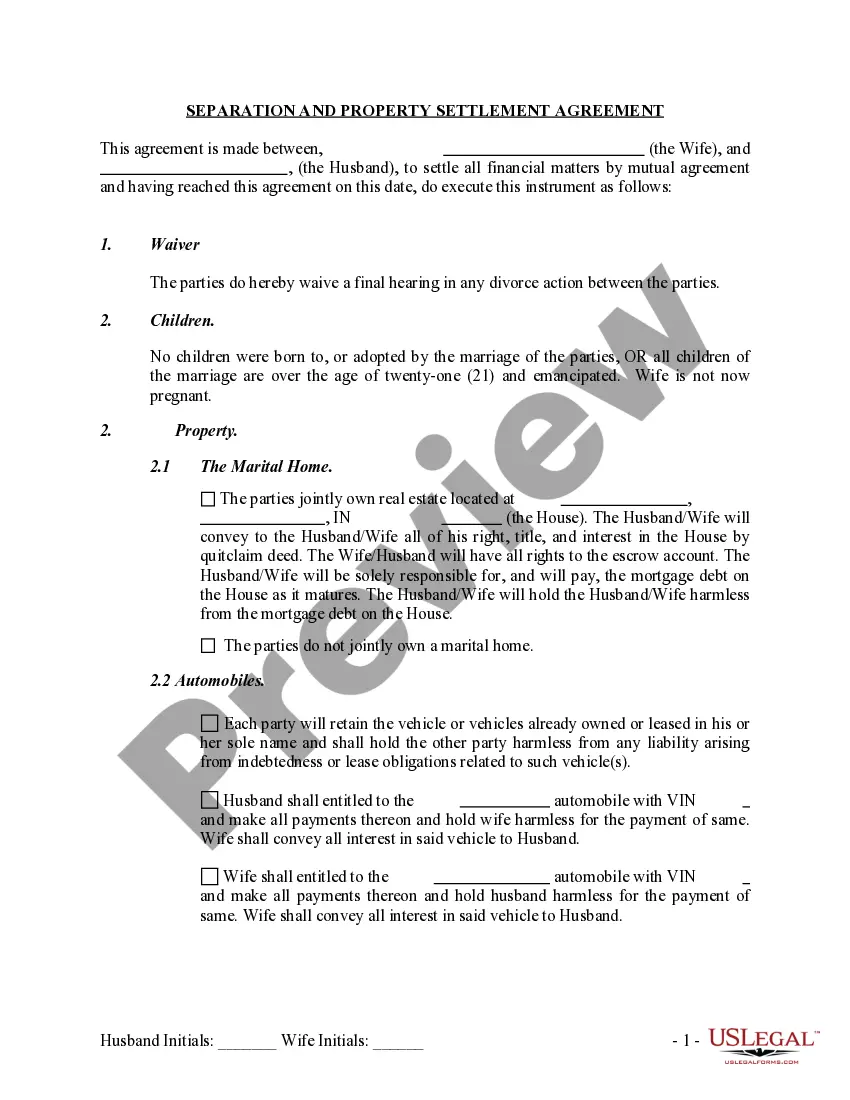

uniting marriage license does not require an officiant to solemnize the marriage but does require the signatures of two witnesses. A traditional marriage license requires an officiant to solemnize the marriage.