Landlord Tenant Forfeit Security Deposit

Definition and meaning

The term landlord tenant forfeit security deposit refers to the legal process by which a landlord retains a tenant's security deposit under specific circumstances. This often occurs when the tenant fails to fulfill the terms of the lease agreement, such as not paying rent, causing damage beyond normal wear and tear, or terminating the lease early.

A security deposit is typically collected at the beginning of a rental agreement to cover potential losses incurred by the landlord. Understanding this term is essential for both tenants and landlords to navigate their rights and responsibilities in a rental situation.

Legal use and context

The legal context surrounding a forfeit security deposit varies by state and is governed by landlord-tenant laws. These laws dictate under what conditions a landlord can retain the security deposit. Commonly permitted reasons include:

- Unpaid rent and utilities

- Damages beyond normal wear and tear

- Unreasonable cleaning costs

- Early termination of the lease

Tenants have the right to challenge any deductions they believe are unjust, and they may initiate legal action if necessary. It is crucial for both parties to be familiar with their state's specific regulations regarding security deposits.

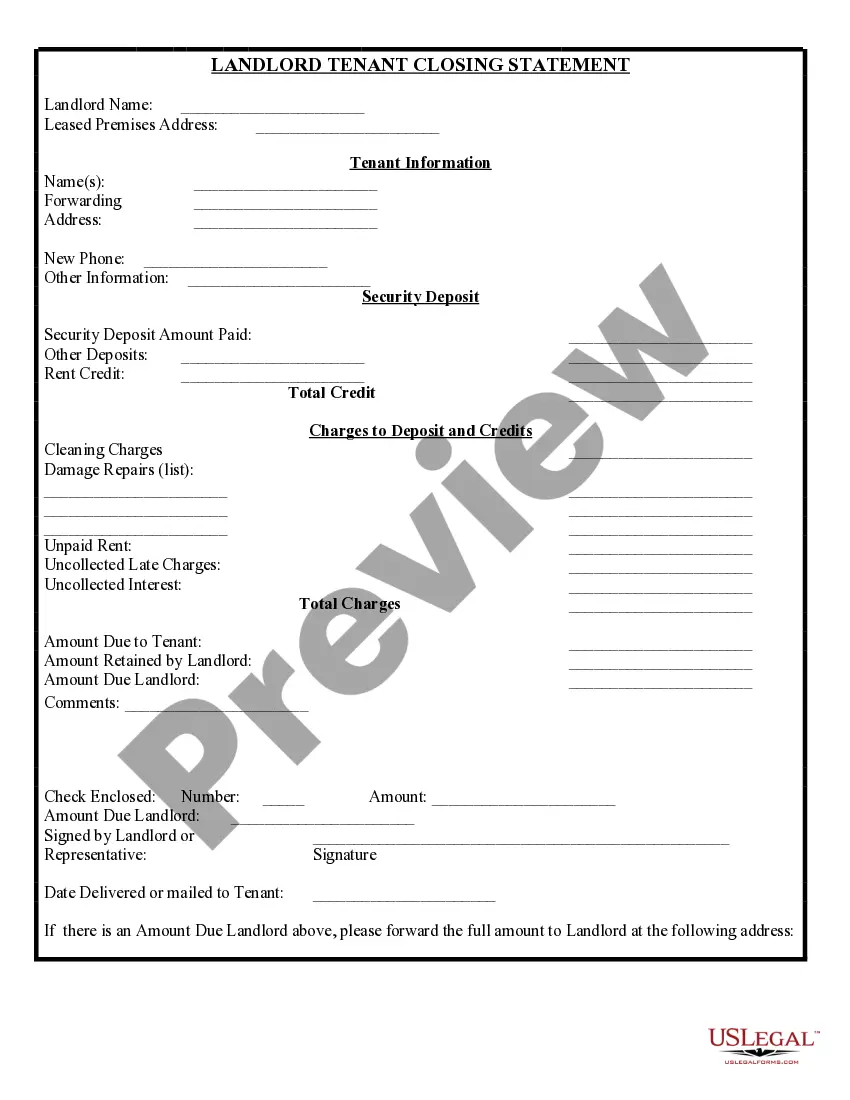

Who should use this form

This form is intended for landlords and tenants involved in a rental agreement in which there are disputes concerning the security deposit. Landlords can utilize it to outline the reasons for withholding the deposit after a tenant vacates the property. Tenants, on the other hand, can use it to formally communicate any disagreements regarding the deductions made from their security deposit.

Understanding the use of this form can help both parties clarify their positions and facilitate a resolution without resorting to legal disputes.

What to do if you disagree with the deduction

If a tenant believes the landlord's deductions from their security deposit are unfair, the following steps can be taken:

- Review your lease: Examine the lease for clauses on security deposit deductions.

- Document the property's condition: Take photos and videos before moving in and after moving out.

- Communicate with the landlord: Send a formal written request explaining the reasons for your disagreement.

- Seek legal action: If necessary, consider small claims court for unresolved disputes.

Taking these steps ensures that tenants can present their case effectively.

How to fill out Tennessee Landlord Tenant Closing Statement To Reconcile Security Deposit?

Wading through the red tape of standard documents and templates can be challenging, particularly when one is not professionally engaged in that field.

Even locating the appropriate template for a Landlord Tenant Forfeit Security Deposit can be laborious, as it must be valid and precise to the last detail.

However, you will significantly reduce the time spent acquiring an appropriate template if it originates from a reliable source.

Acquire the correct form in a few simple steps: Enter the document title in the search box. Locate the correct Landlord Tenant Forfeit Security Deposit from the result list. Review the sample's description or preview it. If the template meets your requirements, click Buy Now. Choose your subscription plan. Use your email to set a security password and register at US Legal Forms. Select a payment method via credit card or PayPal. Download the template file in your desired format. US Legal Forms can save you considerable time in validating whether the online form suits your needs. Create an account and gain unlimited access to all the templates you require.

- US Legal Forms is a service that streamlines the process of finding the correct forms online.

- US Legal Forms serves as a centralized resource for obtaining the most recent form samples, verifying their use, and downloading these samples to complete them.

- It boasts a repository of over 85,000 forms applicable across multiple sectors.

- When looking for a Landlord Tenant Forfeit Security Deposit, you can trust its relevance since all forms are authenticated.

- Having an account with US Legal Forms guarantees that all necessary samples are at your fingertips.

- You can store them in your history or add them to the My documents section.

- Accessing your saved forms from any device is as simple as clicking Log In on the library site.

- If you do not yet possess an account, you can still search for the template you require.

Form popularity

FAQ

You also need to transfer the security deposit out of the liability account and into a revenue account. The easiest way to do this is prepare a journal entry debit the security deposit liability account and credit a revenue account (you might want to create one just for forfeited security deposits).

This question is about Texas Security Deposit Law In Texas, a landlord is allowed to charge a cleaning fee if the rental agreement allows the landlord to do so. Texas laws allow landlords and tenants to agree on what additional deductions or charges may be made to the security deposit.

If the security deposit is against one month's rent or lease payment, it must be recorded as income when received immediately rather than at the time of contract maturity. Any forfeited amount due to break of lease contract can be included in the taxable income by the first party.

What to Include in a Security Deposit Demand Letterthe address of your rental and the dates you rented from.how much you paid for a security deposit.why you are entitled to a return of a portion or all of the deposit.the state laws that require a return of the deposit in a timely manner.More items...

For example, forfeiture of a deposit for not closing a purchase transaction is a common stipulation in a real estate sales contract. In investing, an owner may be required to forfeit shares they hold if they are unable to meet a call on an option. Funds raised by the forfeit are paid to the counterparty.