Sd Divorce D Forever

Description

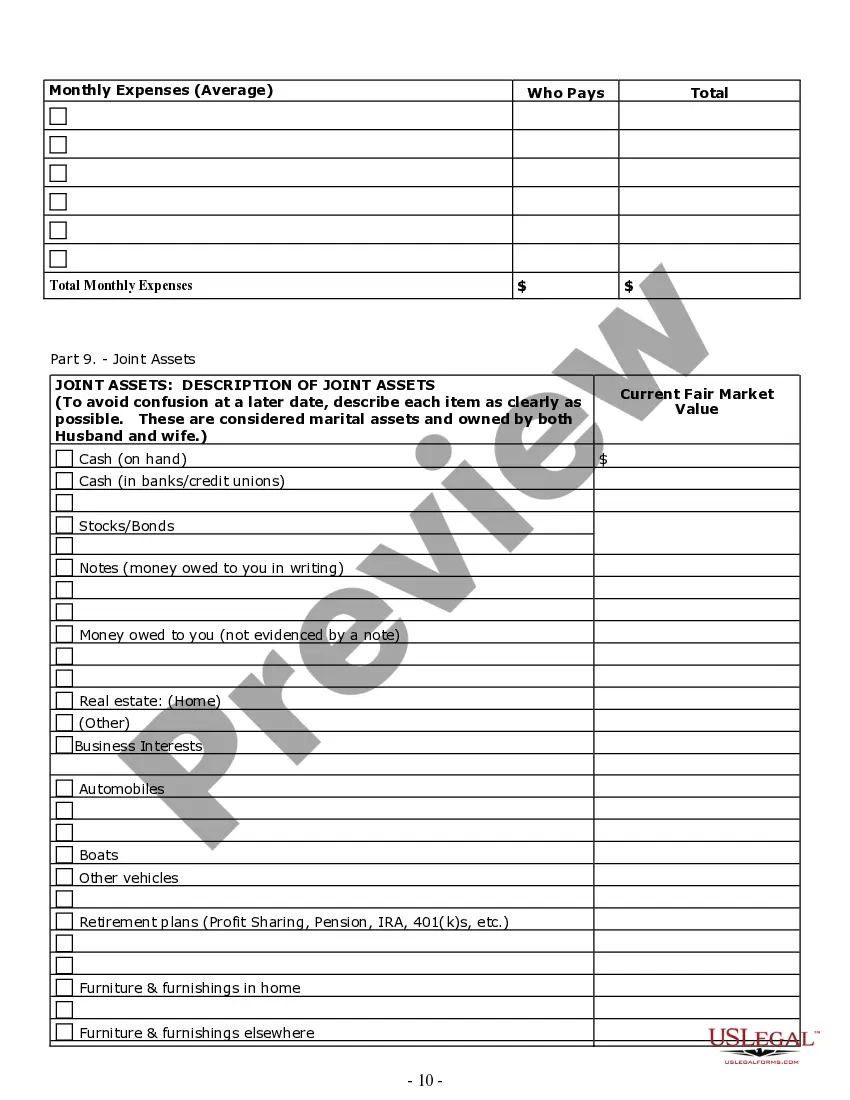

How to fill out South Dakota Divorce Worksheet And Law Summary For Contested Or Uncontested Case Of Over 25 Pages - Ideal Client Interview Form?

Finding a reliable source to access the latest and pertinent legal samples is a significant part of navigating bureaucracy.

Identifying the appropriate legal documents requires precision and careful attention, which is why it is crucial to obtain examples of Sd Divorce D Forever solely from trustworthy sources, such as US Legal Forms. An incorrect template can squander your time and delay your current predicament. With US Legal Forms, you have minimal concerns.

Remove the hassle associated with your legal documentation. Explore the vast US Legal Forms repository to discover legal samples, assess their applicability to your situation, and download them instantly.

- Utilize the library navigation or search bar to locate your sample.

- Examine the form’s details to confirm if it meets the criteria of your state and area.

- Check the form preview, if available, to ensure the template is indeed what you need.

- Return to the search to find the appropriate template if the Sd Divorce D Forever does not fit your requirements.

- If you are confident about the form’s applicability, download it.

- As a registered user, click Log in to verify and access your chosen templates in My documents.

- If you haven't created an account yet, click Buy now to purchase the form.

- Select the payment plan that best fits your needs.

- Proceed to the registration to complete your order.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Sd Divorce D Forever.

- Once you have the form on your device, you may modify it using the editor or print it and complete it manually.

Form popularity

FAQ

A divorce in South Dakota cannot be granted until 61 days have passed from the date the Defendant was served with the opening paperwork. The parties can reach an agreement at any point in that time, but the divorce cannot be finalized until 61 days have passed.

Getting Help Filing Your South Dakota Divorce If you'd like to DIY your divorce, the state has information, instructions, and forms available online. You can also get forms from your court clerk.

South Dakota law requires courts to make an ?equitable division of property? during a divorce. This applies to all property owned by a married couple, both joint property and the individual property belonging to each spouse. It doesn't necessarily mean a split either.

The "waiting period" refers to the time between the start of the divorce proceedings and the court decree granting the final divorce. The waiting period in a South Dakota divorce is a minimum sixty (60) days after your spouse is served with the divorce papers.

SOUTH DAKOTA DIVORCE MADE EASY. This easy to use online divorce is a "do it yourself (without a lawyer)" solution for any uncontested divorce (with or without children) that will be filed in the state of South Dakota.